Regions of Russia. Problems of economic development and growth zone

Regions form the country’s economy. Security of the nation, investment climate, prospects of advanced technologies adoption depend on regions prosperity. There are two indicators to determine the contribution of the RF regions to the national welfare, identifying the capacities and problems of the regional development: the volume of taxes collected and investment flowed.

Moscow and the Khanty-Mansi autonomous district–Yugra lead by total taxes to the budget

In 2018 the budget received a record 21.3 trillion RUB of tax levies.

Leading regions contributed nearly the same amount of taxes: Moscow – 3 488 billion RUB, the Khanty-Mansi autonomous district-Yugra – 3 421 billion RUB. The majority of the budget revenue is due to income and personal income taxes in Moscow and due to mineral extraction tax in the Khanty-Mansi autonomous district-Yugra. These regions provide one third of total income to the budget (see Table 1). The volume of tax collected indicates the developed industries, high remuneration and availability of natural resources.

The lowest amount of collected taxes was recorded in the North Caucasus and the Far East regions. The lowest results were shown by Ingushetia (4 billion RUB) and the Jewish autonomous region (6 billion RUB).

The Khanty-Mansi autonomous district-Yugra demonstrates the highest increase in tax collection: the recovery of oil prices allowed to increase the figure by 54.4%.

| Rank | Region | Income, billion RUB | Region’s share, % | Changes relative to 2017, % |

| 1 | Moscow | 3 488 | 16.4 | 13.7 |

| 2 | Khanty-Mansi autonomous district-Yugra | 3 421 | 16.0 | 54.5 |

| 3 | Yamal-Nenets autonomous district | 1 462 | 6.9 | 28.2 |

| 4 | Saint Petersburg | 1 217 | 5.7 | 11.0 |

| 5 | Moscow region | 920 | 4.3 | 10.5 |

| 6 | The Republic of Tatarstan | 773 | 3.6 | 32.3 |

| 7 | Krasnoyarsk territory | 622 | 2.9 | 31.7 |

| 8 | Samara region | 514 | 2.4 | 23.7 |

| 9 | Irkutsk region | 434 | 2.0 | 35.3 |

| 10 | The Republic of Bashkortostan | 423 | 2.0 | 25.7 |

| Top-10 regions | 13 274 | 62.2 | 26.6 | |

| Other 75 regions | 8 054 | 37.8 | 14.2 | |

| Total | 21 328 | 100 | 23.0 | |

The capital and commodity regions of Western Siberia are most attractive for investors

The economic crisis influenced the investment activities: for the three-year period from 2014 to 2016, the volume of investment decreased. There had been an increase in 2017, and in 2018, the volume of investment increased over the year by 4.3%, reaching 17.3 trillion RUB countrywide.

In 2018 Moscow accounted for 14.1% of financial revenues, Yamal-Nenets autonomous district received 5.9%, and the Khanty-Mansi autonomous district-Yugra received 5.3%. (see Table 2). The first three regions aggregate 25.3% of all investment attracted.

Moscow region, Saint Petersburg, the Republic of Tatarstan, Krasnodar territory, Leningrad region, Krasnoyarsk territory and the Republic of Sakha (Yakutia) are also among the ten leaders, and accounted for 23.3% of investment.

Among the lagging regions are sparsely populated areas of Siberia, the Far East, and the middle zone. As an example, the Republic of Tyva can be cited: with a population comparable to the Yamal-Nenets autonomous district, the amount of funds raised was only 10 billion RUB.

| Rank | Region | Investments, Billion RUB | Region’s share, % | Changes relative to 2017, % |

| 1 | Moscow | 2 429 | 14.1 | 4.3 |

| 2 | Yamal-Nenets autonomous district | 1 024 | 5.9 | 5.5 |

| 3 | Khanty-Mansi autonomous district-Yugra | 922 | 5.3 | 1.9 |

| 4 | Moscow region | 898 | 5.2 | 22.7 |

| 5 | Saint Petersburg | 747 | 4.3 | 4.3 |

| 6 | The Republic of Tatarstan | 630 | 3.6 | -3.5 |

| 7 | Krasnodar territory | 481 | 2.8 | -8.4 |

| 8 | Leningrad region | 467 | 2.7 | 26.8 |

| 9 | Krasnoyarsk territory | 421 | 2.4 | -2.2 |

| 10 | The Republic of Sakha (Yakutia) | 403 | 2.3 | 1.9 |

| Top-10 regions | 8 422 | 48.6 | - | |

| Other 75 regions | 8 864 | 51.4 | - | |

| Total | 17 286 | 100 | 4.3 | |

Imbalance of regional development

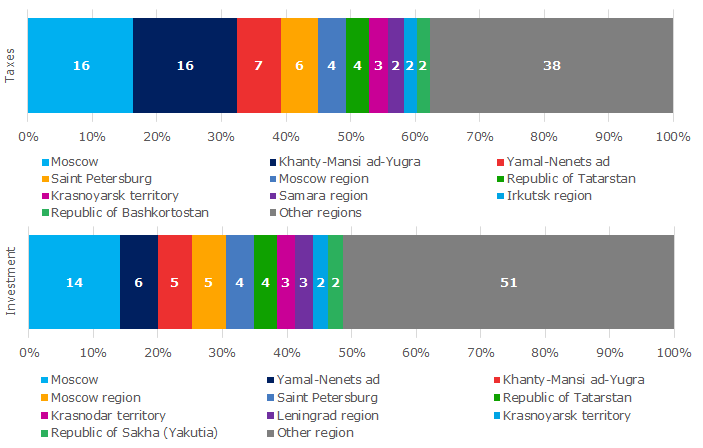

62% of total tax revenues and 49% of investments in infrastructure facilities provide almost the same regions (see Picture 1). 29% of the country's population live on the territory of Top-10 regions, and they attract about half of all investment funds.

The federal policy to smooth out disproportions by redistributing budget funds from “rich” to “poor” does not bring the expected result. An example of the inefficiency of such a redistribution is the introduction in 2018 for the first time in the contemporary history of Russia of external financial management in the Republic of Khakassia and Kostroma region due to their inability to pay off debts.

Picture 1. Regions of Russia in terms of remitted taxes and investment received, %

Picture 1. Regions of Russia in terms of remitted taxes and investment received, %Growing aware of the situation, in February 2019 the government approved the Spatial development strategy of the Russian Federation for the period up to 2025. The Strategy is aimed at reduction of interregional differences, acceleration the pace of economic growth in depressed regions and elimination of transport restrictions. For failure to implement the Strategy, the regions may lose their federal assistance to support inefficient industries.

Results

The Spatial development strategy of Russia will not bring the desired result without a revision of the existing inter-budgetary relations between the federal center and the subjects. Today, donor income goes to recipients - both have no incentive to develop their own economy. It is necessary to increase the independence of the regions, and provide them with tax, customs and other benefits.

It is required to analyze the experience of creating special economic zones (SEZ) and priority social and economic development areas (PSEDA). If there is a positive effect, the program will be implemented to a larger number of depressed regions, and new zones of economic growth will be created.

The development of the RF regions, state of the investment climate, possibilities of the “smart specialization” of the regions are included in the program of the Saint Petersburg International Economic Forum, starting on June 6, 2019.

Profit shifting in case of double taxation

The Federation Council approved the bill on ratification of the international Convention to prevent base erosion and profit shifting.

The Convention is aimed to prevent the abuse of interstate agreements on avoidance of double taxation, as a result of which profit is transferred to countries with a reduced tax rate. This leads to significant losses of budgets on income taxes. According to OECD, the countries budgets lose $100–240 billion per year due to profit shifting to low-tax jurisdictions. That is between 4 and 10 percent of global income tax revenues.

The bill provides the possibility of applying the provisions of the Convention without bilateral negotiations for each of the 71 existing intergovernmental agreements on the avoidance of double taxation reached by Russia.

Thus, the Russian Federation reserves the right not to apply particular provisions of the Convention to all or part of these agreements.

Such jurisdictions as Great Britain, Cyprus, Luxembourg and the Netherlands, which are popular among the Russian entrepreneurs, are ready to make occasional changes to the agreements with Russia.