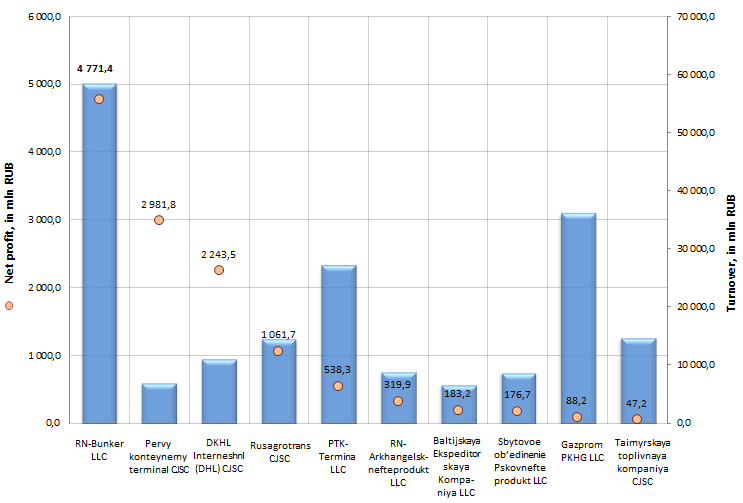

Net profit of companies in the sphere of cargo transportation and storage

Information agency Credinform prepared a ranking of companies in the sphere of cargo transportation and storage.

The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2013). These enterprises were ranked by decrease in net profit ratio.

Net profit (loss) (in RUB) is net undistributed profit (uncovered loss) of the current period, remained after payment of profit tax and other similar obligatory payments.

The indicators of net profit are very important for each enterprise. Net profit can be considered as result of company’s activity, for the period where this profit was showed. Net profit volume depends on the volume of gross profit and amount of taxes. Dividends for company’s shareholders are calculated on the basis of net profit volume.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to average values of profit, but also to all presented combination of financial data.

| № | Name | Region | Turnover, in mln RUB, for 2013 | Netprofit, for 2013 | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | RN-Bunker LLC INN: 7705839398 |

Moscow | 58 494,5 | 4 771,4 | 184 the highest |

| 2 | Pervy konteynerny terminal CJSC INN: 7805113497 |

Saint-Petersburg | 7 018,0 | 2 981,8 | 228 high |

| 3 | DKHL Interneshnl (DHL) CJSC INN: 7707033437 |

Moscow | 11 088,1 | 2 243,5 | 210 high |

| 4 | Rusagrotrans CJSC INN: 7701810253 |

Moscow | 14 509,9 | 1 061,7 | 210 high |

| 5 | PTK-Terminal LLC INN: 7806055343 |

Saint-Petersburg | 27 293,8 | 538,3 | 225 high |

| 6 | RN-Arkhangelsknefteprodukt LLC INN: 2921009226 |

Arkhangelsk region | 8 841,3 | 319,9 | 270 high |

| 7 | Baltijskaya Ekspeditorskaya Kompaniya LLC INN: 7810120958 |

Saint-Petersburg | 6 667,2 | 183,2 | 197 the highest |

| 8 | Sbytovoe ob’edinenie Pskovnefteprodukt LLC INN: 6027042337 |

Pskov region | 8 733,1 | 176,7 | 232 high |

| 9 | Gazprom PKHG LLC INN: 5003065767 |

Moscow | 36 209,5 | 88,2 | 172 the highest |

| 10 | Taimyrskaya toplivnaya kompaniya CJSC INN: 2460047153 |

Krasnoyarsk region | 14 707,6 | 47,2 | 250 high |

Picture. Turnover and net profit of the largest companies in the sphere of cargo transportation and storage (TOP-10)

The turnover of the largest companies, which specialize in cargo storage and handling (TOP-10), made 193 653,0 bln RUB according to the results of the latest published annual financial statement, in comparison with the year 2012 the consolidated figure increased by 10,3%.

Industry leaders accumulate 14,1% of the revenue of all market players, what points to the absence on it of monopolist and developed competition.

All participants of TOP-10 show a positive financial result – this points to the efficiency of the management and adopted development strategy in the organizations.

The first three enterprises of the ranking on absolute values of net profit are as follows: RN-Bunker LLC (4 771,4 mln RUB), Pervy konteynerny terminal CJSC (2 981,8 mln RUB) and DKHL Interneshnl CJSC (2 243,5 mln RUB).

RN-Bunker LLC is the leader in the sphere of production and logistic infrastructure of country's fuel market. The company storages and delivers oil products manufactured by 10 oil refineries of NK Rosneft OJSC to wholesale and retail market (Ryazansky, Komsomolsky, Achinsky, Angarsky, Kuibyshevsky, Novokuibyshevsky, Syzransky, Saratovsky, Tuapsinsky oil refineries and Yaroslavnefteorgsintez).

Pervy konteynerny terminal CJSC (PKT) is the largest container terminal on the territory of the RF. Located in Big Port Saint-Petersburg, it is one of the first specialized container terminals in Russia. It is connected through regular feed communication with large European ports - Rotterdam, Hamburg, Bremerhaven and Antwerpen. Regular weekly ship entries to the terminal are carried out by leading world shipping lines: Maersk Line, MSC, CMA CGM, OOCL, Unifeeder, Team Lines, Hapag Lloyd, FESCO ESF, Evergreen, HMM, Hanjin, COSCO, Yang Ming.

DKHL Interneshnl CJSC (DHL-Rossiya) carries out international express deliveries; freight forwarding by air, road, sea and rail; warehousing services, going beyond only storage - including all solutions from packaging to repairs; mail deliveries worldwide; shipping, carrying out in compliance with special requirements of clients.

According to the independent estimation of the Information agency Credinform, the organizations of the TOP-10 list got a high and the highest solvency index, what can signal to potential investors, that the largest market players can pay off their debts in time and fully, while risk of default is minimal.

See also: Net profit ratio of distributors of pharmaceutical products

The Government of the Russian Federation has expanded subsidies to airline companies.

The Prime Minister of the Russian Federation Dmitry Medvedev has signed a decree amending the air transportation subsidization that applies not only to direct flights, but also to flights with intermediate stops. In addition, the limit on the amount of passenger seats in the aircraft, which fulfills the subsidized transportation to the Crimea is lifted.

During the performance of the program of the direct flights subsidization and the organization of a regional route network emerged that airline companies need refueling landings in transportation though the subsidized routes. According to the adopted regulation the limit on the subsidizing of non-stop flights is lifted. This will provide the maximum enplaned traffic of subsidized flight.

The budget statement for 2015-2017 provides subsidies for regional transportation and development of the regional route network in 2015 to the extent of 3.58 bln rubles.

The Government’s assistance to the Russian air carriers came at a most seasonable time: the industry leaders are experiencing predicaments nowadays, as they have serious financial liabilities.

At year - end 2013 the leading airline companies of Russia had on their books 229 bln rubles of short-term obligations and 66 bln rubles of long-term obligations that is several times greater than their accumulated profit for the year-end. The amount of obligations of the companies “Transaero", "UTair" and "Yamal" exceeded its annual revenue.

The situation of the current year encourages no special optimism: mass bankruptcy of the tour operators, the stagnation of international flights that are more profitable than connecting flights, the worsening of geopolitical situation around Ukraine. All these things will increase additional problems to the air carriers. The amending of the situation can be achieved by increasing of the ticket prices; however, this measure can scare away potential customers and even worsen the rates of companies.