Microcredits for business will increase

We have addressed earlier to the topic of legislative changes in the area of financial market. In particular, this theme was discussed in the article about self-regulated organizations at the financial market. Significant changes are also of concern to microfinance organizations.

According to the Central Bank of the RF, in the National Register of microfinance organizations on March 18, 2016, 3718 active organizations are registered, and 3917 have already excluded from the Register. It is possible to value range of activity by looking at statistics. For example, according to expert estimation, in 2014 microcredits in the amount of about 3 bln RUB were provided, and in 2015 - more than 15 bln RUB. At that, experts predict further increase in microcredits in 2016, explaining such prediction both with decrease inreal income of the population and absence of adequate credit market, for obvious reasons connected with complication of the international situation.

Activity of microfinance organizations in Russia is regulated by the Federal Law of 02.07.2010 № 151-FL «On microfinancing activity and microfinance organizations». To this document a lot of amendments, having a great impact on this activity, were made by the Federal Law of 29.12.2015 №407-FL «On amendments to legislative acts of the RF and invalidation of particular provisions of legislative acts of the RF».

According to the amendments taking into force since March 28, 2016, microfinance organizations will be divided into microfinance and microcredit companies.

Microfinance companies must have capital more than 70 mln RUB. They have the right to attract funds of physical entities not less than 1,5 mln RUB and also the right for bond issue. Consequently, the Central Bank`s supervision for microfinance companies will be enhanced.

Credit facilities of microfinance organizations on crediting of legal entities and individual entrepreneurs are increased to 3 mln RUB against 1 mln RUB earlier.

Microcredit companies with capital less than 70 mln RUB are forbidden to attract funds of residents, and they can provide loans for physical entities only from own funds.

Above this, now by amendments are strictly regulated: status acquisition of microfinance organization and its liquidation, including at the initiative of the Central Bank; restrictions of activities and accounting conditions.

By the above mentioned Federal Law №407-FL amendments to the Federal Law of 07.08.2001 №115-FL «Money laundering Regulations and terrorism financing» and to the Federal Law of 26.10.2002 г. №127-FL «On Insolvency (Bankruptcy)» were made.

Subscribing for the Information and Analytical system Globas-i, you may look at the Register of microfinance organizations in section «Selections and lists», as well as you may learn about activity of each company from the list.

Solvency ratio of the largest Russian fishery enterprises

Information agency Credinform prepared a ranking of the major companies in the RF engaged in fishery.

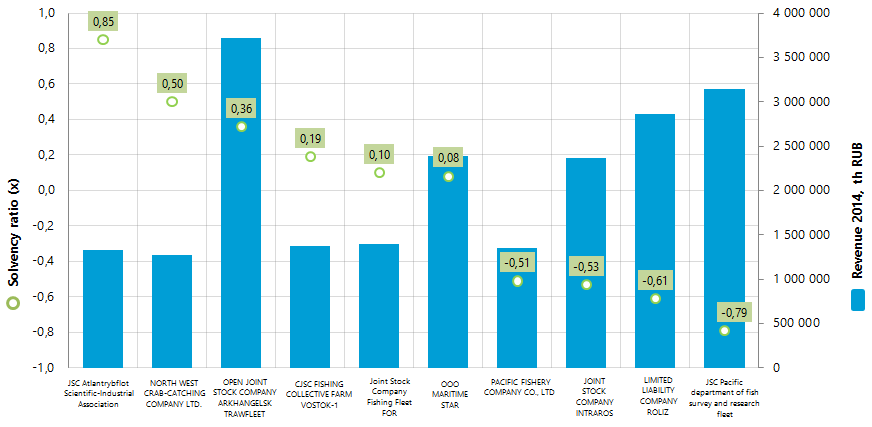

Companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2014). The enterprises were ranked by decrease in solvency ratio (see table 1).

Solvency ratio (x) is equity capital to total assets. It shows the company's dependence on external loans. Recommended value: > 0.5.

The value below the minimum limit means high dependence on external sources of funds that could lead to a liquidity crisis and the precarious financial situation of the company in case of the worsening market conditions.

For the most complete and objective view of the financial condition of the enterprise it is necessary to pay attention not only to the average rates in the industry, but also to the presented set of financial indicators and ratios of the company.

| № | Name | Region | Revenue 2014 th RUB | Revenue2014 to 2013, %% | Solvency ratio (х) | Solvency index Globas-i® |

|---|---|---|---|---|---|---|

| 1 | JSC Atlantrybflot Scientific-Industrial Association INN 3905000203 |

Kaliningrad region | 1 328 400 | 131 | 0,85 | 178 The highest |

| 2 | NORTH WEST CRAB-CATCHING COMPANY LTD. INN 5190119530 |

Murmansk region | 1 268 763 | 168 | 0,50 | 173 The highest |

| 3 | OPEN JOINT STOCK COMPANY ARKHANGELSK TRAWFLEET INN 2901128602 |

Arkhangelsk region | 3 723 113 | 154 | 0,36 | 214 High |

| 4 | CJSC FISHING COLLECTIVE FARM VOSTOK-1 INN 2536010639 |

Primorye territory | 1 370 474 | 122 | 0,19 | 312 Satisfactory |

| 5 | Joint Stock Company Fishing Fleet FOR INN 3908021441 |

Kaliningrad region | 1 397 778 | 112 | 0,10 | 280 High |

| 6 | ООО MARITIME STAR INN 3903017709 |

Kaliningrad region | 2 386 716 | 135 | 0,08 | 230 High |

| 7 | PACIFIC FISHERY COMPANY CO., LTD INN 4909053889 |

Magadan region | 1 348 839 | 124 | -0,51 | 250 High |

| 8 | JOINT STOCK COMPANY INTRAROS INN 2537008664 |

Primorye territory | 2 371 015 | 121 | -0,53 | 261 High |

| 9 | LIMITED LIABILITY COMPANY ROLIZ INN 2536247860 |

Primorye territory | 2 866 516 | 133 | -0,61 | 296 High |

| 10 | JSC Pacific department of fish survey and research fleet INN 2536053382 |

Primorye territory | 3 140 046 | 108 | -0,79 | 283 High |

Solvency ratio of the largest Russian fishery enterprises (Top-10) varies from 0,85 to -0,79. The industry average value in 2014 was 0,26.

Solvency ratios of only two enterprises from the Top-10 meet the recommended norms: JSC Atlantrybflot Scientific-Industrial Association (x0,85) and NORTH WEST CRAB-CATCHING COMPANY LTD. (x0,50). These companies got the highest solvency index Globas-i. This indicates high ability to fulfil the debt liabilities.

Other Top-10 companies are highly depend on raise funds and have solvency index less than 0,5. Their capital does not cover the amount of liabilities. In case of lump-sum on credits the enterprises may have difficulties with repayment. Therefore, the companies in this sector need to proportion intentions to rapidly increase market presence under the reduction of competition of foreign companies to the ability to deal with high debt load.

According to the latest published annual financial statements for 2014, total annual revenue of the Top-10 companies amounted to 21,2 bln RUB, which is by 29% higher than the same companies’ figures in 2013. At the same time the growth rate of revenue of the Top-200 companies engaged in fishing industry over the same period was only 17%. This may indicates the concentration of the fish production in large companies and reduction in the number of small companies. For example, 8% of companies from the same Top-200 enterprises are at varying stages of reorganization or liquidation.

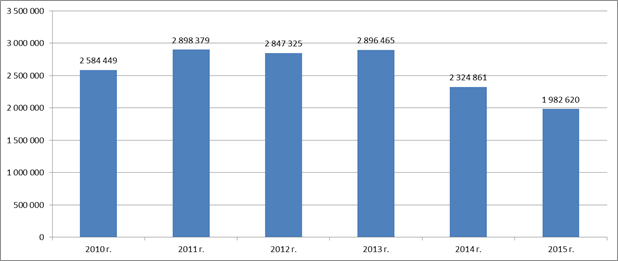

Rosstat data (Picture 2) show the reverse trend of reduction in physical volume of fish production in 2014 – 2015. Thus, the decrease in 2014 relative to 2013 was almost 20% and in 2015 to 2014 - almost 15%.

Picture 2. Production of live fish, fresh or chilled fish, frozen, chilled or fresh fillets in 2010 - 2015, tons (Rosstat data)