Changes in the microfinance legislation

The minimum size of equity of microcredit organizations was changed. It is regulated by the Federal Law of August 2, 2019 №271-FL. Thus, the minimum sizes of equity are set as follows:

| млн руб. | срок начала действия нормы |

| 1 | 01.07.2020 |

| 2 | 01.07.2021 |

| 3 | 01.07.2022 |

| 4 | 01.07.2023 |

| 5 | 01.07.2024 |

The above changes don’t refer to microcredit organizations providing loans for business activities or companies established by the state, constituent entities of the Russian Federation or municipal authorities, or entities with their participation in the capital.

In addition, amendments to the Law «On microfinance activities and microfinance organizations» regarding the list of documents for adding data on legal entities into the State register of microfinance organizations were made. In particular, the original certificate of criminal record for the Board of Directors or the Supervisory Board members is no longer required. However, the calculation of equity and the documents confirming the availability of equity in the amount as established above were added to the list.

The Central Bank of the Russian Federation is endowed with additional powers to supervise the activities of microfinance organizations.

According to the Information and Analytical system Globas as of 19.09.2019, there are 1909 active microfinance and microcredit organizations in Russia.

Information about these organizations and their activities is available for subscribers of the system.

Efficiency of trade in pharmacy

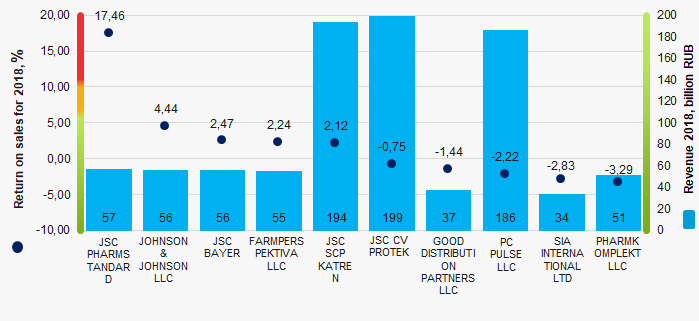

Information agency Credinform represents a ranking of the largest Russian pharmaceuticals wholesalers. The companies with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (2016 - 2018). They were ranked by return on sales ratio (Table 1). The analysis was based on the data of the Information and Analytical System Globas.

Return on sales (%) is a share of operating profit in total sales. The ratio indicates the company’s operational and commercial efficiency, and the volume of company’s funds from the sale of products after covering its cost, taxes and interest on loans.

Spread in values of the ratio for companies from the same industry is determined by differencies in competitive strategies and products range.

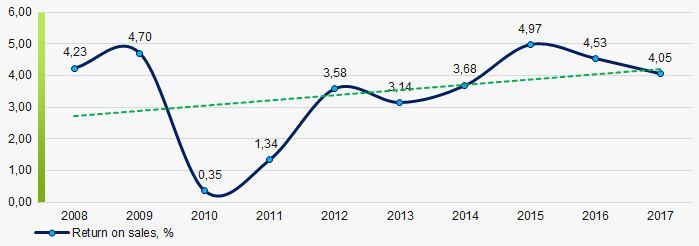

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. The practical value of rerun on sales ratio for the pharmaceuticals wholesalers is from 4,05% in 2017.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, region | Revenue, billion RUB | Net profit (loss), billion RUB | Return on sales, % | Solvency index Globas | |||

| 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| JSC PHARMSTANDARD INN 0274110679 Moscow region |

37,22 37,22 |

57,22 57,22 |

12,35 12,35 |

45,51 45,51 |

20,25 20,25 |

17,46 17,46 |

159 Superior |

| JOHNSON & JOHNSON LLC INN 7725216105 Moscow |

55,42 55,42 |

56,43 56,43 |

3,36 3,36 |

2,19 2,19 |

9,12 9,12 |

4,44 4,44 |

197 High |

| JSC BAYER INN 7704017596 Moscow |

54,03 54,03 |

55,97 55,97 |

0,71 0,71 |

0,06 0,06 |

8,53 8,53 |

2,47 2,47 |

218 Strong |

| FARMPERSPEKTIVA LLC INN 6312050583 Kaluga region In process of reorganization in the form of transformation since 03.09.2019 |

48,94 48,94 |

55,40 55,40 |

0,32 0,32 |

0,37 0,37 |

1,72 1,72 |

2,24 2,24 |

210 Strong |

| JSC SCIENTIFIC PRODUCTION COMPANY KATREN INN 5408130693 Novosibirsk region |

211,07 211,07 |

193,90 193,90 |

1,45 1,45 |

2,45 2,45 |

1,28 1,28 |

2,12 2,12 |

228 Strong |

| JSC CV PROTEK INN 7724053916 Moscow |

215,49 215,49 |

199,43 199,43 |

2,29 2,29 |

2,48 2,48 |

-0,90 -0,90 |

-0,75 -0,75 |

196 High |

| GOOD DISTRIBUTION PARTNERS LLC INN 9705031526 Moscow |

40,12 40,12 |

37,17 37,17 |

0,01 0,01 |

-2,35 -2,35 |

-0,52 -0,52 |

-1,44 -1,44 |

335 Adequate |

| PC PULSE LLC INN 5047045359 Moscow region |

149,67 149,67 |

185,78 185,78 |

1,23 1,23 |

3,90 3,90 |

-3,91 -3,91 |

-2,22 -2,22 |

186 High |

| SIA INTERNATIONAL LTD INN 7714030099 Moscow |

61,18 61,18 |

34,03 34,03 |

0,04 0,04 |

-1,44 -1,44 |

-1,57 -1,57 |

-2,83 -2,83 |

291 Medium |

| PHARMKOMPLEKT LLC INN 5262036363 Nizhniy Novgorod region |

41,12 41,12 |

51,50 51,50 |

0,26 0,26 |

0,44 0,44 |

-4,58 -4,58 |

-3,29 -3,29 |

188 High |

| Total for TOP-10 companies |  914,27 914,27 |

926,84 926,84 |

22,02 22,02 |

53,61 53,61 |

|||

| Average value for TOP-10 companies |  91,43 91,43 |

92,68 92,68 |

2,20 2,20 |

5,36 5,36 |

2,94 2,94 |

1,82 1,82 |

|

| Industry average value |  0,22 0,22 |

0,01 0,01 |

4,05 4,05 |

||||

growth of indicator to the previous period,

growth of indicator to the previous period,  decrease of indicator to the previous period.

decrease of indicator to the previous period.

The average indicator of return on sales ratio of TOP-10 companies is below the industry average and practical values of 2017. In 2018, five companies of TOP-10 increased their figures.

Picture 1. Return on sales ratio and revenue of the largest Russian pharmaceuticals wholesalers (TOP-10)

Picture 1. Return on sales ratio and revenue of the largest Russian pharmaceuticals wholesalers (TOP-10)Over the past 10 years, the industry average values of return on sales ratio have a trend to increase (Picture 2).

Picture 2. Change in the industry average values of return on sales ratio of the largest Russian pharmaceuticals wholesalers in 2008 – 2017

Picture 2. Change in the industry average values of return on sales ratio of the largest Russian pharmaceuticals wholesalers in 2008 – 2017