The Russian budget suffered from the limited business activity

During the several years, tax revenues for the budget had been consistently increasing. However, the volume of taxes collected in 2020 could be less that planned: for the first time since 2009, the dynamics of budget revenues is negative.

The volume of tax revenues for 2020 is lower than in 2018

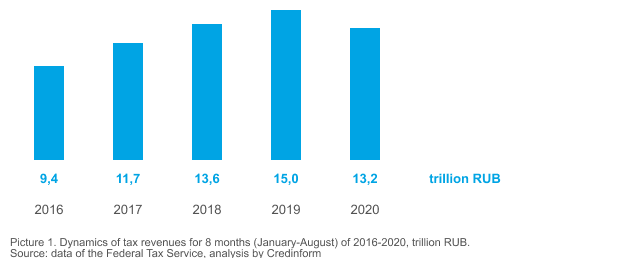

According to the Information agency Credinform, the state consolidated federal budget received 13,2 trillion RUB in January-August 2020, 12% lower than in corresponding period of 2019 when 15 trillion RUB were received, and 3% lower than in 2018 with 13,6 trillion RUB received (Picture 1).

Picture 1. Dynamics of tax revenues for 8 months (January-August) of 2016-2020, trillion RUB. Source: data of the Federal Tax Service, analysis by Credinform

Picture 1. Dynamics of tax revenues for 8 months (January-August) of 2016-2020, trillion RUB. Source: data of the Federal Tax Service, analysis by CredinformNegative dynamics for the first time in 10 years

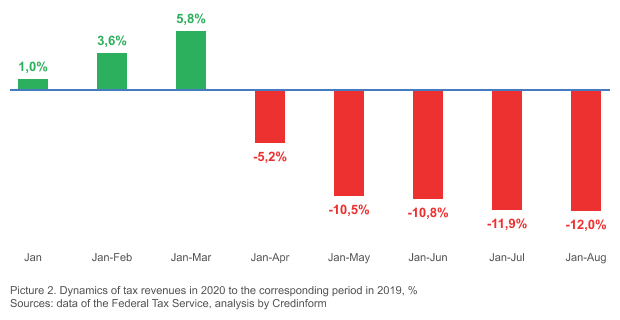

Examining the monthly dynamics of tax revenues, the trend to increase in January-March 2020 (Picture 2) is observed. Since April 2020, the volume of received tax revenues decreased, and the current dynamics is negative for the first time in 10 years.

Picture 2. Dynamics of tax revenues in 2020 to the corresponding period in 2019, % Sources: data of the Federal Tax Service, analysis by Credinform

Picture 2. Dynamics of tax revenues in 2020 to the corresponding period in 2019, % Sources: data of the Federal Tax Service, analysis by CredinformHope for growth

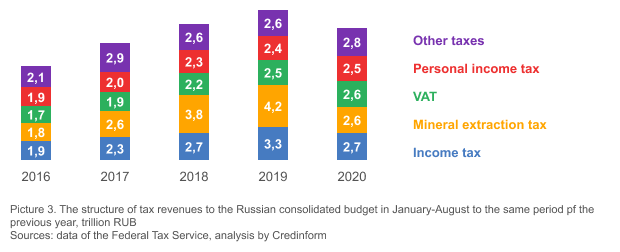

From January to August 2020, there is a 18% decrease (0,6 trillion RUB) in income tax revenues from the companies and 38% decrease (1,6 trillion RUB) in mineral extraction tax revenues compared to the same period of 2019 (Picture 3).

While there is the reduction in income tax and mineral extraction tax revenues, the collection of other taxes is increased. In particular, the volume of value added tax (VAT) payments and personal income tax in January-August 2020 increased by 4% (0,1 trillion RUB) compared to 2019.

A simultaneous increase in VAT and personal income tax payments may indicate a reduction in shadow business in Russia. The growth in VAT revenues was influenced, among other things, by the 20% increased rate. However, the upward trend in revenues has been observed even before its increase in 2019.

Picture 3. The structure of tax revenues to the Russian consolidated budget in January-August to the same period pf the previous year, trillion RUB Sources: data of the Federal Tax Service, analysis by Credinform

Picture 3. The structure of tax revenues to the Russian consolidated budget in January-August to the same period pf the previous year, trillion RUB Sources: data of the Federal Tax Service, analysis by CredinformAlready, it can be concluded that as a result of the business activity restrictions and reduction in tax revenues, the budget of the Russian Federation in 2020 will not receive about 5,5 trillion rubles. A 38% cut in the mineral extraction tax may have a negative impact on the formation of Russia's GDP, since the share of the oil and gas sector is significant.

Simulating situation without the negative impact of external events, the consolidated budget of the Russian Federation for January-August 2020 could show a dynamics of 15% compared to 2019.

Changes in legislation

The Decree of the Government of the Russian Federation as of 16.09.2020 No. 1467, approving the new Provision on licensing the performing of mine-surveying works, will come into force starting from January 1st, 2021.

The activity to be licensed contains the performing of the following works and services:

- creation of mine-surveying reference networks, as well as networks for earth surface movement observation, deformation in mine workings, buildings, facilities and objects while performing works related to mineral resource use;

- spatial and geometric measurements of mine workings and objects, related to mineral resource use, buildings and facilities, determination of its parameters, position and conformity to the project documentation, as well as mining lease status observation;

- recording and reasoning of mine workings scope;

- keeping of the mine graphic documentation.

The full list of types of activities and services to be licensed as well as requirements for both license applicants and license holders are contained in the above-mentioned Provision.

The requirements are: availability of suitable staff members, sole entrepreneurs having a degree in mine-surveying, regulated in-process inspection, equipment for processing of measurements results, measuring instruments and others.

The Federal Service for Environmental, Technological, and Nuclear Supervision (Rostekhnadzor) executes the licensing the performing of mine-surveying works.

A state fee is charged for the issuance or renewal of license.

The Decree will come into force on January 1st, 2021. Particular provisions, concerning supplementary vocational education in the field of industrial safety, will come into force since July 1st, 2021.

The Decree will be valid through 2026.

The users of the Information and Analytical system Globas have access to all the available information (including archive data) about all entities performing mine-surveying works. Currently, more than 2800 companies have licenses for these types of activities.