Compulsory provision of statistical data

Article 13.19 of the Code of Administrative Offences of the Russian Federation provides administrative liability in the form of penalties for non-provision and delay in provision of primary statistical data or errors in statistical reports: for public officers – from 10 000 to 20 000 rubles, for legal entities – from 20 000 to 70 000 rubles.

Secondary offence is subject to fines from 30 000 to 50 000 rubles, and for legal entities – from 100 000 to 150 000 rubles.

Russian Federal Statistics Service by its letter from April 24, 2019 No. SE-04-4/55SMI «On updates of reports to the Federal Statistics Service» explains that respondents that have made errors in primary statistical data must send corrected data within 3 days since their finding (by themselves, of after written notifications of regional statistics bodies or other subjects of official statistics service). The corrected data is to be accompanied by explanations of corrections and further details if necessary.

In these cases penalties are not to be applied due to attenuating circumstances, according to Articles 4.1 and 4.2 of the Code of Administrative Offences of the Russian Federation.

Delays in provision of corrected reports are to be considered by regional statistics bodies in each case individually.

Trends in wholesale of fish

Information agency Credinform represents an overview of activity trends of the largest Russian wholesalers of fish and seafood.

Trading companies with the largest volume of annual revenue (TOP-10 and TOP-1000) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2015 – 2017). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets value is an indicator, reflecting the real value of company’s property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

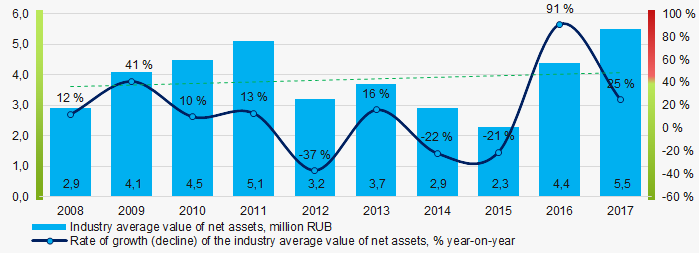

The average values of net assets of TOP-1000 enterprises tend to increase over the ten-year period (Picture 1).

Picture 1. Change in the industry average indicators of the net asset value of wholesalers of fish and seafood in 2008 – 2017

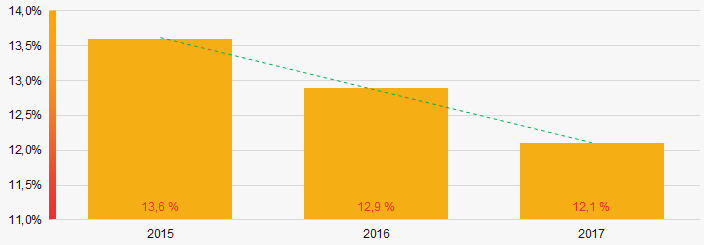

Picture 1. Change in the industry average indicators of the net asset value of wholesalers of fish and seafood in 2008 – 2017The shares of TOP-1000 enterprises with insufficiency of assets were at relatively high level with a downward trend in the last three years (Picture 2).

Picture 2. Shares of enterprises with negative values of net assets in TOP-1000 in 2015 – 2017

Picture 2. Shares of enterprises with negative values of net assets in TOP-1000 in 2015 – 2017Sales revenue

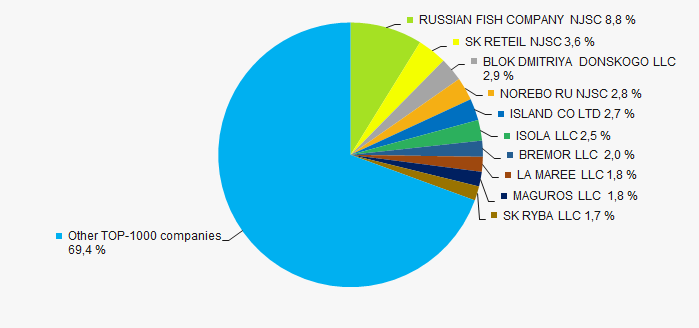

The revenue volume of 10 leading companies of the region made 31% of the total revenue of TOP-1000 in 2017 (Picture 3). It points to a relatively high level of competition in the industry.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2017

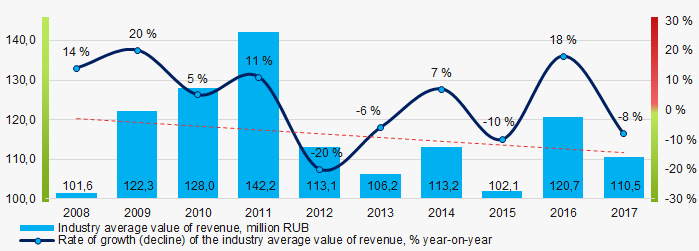

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2017In general, there is a trend towards a decrease in industry average revenue over the ten-year period (Picture 4).

Picture 4. Change in the industry average revenue of TOP-100 wholesalers of fish and seafood in 2008 – 2017

Picture 4. Change in the industry average revenue of TOP-100 wholesalers of fish and seafood in 2008 – 2017Profit and loss

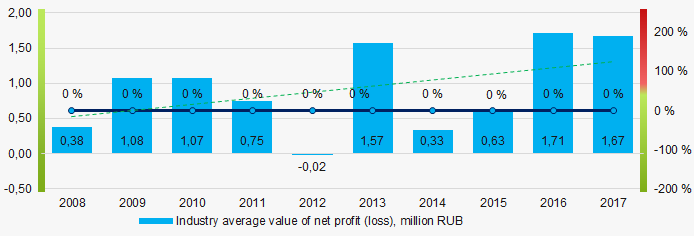

Industry average indicators of net profit trends to increase over the past ten years (Picture 5).

Picture 5. Change in the industry average indicators of net profit of wholesalers of fish and seafood in 2008 – 2017

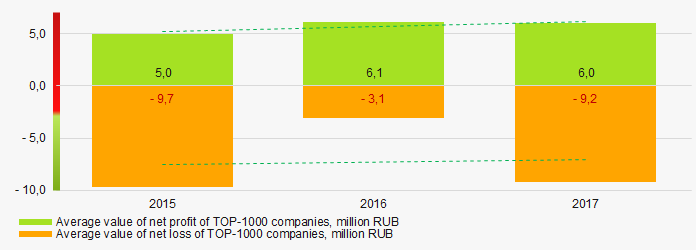

Picture 5. Change in the industry average indicators of net profit of wholesalers of fish and seafood in 2008 – 2017Average values of net profit’s indicators of TOP-1000 companies increase for the three-year period, at the same time the average value of net loss decreases. (Picture 6).

Picture 6. Change in the average values of indicators of net profit and net loss of TOP-1000 companies in 2015 – 2017

Picture 6. Change in the average values of indicators of net profit and net loss of TOP-1000 companies in 2015 – 2017Key financial ratios

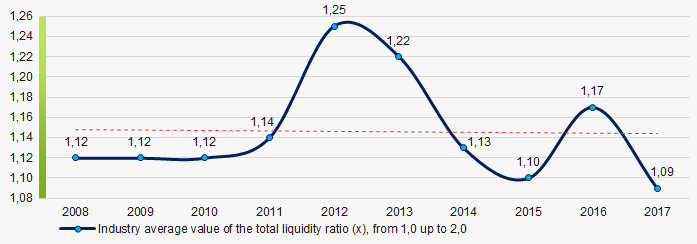

Over the ten-year period the average indicators of the total liquidity ratio of TOP-1000 enterprises were in the range of recommended values - from 1,0 up to 2,0, with a tendency to decrease (Picture 7).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the industry average values of the total liquidity ratio of wholesalers of fish and seafood in 2008 – 2017

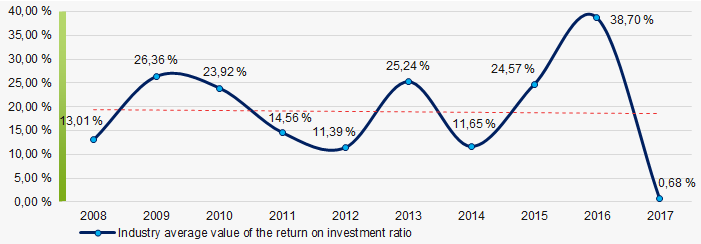

Picture 7. Change in the industry average values of the total liquidity ratio of wholesalers of fish and seafood in 2008 – 2017The industry average values of the return on investment ratio trend to decrease for ten years (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity of own capital involved in the commercial activity and the long-term borrowed funds of an organization.

Picture 8. Change in the industry average values of the return on investment ratio of wholesalers of fish and seafood in 2008 – 2017

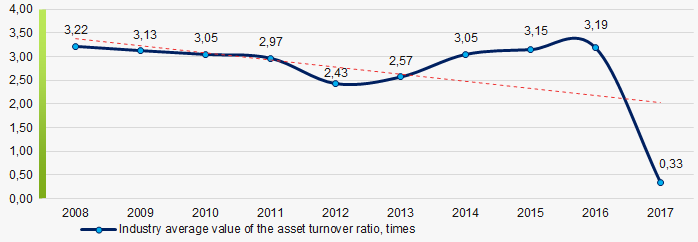

Picture 8. Change in the industry average values of the return on investment ratio of wholesalers of fish and seafood in 2008 – 2017Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This ratio of business activity trends to decrease over ten-year period (Picture 9).

Picture 9. Change in the industry average values of the asset turnover ratio of wholesalers of fish and seafood in 2008 – 2017

Picture 9. Change in the industry average values of the asset turnover ratio of wholesalers of fish and seafood in 2008 – 2017Small business

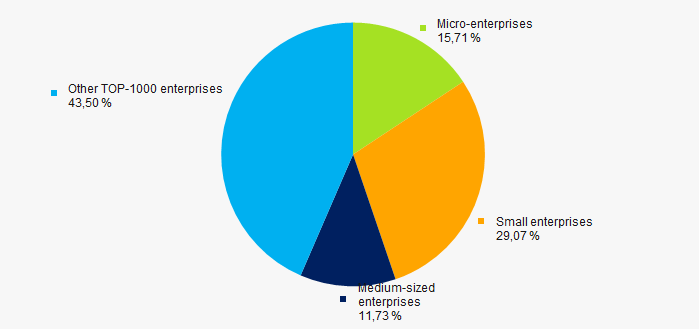

95% of TOP-1000 companies are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the RF. At the same time, their share in the total revenue amounted to 57% in 2017, that is more than two times higher than the national average one (Picture 10).

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-1000 companies, %

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-1000 companies, %Main regions of activity

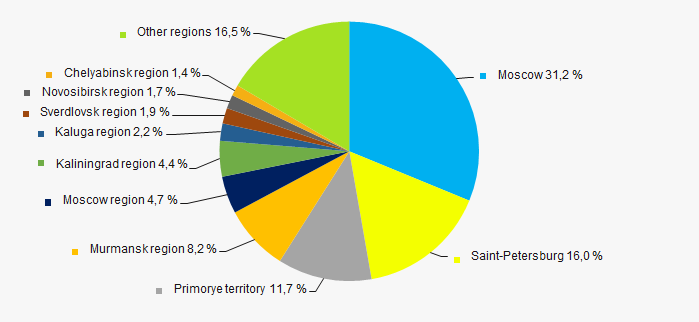

The TOP-1000 companies are distributed unequal across Russia and registered in 69 regions. Almost 59% of their revenue are concentrated in Moscow, Saint-Petersburg and the Primorye territory (Picture 11).

Picture 11. Distribution of the revenue of TOP-1000 companies by Russian regions

Picture 11. Distribution of the revenue of TOP-1000 companies by Russian regionsFinancial position score

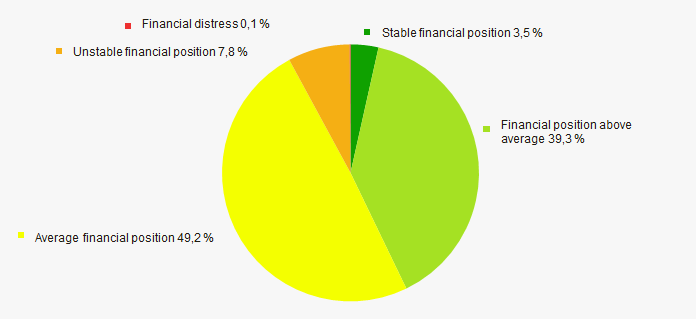

An assessment of the financial position of TOP-1000 companies shows that almost half of them are in an average financial position (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

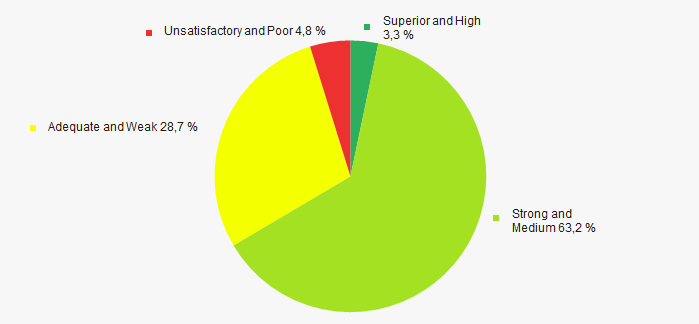

The largest part of TOP-1000 companies got Superior/High or Strong/Medium solvency index Globas, that points to their ability to pay off their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasAccording to the Federal Service of State Statistics, the share of wholesalers of fish and seafood in the revenue volume from the sale of goods, products, works, and services made 0,05% countrywide for 2018.

Conclusion

A comprehensive assessment of activity of the largest Russian wholesalers of fish and seafood, taking into account the main indices, financial indicators and ratios, points to the prevalence of positive trends in the industry (Table 1).

— positive trend (factor),

— positive trend (factor),  — negative trend (factor).

— negative trend (factor).

| Trends and evaluation factors | Specific share of factor, % |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  5 5 |

| Rate of growth (decline) in the average size of revenue |  -10 -10 |

| Level of competition / monopolization |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Growth / decline in average values of companies’ net loss |  10 10 |

| Increase / decrease in average values of total liquidity ratio |  -5 -5 |

| Increase / decrease in average values of return on investment ratio |  -5 -5 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in the region in terms of revenue being more than 22% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  5 5 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of factors |  2,9 2,9 |