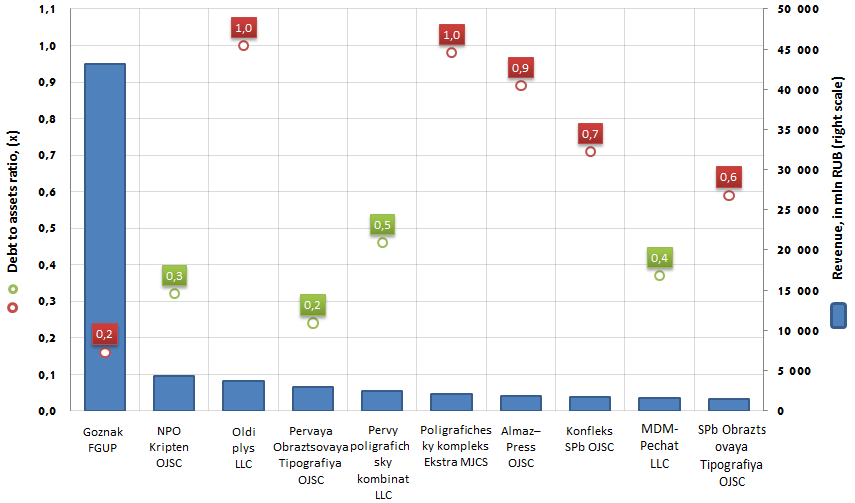

Debt to assets ratio of Russian printing companies

Information agency Credinform prepared a ranking of Russian printing companies.

The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2013). These enterprises were ranked by decrease in total sales revenue per annum. The debt to assets ratio was calculated for each company got shortlisted in TOP-10, TOP-100 lists.

Debt to assets ratio (х) is the relation of long-term and short-term liabilities to total assets. It shows what proportion of assets of an enterprise is funded with debt.

Recommended value is: from 0,2 to 0,5. If the ratio is above the upper standard value, it can point to a potential investor to an excessive debt load of a company, which promotes its market development, however, has a detrimental effect on the stability of the corporate finance. But if the ratio is below the lower standard value, then we may talk about conservative strategy of the financial management, care in attracting of new borrowings.

It should be understood, that recommended values can differ essentially as well for enterprises of different

activity fields, as for organizations of the same industry, consequently, these values are exclusively of informational character.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to average values of indexes in the industry, but also to all combination of financial indicators and ratios of a company.

| № | Name | Region | Revenue, in mln RUB, for 2013 | Debt to assets ratio, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Goznak FGUP INN 7813352058 |

Saint-Petersburg | 43 169 | 0,2 | 177 the highest |

| 2 | NPO Kripten OJSC INN 5010020686 |

Moscow region | 4 253 | 0,3 | 142 the highest |

| 3 | Oldi plys LLC INN 7726609934 |

Moscow | 3 652 | 1,0 | 264 high |

| 4 | Pervaya Obraztsovaya Tipografiya OJSC INN 7705709543 |

Moscow | 2 980 | 0,2 | 201 high |

| 5 | Pervy poligrafichesky kombinat LLC INN 5024051807 |

Moscow region | 2 486 | 0,5 | 243 high |

| 6 | Poligrafichesky kompleks Ekstra M JCS INN 5024065038 |

Moscow region | 2 073 | 1,0 | 329 satisfactory |

| 7 | Almaz–Press OJSC INN 7703183209 |

Moscow | 1 778 | 0,9 | 286 high |

| 8 | KonfleksSPb OJSC INN 7806109091 |

Saint-Petersburg | 1 699 | 0,7 | 224 high |

| 9 | MDM-Pechat LLC INN 7813096904 |

Leningrad region | 1 580 | 0,4 | 160 the highest |

| 10 | SPb Obraztsovaya Tipografiya OJSC INN 7825071848 |

Saint-Petersburg | 1 409 | 0,6 | 203 high |

Five from ten (TOP-10) the largest printing companies of Russia in terms of revenue demonstrate a high dependence on borrowed funds: the debt to assets ratio is above the upper standard value. Industry leader – the state enterprise FGUP Goznak, on the contrary, follows moderate borrowing policy, without a sharp increase of its credit portfolio, relying mainly on budgetary inflows (in contrast to commercial companies).

Picture 1. Net profit and debt to assets ratio of the largest printing companies of the RF (TOP-10)

Annual revenue of the largest printing companies in Russia (TOP-10) amounted to 65,1 bln RUB, according to the latest published annual financial statements (for 2013), that is by 3,9% lower than the figure recorded a year earlier (67,2 bln RUB). It should be noted that most of the revenue of the leading enterprises of the industry is accumulated by FGUP Goznak, issuing national currency banknotes, stamps, security documents, security paper, excise marks, general-purpose industrial grade paper.

The rest participants of the ranking organizations of the commercial sector, whose business is focused on the printing of newspapers, magazines, advertising materials, books etc; their revenue is much lower than that of a state-owned enterprise.

Nine enterprises in the TOP-10 list got high and the highest solvency index. This fact can testify that the organizations can pay off their debts in time and fully, while risk of default is minimal.

«Poligrafichesky kompleks «Ekstra M» got satisfactory solvency index, mainly due to the net loss from main activity over the last few years.

New Russian Procurement Regulations: Off-shore Suppliers Can No longer Participate in Government Procurement

To facilitate the growth of the local business community it is forbidden for corporations registered in the off-shore jurisdictions to bid for Russian government procurements. The law went into effect August 13, 2015. Countries and territories designated as ‘off Shore Jurisdictions’ are named in the RF Tax Code (Amendment 1 Clause 3 Article 284).

Since the law came into effect operators of the electronic trading platforms are now required to cease off-shore corporations and once they have registered operations in Russia they will receive accreditation. It is important to note that corporations registered in the off-shore jurisdictions can no longer participate in an electronic tender, even if the announcement about the government tender was placed and the relevant application documents were prepared before August 13, 2015. The commission in charge for government procurements is obliged to check if participants are compliant.

In case of non-electronic tenders, the question about the registration of the off-shore corporations which applied before 13 August remains to be considered.

The implication of the Federal Law No. 227-FZ 13.07.2015, “On Amending part of the Federal Law on Contract systems in the field of procurement of goods, works and services for governmental and municipal needs,” means that companies who want to participate in government procurement have to be legally domiciled in Russia or other locations, not referred to in Article 284 of the RF Tax code mentioned above.