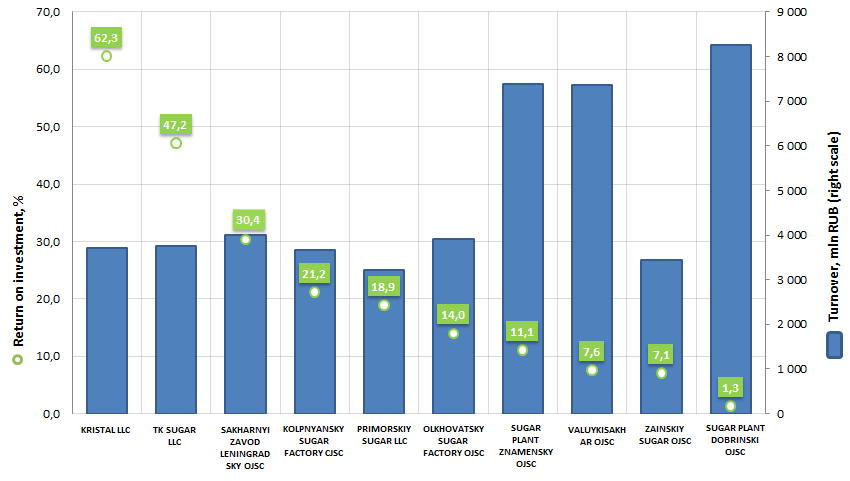

Return on investment of the largest Russian sugar manufacturers

Information Agency Credinform has prepared the ranking of the largest sugar manufacturers.

Top-10 enterprises in terms of revenue were selected according to the data from the Statistical Register for the latest available period (for the year 2014). The enterprises were ranked by decrease in return on investment; besides, revenue trend data relative to previous period and solvency index GLOBAS-i® is also represented (see table 1).

Return on investment (%) is the ratio of net profit (loss) and net assets value. It shows how many monetary units the company used to obtain one monetary unit of net profit. In other words, the ratio demonstrates the return level from each ruble, received from the investment.

For the most full and fair opinion about the company’s financial situation, not only investment profitability level should be taken into account, but also the whole set of financial indicators and ratios.

| № | Name | Region | Revenue, mln RUB, 2014 | Revenue growth,% | Return on investment, % | solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | KRISTAL LLC INN 6824004406 |

Tambov region | 3 712,1 | 18,0 | 62,3 | 247 high |

| 2 | TK SUGAR LLC INN 0411095062 |

Altai Republic | 3 755,3 | 18,5 | 47,2 | 254 high |

| 3 | SAKHARNYI ZAVOD LENINGRADSKY OJSC INN 2341006687 |

Krasnodar region | 4 011,7 | 41,2 | 30,4 | 202 high |

| 4 | KOLPNYANSKY SUGAR FACTORY CJSC INN 5711002822 |

Orel region | 3 660,3 | 37,2 | 21,2 | 227 high |

| 5 | PRIMORSKIY SUGAR LLC INN 2511005010 |

Primorski territory | 3 211,6 | 98,5 | 18,9 | 266 high |

| 6 | OLKHOVATSKY SUGAR FACTORY OJSC INN 3618003708 |

Voronezh region | 3 910,3 | 67,9 | 14,0 | 224 high |

| 7 | SUGAR PLANT ZNAMENSKY OJSC INN 6804000019 |

Tambov region | 7 395,4 | 6,5 | 11,1 | 245 high |

| 8 | VALUYKISAKHAR OJSC INN 3126000974 |

Belgorod region | 7 360,2 | 37,8 | 7,6 | 207 high |

| 9 | ZAINSKIY SUGAR OJSC INN 1647008721 |

Republic of Tatarstan | 3 442,9 | 41,5 | 7,1 | 217 high |

| 10 | SUGAR PLANT DOBRINSKI OJSC INN 4804000086 |

Lipetsk region | 8 255,6 | 187,0 | 1,3 | 237 high |

Banking groups and holdings

Free competition in the banking field, as well as in the industry, invariably leads to concentration. Small banks are merged by larger competitors or de facto are managed by them. This comes with the number of banks reduction, along with the banks enlargement and increase in operations volume. At the competition between banks and major unions of banking capital, the seeking for monopoly agreements is growing. High finances, for example placing the government loans, investment in large joint-stock companies and projects, are conducted under agreement of several leading banks.

Bank holding company is a bank or corporation, having a share in the authorized capital of one or several banks sufficient for controlling them.

Activity of bank holdings in Great Britain is a subject to the banking activity and company laws. According to the law, the Central bank of Great Britain has a right to demand all necessary information from the holding.

The activity of bank holdings in the USA is controlled by the Bank Holding Company Act of 1956. All bank holding companies are obliged to be registered in the Federal Reserve board of governors, being responsible for their activity.

Centralization of banking capital occurring in the merger of major banks in bank unions, as well as in assets increase and branches expansion can be shown at the example of the Russian banking system development in the early 21th century. This is proved by the statistics of the Central Bank of Russia:

| 01.01.2001 | 01.01.2005 | 01.01.2010 | 01.01.2015 | 01.10.2015 | |

|---|---|---|---|---|---|

| Registered banks, total | 2124 | 1516 | 1178 | 1049 | 1031 |

| Assets of 5 major banks (bln RUB) | 1,0 | 3,2 | 14,1 | 41,6 | 42,6 |

Creation and operating of banking groups and holdings in Russia is a subject to the Art. 4 of the Federal law No. 395-1 (as amended on 13.07.2015) “On banks and banking activities” of 02.12.1990.

The law identifies the banking group as a union, being not a legal entity with a parent bank having a significant direct or indirect (through a third party) impact on decisions of governing bodies of other group members. Opposite to the group, the banking holding is controlled by a non-credit legal entity without banking license. Management Company without the right on insurance, banking, manufacturing and commercial activity can also be formed for the holding control.

According to the Law and Ordinance of the Bank of Russia No. 3780-U, dated 9 September 2015, “On the Procedure for Notifying the Bank of Russia on the Establishment of a Bank Holding Company, the Formation of a Management Company of a Bank Holding Company and its Granted Powers”, banking groups and holdings can be formed only with the obligatory notification to the Central Bank of Russia. They are obliged to annual provision of the regulator with consolidated financial accounts (including international standard) with auditor’s report.

VTB can be an example of banking group. Parent PJSC VTB directly holds 22 subsidiary credit and financial institutions. Through subsidiaries the parent bank also controls 3 banks and 10 companies.

Speaking about the banking holding’s activity, Financial group “Otkritie” with “Otkritie” Management Company considered. Bank Otkritie Financial Corporation, Khanty-Mansiysk Otkritie Bank, National bank “Trust”, Otkritie Capital, Otkritie broker, Otkritie Life insurance are included in the holding.

Creation of banking groups and holdings gives an opportunity to consolidate assets and capital, use united brand, and expand the business geography. According to the analysts, all these establish conditions for improving stability of credit institutions and the banking system in general. This is up-to-date especially in the current situation, when the Russian banks are almost divided from the western sources of cheap loans due to the sanctions.

According to the Central Bank of the RF as of 1 November 2015, there are 757 active credit institutions with 1473 branches in Russia. Subscription on the Information and analytical system Globas-i® give you an access to the banks’ activity, financial accounts and their assessments, as well as to archive information on banks with terminated licenses.