Prospects of economic recovery

Statistics of macroeconomic indicators in Russia for 6 months (October-December of 2015 and January-March of 2016) confirms opinion of experts that the peak of crisis passed in 2015 and economic growth is renewed (look at table 1). Positive tendencies in 2016 are noticed in agriculture, railway transportation, charged services to citizens, partly in retail trade. Indexes of consumer prices and manufacturers prices of industrial goods showed stable dynamics to decrease. Along with that, economic problems affected the indicators of employment – number of unemployed keeps growing.

| October 2015 г. | November 2015 г. | December 2015 г. | January 2016 г. | February 2016 г. | March 2016 г. | |

|---|---|---|---|---|---|---|

| Gross domestic product, bln RUB | 53 361,3 | 80412,5 | 80 804,3 | |||

| Industrial production index , in % to the same month of the previous year | 96,4 | 96,5 | 95,5 | 97,3 | 101 | 99,5 |

| Agricultural products, bln RUB | 721,8 | 471,2 | 211,4 | 159 | 179,5 | 262,2 |

| Freight turnover, bln t-km | 459,1 | 443,2 | 458,6 | 428,3 | 405,6 | 432,2 |

| Which includes: railway transport | 198,6 | 196,9 | 202 | 182,9 | 185 | 197,8 |

| Retail turnover, bln RUB | 2 378,3 | 2 366,9 | 2 865 | 2 125,1 | 2 086,4 | 2 230,1 |

| Volume of charged services to citizens, bln RUB | 675,8 | 676,9 | 718,8 | 641,1 | 660,9 | 682 |

| Foreign trade turnover, bln USD | 43,1 | 44,4 | 42 | 45,9 | 27,4 | 33 |

| Which includes: export of goods | 26,4 | 27,2 | 25,5 | 28,4 | 17,6 | 20,2 |

| import of goods | 16,8 | 17,2 | 16,4 | 17,4 | 9,7 | 12,8 |

| Investment in equity, bln RUB | 1 547,6 | 1 446,8 | 2 460,3 | 14555,91) | ||

| Consumer price index, in % to the same month of the previous year | 115,6 | 115 | 112,9 | 109,8 | 108,1 | 107,3 |

| Industrial goods manufacturers price index, in % to the same month of the previous year | 114,2 | 113,9 | 110,7 | 107,5 | 103,5 | 100,8 |

| Real disposable financial, in % to the same month of the previous year | 94,4 | 94,6 | 99,3 | 93,7 | 93,1 | 98,2 |

| Average monthly salary of corporate employees: nominal, RUB | 33 240 | 33 857 | 42 684 | 32 122 | 32 990 | 35 570 |

| real, in % to the same month of the previous year | 89,1 | 91 | 90 | 93,9 | 97,4 | 101,6 |

| Total number of the unemployed, mln people | 4,3 | 4,4 | 4,4 | 4,4 | 4,4 | 4,6 |

| Number of legally registered unemployed, mln people | 0,9 | 0,9 | 1 | 1 | 1,1 | 1,1 |

Note: 1) data on January-February of 2015

Inspite of positive tendencies, there are grounds to believe that economic recovery will be delayed. It is caused by the following factors: low oil prices, weak national currency, high inflation and interest rate, deficit of investment, longtime realization of import substitution program, low purchasing ability and others. It should be noted that among mentioned factors there are system imbalances that includes dependency on oil prices, sensitiveness to speculative capital flows and inefficiency of basic economic policy tools.

The Russian rating agency ACRA, taking into account current economic situation, has released their first macroforecast that covers the period from 2016 to 2020. In 2016 the agency forecasts oil price 39 USD per barrel at average, decrease in GDP - 1,8%, investment decrease - to 5,2%, rouble flactuation at 68-71 RUB./$, inflation in the amount of 7,2%. According to ACRA, the industrial production growth will start not until 2017 and will not exceed 1% per year.

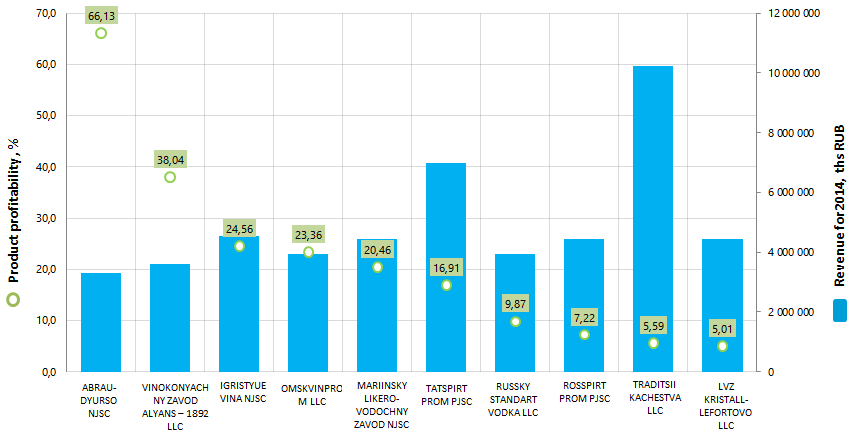

Product profitability of the largest Russian enterprises – manufacturers of alcoholic beverages and ethyl alcohol

Information agency Credinform offers the ranking of Russian enterprises – manufacturers of alcoholic beverages and ethyl alcohol. The companies with the highest volume of revenue were selected for the ranking according to the data from the Statistical Register for the latest available period (for the year 2014). These enterprises were ranked by decrease in product profitability ratio (Table 1).

Product profitability is calculated as the relation of sales profit to expenses from ordinary activities. Totally the profitability reflects the economic efficiency of production, and product profitability ratio allows us to make a conclusion to understand whether output of one or another product is reasonable. There are no specified values prescribed for indicators of this group, because they vary strongly depending on the industry.

| Name, INN, region | Net profit 2014, ths RUB | Revenue of 2014, ths RUB | Revenue of 2014, to 2013, %% | Product profitability, % | Solvency index Globas-i® |

|---|---|---|---|---|---|

| ABRAU-DYURSO NJSC INN 2315092440 Krasnodar territory |

15 026 | 3 301 993 | 115 | 66,13 | 238 high |

| VINOKONYACHNY ZAVOD ALYANS – 1892 LLC INN 3914010751 Kaliningrad region |

472 723 | 3 612 778 | 95 | 38,04 | 188 the highest |

| IGRISTYUE VINA NJSC INN 7830001010 Saint-Petersburg |

467 445 | 4 538 263 | 117 | 24,56 | 235 high |

| OMSKVINPROM LLC INN 5506006782 Omsk region |

547 962 | 3 941 737 | 78 | 23,36 | 241 high |

| MARIINSKY LIKERO-VODOCHNY ZAVOD NJSC INN 4213003050 Kemerovo region |

177 077 | 4 433 126 | 79 | 20,46 | 250 high |

| TATSPIRTPROM PJSC INN 1681000049 Republic of Tatarstan |

1 153 257 | 6 996 663 | 95 | 16,91 | 191 the highest |

| RUSSKY STANDART VODKA LLC INN 7703286148 Saint-Petersburg |

382 147 | 3 930 241 | 115 | 9,87 | 223 high |

| ROSSPIRTPROMPJSC INN 7730605160 Moscow |

101 259 | 4 427 908 | 197 | 7,22 | 251 high |

| TRADITSII KACHESTVA LLC INN 5006008213 Moscow region |

229 445 | 10 220 701 | 92 | 5,59 | 220 high |

| LVZ KRISTALL-LEFORTOVO LLC INN 1328005717 Republic of Mordovia |

109 793 | 4 438 155 | 235 | 5,01 | 272 high |

ABRAU-DYURSO NJSC takes the first place of the ranking with the value of production profitability 66,13%. High result, at times exceeding the industry average indicator of 8,21%, testifies to the lowest production costs in the industry. However, in comparison with its competitors, this enterprise shows relatively modest results in terms of net profit.

The leader of the industry on the volume of revenue for 2014 - TRADITSII KACHESTVA - is on the next-to-last place of the TOP-10 with the indicator value 5,59%, that is below the average industry level. At the same time, the enterprise reduced the volume of revenue by 8% compared to the previous period.

All TOP-10 companies got the highest and high solvency index Globas-i®, that points to their ability to pay off their debts in time and fully.

Picture 1. Revenue and product profitability of enterprises – manufacturers of alcoholic beverages and ethyl alcohol (TOP-10)

Totally the companies of the industry operate profitably, but demonstrate a decrease in the industry average indicator of product profitability from 16,91% in 2009 up to 8,21% in 2014. Five companies from the TOP-10 showed a decrease in sales result in 2014, and the revenue of the largest 100 companies of the industry in total has decreased by 3% in 2014 compared to the previous period and amounted to 117,5 bln RUB.

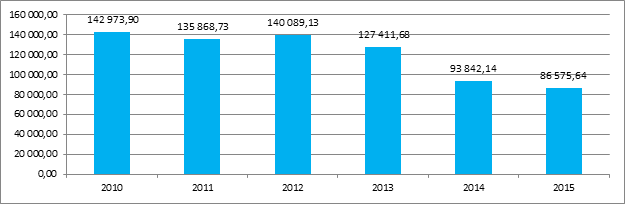

A decrease in physical volumes of production of alcoholic drinks and alcoholic beverages, except for spirit manufacture, is testified also by the data of Rosstat for 2010 - 2015 years. (Picture 2 and Table 2).

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2015 to 2010, +/- % | |

|---|---|---|---|---|---|---|---|

| Table wines | 43 933,65 | 42 126,52 | 37 577,99 | 33 587,90 | 32 497,46 | 39 270,13 | -11 |

| Vodka | 92 565,87 | 86 308,38 | 97 640,37 | 84 587,58 | 63 537,87 | 62 816,46 | -32 |

| Cognac | 8 859,08 | 8 206,67 | 10 273,41 | 7 400,70 | 6 625,62 | 7 242,82 | -18 |

| Alcoholic beverages with an alcohol content of up to 25 % inclusive of the volume of the finished product | 3 391,34 | 3 155,86 | 3 687,68 | 3 393,99 | 2 849,62 | 2 729,75 | -20 |

| Alcoholic beverages with an alcohol content of more than 25 % of the volume of the finished product | 6 926,99 | 4 763,85 | 5 277,60 | 5 144,12 | 3 743,88 | 3 846,02 | -44 |

| Alcohol products | 220 451,01 | 208 910,27 | 206 099,73 | 194 149,22 | 165 100,34 | 168 622,86 | -24 |

| Denatured ethyl alcohol | 4 183,40 | 2 691,58 | 2 707,84 | 13 243,41 | 11 673,01 | 11 350,63 | 171 |

| Ethyl alcohol rectified from food raw material | 30 975,40 | 31 963,15 | 42 165,63 | 40 207,61 | 34 315,68 | 37 102,82 | 20 |

The industry of production of alcoholic beverages is characterized by a high concentration of wine producers in the southern regions of Russia, i.e. closer to sources of raw materials. This is evidenced by the statistics of the Information and analytical system Globas-i® about the number of companies of the industry registered in regions, having financial statements for 2014 in the statistical register (TOP-10 regions):

| 1. | Krasnodar territory | 22 |

| 2. | Moscowregion | 7 |

| 3. | Moscow | 6 |

| 4. | Stavropol territory | 6 |

| 5. | Saint-Petersburg | 4 |

| 6. | Leningrad region | 4 |

| 7. | Republic of Dagestan | 4 |

| 8. | Kaliningrad region | 3 |

| 9. | Republic of Mordovia | 3 |

| 10. | Tver region | 3 |

Moreover, it should be noted that the main enterprises for the production of strong alcoholic beverages are concentrated in large industrial centers of the country.