Changes in legislation

On November 7, 2020, the Federal law No. 349-FL of October 27, 2020 came into force, changing the procedure for entering information to the Unified Register of Small and Medium-sized Enterprises (hereinafter “SMEs”).

The law provides that information on small business that meets the relevant conditions will be entered to the register on the 10th of each month based on information available to the Federal Tax Service (hereinafter “FTS”) of the Russian Federation as of the first day of each month. Previously, the information was entered to the register once a year.

Entrepreneurs who have not provided information to the FTS or who have ceased to meet the criteria for small businesses will be excluded from the SMEs register only once a year - on July 10 as before.

In addition, at the beginning of October 2020, organizations providing support to small businesses and self-employed individuals have already reported on the support measures provided in 2019-2020. The list of such information is determined by the Federal law No. 279-FL of August 2, 2019. This information will be included in the first stage of inclusion the information in the SMEs register, scheduled for December 20, 2020.

The subscribers of the Information and Analytical system Globas have access to the list of legal entities and individual entrepreneurs that have received support from the government, and to the Unified Register of Small and Medium-sized Enterprises receiving support from the Moscow Government. This information is contained in the "Lists we recommend” section. Both registers have data on more than 270 thousand active entities.

Trends of activity in the education sector

Information agency Credinform presents a review of the activity trends of the largest commercial educational organizations in Russia.

The largest organizations rendering educational services (TOP-1000) in terms of annual revenue were selected for the analysis according to the data from the Statistical Register for the period of 2010 – 2019 years. The analysis was based on the data from the Information and Analytical system Globas.

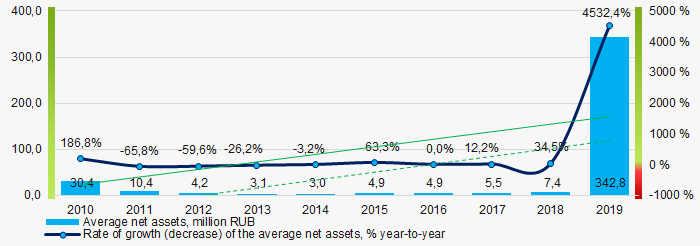

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest educational organization in term of net assets is ChU NOU MIEP, INN 5001009679, Moscow. In 2019, net assets value of the organization amounted to almost 3 billion RUB.

The lowest net assets value among TOP-1000 was recorded for OTS EF ENGLISH FIRST CIS, INN 7707082829, Moscow. In 2019, insufficiency of property of the organization was indicated in negative value of more than -2 billion RUB.

For the decade, the average net assets values of TOP-1000 had a trend to increase, with the positive growth rates (Picture 1).

Picture 1. Change in average net assets value in TOP-1000 in 2010 - 2019

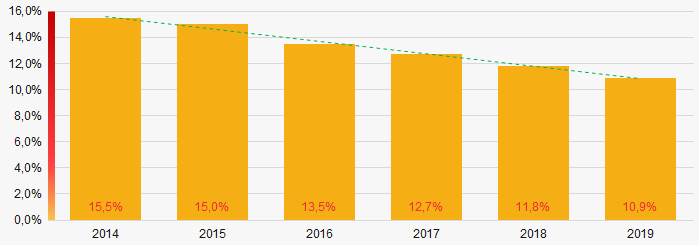

Picture 1. Change in average net assets value in TOP-1000 in 2010 - 2019The shares of TOP-1000 organizations with insufficient property were decreasing during last 6 years (Picture 2).

Picture 2. Shares of organizations with negative net assets value in TOP-1000 in 2014 - 2019

Picture 2. Shares of organizations with negative net assets value in TOP-1000 in 2014 - 2019Sales revenue

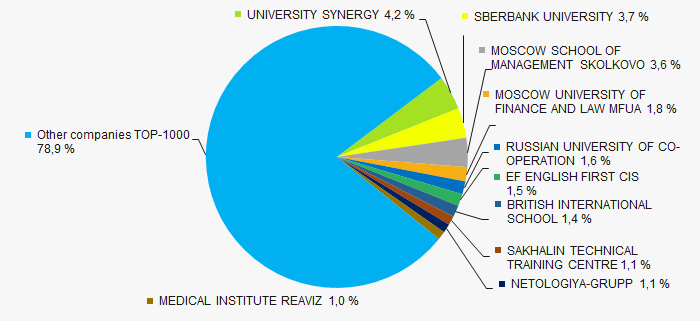

The revenue volume of ten leading organizations amounted to 21% of the total revenue of TOP-1000 organizations in 2019. (Picture 3).

Picture 3. Shares of TOP-10 companies in the total revenue of TOP-1000 in 2019

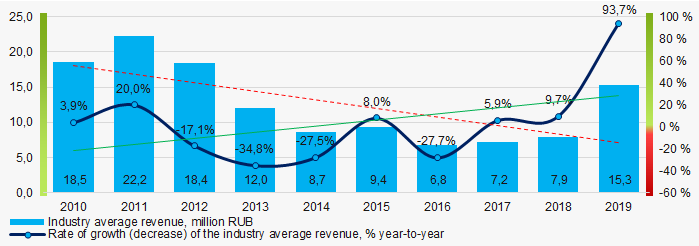

Picture 3. Shares of TOP-10 companies in the total revenue of TOP-1000 in 2019In general, there was a trend to increase in revenue with increasing growth rates (Picture 4).

Picture 4. Change in average revenue in TOP-1000 in 2010 - 2019

Picture 4. Change in average revenue in TOP-1000 in 2010 - 2019Profit and loss

The largest organization in term of net profit is MOSCOW UNIVERSITY OF FINANCE AND LAW MFUA, INN 7725082902, Moscow. The organization’s profit amounted to 337 billion RUB in 2019.

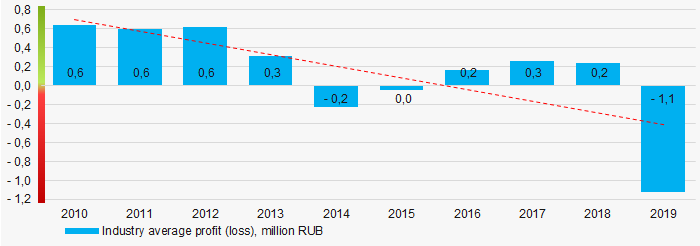

During the decade, the average profit figures of TOP-1000 companies had a trend to decrease (Picture 5).

Picture 5. Change in average profit (loss) in TOP-1000 in 2010 - 2019

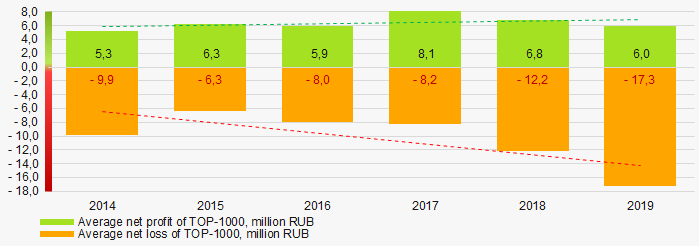

Picture 5. Change in average profit (loss) in TOP-1000 in 2010 - 2019For a six-year period, the average net profit figures of TOP-1000 organizations had a trend to increase with the increasing average net loss (Picture 6).

Picture 6. Change in average net profit and net loss in ТОP-1000 in 2014 - 2019

Picture 6. Change in average net profit and net loss in ТОP-1000 in 2014 - 2019Key financial ratios

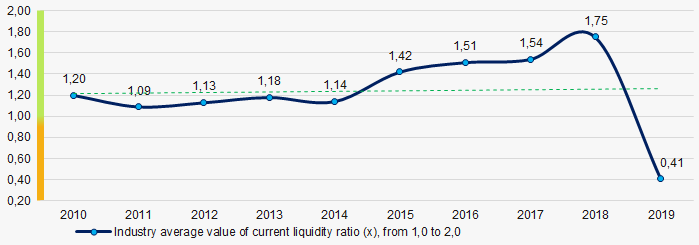

During the decade, the average values of the current liquidity ratio of TOP-1000 were in general within the recommended interval – from 1,0 to 2,0, with a trend to increase. (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of organization’s assets to repay on short-term liabilities.

Picture 7. Change in average values of current liquidity ratio in TOP-1000 in 2010 - 2019

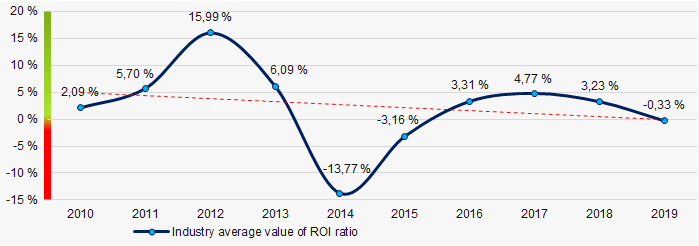

Picture 7. Change in average values of current liquidity ratio in TOP-1000 in 2010 - 2019During the decade, there was a general trend to decrease in the average ROI values (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in TOP-1000 in 2010 - 2019

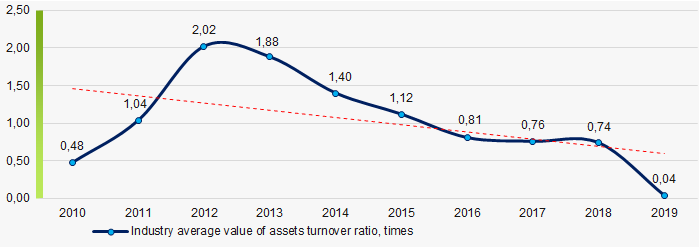

Picture 8. Change in average values of ROI ratio in TOP-1000 in 2010 - 2019Assets turnover ratio is the ratio of sales revenue and organization’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

During the decade, there was a trend to decrease of this ratio (Picture 9).

Picture 9. Change in average values of assets turnover ratio in TOP-1000 in 2010 - 2019

Picture 9. Change in average values of assets turnover ratio in TOP-1000 in 2010 - 2019Small enterprises

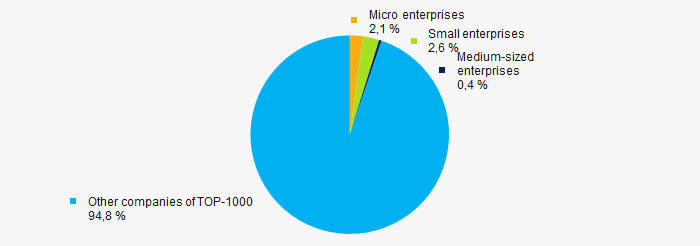

10% organizations of TOP-1000 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. However, their share in total revenue of TOP-1000 amounts to 5%, which is lower than the average country value in 2018 – 2019 (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in TOP-1000 in 2011

Picture 10. Shares of small and medium-sized enterprises in TOP-1000 in 2011Main regions of activity

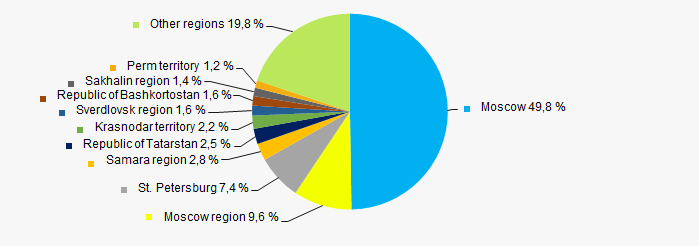

TOP-1000 organizations are registered in 72 regions. Almost the half of the largest by the revenue volume organizations consolidate in Moscow. (Picture 11).

Picture 11. Distribution of TOP-1000 companies by financial position score

Picture 11. Distribution of TOP-1000 companies by financial position scoreFinancial position score

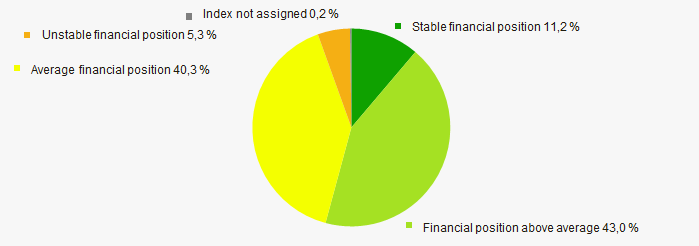

According to the assessment, the financial position of most of TOP-1000 companies is above average (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

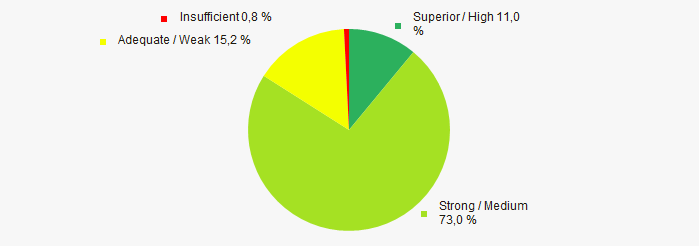

The major part of TOP-1000 companies got Superior / High and Strong index Globas. This fact shows their ability to meet their obligations fully and by the due date (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasConclusion

Complex assessment of activity of the largest educational organizations in Russia, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of positive trends in 2010 - 2019 (Table 1).

| Trends and evaluation factors | Relative share of factor, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition / monopolization |  5 5 |

| Dynamics of the average revenue |  -10 -10 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Dynamics of the average profit (loss) |  -10 -10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Growth / decline in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of current liquidity ratio |  10 10 |

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in terms of revenue being more than 22% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  0,9 0,9 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).