Establishment of new legal entities is almost at the pre-crisis level

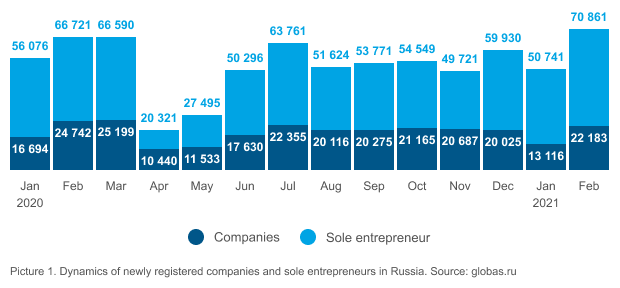

COVID-19 restrictions have resulted in the notable decrease in the number of newly registered companies in April – June 2020. However, the statistics is almost at the pre-crisis level by February 2021.

Following the results of February 2021, 22 thousand companies and 71 thousand sole entrepreneurs were established in Russia, which is slightly below then in the pre-pandemic February 2020 (Picture 1).

Picture 1. Dynamics of newly registered companies and sole entrepreneurs in Russia. Source: globas.ru

Picture 1. Dynamics of newly registered companies and sole entrepreneurs in Russia. Source: globas.ruWholesale and construction are the main activity types of newly established companies

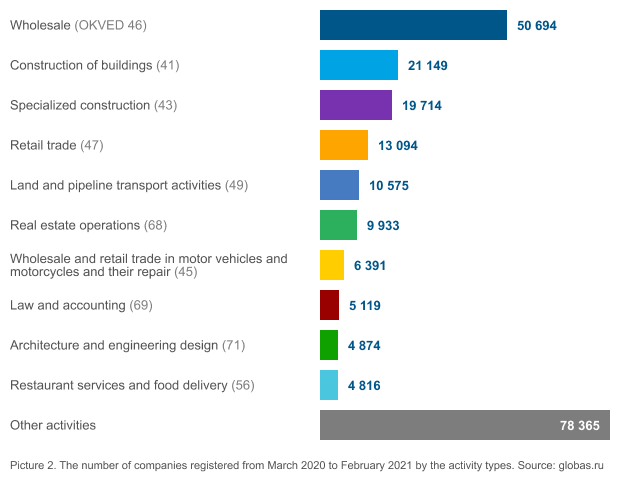

From March 2020 to February 2021, 224,7 thousand new companies were established in Russia. 50,7 thousand of them are wholesalers, 21,1 thousand are engaged in construction of buildings and 19,7 – in specialized construction (Picture 2).

Picture 2. The number of companies registered from March 2020 to February 2021 by the activity types. Source: globas.ru

Picture 2. The number of companies registered from March 2020 to February 2021 by the activity types. Source: globas.ruRetail trade, freight and passenger transportation are the most popular activities among newly registered sole entrepreneurs

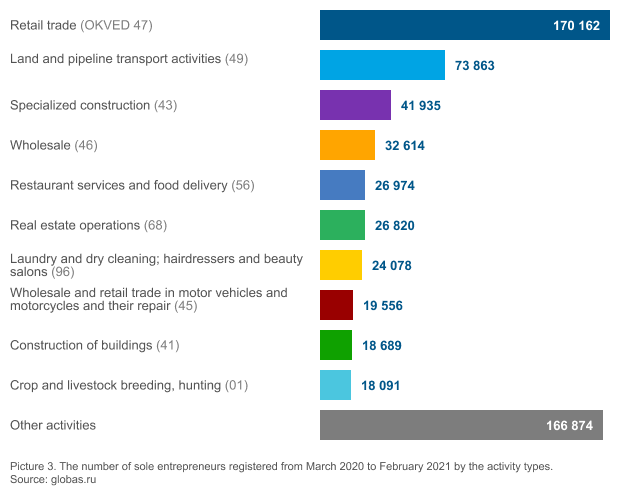

From March 2020 to February 2021, 619,7 thousand sole entrepreneurs were established in Russia. 170,2 thousand, i.e. every third of them, are retailers, and 73,9 thousand sole entrepreneurs provide services in the field of land freight and passenger transportation. (Picture 3).

Picture 3. The number of sole entrepreneurs registered from March 2020 to February 2021 by the activity types. Source: globas.ru

Picture 3. The number of sole entrepreneurs registered from March 2020 to February 2021 by the activity types. Source: globas.ruThe nominal GDP volume in 2020 amounted to 106,607 trillion RUB. The Central Bank of Russia forecasts a 3-4% increase in GDP in 2021 that will be the highest result since 2012. The recovery will promote the revival of economic activity in the country, as well as the increase in newly established companies and businesses.

Changes in legislation

The Federal Law No. 477-FL of December 29, 2014 amended the Tax Code of the Russian Federation (hereinafter “the Tax Code”) with the requirements, according to which the sole entrepreneurs are not obliged to pay for a patent or tax under the simplified tax system. This is possible under the following conditions:

- наличие соответствующего регионального закона о налоговых каникулах в определенных сферах деятельности ИП;

- регистрация ИП после принятия такого закона.

The validity period of these requirements was determined until January 1, 2021 and extended until 2024 by the Federal Law No. 266-FL of July 31, 2020.

The zero tax or patent rate is valid for two tax periods from the date of registration, provided that the share of income from the activity in respect of which the exemption is applied is at least 70%. Generally, this is applied to the industrial, social and scientific spheres.

Currently, laws on tax holidays have been adopted and are in force in 67 constituent entities of Russia, including the largest regions: Moscow and Moscow region, Saint Petersburg and Leningrad region, Krasnodar territory, Nizhny Novgorod, Novosibirsk and Sverdlovsk regions.

In accordance with paragraph 4 of Art. 346.20 of the Tax Code, the regional laws may establish the additional restrictions: by the type of activity, average number of employees, maximum amount of income. Similar conditions for the application of tax holidays may also be applied to the newly registered sole entrepreneurs using the patent system (clause 3 of Art. 346.50 of the Tax Code).

The users of the Information and Analytical system Globas have access to the comprehensive (including archived) information about 16 million sole entrepreneurs.