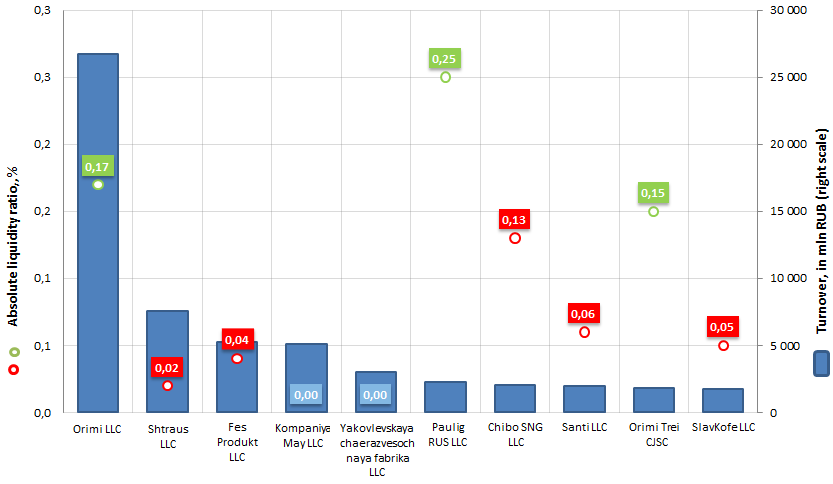

Absolute liquidity ratio of tea and coffee manufacturers in Russia

Information agency Credinform prepared a ranking of the largest companies in Russia, mainly specializing in the production and supply of tea and coffee.

The TOP-10 list of enterprises was drawn up for the ranking on the volume of revenue, according to the data from the Statistical Register for the latest available period (for the year 2014). These enterprises were ranked by increase in turnover. Moreover following data are presented: on the dynamic of revenue related to the previous period, absolute liquidity ratio and solvency index GLOBAS-i (s. Table 1).

Absolute liquidity ratio (%) is the relation of the amount of cash, being at the disposal of a company, to short-term liabilities. It allows to determine the share of short-term liabilities, which an enterprise can pay off in the near future (at once), without waiting for the payment of accounts receivable and sales of other assets. The recommended value is > 0,15. The higher is the indicator the better is the solvency of an enterprise.

On the other hand, too high ratio value may testify to irrational capital structure, out-of-work assets in the form of cash and funds deposited in accounts, that depreciate and lose their initial liquidity in view of time factor and inflation (at the time of their receipt).

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to the level of profitability of investments, but also to all presented combination of financial indicators and company’s ratios.

| № | Name | Region | Revenue, in mln RUB, for 2014 | Revenue increase,% | Absolute liquidity ratio, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | Orimi LLC INN 4703044256 |

Leningrad region | 26 704 | 18,1 | 0,2 | 203 high |

| 2 | Shtraus LLC INN 7726584503 |

Vladimir region | 7 538 | 18,8 | 0,0 | 297 high |

| 3 | Fes Produkt LLC INN 5007049413 |

Moscow region | 5 224 | 23,1 | 0,0 | 262 high |

| 4 | Kompaniya May LLC INN 5052013232 |

Moscow region | 5 119 | 20,0 | 0,0 | 205 high |

| 5 | Yakovlevskaya chaerazvesochnaya fabrika LLC INN 5074021100 |

Moscow region | 3 018 | -3,5 | 0,0 | 184 the highest |

| 6 | Paulig RUS LLC INN 6949003920 |

Tver region | 2 292 | 13,1 | 0,3 | 319 satisfactory |

| 7 | Chibo SNG LLC INN 7710502329 |

Moscow | 2 053 | -11,3 | 0,1 | 296 high |

| 8 | Santi LLC INN 7702371288 |

Moscow | 2 000 | -7,4 | 0,1 | 360 satisfactory |

| 9 | Orimi Treid CJSC INN 7804045886 |

Saint-Petersburg | 1 834 | -69,4 | 0,2 | 213 высокий |

| 10 | SlavKofe LLC INN 7706514177 |

Moscow | 1 736 | 23,9 | 0,1 | 310 satisfactory |

How to improve efficiency of own business under high inflation and expensive dollar?

The year 2015, difficult in relation to economy, is coming to an end. Some difficulties were caused by such factors as decline in market price on oil and gas – main sources of Russian budgeting; depreciation of national currency in relation to USD; GDP negative growth as a result of decrease in production volume, work and services, earnings of export operations; reduction of investments; unreasonable prices growth; decline in demand and purchasing capacity; high credit rates and others.

The state of the economy in 2016 does not seem to be rosy. Next year proceeding of inflation growth is expected on the back of further reservation (or decline) of market price on oil and gas and depreciation of RUB to USD; decrease in consumer demand and investments; lack of liquidity; delay of credit provision; growth of payment delay and other factors that typical for stagnating economy.

Under such conditions the Central Bank of the RF believes that it is possible to change the economic situation with the help of stable prices. In this case mega-regulator focuses its efforts on solving two main tasks: inflation targeting* on 4% rate to 2017 and control of poverty, that is control of decline in real salary of citizens.

* Inflation targeting — complex of measures taken by the state authorities to control the inflation rate in the country. Measures include establishment of plan inflation indicator for some period and selection of proper monetary instruments to control the inflation rate.

Currently experts mark out several stability trends. They include: military-industrial complex; government order and government support; food industry of economy-class and industries produce goods for import substitution.

Business analytics consider those companies successful that find high demanded in crisis services; provide consumers and partners with interesting options, thus becoming more customer-oriented. Practice shows that companies could overcome difficult period in economy with using strict financial tactics.

What measures for business under conditions of high inflation and expensive dollar should be taken for overcoming negative trends in economic development?

Experts list following measures:

- to make an audit of expenses, to define main effective ways of company development and to take reasonable austerity measures;

- to minimize costs on industrial, management and other activities;

- refuse from non-core, unpromising, costly assets;

- to develop efficient business-projects;

- to reduce a prime cost of output products and provided services;

- to focus on consumer demands;

- to consider low-income consumers while choosing the price or raise prices only on high quality products;

- to implement instruments for increase in labor productivity;

- to take different business tasks on outsourcing;

- to increase market share with the help of other regions;

- to employ funds under profitable/noteworthy conditions, in case of having accumulated funds;

- to apply for splitting company into several parts, that let to minimize taxation and use existing preferences and others.