New challenges for business in Russia. How to work in the reality of the XXI century

International restrictions, reorientation of the global economy to the East, regular changes in legislation, large-scale sanctions, breaks in trade chains, “legalization” of parallel imports, all these factors form the new economic reality of the XXI century. The skill of successful adaptation to rapidly changing environmental conditions is the key to effectively made decisions.

Focus on the East

The sharp break in export-import relations with the European Union and Western countries, as well as the departure of large foreign companies, are forcing businesses to look for new reliable partners. The course of reorientation of the Russian economy and international trade towards the Asian direction announced at the state level creates opportunities for entrepreneurs to search for new markets and build alternative supply chains.

The geography of sanctions and restrictions against Russia is represented by the United States, the European Union, Switzerland, Great Britain, Japan, Canada, Australia, New Zealand and other countries. Therefore, when planning transactions, it is worth considering the effect of not only direct, but also secondary sanctions. The US sanctions legislation, for instance, allows the introduction of restrictive measures against the participants in the transaction, if the result is the export or re-export of goods and technologies prohibited from being imported into Russia.

| Automate the verification of counterparties in Globas using the Sanctions risks report. The functionality of the report allows you to carry out a comprehensive analysis of legal entities, individual entrepreneurs, divisions and persons for inclusion in the sanctions lists, evaluate indirect and secondary sanctions, including the 50 Percent Rule. |

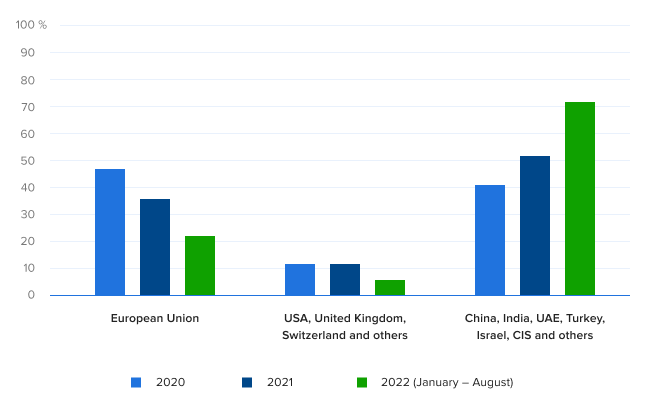

However, more than 80 countries around the world have not imposed sanctions against Russia. These countries are open to cooperation and development of trade and market relations. The statistics of the Information Agency Credinform confirms that the customers of business reports via Globas are now focused on companies in China, India, UAE, Turkey, Israel and CIS.

Picture 1. Distribution of business reports on foreign companies, 2020-2022

Picture 1. Distribution of business reports on foreign companies, 2020-2022Sources: Credinform, Globas

| Due to a wide network of partners, Credinform provides information

about legal entities and entrepreneurs around the world: in Asia, Africa, Europe, America and Australia. The report can be ordered individually or via

Globas. The content of the reports complies with international standards: registration data, management, shareholders, types of activities, balance sheet, income statement, comprehensive assessment of solvency. For each foreign company, the experts of the Credinform Information Department additionally search for links with Russian business. |

Parallel import

In connection with the withdrawal from Russia of a number of large foreign companies and brands, parallel import was legalized at the legislative level. Decree of the Government of the Russian Federation of March 29, 2022 No. 503.

Parallel import refers to the import of goods into the country without the consent of the right holder. According to the list of the Ministry of Industry and Trade, the import of cars, medical equipment, pharmaceutical products, household appliances and weapons into the country is allowed. A full list of products is specified in the Order No. 1532 dated April 19, 2022.

The importation of goods under parallel import imposes a number of obligations on the business. Now, only the end seller is responsible for observance of all consumer rights and fulfillment of warranty obligations. Moreover, only original goods can be imported.

| Check the supplier before the deal to protect yourself from buying low-quality goods. Globas will help to check the experience of the importer, whether it has employees and assets. As well as the attention will be paid to the courts for non-fulfillment of supply contracts, active or bad enforcement proceedings, and fines. |

Postponed effect. Why Moratorium on bankruptcy can do a disservice

Moratorium on bankruptcy, imposed up to October 1, 2022, became another anti-crisis measure to support business in Russia. The moratorium protected citizens, individual entrepreneurs and legal entities, except for the developers from the register of distressed objects and persons who refused from the moratorium.

An unobvious and negative consequence of the expiration of the moratorium may be a new wave of bankruptcies, as well as the closure of enterprises dependent on imports, and as a result, the threat of non-fulfillment of already concluded agreements and contracts.

To avoid these negative consequences, it is necessary to carry out a comprehensive study of the future counterparty, check its financial position, tax burden, judicial history, the status of pledge and leasing agreements.

| In the Information and Analytical System Globas you can check which of your counterparties are already going through bankruptcy proceedings, or have unstable financial situation and at the same time apply a moratorium, and which ones have refused this support measure. |

Friendly compliance

Decree of the President of the Russian Federation No. 81 dated March 1, 2022 introduced a special procedure for executing transactions with foreign persons from the list of unfriendly states. From March 02, 2022, transactions to which a special procedure must be applied include:

- granting credits and loans to non-residents in rubles;

- granting loans to non-residents in foreign currency;

- purchase and sale of securities and real estate to non-residents;

- transferring money without opening a bank account using foreign payment services.

The mentioned transactions are allowed only with the consent of the Government Commission for the Control of Foreign Investments in the Russian Federation. To make transactions with securities, you need to obtain permission from the Bank of Russia.

Currently, the list of unfriendly states includes 55 countries and territories. Among them: USA, UK, EU member states, Switzerland, Canada, Japan, Republic of Korea.

| Use

Globas

to check if a shareholder of a partner company is registered in a country that commits unfriendly actions against the Russian Federation. Globas users have access to ready-made reports on enterprises, where 350 criteria for full compliance control are checked. Download a ready-made report for your own company or for your counterparties and assess the risk level of the transaction. If you are not subscribed to Globas yet, fill out an application for trial access and check if there are high-risk partners among your counterparties. GET TRIAL ACCESS |

Automated solutions for business partners check: today and tomorrow

Continuously changing market conditions, high decision-making speed, multitasking and the need to reduce risks require modern approaches to business partners check. Currently, the transfer of routine operations to the digital ones affects almost all business processes in companies, as a result of which labor productivity increases and the number of errors decreases.

Today, most companies firstly focus on the automation of operations that directly affect profits and revenues: finance and accounting, document management, production, inventory control. The Russian enterprises are at the very beginning of supporting processes automation, such as economic security and risk management. This means that time-consuming manual checks and screenings of business partners are still the reason for slowing down other corporate processes.

The growing complexity of customers and suppliers check makes launching the automated solution a difficult but necessary measure. There are five main trends:

- Every year the number of reasons to check your counterparty increases: credit risks, KYC, anti-corruption compliance, the anti-money laundering Russian Federal Law 115-FL, sanctions risks, and all these are against the backdrop of the economic shocks of 2020-2022.

- Open Government in Russia stimulates the growth of available sources with different information on companies. Today it is necessary to collect, process and analyze more data and it requires much more time.

- In addition to external sources, each company stores a pool of accumulated corporate data required for check and screening: lists of employees, "black" and "white" lists of customers and suppliers, payment history. Such data also need to be analyzed and compared with external sources of information.

- The structure of companies is becoming more complex, and corporate standards do not always keep pace with these changes. The lack of unified corporate regulations leads to the fact that the check of the same business partner by different departments gives conflicting results.

- Human factor. The overall result is always influenced by the qualification and motivation of the employee involved in business partners check. Therefore, the introduction of general regulations and the formation of a unified information environment is becoming the main way to improve the quality of checks.

| Globas uses over 300 sources to help you to evaluate business activities of companies. Globas analyzes and compares all available data, selects the key information and provides the result of the check in a convenient format. |

Information agency Credinform helps to minimize business risks by introducing a single standard of checks and speeding up regulatory processes. To this end, Credinform can offer two options for the automated check of customers and suppliers.

Option 1.| Instant data exchange using Globas.API allows you to integrate data from Globas into your corporate system. It may include accounting or management programs 1C, Bitrix, CRM, SAP, as well as self-developed software. |

You can automate the search and assessment of new customers and suppliers, adding up-to-date company’s details to your own database, receive reports and official papers on current clients in a few seconds, and also learn about important changes in time.

We recommend integration with Globas if you have:

-

Significant number of business partners

Automation of verification processes will help reduce risks, standardize check procedures and help avoid entering into a contract with an unreliable entity. -

Large number of procurement and tenders

Automated check of bidders will speed up the decision-making process and reduce the checking costs by delegating this procedure to the procurement department. -

Many representative offices, branches

In the case of a geographically distributed network of branches, you can ensure checks in the Far East of Russia in accordance with a single standard, while the head office in the European part of Russia is still close.

Integration with Globas.API can significantly improve the quality of management, ensure the consistency of personnel actions, reduce the number of errors, ensure the parallel execution of several tasks and quick decision-making in ordinary routine cases. However, development and integration may take several months.

Option 2.| Reports built-in Globas allow you to automate the processes of checking business partners under your corporate regulations. Reports have 350 criteria for automated check, as well as the ability to add your own parameters for manual verification. |

After completing the settings, the check will be performed automatically under your parameters when you open the company profile. To complete the report, you will need to fill the appropriate self-verification fields in, and attach documents. Documents can be stored both in Globas and on your desktop. Check results can be sent as a file to employees of other departments. Also you can share your report settings to unify the checking procedures.

Globas contains five types of pre-configured Reports to assist in building a reliable risk management system and reducing the likelihood of claims from regulators. All checking criteria comply with the requirements of the Federal Tax Service, AML / CFT legislation (Combating money laundering and financing of terrorism) under the Federal Law 115-FL, letters from the Central Bank and Rosfinmonitoring, as well as the sanctions legislation of Russia and other countries.

Reports in Globas is a reliable tool for starting the process of automated check and forming clear regulations when analyzing business partners. However, Reports should be considered as an interim phase to full API integration. Customized Reports are easier to implement, and the transition to routine checks takes less time. However, keep in mind that typical software may not fully fit the individual requirements of the company. Only an individually developed product, for example, integrated with Globas.API, can satisfy all requirements of your company.

| Information agency Credinform has rich experience in supporting the integration for companies, both in the real and financial sectors of the economy. If you are thinking about automating your business risks activities, please, request a trial access to Globas. Our experts will advise on possible ways of integration and select the best solution. |