Software development trends

Information agency Credinform has prepared a review of the activity trends of the largest software developers in Russia.

Software developers and companies rendering consultancy services in this business area (TOP-1000) with the largest annual revenue were selected for the analysis, according to the latest accounting periods in the Statistical Register and the Federal Tax Service (2010 – 2019). The analysis was based on the data from the Information and Analytical system Globas.

Net assets value is an indicator, reflecting the real value of company’s property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest enterprise of the industry in terms of net assets is Joint Stock Company Atomic Energy Power Corporation, INN 7706664260, Moscow. In 2019, net assets value of the company amounted to 1352 billion RUB.

The lowest net assets value among TOP-1000 was recorded for TECHNOSERV MANAGEMENT, INN 7722536788, Moscow. In 2019, insufficiency of property of the company was indicated in negative value of -5142 billion RUB.

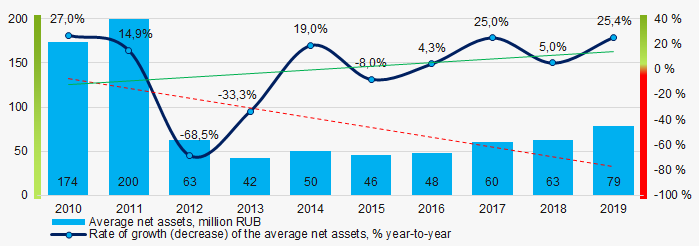

During the decade, average industry values of net profit ratio had a tendency to decrease with a positive dynamics of growth rates. (Picture 1).

Picture 1. Change of industry average values of net profit ratio of software developers in Russia in 2010 – 2019

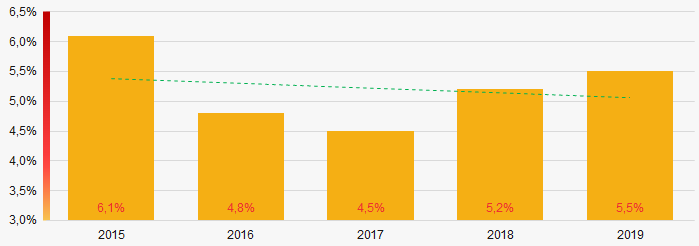

Picture 1. Change of industry average values of net profit ratio of software developers in Russia in 2010 – 2019The shares of TOP-1000 enterprises with insufficiency of assets have a tendency to decrease in the last five years (Picture 2).

Picture 2. Shares of companies with negative net assets value of TOP-1000 in 2015 – 2019

Picture 2. Shares of companies with negative net assets value of TOP-1000 in 2015 – 2019Sales revenue

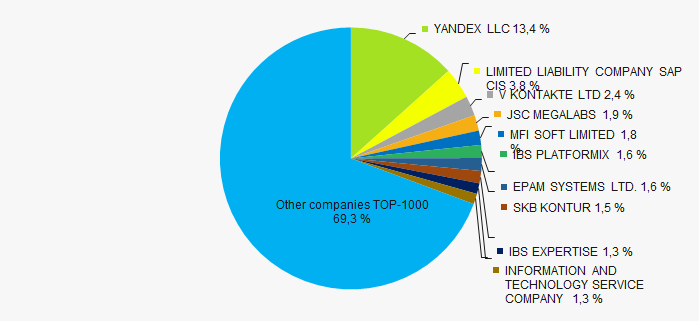

The revenue volume of 10 leading companies of the industry made 31% of the total revenue of TOP-1000 in 2019 (Picture 3). It points to a high level of monopolization in the industry.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises in 2019

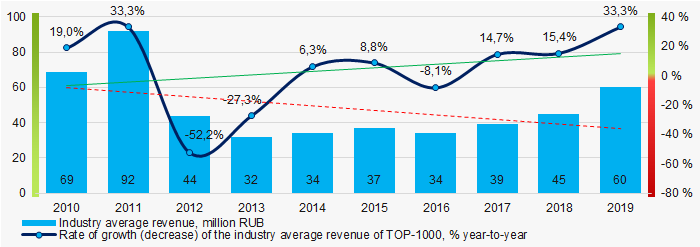

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises in 2019In general, there is a tendency to decrease in the revenue volumes, with a positive dynamics of growth rates (Picture 4).

Picture 4. Change in the industry average revenue in 2010 – 2019

Picture 4. Change in the industry average revenue in 2010 – 2019Profit and losses

The largest company of the industry in terms of net profit value is YANDEX LLC, INN 7736207543, Moscow. The company's profit amounted to 26,5 billion RUB in 2019.

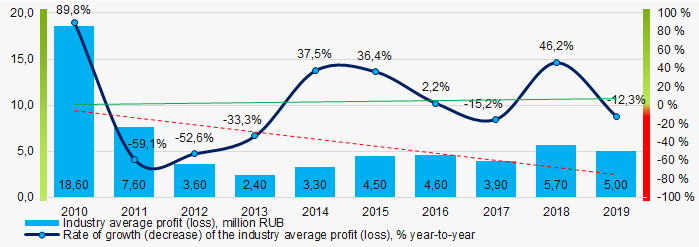

Over a ten-year period, the indicators of the industry average profit have a tendency to decrease, with a positive dynamics of growth rates (Picture 5).

Picture 5. Change in the industry average indicators of profit (loss) in 2010 – 2019

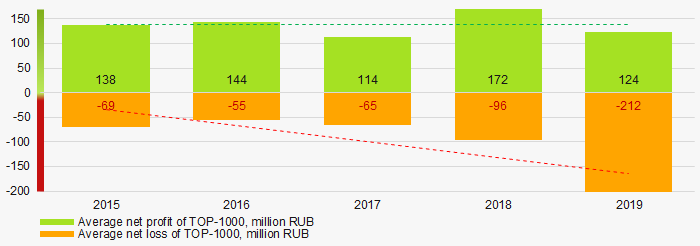

Picture 5. Change in the industry average indicators of profit (loss) in 2010 – 2019Over a five-year period, average values of net profit’s indicators of TOP-1000 enterprises have a tendency to decrease, at the same time the average value of net loss increases. (Picture 6).

Picture 6. Change in the industry average indicators of net profit and net loss of TOP-1000 companies in 2015 – 2019

Picture 6. Change in the industry average indicators of net profit and net loss of TOP-1000 companies in 2015 – 2019Key financial ratios

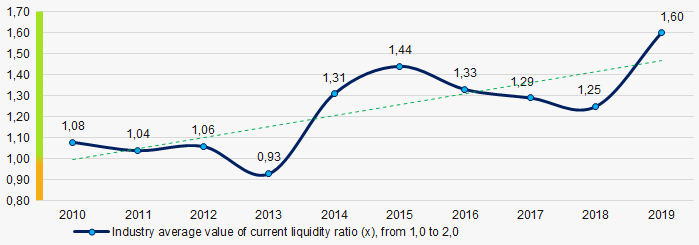

Over the ten-year, period the industry average indicators of the total liquidity were within the range of recommended values - from 1,0 up to 2,0, with a tendency to increase. (Picture 7).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the industry average values of the total liquidity ratio in 2010 – 2019

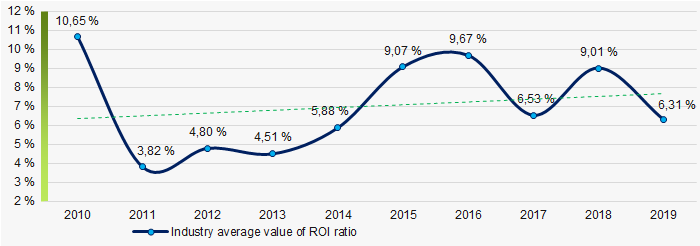

Picture 7. Change in the industry average values of the total liquidity ratio in 2010 – 2019Over the ten-year period, the industry average values of the return on investment ratio have a tendency to increase. (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity and the long-term borrowed funds of an organization.

Picture 8. Change in industry average values of ROI ratio of TOP-1000 in 2010 – 2019

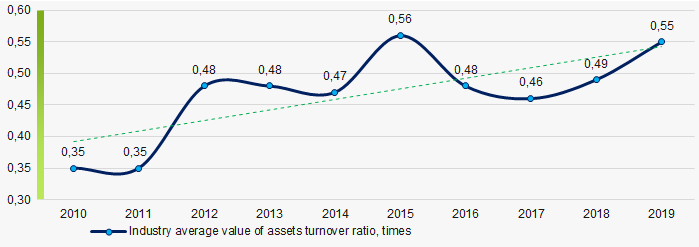

Picture 8. Change in industry average values of ROI ratio of TOP-1000 in 2010 – 2019Asset turnover ratio is calculated as the relation of sales revenue to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Over a ten-year period, indicators of this ratio of business activity showed an upward trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio of TOP-1000 in 2010 – 2019

Picture 9. Change in average values of assets turnover ratio of TOP-1000 in 2010 – 2019Small enterprises

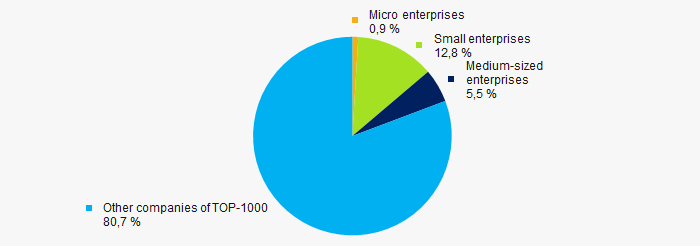

66% companies of TOP-1000 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. At the same time, their share in total revenue of TOP-1000 amounts to 19%, which is lower than the national average indicator in 2018-2019 (Picture 10).

Picture 10. Shares of the revenue of small and medium-sized enterprises in TOP-1000 companies

Picture 10. Shares of the revenue of small and medium-sized enterprises in TOP-1000 companiesMain regions of activity

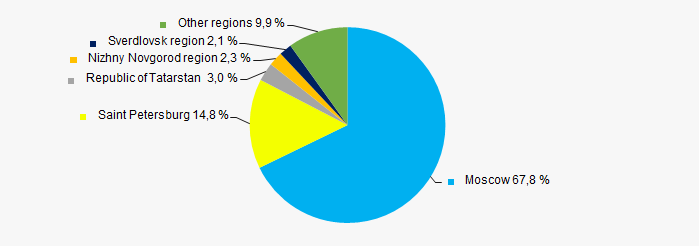

The TOP-1000 companies are registered in 55 regions and distributed unequal across Russia. Almost 83% of the largest enterprises in terms of revenue are concentrated in Moscow and St. Petersburg (Picture 11).

Picture 11. Distribution of the revenue of TOP-1000 companies by Russian regions

Picture 11. Distribution of the revenue of TOP-1000 companies by Russian regionsFinancial position score

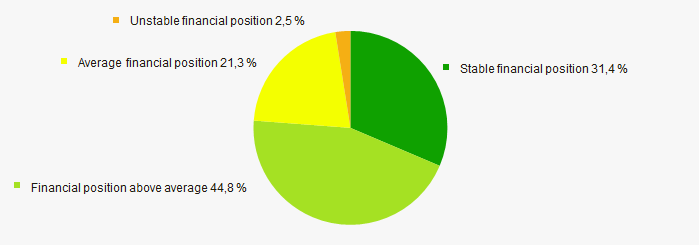

According to the assessment, the financial position of most of TOP-1000 companies is above average (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position score Solvency index Globas

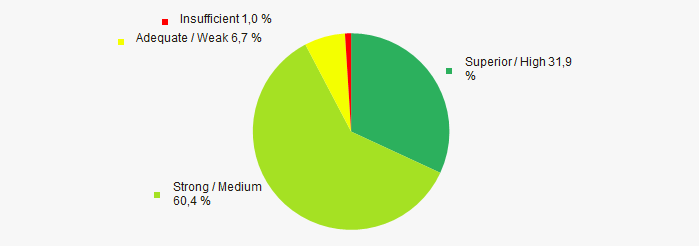

Most of TOP-1000 companies got Superior / High and Strong index Globas. This fact shows their ability to meet their obligations fully and by the due date (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasConclusion

Complex assessment of activity of the largest software developers in Russia, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of positive trends in 2010- 2019 (Table 1).

| Trends and evaluation factors | Specific share of factor, % |

| Dynamics of the number of active companies |  -10 -10 |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition / monopolization |  5 5 |

| Dynamics of the average revenue |  -10 -10 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Dynamics of the average profit (loss) |  -10 -10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Increase / decrease in average values of companies’ net profit |  5 5 |

| Increase / decrease in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  10 10 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  10 10 |

| Share of small and medium-sized businesses in terms of revenue being more than 20% |  5 5 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  3,2 3,2 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

Top-10 private museums of Saint Petersburg by revenue in 2019

Saint Petersburg is one of the most beautiful cities in the world. It was the capital of the Russian Empire for more than two centuries. Luxurious palaces, monumental buildings and monuments are located in the heart of Saint Petersburg. There are over 200 museums and their branches, including those not belonging to the state. Using high-tech and interesting themes, private museums exhibit modern art. Many of these museums are found in guidebooks, are recommended to visit and are the "trademark" of the city. Information agency Credinform presents a ranking of private museums of Saint Petersburg. Using the Information and Analytical system Globas, have selected Top-10 private museums by revenue in 2019.

| No. | Name | Revenue in 2019, million RUB |

| 1 | Grand Maket Russia | 267,9 |

| 2 | Erarta | 86,8 |

| 3 | Planetarium 1 | 83,4 |

| 4 | Wax museum | 17,5 |

| 5 | Museum of Russian vodka | 17,4 |

| 6 | Museum of coffee | 10,2 |

| 7 | Museum of dolls | 4,9 |

| 8 | Museum of spices | 1,6 |

| 9 | Museum of toys | 1,4 |

| 10 | Museum of nonconformist art | 1,0 |

Grand Maket Russia with the highest revenue (267,9 million RUB) is the first in the ranking. It is a miniature model of Russia, where collective images of the regions of the Russian Federation are demonstrated. This model is the largest in Russia and the second largest in the world. The uniqueness of the museum lies in the fact that it is fully interactive; visitors can independently set in motion the figures located at the exhibition facility.

Erarta is ranked the second by revenue (86,8 million RUB). This is the first museum of contemporary art in St. Petersburg. The name of the museum comes from two words "era" and "arta", which means "time of art". The collection includes more than 2,800 objects of art: paintings, sculptures, graphics, installations. The exhibitions feature works by Russian artists of the second half of the 20th - early 21st centuries. Erarta not only demonstrates the works of contemporary artists, but also supports Russian art and creates its own projects. The museum is very popular with all ages. Every visitor can find art to their liking here.

Planetarium 1 is the third (83,4 million RUB). It is one of the largest planetariums in the world. Space will always fascinate and attract people's attention. Absolutely every person wants to learn the history of the origin of the planet Earth and the solar system. Using modern technologies, the museum staff manages to transfer visitors to the center of the Universe and lift the veil of the mystery of the Universe.

Wax museum is ranked the forth (17,5 million RUB). Wax figures of popular film actors, musicians, cartoon characters and historical figures are its main specialization. The scale of the figures corresponds to the dimensions described in a book, in a movie or in life. For the first time in Russia, a wax exhibit appeared in Saint Petersburg, it was brought by Emperor Peter I from Europe.

Then follows the Museum of Russian vodka (17,4 million RUB). It tells about the history of the origin of the Russian national drink. The highlight of the museum is the tasting of various types of vodka, accompanied by traditional Russian snacks.

Museum of coffee (10,2 million RUB) is ranked the sixth. It is one of the most unusual and interesting museums in Saint Petersburg created for lovers and connoisseurs of real coffee. However, it gained popularity not only among his fans. Thanks to the museum, you can learn a lot about the history of coffee, as well as the regions where it grows and is produced, how it is roasted, as well as about popular recipes and brewing methods.

Saint Petersburg museum of dolls (4,9 million RUB) is the seventh in the ranking. The main exhibits are dolls made by students of the staging department of the Academy of Theater Arts. Their best works are exhibited in the halls of the museum. The layout of each showcase is similar to a theatrical stage with doll characters, which creates the effect of a kind of immersion of the viewer in a magical doll atmosphere. There are over 40 thousand of dolls in the museum.

Then follows the Museum of spices. Income for 2019 amounted to more than 1,6 million RUB. This museum is the only one in Russia and the third in the world. Here, visitors will be told about what spicy plants are, how and where they grow, how they are harvested and processed.

Saint Petersburg museum of toys (1,4 million RUB) is the first private museum of the city. It appeared in 1997. The main task of the museum is to collect, store and study the toy not only as a unique phenomenon of material culture, but also as a special kind of art, in which ancient national traditions and the most modern artistic trends are intertwined.

The last in the ranking is the Museum of nonconformist art (1,0 million RUB). Nonconformism is the unofficial (alternative or other) art of the USSR. Representatives of this trend are the artists of the USSR of the 1950s-1960s, who were banned in the country for reasons of political ideology and censorship. The museum collaborates with a number of leading galleries in Russia, Europe and the United States, including the State Hermitage, the Russian Museum, and its collection includes over 3,000 works.

The ranking results showed that Saint Petersburg firmly retains the title of the "Cultural Capital" of Russia, concentrating a large number of unique and diverse museums.