Enterprise’s bankruptcy stages

In the Russian Federation the bankruptcy proceeding of legal entities, individuals and private entrepreneurs is regulated by the Federal Law "On Insolvency (Bankruptcy)" as of 26.10.2002 N 127-FZ.

It should be noted, that the bankruptcy proceeding can be used as illegal way of avoiding of obligations, misrepresentation of contractors, and for the purpose of the concealment of misappropriation of enterprise's property. Such bankruptcy qualifies as a fictitious and is penal.

The bankruptcy of the enterprise starts with decision, which was made by arbitration court, after filing of an application about recognition of the debtor by the bankrupt in arbitration court. The application may file a creditor, authorized authority (for example, the Federal Tax Service of the Russian Federation) or the debtor itself represented by individual executive body. Herewith the debtor has the right to submit the application about own bankruptcy to arbitration court in case of its foresight and under the circumstances, which will obviously testify, that he won't be able to fulfill the liabilities.

While filing of an application, there are restrictions on the minimum amount of the debt of the debtor company: 100 000 RUB., for individual entrepreneurs 10 000 RUB. Herewith the delay should be not less than 3 months.

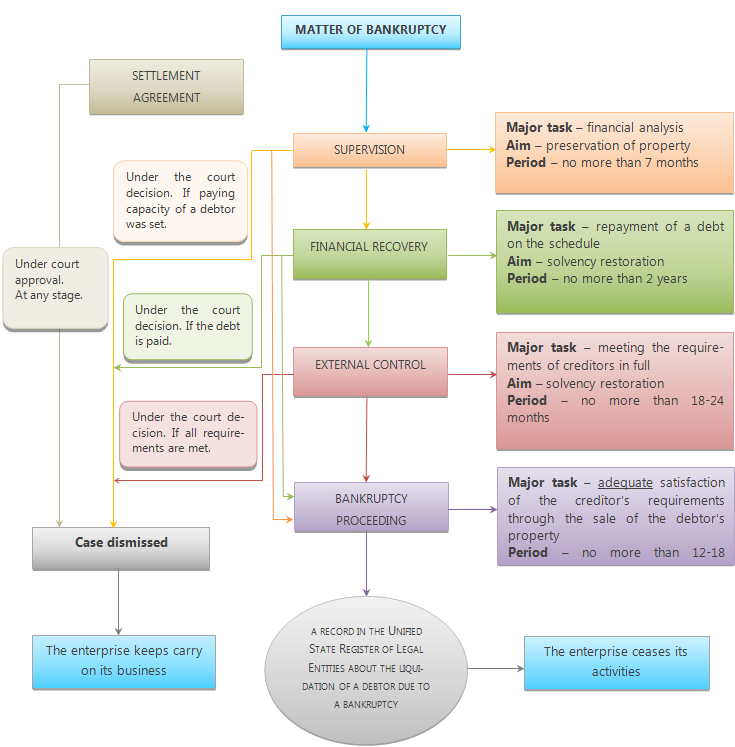

There are 5 stages of the bankruptcy procedure. Depend on the stage and the carried-out functions, the arbitration court shall appoint a bankruptcy commissioner in a particular bankruptcy case.

| Bankruptcy stage | Bankruptcy commissioner | Full powers of individual executive body |

|---|---|---|

| Supervision | Interim manager | powers are limited |

| Financial recovery | Administrative manager | powers are limited, but upon a petition can be ceased |

| External control | Eexternal administrator | powers are ceased |

| Bankruptcy proceeding | Bankruptcy supervisor | powers are ceased |

| Settlement agreement | - | - |

Bankruptcy commissioner — is necessarily a citizen of the Russian Federation, one of the self-regulating organizations of arbitration managers member. The decisions of bankruptcy commissioner are obligatory for execution.

For convenience, all bankruptcy stages are shown on the scheme.

Further you can find a brief overview of each stage.

1. Bankruptcy stage – Supervision

Chapter IV of the Federal Law «On Insolvency (Bankruptcy)»

Supervision procedure is introduced in order to ensure the safety of debtor’s property, for carrying out the analysis of its financial condition, formation of creditors' claims register and holding their first meeting.

Supervision is entered for a period no more than for 7 months. Within this time, the interim manager is obligated to publish the relevant information in Kommersant newspaper and web-site of the Unified Federal Register of Bankruptcy Data.

By results of the creditors meeting, the court makes decision about:

- discontinuance of proceeding, if the solvency of the debtor is set

- introduction of financial recovery;

- introduction of external control;

- introduction of bankruptcy proceeding;

- approval of the settlement agreement.

2. Bankruptcy stage – Financial recovery

Chapter V of the Federal Law «On Insolvency (Bankruptcy)»

Financial recovery is introduced by the arbitration court under the relevant decision of the creditors meeting.

The debtor according to the schedule starts to repay the debts almost right after the procedure was introduced. At the same time, the financial recovery measures are carried out.

The management of the debtor within the period of financial recovery is carried out with some restrictions. The debtor is not allowed to make deals, which increase the debt more than by 5%, which are connected with property acquisition or alienation of debtor’s property or lead to new loans, without permission of the administrative manager.

The procedure is introduced by the arbitration court for a period no more than 2 years.

By results of the financial recovery procedure, the arbitration court makes one of the following decisions:

- discontinuance of insolvency proceeding, if all requirements are met

- introduction of external control, in case of possibility of financial recovery of the debtor;

- recognize the debtor as a bankrupt and start bankruptcy proceeding, in case of absence of grounds for introduction of external control and presence of bankruptcy signs.

3. Bankruptcy stage – External control

Chapter VI of the Federal Law «On Insolvency (Bankruptcy)»

Within the period of the financial recovery, the debtor's management is completely discharged, with delegation of the power to the external administrator, the major task of which is financial recovery of the debtor.

External control is provided by various activities, like: restructuring of the debtor, debt restructuring, business process re-engineering, reduction of the employees etc.

The procedure is introduced by the arbitration court for a period no more than 18 months, which can be prolonged no more than for 6 months, but jointly with financial recovery period, shouldn't exceed 2 years.

By results of the creditors meeting, the court makes decision about:

- discontinuance of proceedings (if all requirements are met);

- start the bankruptcy proceeding;

- approval of the settlement agreement.

4. Bankruptcy stage - Bankruptcy proceeding

Chapter VII of the Federal Law «On Insolvency (Bankruptcy)»

Bankruptcy proceeding is initiated by the court, in case of the absence of real possibility to restore the solvency of the debtor, and/or other bankruptcy procedures were ineffective. From the moment the bankruptcy proceeding was initiated, the debtor is called bankrupt.

Major task - is adequate satisfaction of the creditor's requirements through the sale of the debtor's property.

The consequences of the bankruptcy proceeding:

- maturity of all debtor’s obligations;

- charging of interest, forfeits (fines, penalties) and other sanctions for non-execution or default in performance of monetary obligations is stopped;

- the realization of the implementation documents is stopped, including documents, which were executed within earlier procedures used in bankruptcy case;

- powers of the debtor’s head are terminated;

- all creditors requirements can be presented only during the bankruptcy proceeding;

Bankruptcy proceeding is introduced for a period of up to 6 months, and can be prolonged no more than for 6 months.

The decision about recognition of the enterprise by the bankrupt and start of bankruptcy proceeding is published in Kommersant newspaper with significant facts: order, terms of presentation of requirements, court name etc.

The decision of the arbitration court about the end of the bankruptcy proceeding can be appealed before the date of making a record about the liquidation of a debtor in the Unified State Register of Legal Entities. From the moment the record was made, the bankruptcy proceeding is considered to be complete.

5. Bankruptcy stage - Settlement agreement

Chapter VIII of the Federal Law «On Insolvency (Bankruptcy)»

The conclusion of the settlement agreement is available to the parties at any bankruptcy proceeding stage.

Within the period of the settlement agreement, former liabilities are liquidated, the conditions of the settlement agreement, which are approved by the creditors meeting and arbitration court, come into force. The case is terminated.

In case of the settlement agreement rescission, the creditors have the right to present their requirements in the structure and size, which were provided by the settlement agreement.

Consolidated financial statements. For what, to whom and in what form to prepare

Consolidated financial statements is a financial data reporting of a group of companies, in which assets, liabilities, capital, income, expenses and cash flows of the parent enterprise and its subsidiary enterprises are presented as assets, liabilities, capital, income, expenses and cash flows of a single economic entity.

In Russia the preparation and submission of consolidated financial statements is governed by the same-name Federal law №208-FZ "On consolidated financial statements" from 27.07.2010 and the International Financial Reporting Standards (IFRS).

Successfully developing Russian companies face inevitably a question of attracting additional investments, including foreign ones. By establishing standards on the preparation of consolidated financial statements in accordance with IFRS rules, lawmakers aim to make financial statements of companies more transparent and attractive for investors. In fact most often by preparation of reporting in accordance with RSA the main task become not the formation of full-fledged information about company's financial position, but tax optimization and minimization of claims from the part of inspection authorities.

In 2014 the number of companies required to prepare, submit and publish consolidated financial statements in accordance with IFRS, was significantly expanded. Now it includes:

- credit institutions;

- insurance companies (except health insurance companies, operating exclusively in the field of obligatory health insurance);

- non-state pension funds;

- management companies of investment funds, mutual funds and non-state pension funds;

- clearing organizations;

- federal state unitary enterprises, the list of which is approved by the Government of the Russian Federation;

- open joint stock companies, whose shares are federally owned and a list of which is approved by the Government of the Russian Federation;

- other organizations, whose securities are admitted to organized trading by their inclusion in the quotation list.

There are several methods to carry out the consolidation. The choice of one or another method depends on the degree of influence of the parent company. So, for subsidiary enterprises (the interest is more than 50%) the acquisition method is of the priority, and for associated companies and joint ventures (the interest is from 20 up to 49%) – the equity method. By this, a number of procedures is the common one regardless of the method: the statements of parent company and controlled entity must be prepared as of the same accounting date, it must be complied with unified accounting policy.

To be acquainted with consolidated statements of group companies you can use the database of the Information and analytical system Globas-i®.