Restrictions on procurement of foodstuff for state and municipal needs

Starting September 3rd, 2016 the Government Regulation of the RF “Concerning access restrictions to certain ranges of foodstuff from foreign countries for purposes of procurements for meeting state and municipal needs” as of August 22nd, 2016 №832 came into force.

The Regulation, prepared by the Ministry of Agriculture, is focused on protection of the Russian agricultural market and correspondingly on support of domestic goods producers. The operation of restrictions won’t refer to commercial procurement of shops, outlet chains and public catering enterprises. The goods from the Eurasian Economic Union (EEU) countries are exempt from the restrictions, if no less than two applications meeting the requirements while identifying the supplier in the course of public procurement were filed.

In the restrictive list there are such foodstuffs as meat and fish products, milk, cheese, butter, rice, sugar and salt.

In the explanatory note to the Regulation it is stated that the above mentioned goods are produced in Russia and the EEU countries in the quantities sufficient for satisfying the needs of the social sphere.

Significant changes have taken place in the Russian market of foodstuffs recently. The growth of the production in many branches of farming is observed. We have already devoted several publications to production of grain, livestock, fishery и др

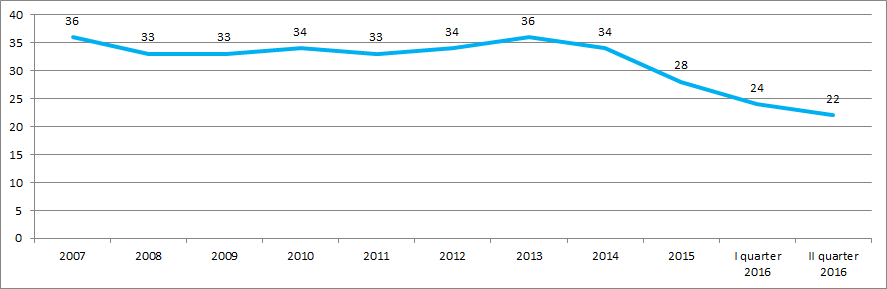

Moreover, there is a downtrend of dependence on imports on many types of foodstuff. The following data of the Federal State Statistics Service in the Figure 1 and Table 1 gives evidence to it.

Dependence on imports of cereals, pork, poultry, cheese, preserved meat and confectionery were decreasing with the biggest rates.

| Article | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | Rates of decrease (increase) 2015 to 2010, % |

|---|---|---|---|---|---|---|---|

| Cereal | 2,2 | 2,0 | 1,4 | 1,8 | 0,5 | 0,3 | -86,3 |

| Pork | 46,8 | 42,8 | 41,3 | 31,0 | 16,6 | 12,5 | -73,3 |

| Poultry | 18,2 | 12,5 | 14,0 | 12,8 | 10,2 | 5,6 | -69,2 |

| Cheese | 47,4 | 46,1 | 47,8 | 48,0 | 37,3 | 23,3 | -50,8 |

| Preserved meat | 17,1 | 22,0 | 25,1 | 20,0 | 13,7 | 9,0 | -47,4 |

| Confectionery | 11,1 | 11,6 | 12,5 | 12,0 | 9,4 | 5,9 | -46,8 |

| Vegetable fat | 23,9 | 22,0 | 16,3 | 19,0 | 14,7 | 17,5 | -26,8 |

| Beef | 64,5 | 59,5 | 59,9 | 59,0 | 57,3 | 48,0 | -25,6 |

| Animal fat | 32,3 | 32,2 | 34,2 | 35,9 | 34,4 | 25,5 | -21,1 |

| Flour | 0,9 | 1,0 | 0,7 | 1,5 | 0,9 | 0,8 | -11,1 |

| Powder milk and cream | 60,1 | 40,7 | 48,4 | 60,5 | 49,5 | 56,4 | -6,2 |

| Sugar | 5,4 | 3,7 | 5,3 | 8,2 | 7,4 | 6,2 | 14,8 |

Product profitability of vegetable production enterprises

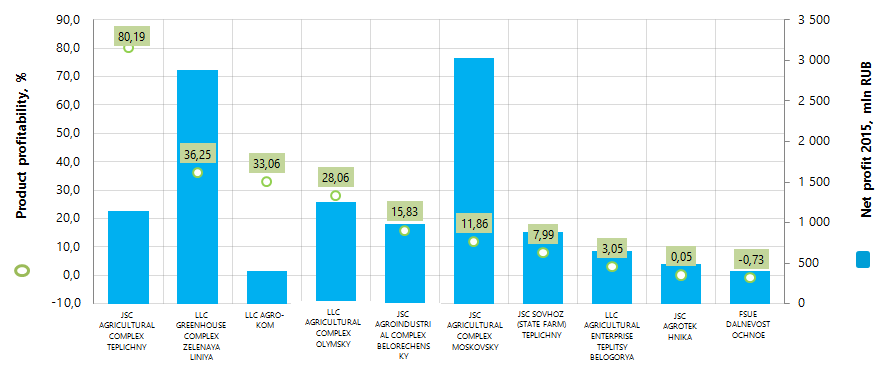

Information agency Credinform presents a ranking of the largest Russian vegetable production enterprises in terms of product profitability ratio.

The companies with the highest volume of revenue (TOP-10) were selected for this ranking according to the data from the Statistical Register for the latest available period (2015). These enterprises were ranked by decrease in product profitability ratio. (Table 1).

Product profitability is calculated as the ratio of sales profit to expenses from ordinary activities. In general, profitability reflects the economic efficiency of production. Product profitability analysis allows us to make a conclusion whether output of one or another product is reasonable. There are no prescribed values for indicators of this group, because they vary strongly depending on the industry.

For the most full and fair opinion about the company’s financial position, not only product profitability rate should be taken into account, but also the whole set of financial indicators and ratios.

| Name, INN, region | Net profit 2015, mln RUB | Revenue of 2015, mln RUB | Revenue of 2015 to 2014, %% | Product profitability of 2014, % | Product profitability of 2015, % | Solvency index Globas-i |

|---|---|---|---|---|---|---|

| JSC AGRICULTURAL COMPLEX TEPLICHNY ИНН 2312036895 Krasnodar territory |

502,4 | 1 140,0 | 119 | 62,09 | 80,19 | 233 High |

| LLC GREENHOUSE COMPLEX ZELENAYA LINIYA INN 7826084060 Krasnodar territory |

836,7 | 2 877,3 | 244 | 17,90 | 36,25 | 223 High |

| LLC AGRO-KOM INN 0701002574 The Kabardino-Balkar Republic |

71,1 | 404,6 | 94 | 62,36 | 33,06 | 281 High |

| LLC AGRICULTURAL COMPLEX OLYMSKY INN 4608005786 Kursk region |

281,6 | 1 250,0 | 129 | 61,67 | 28,06 | 212 High |

| JSC AGROINDUSTRIAL COMPLEX BELORECHENSKY INN 6639009424 Sverdlovsk region |

134,0 | 977,8 | 100 | 12,95 | 15,83 | 202 High |

| JSC AGRICULTURAL COMPLEX MOSKOVSKY INN 5003003432 Moscow |

159,4 | 3 026,7 | 96 | 19,23 | 11,86 | 246 High |

| JSC SOVHOZ (STATE FARM) TEPLICHNY INN 6501254511 Sakhalin region |

122,5 | 887,7 | 122 | 6,11 | 7,99 | 220 High |

| LLC AGRICULTURAL ENTERPRISE TEPLITSY BELOGORYA INN 3123227670 Belgorod region |

380,6 | 645,8 | 178 | -17,13 | 3,05 | 320 Satisfactory |

| JSC AGROTEKHNIKA INN 4716002207 Leningrad region |

-50,5 | 486,9 | 79 | 10,10 | 0,05 | 550 Unsatisfactory |

| FSUE DALNEVOSTOCHNOE INN 2502003633 Primorie territory |

2,4 | 407,6 | 113 | -5,16 | -0,73 | 245 High |

JSC AGRICULTURAL COMPLEX TEPLICHNY has shown the highest product profitability ratio 80,19%. Enterprise with the largest revenue for 2015 - JSC AGRICULTURAL COMPLEX MOSKOVSKY takes sixth place of the ranking. Its share in total revenue volume of TOP-10 companies is 25%. This enterprise turned out to be among three companies of the TOP-10 list, showing decrease in profit and revenue of 2015 compared to the previous year. FSUE DALNEVOSTOCHNOE has got negative values of product profitability both in 2014 and in 2015.

Summarizing the financial and other indicators, eight out of TOP-10 companies have got high solvency index Globas-i. This demonstrates their ability to pay off the debts in time and to the full extent.

LLC AGRICULTURAL ENTERPRISE TEPLITSY BELOGORYA has got satisfactory solvency index Globas-i due to the information about company being a defendant in debt collection arbitration proceedings.

JSC AGROTEKHNIKA has got unsatisfactory solvency index Globas-i due to the information about bankruptcy claim as well as being a defendant in debt collection arbitration proceedings.

The average product profitability value among TOP-10 companies in 2015 is 21,56%, compared to 23,01% in 2014 . Four enterprises shown decrease in product profitability value.

Total revenue volume of TOP-10 companies in 2015 is 12,1 bln RUB, that is 24% higher than in 2014. Total net profit of this group for the same period increased more than 86%.

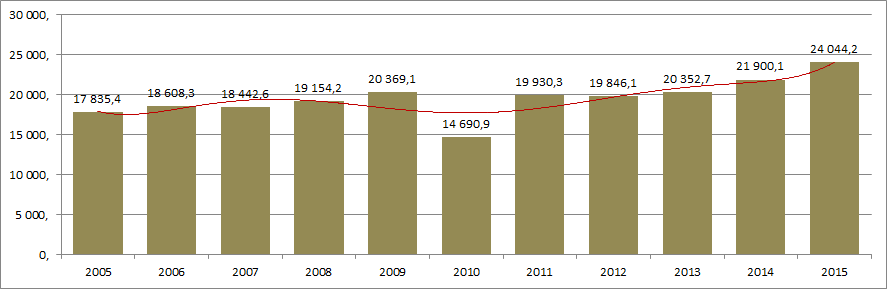

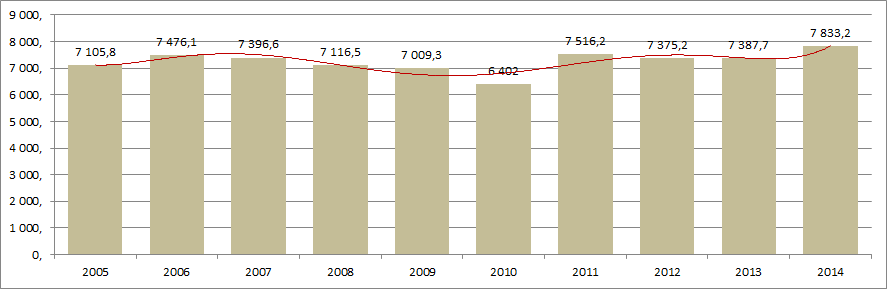

In general, enterprises operate profitably. The industry demonstrates positive dynamics in vegetables production, that is proved by the data of the Federal State Statistics Service (Rosstat)(Picture 2,3).

Vegetables producing companies are located in regions with the best environment for agricultural production and also attracted to the largest distribution areas – Moscow and Saint-Petersburg. According to the data of the Information and analytical system Globas-i, 100 largest companies in terms of revenue volume for 2014 are registered in 44 regions. Most of them are registered in the following regions (TOP-6 regions):

| Region | Number of companies |

|---|---|

| Moscow region | 10 |

| Bryansk region | 7 |

| Samara region | 6 |

| The Republic of Bashkortostan | 5 |

| Leningrad region | 4 |

| Stavropol territory | 4 |