Legislation amendments on international exchange of financial information for tax purposes

In the article «Russia has acceded to the Multilateral Competent Authority Agreement on automatic exchange of Country-by-Country Reporting» as of 07.03.2017 was noted, that for complete actual use of the Agreement (Multilateral Competent Authority Agreement on Country-by-Country Reporting) it is necessary to adopt the relevant domestic law. Such law was adopted in the end of 2017.

According to the Federal Law as of 27.11.2017 №340-FZ, Chapter 14.4-1 was added to the first part of the Tax Code of the Russian Federation. Submission of documentation for multinational groups of companies.

The new chapter of the Tax Code legislatively gives the definitions of such concepts as multinational group of companies and its member, country-by-country information and reporting for a multinational group of companies, global and domestic documentation. Regulations for notification on participation in the multinational group of companies, country-by-country information, global and domestic documentation were defined.

For violation of the specified requirements the tax liability of financial market entities was imposed:

- failure to provide financial information in time - 500 th RUB penalty

- non-inclusion of financial information about the client, beneficiary party and persons directly or indirectly controlling them - 50 th RUB penalty for each act of infringing

- violation of the procedure for determining tax residency of clients, beneficiaries and persons directly or indirectly controlling them - 50 th RUB penalty for failure to take measures for each

- illegal non-presentation of the notification on participation in the multinational group of companies or submission of the notification containing false data within a specified period of time - 50 th RUB penalty

- illegal non-presentation of the country-by-country reporting or present the report containing false data within a specified period of time - 100 th RUB penalty

- late file of global documentation by tax payer

Chapter 20.1 was also added to the first part of the Tax Code of the Russian Federation. Automatic exchange of Country-by-Country Reporting with foreign countries (territories).

The following definitions are specified in the Chapter: international automatic exchange of Country-by-Country Reporting with relevant authorities of foreign states (territories); the structure of financial market and its clients; financial services; financial information; beneficiary party; person controlling the client; financial assets.

In addition to the above, the following items were determined: the rights and responsibilities of financial market entities on representation of information to the relevant federal executive authority and its powers in connection with the automatic exchange of financial reporting; restriction on the use of information contained in the Country-by-Country Reporting;

The law was published and entered into force taking into account the features of application of particular provisions.

According to the experts of Information Agency Credinform, more than 300 largest Russian holding companies, 2016 total revenue of which meet the requirements of the Agreement on exchange of Country-by-Country Reporting (according to the Information and Analytical system Globas), are obligated to submit the Country-by-Country Reporting. Among these companies are: FEDERAL GRID COMPANY OF UNIFIED ENERGY SYSTEM, GASPROM, MOSENERGO, NOVOLIPETSK STEEL, LUKOIL, Transneft, SIBERIA AIRLINES, RusHydro, URALKALI, Mining and Metallurgical Company NORILSK NICKEL.

Trends in employment and recruitment

Information agency Credinform represents an overview of trends in the field of employment and recruitment.

Enterprises with the largest volume of annual revenue (TOP-10 and TOP-2000) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2015 and 2016). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Legal forms and unreliable data

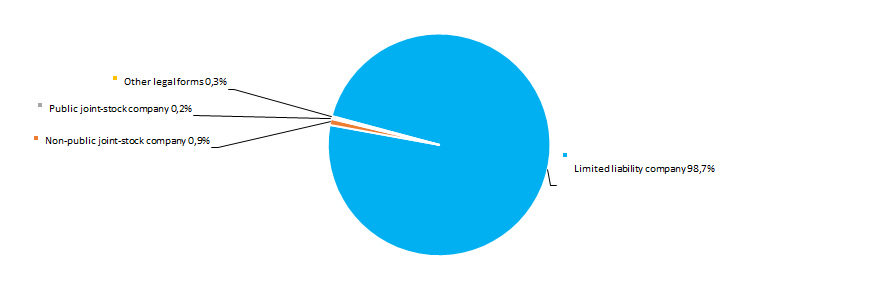

The most spread legal form of enterprises in the industry is a limited liability company. Non-public joint-stock companies also make a significant part. (Picture 1).

Picture 1. Distribution of TOP-2000 companies by legal forms

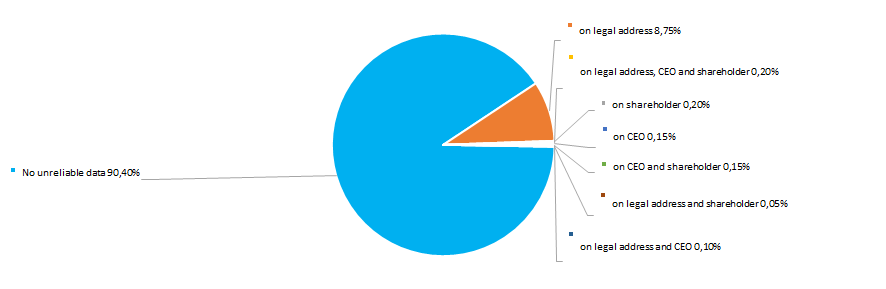

Picture 1. Distribution of TOP-2000 companies by legal formsAccording to the results of investigation of the Federal Tax Service of the RF, almost 10% of companies in the industry have records of unreliable data entered into the Unified State Register of Legal Entities (Picture 2).

Picture 2. Shares of TOP-2000 companies, having records of unreliable data in the Unified State Register of Legal Entities

Picture 2. Shares of TOP-2000 companies, having records of unreliable data in the Unified State Register of Legal Entities Sales revenue

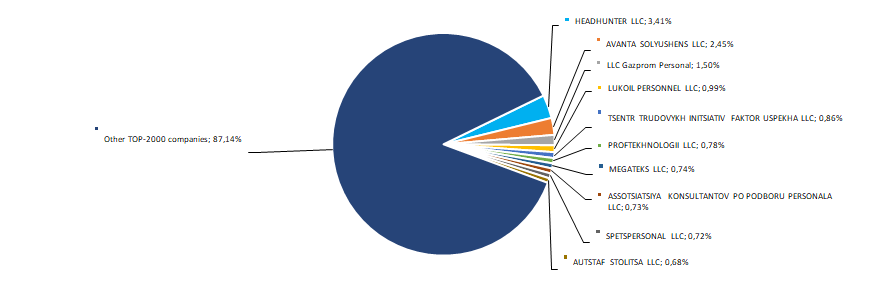

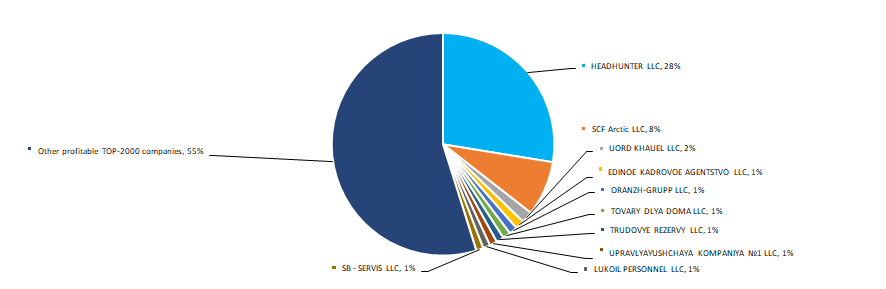

The revenue of 10 industry leaders made 13% of the total revenue of 2000 the largest companies in 2016. It points to a high level of competition in the industry. HEADHUNTER LLC - an on-line resource operator for job search and recruitment - became the largest company in terms of revenue in 2016. (Picture 3).

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-2000 companies for 2016

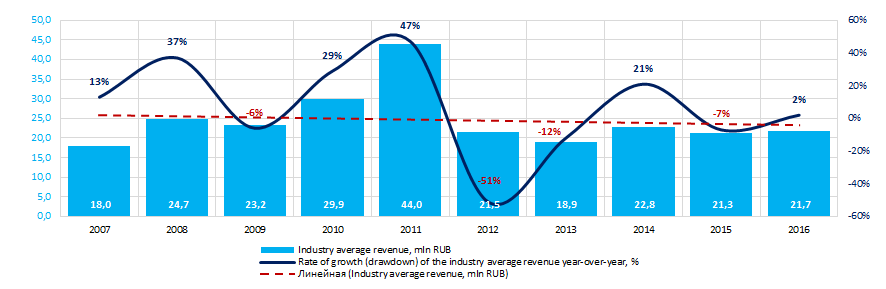

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-2000 companies for 2016The best results in the industry in terms of revenue for the ten-year period were achieved in 2011. During the crisis periods in the economy in 2009, 2012, 2013 and 2015 the industry average indicators decreased significantly. In general, there is a trend towards a decrease in volume revenue. (Picture 4).

Picture 4. Change in the industry average revenue of companies in the field of employment and recruitment in 2007 – 2016

Picture 4. Change in the industry average revenue of companies in the field of employment and recruitment in 2007 – 2016Profit and losses

The profit volume of 10 industry leaders in 2016 made 45% of the total profit of TOP-2000 companies. The leading position in terms of profit volume in 2016 is taken also by HEADHUNTER LLC. (Picture 5).

Picture 5. Share of participation of TOP-10 companies in the total volume of profit of TOP-10 companies for 2016

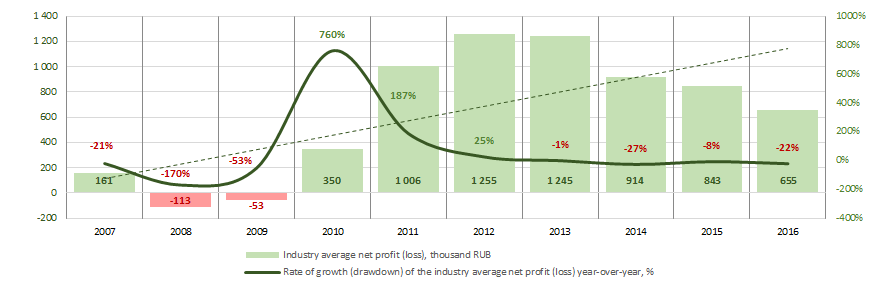

Picture 5. Share of participation of TOP-10 companies in the total volume of profit of TOP-10 companies for 2016 Industry average indicators of companies’ profit for the ten-year period are not stable. Negative values of the indicator were observed in 2008 - 2009. In general, profit’s indicators tend to increase. The industry showed the best results in 2012. (Picture 6).

Picture 6. Change in the industry average indicators of profit of companies in the field of employment and recruitment in 2007 – 2016

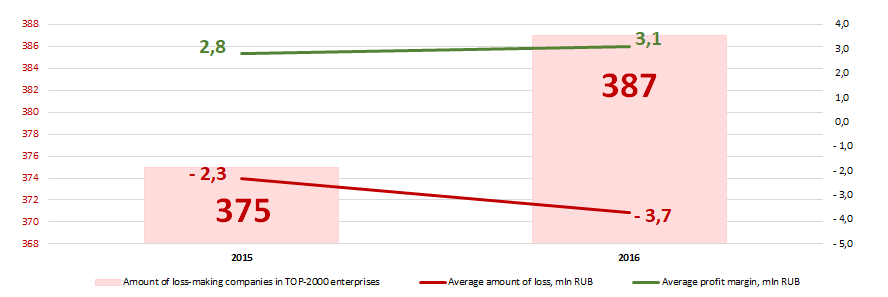

Picture 6. Change in the industry average indicators of profit of companies in the field of employment and recruitment in 2007 – 2016There were 375 loss-making enterprises observed in 2015 among TOP-2000 companies. In 2016 their number increased to 387 or by 3%. At the same time, the average size of their loss increased by 61%. For the rest of TOP-2000 companies the average profit margin increased by 11% over the same period (Picture 7).

Picture 7. Number of loss-making companies, average value of loss and profit of TOP-2000 enterprises in 2015 – 2016

Picture 7. Number of loss-making companies, average value of loss and profit of TOP-2000 enterprises in 2015 – 2016Key financial ratios

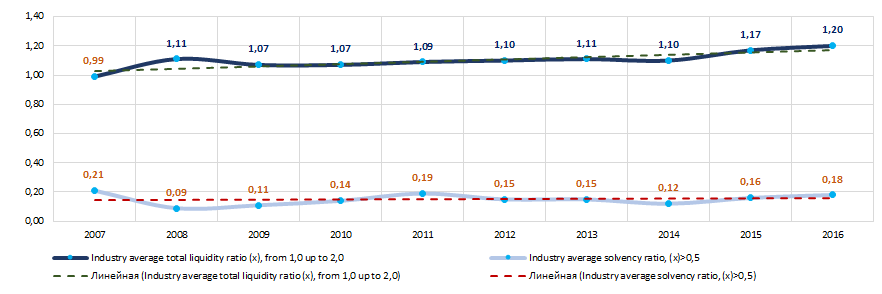

Over the ten-year period the average industry indicators of the total liquidity ratio were in the range of recommended values - from 1,0 up to 2,0, except the year 2007. In general, the ratio trends to increase.

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

The solvency ratio (the relation of the amount of own capital to the balance sum) shows the company's dependence on external borrowings. Recommended value is > 0.5. The value of the ratio below the minimum value means a strong dependence on external sources of funds.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For companies in the field of employment and recruitment the practical value of the solvency ratio ranged from 0,03 up to 0,98 in 2016.

Over the ten-year period the average industry indicators of the ratio were below the recommended value and in the interval of practical values (Picture 8).

In general, the ratio indicators has no pronounced trend.

Picture 8. Change in the average industry values of the total liquidity and solvency ratios of companies in the field of employment and recruitment in 2007 – 2016

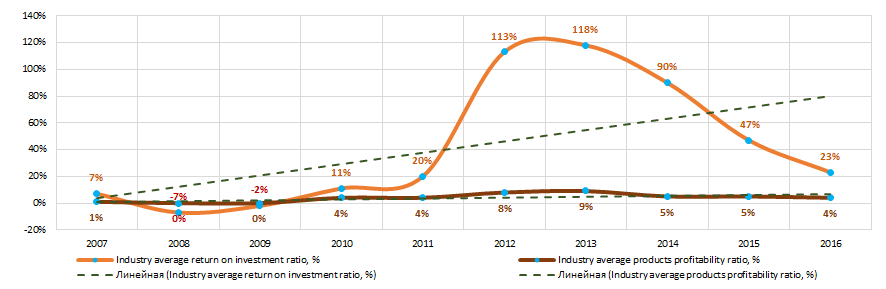

Picture 8. Change in the average industry values of the total liquidity and solvency ratios of companies in the field of employment and recruitment in 2007 – 2016There has been an instability observed in indicators of the return on investment ratio for ten years, with a tendency to increase. In 2008 - 2009 the indicators decreased to negative values (Picture 9). The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity and the long-term borrowed funds of an organization.

The indicators of the products profitability ratio were relatively stable, with a tendency to increase, in the same period (Picture 9). The ratio is calculated as the relation of profit from sales to expenses for ordinary activities. In general, profitability reflects the economic efficiency of production.

Picture 9. Change in the average industry values of the return on investment and products profitability ratios of companies in the field of employment and recruitment in 2007 – 2016

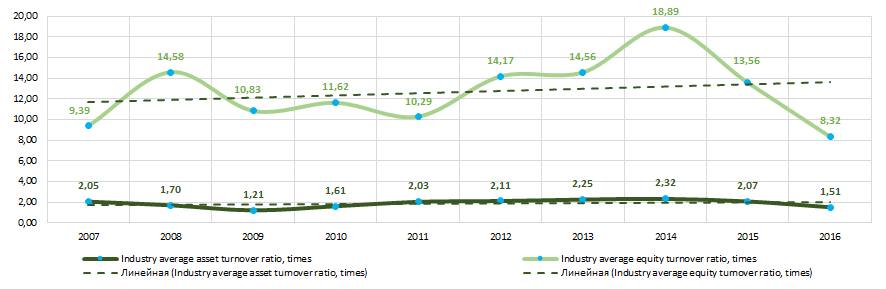

Picture 9. Change in the average industry values of the return on investment and products profitability ratios of companies in the field of employment and recruitment in 2007 – 2016Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

Equity turnover ratio is calculated as the relation of revenue to average annual amount of equity and shows the intensity of use of the whole part of assets.

Over a ten-year period both activity ratios demonstrated a tendency to increase (Picture 10).

Picture 10. Change in the industry average values of the activity ratios of companies in the field of employment and recruitment in 2007 – 2016

Picture 10. Change in the industry average values of the activity ratios of companies in the field of employment and recruitment in 2007 – 2016 Production structure

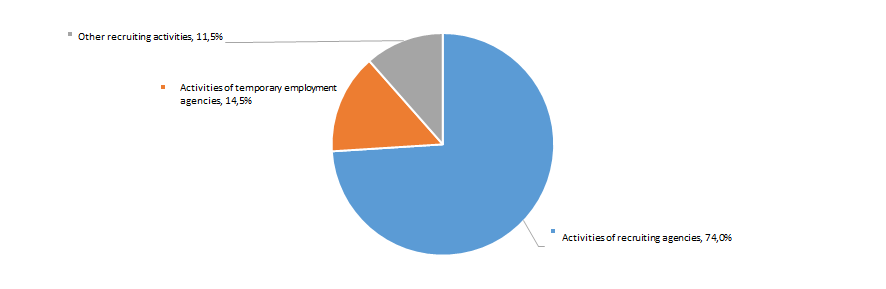

The largest part from TOP-2000 companies specializes in recruitment agency activity (Picture 11).

Picture 11. Distribution of TOP-300 companies by types of services provided, %

Picture 11. Distribution of TOP-300 companies by types of services provided, %Dynamics of business activity

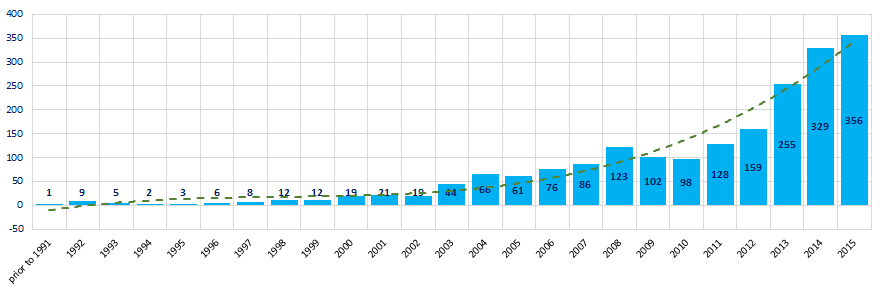

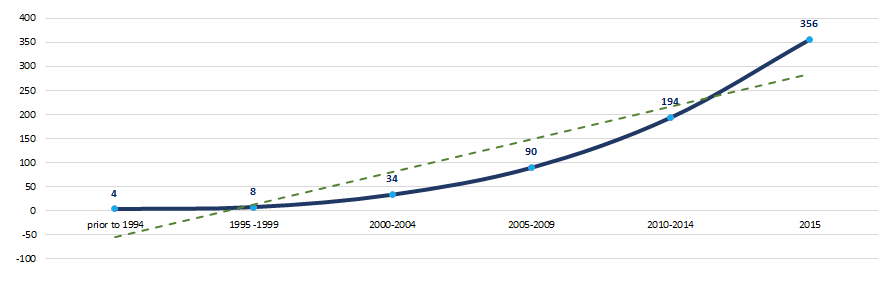

Over the 25-year period the number of registered companies from the TOP-2000 list are unequally distributed by the year of foundation. The largest number of enterprises was established in 2015. In general, there is a tendency to increase of the number of registered companies. (Picture 12).

Picture 12. Distribution of TOP-2000 companies by years of their foundation

Picture 12. Distribution of TOP-2000 companies by years of their foundationBusiness took the greatest interest to commercial services in employment and recruitment after 2004. (Picture 13).

Picture 13. Average number of TOP-2000 companies registered within the year, by periods of their foundation

Picture 13. Average number of TOP-2000 companies registered within the year, by periods of their foundationMain regions of activity

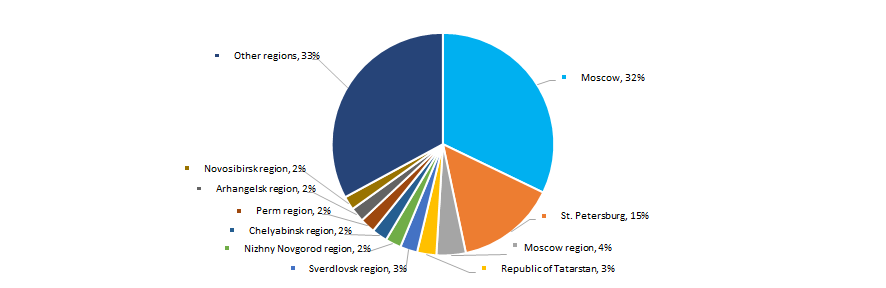

Companies of the industry are unequally distributed across the country. Their largest number is registered in Moscow and St. Petersburg – regions with the greatest concentration of labor resources (Picture 14).

TOP-2000 companies are registered in 61 regions of Russia.

Picture 14. Distribution of TOP-2000 companies by regions of Russia

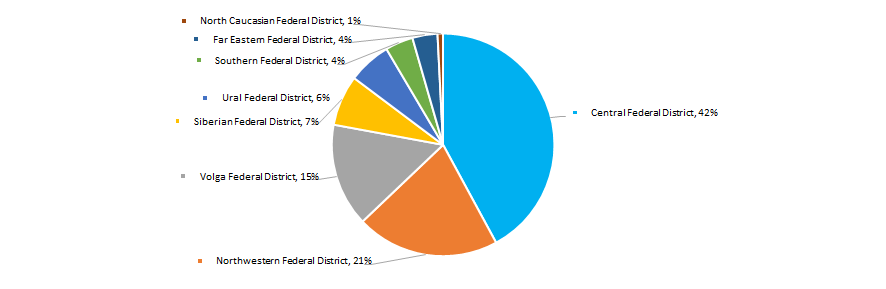

Picture 14. Distribution of TOP-2000 companies by regions of RussiaThe largest number of companies of the industry is concentrated in the Central federal district of the country (Picture 15).

Picture 15. Distribution of TOP-2000 companies by federal regions of Russia

Picture 15. Distribution of TOP-2000 companies by federal regions of RussiaThe share of companies with branches or representative offices, from TOP-2000 enterprises, is 2%.

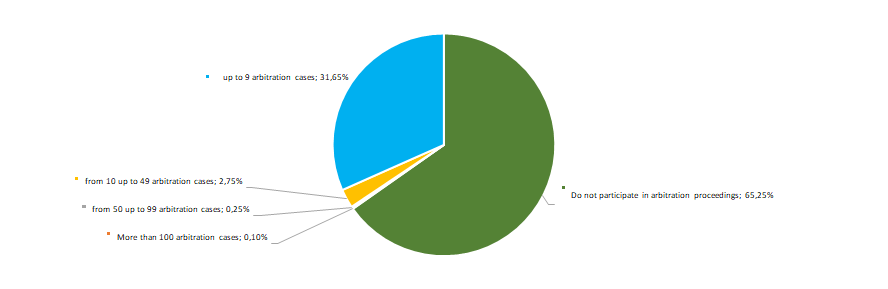

Participation in arbitration proceedings

The vast majority of companies of the industry either does not participate in arbitration proceedings at all, or participates in few cases. (Picture 16).

Picture 16. Distribution of TOP-2000 companies by the activity of participation in arbitration proceedings

Picture 16. Distribution of TOP-2000 companies by the activity of participation in arbitration proceedingsReliability index

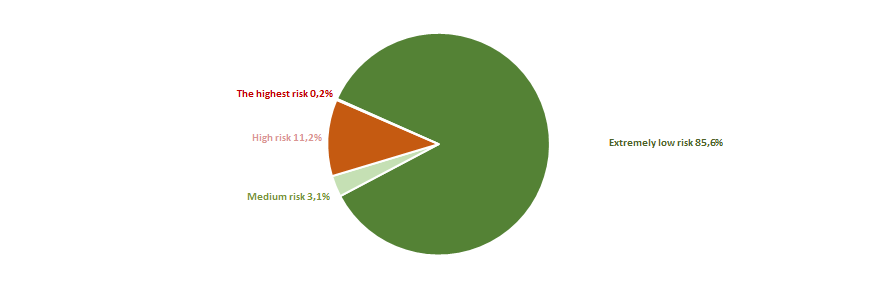

In terms of the presence of signs of «fly-by-night companies» or unreliable organizations, the great majority of enterprises of the industry demonstrate an extremely low risk of cooperation (Picture 17).

Picture 17. Distribution of TOP-2000 companies by reliability index

Picture 17. Distribution of TOP-2000 companies by reliability indexFinancial position score

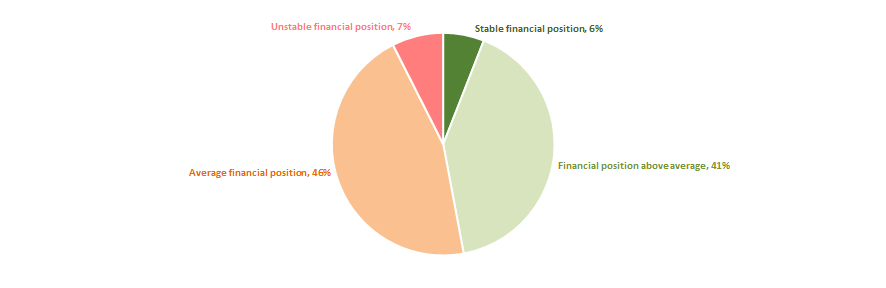

An assessment of the financial position of companies in the industry shows that the largest number of enterprises are in average financial position (Picture 18).

Picture 18 Distribution of TOP-2000 companies by financial position score

Picture 18 Distribution of TOP-2000 companies by financial position scoreLiquidity index

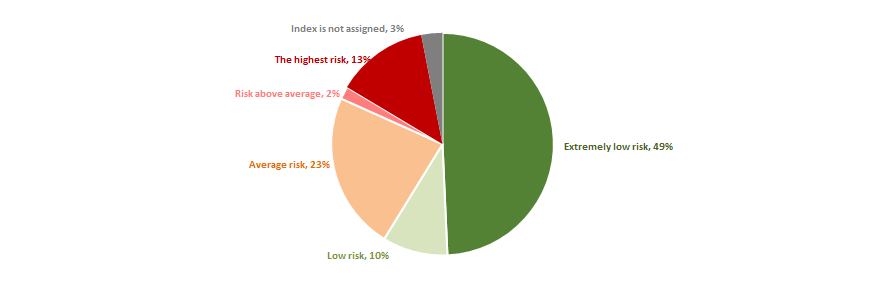

More than a half of companies of the industry show a minimal or insignificant levels of bankruptcy risk in the short-term period. (Picture 19).

Picture 19. Distribution of TOP-2000 companies by liquidity index

Picture 19. Distribution of TOP-2000 companies by liquidity indexSolvency index Globas

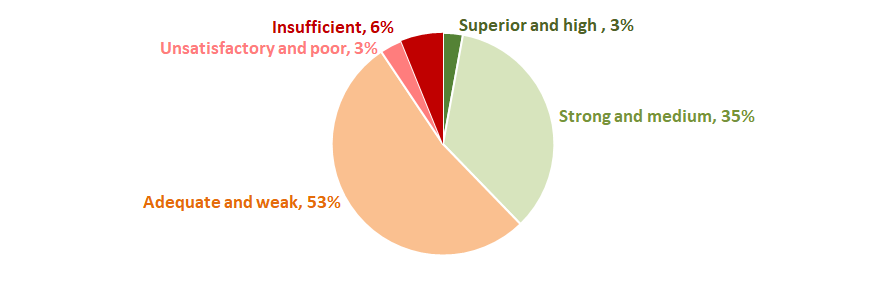

Most of companies of the industry among 2000 the largest got the Superior/High or Strong/Medium Solvency index Globas. (Picture 20).

Picture 20. Distribution of TOP-2000 companies by Solvency index Globas

Picture 20. Distribution of TOP-2000 companies by Solvency index GlobasThus, a comprehensive assessment of enterprises in the field of employment and recruitment, taking into account the main indices, financial indicators and ratios, points to prevalence of relatively favorable trends in the industry.