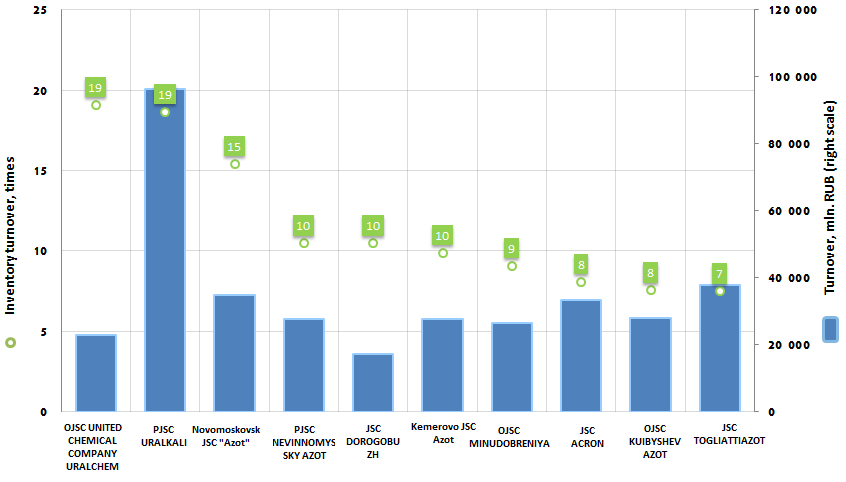

Inventory turnover of the largest Russian enterprises, engaged in manufacture of fertilizers

Information Agency Credinform has prepared the ranking of the companies, engaged in manufacture and supply of fertilizers.

The largest enterprises in terms of revenue were selected according to the data from the Statistical Register for the latest available period (for the year 2013). Then, the companies were ranged by decrease in rate of inventory turnover.

Inventory turnover (times) is a ratio of revenue and average stock value for a period. It shows the efficiency of inventories sales. The higher is the rate, the faster are the production cycle and sale of goods.

Low inventory turnover ratio is the poor indicator of financial and economic activity of the company, it reflects the surplus stocks and (or) poor sales, demand for products; the result is overstocking.

In contrast, the high inventory turnover ratio reflects the mobility of company's funds: the faster is the stock rotation, the faster is the money turnover, invested in stocks, and the return in the form of revenue from sales of finished products; the higher is the inventory turnover - the better for the company. Low stocks are forcing the company to balance on the brink of deficit, that is inevitably lead to losses of customers and unreasonably high expenses on rapid replenishment of stocks: the company has to bring enough goods.

Thus, the optimality of reserves is mandatory for company’s business activities, and inventory turnover is the indicator, which must be constantly updated.

For the most full and fair opinion about the company’s financial statement, not only the average revenue values should be taken into account, but also the whole set of financial indicators and ratios.

| № | Name | Region | Revenue, mln. RUB, 2013 | Inventory turnover, times | Solvency index GLOBAS-i ® |

|---|---|---|---|---|---|

| 1 | OJSC UNITED CHEMICAL COMPANY URALCHEM INN 7703647595 |

Moscow | 22 783,0 | 19 | 297 high |

| 2 | PJSC URALKALI INN 5911029807 |

Perm region | 96 308,9 | 19 | 191 the highest |

| 3 | Novomoskovsk JSC "Azot" INN 7116000066 |

Tula region | 34 966,0 | 15 | 176 the highest |

| 4 | PJSC NEVINNOMYSSKY AZOT INN 2631015563 |

Stavropol region | 27 770,2 | 10 | 205 high |

| 5 | JSC DOROGOBUZH INN 6704000505 |

Smolensk region | 17 359,6 | 10 | 148 the highest |

| 6 | Kemerovo JSC Azot INN 4205000908 |

Kemerovo region | 27 802,0 | 10 | 208 high |

| 7 | OJSC MINUDOBRENIYA INN 3627000397 |

Voronezh region | 26 585,4 | 9 | 197 the highest |

| 8 | JSC ACRON INN 5321029508 |

Novgorod region | 33 420,5 | 8 | 284 high |

| 9 | OJSC KUIBYSHEVAZOT INN 6320005915 |

Samara region | 28 045,1 | 8 | 180 the highest |

| 10 | JSC TOGLIATTIAZOT INN 6320004728 |

Samara region | 37 716,1 | 7 | 152 the highest |

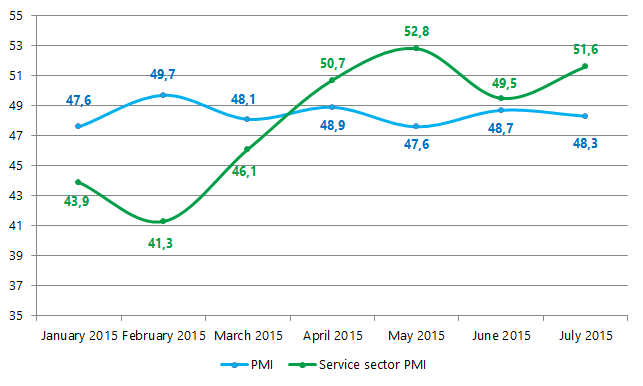

Personal Manager Index (PMI) and Entrepreneur Confidence Index (ECI) confirm the expectations improvement in production industry and in services sector

Purchasing Managers Index (PMI) is one of the most important forward-looking economic indicators. In various economic literature there are different renderings of this index. For instance, it is aggregate subjective macroeconomic measure, or optimism indicator of the top and middle management economic level, or business optimism of business members, or consolidated figures for economic climate, called procurement manager index, or productive-economic indicator of non-state macroeconomic statistics.

Along with this the PMI uniting features are:

- it qualifies the economic climate in productive industry (PMI Manufacturing) and in service sector (PMI Services/PMI non-manufacturing);

- it is calculated and published by different statistics agencies, financial institutions and productive-economic associations;

- survey findings of senior executives, managers are used in bases of calculations;

- it makes possible to study economics’ influence on price assessment;

- it enables to study and to predict the dynamics of economic trends in business, boiling and turning point of business cycle

Due to the fact that the components of the index are new orders, employment, procurement prices and warehouse stocks, the PMI is also used for measurement of changes, forecasting, planning in the field of the new industrial orders, industrial output, employment and operation speed of suppliers.

The principle of making both indices is the same. In the course of polling the managers give the following answers, for example: “the situation worsens” or “the situation improves”. Zero value of the index is adjusted to 50. It means that the index value will amount to 50, if there is an equal number of answers given by the members of the poll. If there are more of those who see the decline, the index value will be lower than 50 and conversely. This index is non-state statistics and is calculated in different countries by different organizations, in the USA – ISM, Europe – Markit Economics, China – HSBC.

Thus according to Markit Economics, there was moderate growth resumption in the Russian service industry in July 2015. It happened due to the fact that the PMI amounted to 51,6 points (see Graph 1) while in June it had 49,5 points. General increase of economic activity in service sector happened on the backdrop of new orders. The growth is marked within four months in succession, what is more the growth rates accelerated to the maximum within the last 20 months.

Graph 1. PMI in production industry and service sector in Russia for January-July 2015, points

In the Russian productive industry the general increase of economic activity is conversely being limited. In June 2015 the PMI amounted to 48,7 points, in July to 48,3 points. Insignificant cut-back of new orders, unimplemented production capacities and job cut answer for the reduction of the index. In the meantime in July 2015 the strengthening of new orders general increase to maximum level is marked in private sector since November 2013. However the receipt of new orders was inadequate for the full utilization of production capacities. Job cut also took place in July, but the rates were minimal following the results of the last 9 months.

According to evaluation methods, the figures being lower than «45-50» are the indicators of economic slowdown. However frequently the real situation exerts less influence on the PMI value. There is a belief that indices are more affected by psychological factors. In addition the indices exert the limited effect. The growth of indices value is a favorable factor.

In Russia monthly business activity polls are held by the Federal State Statistics Service (Rosstat). More than 4 hundred enterprises take part in it (except for small companies). The poll findings are expressed in Entrepreneur Confidence Index, ECI. It is calculated in % as an arithmetical average of the balances according to an actual demand, current stock of finished products (reversed in sign) and expected production output. (see Table 1).

| Name | January | February | March | April | May | June | July |

|---|---|---|---|---|---|---|---|

| Manufacturing activities | -9 | -6 | -6 | -5 | -6 | -6 | -6 |

| Extraction of minerals | -7 | -5 | -5 | -5 | -3 | -2 | -2 |

| Production and transmission of electric power, gas and water | -2 | -8 | -11 | -14 | -13 | -10 | -5 |

The analysis of the index shows that a surplus stock of finished goods predominates, owing to the fact that the index value has a minus. Alongside this the ECI has improved by July 2015 in such groups as “Extraction of minerals” and “Production and transmission of electric power, gas and water”.

Study of the business activity in the service sector is also held by the Rosstat and is represented in corresponding ECI (Table 2). Together with this the following values are represented: changes in amount of services rendered, demand for service, services prices (tariff), general economic climate in organization and trends of economic climate changes. Evaluation methods are documented by Rosstat under each indicator.

| Name | 2014 | 2015 | ||||

|---|---|---|---|---|---|---|

| quarters | ||||||

| I | II | III | IV | I | II | |

| Entrepreneur Confidence Index in service sector | -2 | 6 | 2 | -4 | -12 | -1 |

| Measurement of change in amount of service rendered (in monetary terms): - prospective changes | 19 | 13 | 7 | -2 | 10 | 9 |

| - actual changes | -17 | 0 | -1 | -7 | -26 | -6 |

| Measurement of change in demand for service: - prospective changes | 19 | 13 | 6 | -2 | 10 | 8 |

| - actual changes | -18 | 0 | -2 | -7 | -26 | -7 |

| Measurement of change in services prices (tariffs): - prospective changes | 6 | 5 | 2 | 5 | 7 | 6 |

| - actual changes | 2 | 3 | 3 | 1 | 7 | 5 |

| Measurement of the general economic climate in organization | 4 | 6 | 6 | 4 | -10 | -5 |

| Measurement of the economic climate changes trends: - prospective changes | 21 | 16 | 10 | 1 | 9 | 9 |

| - actual changes | -7 | 5 | 3 | -2 | -21 | -3 |

Analysis of the values shows that negative trend of December 2014 has significantly influenced the situation in the first quarter of 2015. However by the end of the second quarter the improvement on a range of indicators is noticeable.

Business activity value by PMI and ECI in Russia in the second quarter of 2015 confirms the expectation trend of the situation improvement in production industry and service sector. It is evident as a hope on demand strengthening, growth of new orders. It will lead to production increase and increase of the works and services amount. In this respect there will be escalation of capacity utilization and necessity for additional human resources. Thus, the expected improvement of the economic climate might generate growth of entrepreneurs’ income. It will be possible to take up the position that the mentioned improvement is a steady trend when these indicators will be analyzed on the long time period in third and fourth quarter of 2015.