How to identify the unfair supplier?

According to the Article 19 of the 94th Federal law "On placing the orders for state and municipal needs" unfair suppliers are included in special register maintained by the Anti-Monopoly Service.

There are two reasons for entering in the mentioned register of unfair suppliers. First, if the auction winner refuses to sign the contract. In this case, the customer must notify the Federal Antimonopoly Service (FAS) for further verification and unfair supplier gets into the registry in case of validation. The second reason is significant violation of contract terms. In this case, the customer terminates the contract in court, and refers to the OFAS only after the court decision comes into force.

Information about the firm is in the Register of unfair suppliers (RUS) for two years from the entry date. The company has no right to participate in the bidding for this period of time, and only expiration could be the reason for the removal from the register.

In the future the requirements of keeping the Register are planned to be tightened. Now founders and directors of organizations included in the registry often start a new business or change tax number (INN) and continue their activities. Therefore, the FAS plans to add information on founders and directors to the registry. But as long as the change is not introduced, companies should take heed in order not to face the unfair suppliers while entering into agreements.

Specialized Information-analytical system Globas-i helps to find online all the necessary information about the supplier: registration data, information on licenses, litigation, leadership and shareholders structure. The system also contains information on the dates of inclusion and exclusion of the company to / from the Register of unfair suppliers. Moreover, the Reliability index is to appear in the system, with the help of such index the user can easily recognize a fly-by-night company.

Profitability of operating profit before payment of taxes and interest (margin EBIT) of railway rolling stock manufacturers in the Russian Federation

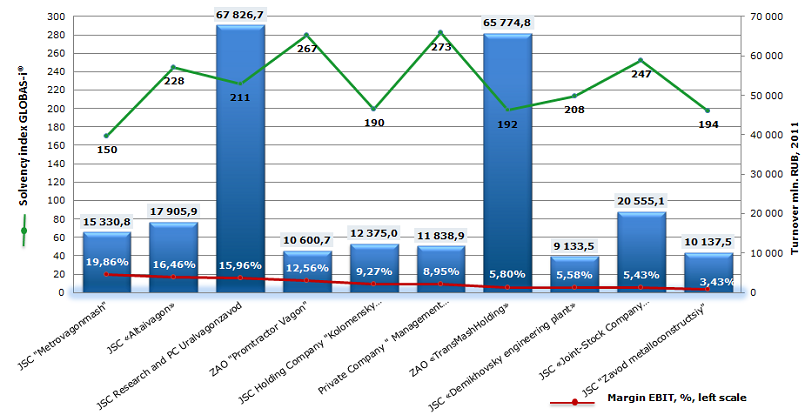

Information agency Credinform has prepared ranking of railway rolling stock manufacturers in the Russian Federation. The ranking includes the largest enterprises and is based on revenue as stated in the Statistics register, with the reference period of 2011. Companies were ranged by descending profitability of operating profit before payment of taxes and interest on the credits (margin EBIT).

Margin EBIT (%) – the ratio of profit before tax and interest on borrowed funds to sales proceeds. The recommended value of margin EBIT should be at least positive number. However it doesn’t guarantee net profit – after accounting of interest to creditors, especially, if company has significant debts, there can be loss. The higher the ratio, the bigger the probability that company will show net profit. This ratio lets to compare companies not taking into account tax payments and the value of loan portfolio, thus the total efficiency of uses by organization its resources and productivity of company's financial management is estimated.

| № | Name | INN | Region | Turnover 2011, mln. RUB | Margin EBIT, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | JSC "Metrovagonmash" | 5029006702 | Moscow region | 15 330,8 | 19,86 | 150(the highest) |

| 2 | JSC «Altaivagon» | 2208000010 | Altai territory | 17 905,9 | 16,46 | 228(high) |

| 3 | JSC Research and PC Uralvagonzavod | 6623029538 | Sverdlovsk region | 67 826,7 | 15,96 | 211(high) |

| 4 | ZAO "Promtractor Vagon" | 2128701370 | The Republic of Chuvashia | 10 600,7 | 12,56 | 267(high) |

| 5 | JSC Holding Company "Kolomensky zavod" | 5022013517 | Moscow region | 12 375,0 | 9,27 | 190(the highest) |

| 6 | Private Company " Management Company "Bryansk Engineering Works" | 3232035432 | Bryansk region | 11 838,9 | 8,95 | 273(high) |

| 7 | ZAO «TransMashHolding» | 7723199790 | Moscow | 65 774,8 | 5,8 | 192(the highest) |

| 8 | JSC «Demikhovsky engineering plant» | 5073050010 | Moscow region | 9 133,5 | 5,58 | 208(high) |

| 9 | JSC «Joint-Stock Company Railwaycar-Building Works Tver» | 6902008908 | Tver region | 20 555,1 | 5,43 | 247(high) |

| 10 | JSC "Zavod metalloconstructsiy" | 6449008704 | Saratov region | 10 137,5 | 3,43 | 194(the highest) |

Diagram 1. Margin EBIT, revenue and solvency index GLOBAS-i® TOP-10 manufacturers of railway rolling stock in the Russian Federation

Total turnover of TOP-10 companies by the results of 2011 financial year is 241,48 bln. RUB. The average value of margin EBIT – 10,3%.

As we can see on diagram, two enterprises are notable by annual turnover: OJSC Research and PC Uralvagonzavod (manufactures tank cars, platform-cars, hopper cars) and ZAO Transmashholding (main and industrial locomotives, mainline and shunting locomotives, locomotive and marine diesel engines, freight and passenger cars, electric trains and subway cars), with the revenue 67 827 mln. RUB and 65 775 mln. RUB respectively. UralVagonZavod showed margin EBIT value more than in average 10 largest manufacturers of railway rolling stock in RF – 16%, Transmashholding less – 5,8%.

Besides OJSC Research and PC Uralvagonzavod, the highest value of margin EBIT have the following companies: JSC Metrovagonmash (19,9%) - produce cars for subways of Moscow, Saint-Petersburg, Baku, Tbilisi, Kharkov, Budapest, Prague and other Russian cities, near and far abroad; JSC Altaivagon (16,5%) – one of the largest Russian plants for production of rail freight rolling stock - tanks, platforms, etc.

However these companies and other enterprises from TOP-10 list fall into the highest and high value of independent solvency index GLOBAS-i® of Information agency Credinform. That speaks about ability of companies to meet debt obligations on time and in full. Risk of non-performance of debts is minimum or inconsiderable. Such situation can be explained by the high level of orders on railway rolling stock by JSC "RZD", urban subways, oil, coal and other companies from different industries at rather high depreciation percent of existing park.