Agriculture of the Southern Federal district of Russia

Information agency Credinform has prepared a review of activity trends of the largest agricultural companies of the Southern Federal district of Russia.

The largest companies (ТОP-1000) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2013 - 2018). The analysis was based on data of the Information and Analytical system Globas.

Net assets is a ratio reflecting the real value of company's property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The ratio is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets is JSC FIRMA AGROKOMPLEKS IM. N.I.TKACHEVA, INN 2328000083, which is in process of reorganization in the form of acquisition of other legal entities since 10/04/2019. In 2018 net assets of the company amounted to 23,7 billion RUB.

The smallest size of net assets in TOP-1000 had LLC EVRODON, INN 6125021399. Case on declaring the company bankrupt (insolvent) is proceeding. The lack of property of the company in 2018 was expressed in negative terms -9,3 billion RUB.

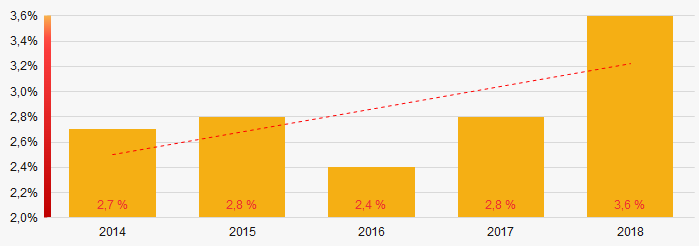

For the last five years, the average values of TOP-1000 net assets showed the growing tendency (Picture 1).

Picture 1. Change in average net assets value of ТОP-1000 companies in 2014 – 2018

Picture 1. Change in average net assets value of ТОP-1000 companies in 2014 – 2018For the last five years, the share of ТОP-1000 enterprises with lack of property is growing (Picture 2).

Picture 2. The share of enterprises with negative net assets value in ТОP-1000

Picture 2. The share of enterprises with negative net assets value in ТОP-1000Sales revenue

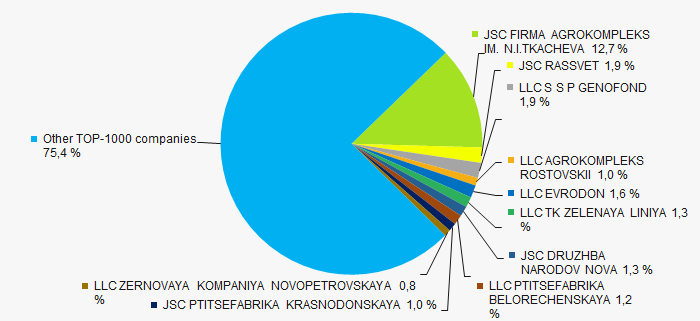

In 2018, the total revenue of 10 largest companies amounted to almost 25% from ТОP-1000 total revenue (Picture 3). This fact testifies the high level of intra-industry competition in the Southern region.

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2018

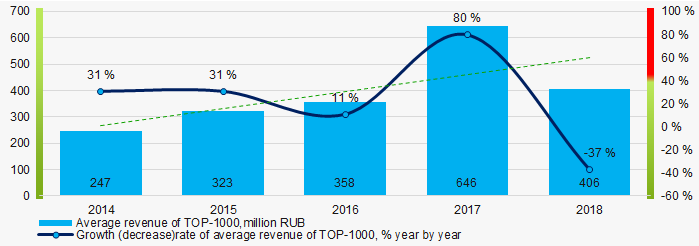

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2018In general, the growing trend in sales revenue is observed (Picture 4).

Picture 4. Change in average revenue of TOP-1000 in 2014 – 2018

Picture 4. Change in average revenue of TOP-1000 in 2014 – 2018 Profit and loss

The largest company in terms of net profit is LLC S S P GENOFOND, INN 2371000869. In 2018 the company’s profit amounted to 6,2 billion RUB.

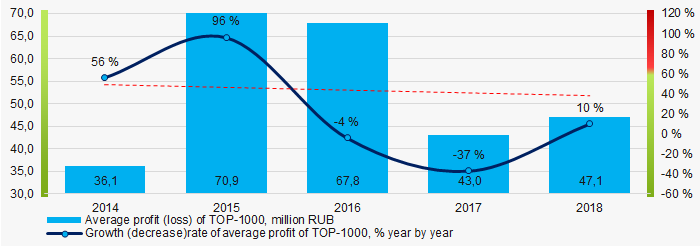

For the last five years, the average profit values of TOP-1000 show the decreasing tendency (Picture 5).

Picture 5. Change in average profit of TOP-1000 in 2014 – 2018

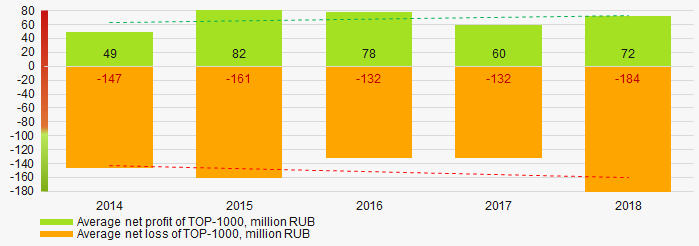

Picture 5. Change in average profit of TOP-1000 in 2014 – 2018 Over a five-year period, the average net profit values of ТОP-1000 show the growing tendency, along with this the average net loss is growing too (Picture 6).

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2014 – 2018

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2014 – 2018Main financial ratios

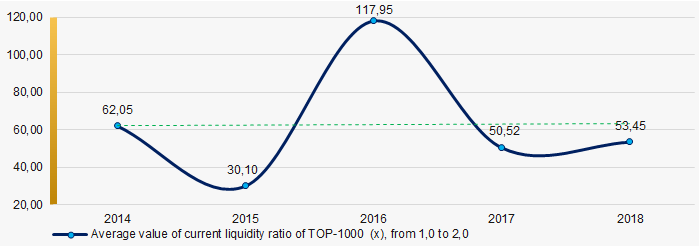

For the last five years, the average values of the current liquidity ratio were higher than the recommended values - from 1,0 to 2,0, with growing tendency (Picture 7).

The current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 7. Change in average values of current liquidity ratio of TOP-1000 companies in 2014 – 2018

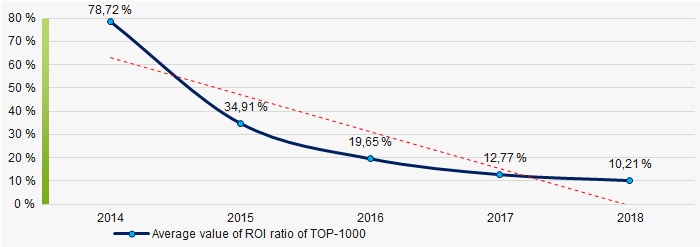

Picture 7. Change in average values of current liquidity ratio of TOP-1000 companies in 2014 – 2018For the last five years, the high level of the average values of ROI ratio with downward trend is observed (Picture 8).

The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2014 – 2018

Picture 8. Change in average values of ROI ratio in 2014 – 2018Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit

For the last five years, this business activity ratio demonstrated the downward trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2014 – 2018

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2014 – 2018Small businesses

73% of ТОP-1000 companies are registered in the Unified register of small and medium-sized enterprises of the Russian Federal Tax Service. Herein, their share in TOP-1000 total revenue amounted to more than 35%, which is significantly higher than national average value (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000Main regions of activity

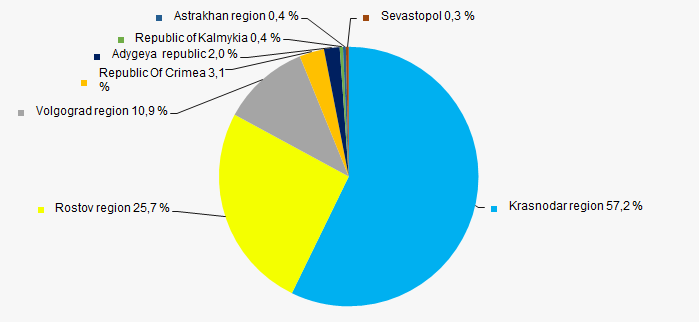

ТОP-1000 companies are registered in 8 regions and unequally located across the federal district. Almost 83% of the largest enterprises in terms of revenue are located in Krasnodar and Rostov regions (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by regions of Southern federal district

Picture 11. Distribution of TOP-1000 revenue by regions of Southern federal districtFinancial position score

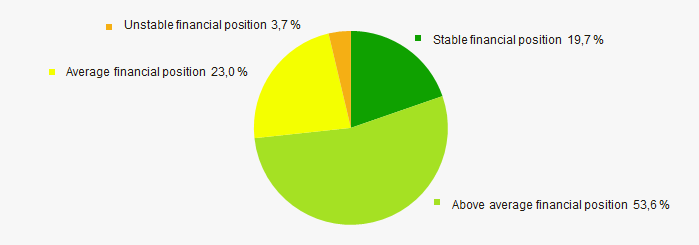

An assessment of the financial position of TOP-1000 companies shows that the largest part have above average financial position (Picture 12)..

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

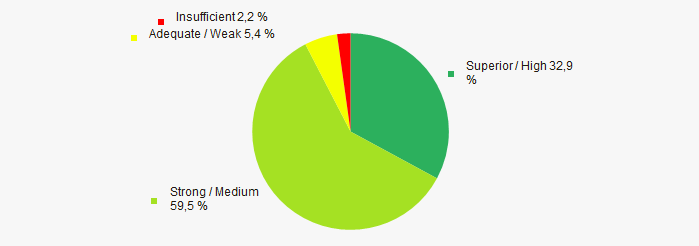

Most of TOP-1000 companies got superior/high or strong/medium Solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by Solvency index Globas

Picture 13. Distribution of TOP-1000 companies by Solvency index GlobasConclusion

A complex assessment of the largest agricultural companies of the Southern federal district, taking into account the main indexes, financial ratios and indicators, demonstrates the presence of positive trends (Table 1).

| Trends and assessment factors | Relative share, % |

| Growth/drawdown rate of average net assets value |  10 10 |

| Increase / decrease in the share of enterprises with negative net assets |  -10 -10 |

| The level of competition / monopolization |  10 10 |

| Growth/drawdown rate of average revenue |  10 10 |

| Growth/drawdown rate of average net profit (loss) |  -10 -10 |

| Increase / decrease in average net profit of companies |  10 10 |

| Increase / decrease in average net loss of companies |  -10 -10 |

| Increase / decrease in average values of current liquidity ratio |  5 5 |

| Increase / decrease in average values of ROI ratio |  -10 -10 |

| Increase / decrease in average values of assets turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses by revenue more than 22% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of factors |  1,1 1,1 |

favorable trend (factor),

favorable trend (factor),  unfavorable trend (factor).

unfavorable trend (factor).

High-growth companies will determine the future of the economy

Dynamically developing companies create new markets, implement technologies, set professional standards and form consumer preferences. The key condition for gazelle companies is high growth rate: minimum by 20-30% annually for at least 4 years. Gazelle companies are the most successful and stable-growing companies, providing new jobs, contributing to the GDP increase, and being able to influence the domestic economy growth and be the marker of structural changes.

Are the Russian gazelles able to become the engine of the economy?

The Russian gazelle companies were studied with the Information and Analytical system Globas. Companies with at least 30% of annual growth were selected out of 3,5 million active commercial entities. Revenue exceeding 50 million RUB, and positive net assets were recorded for these companies in 2018.

Regions of activity

About 1% or a little over 3 thousand Russian entities fall under the gazelles criteria. Total 2018 turnover of 5,2 trillion RUB is 2,8% of turnover of all entities. There are from 1% to 5% of gazelle companies in developed economies. At the same time, up to 50% of GDP growth fall for their share.

The majority or 26% of gazelles are located in Moscow, 9% - in Saint Petersburg, and 6% - in Moscow region. By total revenue, high-growth companies from Saint Petersburg are almost close to those from Moscow: gazelles from Saint Petersburg accumulate 1,3 trillion RUB of revenue, and the Moscow ones have 1,5 trillion RUB. Other regions are significantly behind the leaders by both the number of companies and total revenue.

Gazelles are presented in almost all subject of Russia, excluding the Republics of Dagestan and Ingushetia, and sparsely populated Chukotka and Nenets autonomous districts.

Size of the Russian gazelles

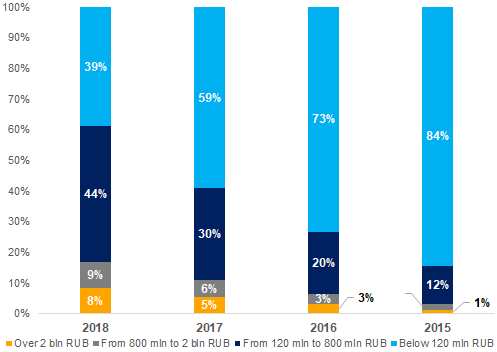

The majority of high-growth companies do not fall under the category of large business. Only 8% of companies have 2018 revenue exceeding 2 billion RUB. 44% of total number of gazelles have revenue from 120 million RUB to 800 million RUB.

In general, high-growth companies became lager for the researched 4 years: in 2015, the revenue of 1% of gazelles exceeded 2 billion RUB. The main share fell for companies with turnover up to 120 million RUB (see Picture 1).

Picture 1. Distribution of high-growth companies by annual revenue

Picture 1. Distribution of high-growth companies by annual revenueEconomic sectors

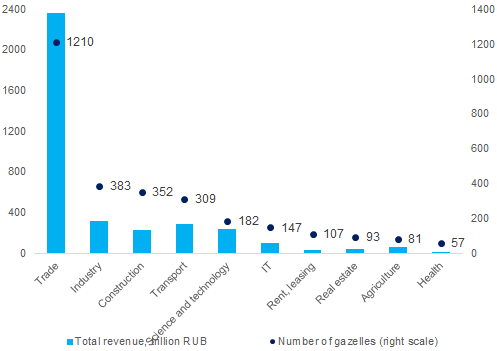

1 210 companies or 38% of total number of gazelles are engaged in wholesale and retail trade. This sector accumulates the majority of total revenue: 2,4 trillion RUB or 45% of total gazelles’ revenue (see Picture 2).

There are no gazelles in mining. Mainly large companies occupy this sector, and the majority of gazelles are medium-sized and small companies.

Picture 2. Distribution of high-growth companies by economic activity; total revenue for 2018

Picture 2. Distribution of high-growth companies by economic activity; total revenue for 2018Leaders

Table 1 presents the largest gazelles in term of revenue. They are included in TOP-10 of economic sectors with the highest number of gazelles involved. The table contains well-known brands, such as Pyatyorochka retail chain, airline company AZUR air, Spasibo by Sberbank and companies engaged in industries the products of which have until recently been mainly imported (production of large-diameter pipes, for instance).

Table 1. TOP-10 of sectors by the number of high-growth companies represented by the revenue leaders

| Rank | Sector | Company | Revenue in 2018, billion RUB | Average growth of revenue in 2015-2018, % | Scope of business |

| 1 | Trade | LLC AGROTORG | 1 036 | 75 | Pyatyorochka retail chain |

| 2 | Industry | ZAGORSK PIPE PLANT JSC | 39 | 317 | Production of large-diameter pipes |

| 3 | Construction | LLC SPETSTRANSSTROY | 21 | 701 | Construction of transport infrastructure |

| 4 | Transport | AZUR air LLC | 44 | 174 | Charter service |

| 5 | Science and technology | JSC NIPIGAZPERERABOTKA | 115 | 167 | Development and design in oil and gas industry |

| 6 | Information technologies | JSC CENTRE OF LOYALTY PROGRAMMERS | 26 | 57 | Spasibo service by Sberbank |

| 7 | Rent, leasing | LLC LIZPLAN RUS | 3 | 214 | Corporate car leasing |

| 8 | Real estate | LLC OPERATOR OF COMMERCIAL REAL ESTATE | 11 | 1 635 179 | Lease of storage facilities |

| 9 | Agriculture | LLC AGROTEK-VORONEZH | 7 | 249 | Pork production |

| 10 | Health | LLC A410 | 2 | 197 | Aesthetic pharmaceuticals and cosmetology under the Allergan brand |

Conclusion

The number of the Russian high-growth companies is compatible by the level with the developed economies. However, their contribution to the domestic product is significantly less. The potential of the Russian gazelles is not unleashed yet. The majority of high-growth companies by both the number and total revenue are engaged in trade and this sector creates no higher value-added unique product. Only after the existing imbalance is eliminated through the accelerated development of industry, IT and science, it will be possible to talk about the qualitative transformation of domestic GDP, including due to the contribution of gazelle companies.