TOP-10 countries by stock of cars

Today there is a rapid transformation of the global automotive market. If during the XX century the United States and Western Europe were the key regions for leading automobile concerns, then since 2010, China has been being first by the number of cars sold: by the end of 2019, this figure in China amounted to 25,8 million units, in the USA – 17,5 million units. (see Table 1).

The United States still leads in the total stock of cars: today there are 274 million cars. However, in the short term, this century-old leadership will be lost, since the relative level of motorization is close to its natural limit: in the United States, 838 cars fall per 1 thousand inhabitants, including infants.

In China, the market is far from satiety. The level of motorization is estimated at 181 cars per 1 thousand inhabitants, which is 2,1 times lower than in Russia - 381 cars. Taking into account the growth of welfare of citizens in China, the further rapid growth in the local stock of cars should be expected. The total number of vehicles in the PRC has reached 260 million units, which is only 14 million units less than in the USA.

India is ranked 3rd by stock of cars - 243 million units. However, annual sales of new cars there are much lower than in China. Despite this, having huge population, India will also bypass the United States in total stock of cars in the medium term.

Russia ranks 1st in Europe in terms of the number of vehicles: 56 million cars are registered in the country.

| Rank | Country | Total stock of cars, million | Number of cars sold in 2019, million | Number of cars per 1000 inhabitants |

| 1 | USA | 274 | 17,5 | 838 |

| 2 | China | 260 | 25,8 | 181 |

| 3 | India | 243 | 3,8 | 176 |

| 4 | Japan | 78 | 5,2 | 615 |

| 5 | Brazil | 74 | 2,8 | 350 |

| 6 | Russia | 56 | 1,8 | 381 |

| 7 | Germany | 46 | 3,6 | 561 |

| 8 | Italy | 38 | 2,0 | 625 |

| 9 | Mexico | 37 | 1,4 | 297 |

| 10 | France | 32 | 2,6 | 478 |

The COVID-19 pandemic will certainly make adjustments to the global automotive market. Everywhere there will be a significant decline in sales, consumption of gasoline and diesel fuel. Nevertheless, the trend cannot be changed. The future of the auto industry is in Asia, and given the number of people in the region, steady demand for oil products, metals, and composite materials will remain.

TOP-1000 companies of the North Caucasus

In order to reduce interregional differences in the level and quality of life of the population, accelerate the rate of economic growth and technological development, as well as to ensure the national security of the country, the Government of the Russian Federation approved the strategy of spatial development of Russia until 2025, consisting of 12 macro-regions, in February 2019. One of them is the North Caucasus region, which includes: Sevastopol, Kabardino-Balkaria, Karachayevo-Cherkessian and Chechen Republics, Krasnodar and Stavropol territories, Republic of Adygea, Dagestan, Ingushetia, Crimea, Republic of North Ossetia-Alania, Rostov region.

Information agency Credinform represents an overview of activity trends of the largest enterprises of the real sector of the economy in the North Caucasus economic region of Russia.

Enterprises with the largest volume of annual revenue (TOP-1000) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2013 - 2018). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets value is an indicator, reflecting the real value of company’s property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest enterprise of the North Caucasus economic region of Russia in terms of net assets is GAZPROM TRANSGAZ KRASNODAR LLC, INN 2308128945, Krasnodar territory. Its net assets amounted to more than 206 billion rubles in 2018.

The smallest amount of net assets in the TOP-1000 list was hold by GAZPROM MEZHREGIONGAZ GROZNY LLC, INN 2013006003, Chechen Republic. The insufficiency of property of this company in 2018 was expressed as a negative value of -83 billion rubles.

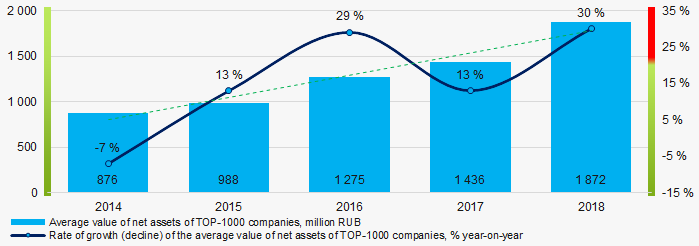

The average values of net assets of TOP-1000 enterprises tend to increase over the five-year period (Picture 1).

Picture 1. Change in the average indicators of the net asset value of TOP-1000 companies in 2014 – 2018

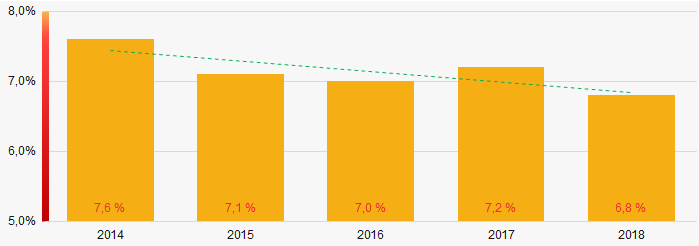

Picture 1. Change in the average indicators of the net asset value of TOP-1000 companies in 2014 – 2018The shares of TOP-1000 enterprises with insufficiency of assets have a tendency to decrease in the last five years (Picture 2).

Picture 2. Shares of enterprises with negative values of net assets in TOP-1000

Picture 2. Shares of enterprises with negative values of net assets in TOP-1000Sales revenue

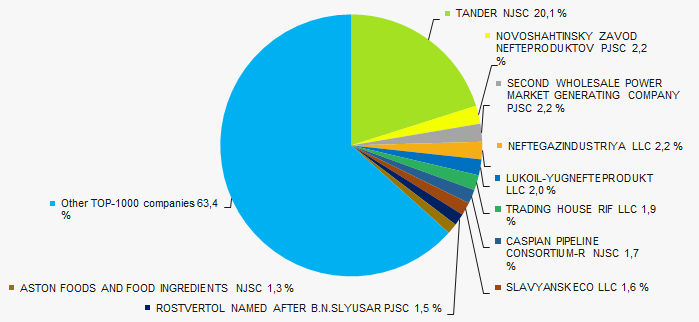

The revenue volume of 10 leading companies of the region made almost 37% of the total revenue of TOP-1000 in 2018 (Picture 3). It points to a relatively high level of capital concentration.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2018

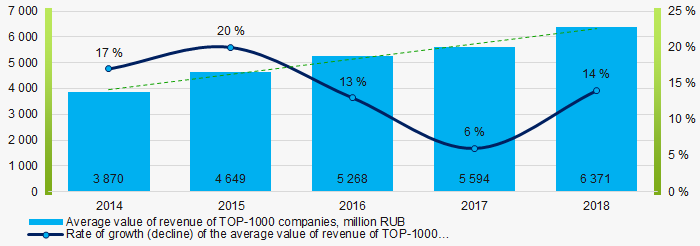

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2018 In general, there is a tendency to increase in the revenue volumes (Picture 4).

Picture 4. Change in the average revenue of TOP-1000 companies in 2014 – 2018Change in the average revenue of TOP-1000 companies in 2014 – 2018

Picture 4. Change in the average revenue of TOP-1000 companies in 2014 – 2018Change in the average revenue of TOP-1000 companies in 2014 – 2018Profit and losses

The largest company in terms of net profit value is CASPIAN PIPELINE CONSORTIUM-R NJSC, INN 2310040800, Krasnodar territory. Company's profit amounted to more than 36 billion rubles in 2018.

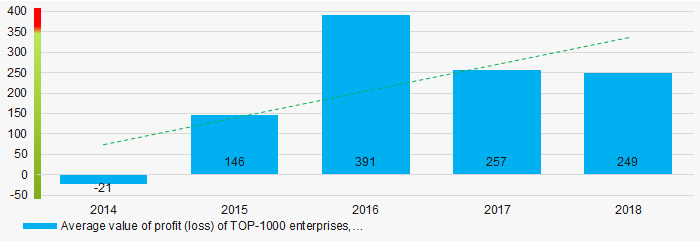

Over a five-year period, TOP-1000 enterprises showed a tendency to growth of profit (Picture 5).

Picture 5. Change in the average indicators of profit of TOP-1000 companies in 2014 – 2018

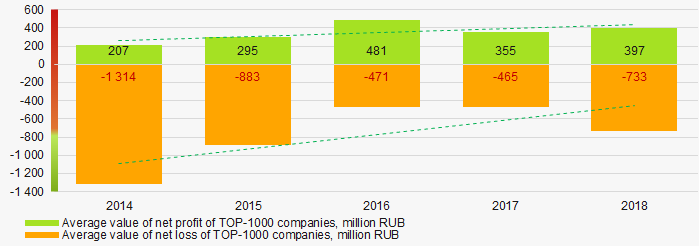

Picture 5. Change in the average indicators of profit of TOP-1000 companies in 2014 – 2018Average values of net profit’s indicators of TOP-1000 enterprises have a tendency increase over a five-year period, at the same time the average value of net loss decreases. (Picture 6).

Picture 6. Change in the average indicators of net profit and net loss of TOP-1000 companies in 2014 – 2018

Picture 6. Change in the average indicators of net profit and net loss of TOP-1000 companies in 2014 – 2018 Key financial ratios

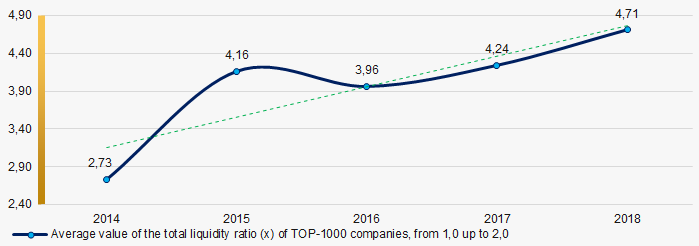

Over the five-year period, the average indicators of the total liquidity of TOP-1000 enterprises were above the range of recommended values - from 1,0 up to 2,0, with a tendency to increase. (Picture 7).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the average values of the total liquidity ratio of TOP-1000 companies in 2014 – 2018

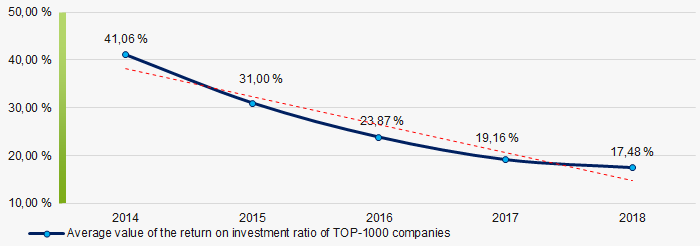

Picture 7. Change in the average values of the total liquidity ratio of TOP-1000 companies in 2014 – 2018Over the course of five years, there is a rather high level of average indicators of return on investment ratio, with a tendency to decrease (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity and the long-term borrowed funds of an organization.

Picture 8. Change in the average values of the return on investment ratio of TOP-1000 companies in 2014 – 2018

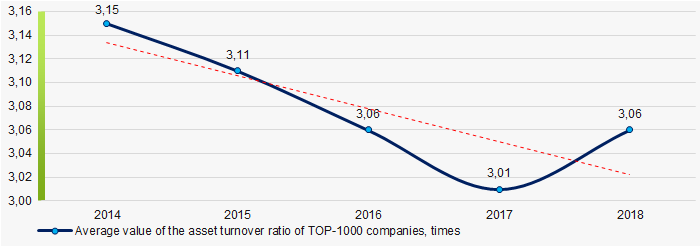

Picture 8. Change in the average values of the return on investment ratio of TOP-1000 companies in 2014 – 2018 Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

Over a five-year period, this indicator of business activity showed a tendency to decrease (Picture 9).

Picture 9. Change in the average values of the asset turnover ratio of TOP-1000 companies in 2014 – 2018

Picture 9. Change in the average values of the asset turnover ratio of TOP-1000 companies in 2014 – 2018Small business

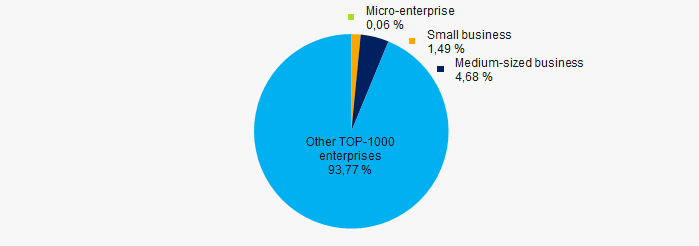

30% enterprises from TOP-1000 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the RF. At the same time, their share in the total revenue of TOP-1000 amounts to 6%, that is significantly lower than the national average one in 2018 - 2019. (Picture 10).

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-1000 companies

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-1000 companiesMain regions of activity

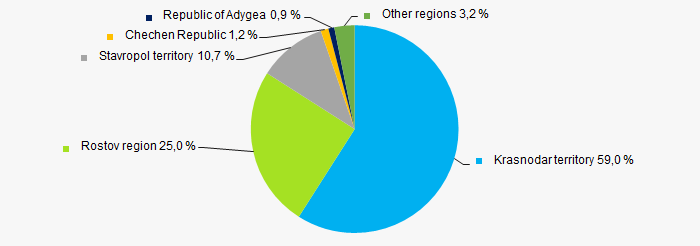

TOP-1000 companies are registered in all 12 regions and distributed unequal across the territory. 84% of the largest enterprises in terms of revenue are concentrated in Krasnodar territory and Rostov region (Picture 11).

Picture 11. Distribution of the revenue of TOP-1000 companies by regions of the North Caucasus economic region of Russia

Picture 11. Distribution of the revenue of TOP-1000 companies by regions of the North Caucasus economic region of RussiaFinancial position score

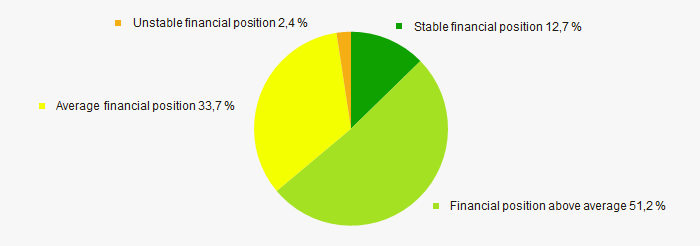

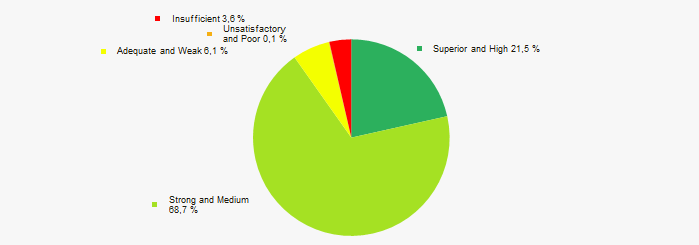

An assessment of the financial position of TOP-1000 companies shows that the financial position of the most of them is above average. (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

The vast majority of TOP-1000 enterprises got Superior/High or Strong/Medium Solvency index Globas, that points to their ability to pay off their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-50 companies by solvency index Globas

Picture 13. Distribution of TOP-50 companies by solvency index GlobasIndustrial production index

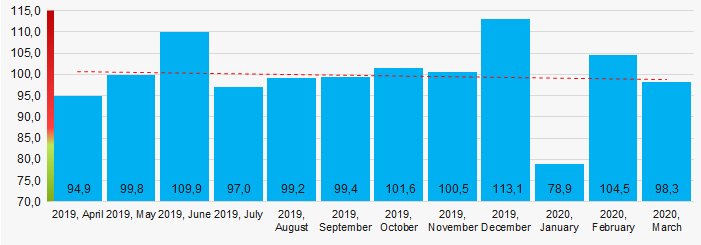

According to the Federal State Statistics Service, there is a tendency towards a decrease in indicators of the industrial production index in the North Caucasus economic region of Russia during 12 months of 2019 – 2020 (Picture 14). At the same time, the average index month-over-month made 99,7%.

Picture 14. Averaged industrial production index in the territory of the North Caucasus economic region of Russia in 2019 - 2020, month-over-month (%)

Picture 14. Averaged industrial production index in the territory of the North Caucasus economic region of Russia in 2019 - 2020, month-over-month (%)According to the same data, the share of enterprises of the North Caucasus economic region of Russia in the total amount of revenue from the sale of goods, works, services made 4,643% countrywide for 2019, that is lower than the indicator for 2018, which amounted to 4,701%.

Conclusion

A comprehensive assessment of activity of the largest enterprises of the real sector of the economy in the North Caucasus economic region of Russia, taking into account the main indices, financial indicators and ratios, points to the prevalence of positive trends (Table 1).

| Trends and evaluation factors of TOP-1000 | Specific share of factor, % |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition / monopolization |  -10 -10 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of net profit of companies |  10 10 |

| Growth / decline in average values of net loss of companies |  10 10 |

| Increase / decrease in average values of total liquidity ratio | |

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized enterprises in the region in terms of revenue being more than 22% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Industrial production index |  -10 -10 |

| Dynamics of the share of proceeds of the region in the total revenue of the RF |  -10 -10 |

| Average value of the specific share of factors |  0,9 0,9 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).