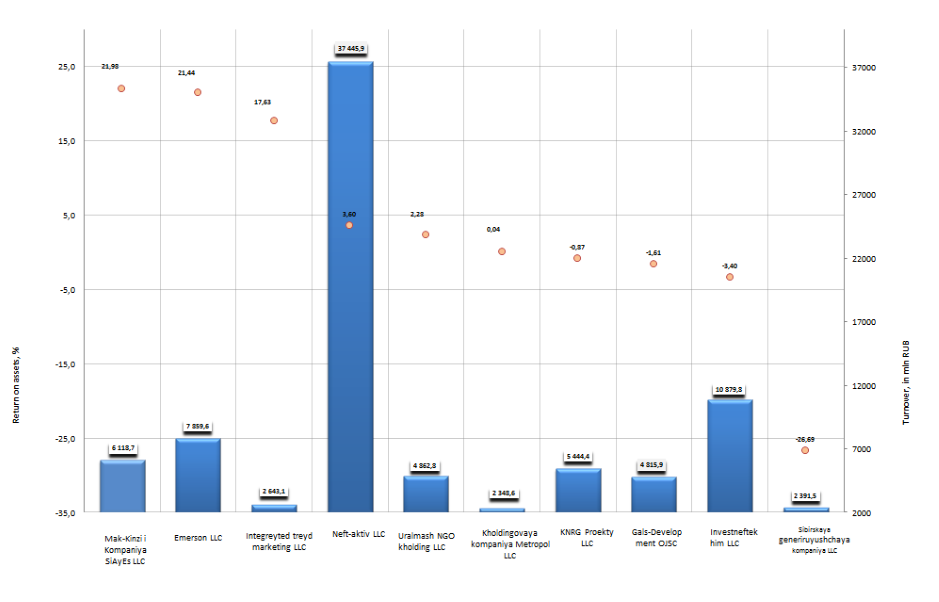

Return on assets of enterprises engaged in consultation on questions of commercial activity and management

Information agency Credinform offers to get acquainted with the ranking of enterprises engaged in consultation on questions of commercial activity and management. The companies with the highest volume of revenue involved in this activity were selected by the experts according to the data from the Statistical Register for the latest available period (for the year 2013). Then, the first 10 enterprises selected by turnover were ranked by decrease in return on assets.

Return on assets is a financial indicator, which characterizes the benefit from the use of all assets of an organization. This ratio is calculated as the relation of net profit and interests payable to company’s total assets value and shows, how many monetary units of net profit were earned by each unit of total assets.

There are no recommended or specified values prescribed for profitability ratios, because their values vary strongly depending on the branch.

| № | Name, INN | Region | Turnover for 2013, in mln RUB | Return on assets, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Mak-Kinzi i Kompaniya SiAyEs LLC INN 7710708760 |

Moscow | 6119 | 21,98 | 298 (high) |

| 2 | Emerson LLC INN 7705130530 |

Moscow | 7860 | 21,44 | 284 (high) |

| 3 | Integreyted treyd marketing LLC INN 7715565611 |

Moscow | 2643 | 17,63 | 273 (high) |

| 4 | Neft-aktiv LLC INN 7725594298 |

Moscow | 37 446 | 3,6 | 279 (high) |

| 5 | Uralmash neftegazovoe INN 7707727918 |

Moscow | 4863 | 2,28 | 367 (unsatisfactory) |

| 6 | Kholdingovaya kompaniya Metropol LLC INN 7706632798 |

Moscow | 2349 | 0,04 | 311 (unsatisfactory) |

| 7 | Kaspiyskaya energiya Proekty LLC INN 3015057870 |

Astrakhan region | 5444 | -0,87 | 286 (high) |

| 8 | Gals-Development OJSC INN 7706032060 |

Moscow | 4816 | -1,61 | 263 (high) |

| 9 | Investneftekhim LLC INN 1655077599 |

Republic of Tatarstan | 10 880 | -3,4 | 328 (satisfactory) |

| 10 | Sibirskaya generiruyushchaya kompaniya LLC INN 7709832989 |

Moscow | 2391 | -26,69 | 334 (satisfactory) |

The first three enterprises of the ranking are as follows: Mak-Kinzi i Kompaniya SiAyEs LLC (return on assets value is 21,98%), Emerson LLC (21,44%) and Integreyted treyd marketing LLC (17,63%). The return on assets values of these companies is above 17%, what is a good result for the representatives of services sector. Moreover, all the first three enterprises got a high solvency index GLOBAS-i®, what testifies that these organizations can pay off their debts in time and fully.

Diagram. Return on assets of Russian enterprises engaged in consultation on questions of commercial activity and management, TOP-10

The return on assets value of companies Kaspiyskaya energiya Proekty LLC (-0,87%), Gals-Development OJSC (-1,61%), Investneftekhim LLC (-3,4%) and Sibirskaya generiruyushchaya kompaniya LLC (-26,69%) is below zero, because the enterprises have losses following the results of the accounting period.

The return on assets value for capital-intensive industries is, as a rule, lower than for companies of services sector, which don’t need large financial investments and investments in current assets. However, the results obtained within this ranking demonstrate not the most favorable picture: only three companies of the TOP-10 list showed a worthy result. However, it should be remembered, that for comprehensive and objective assessment of an enterprise it is necessary to consider the combination of financial and non-financial indicators.

Where is it more popular to take credits?

According to research of the National Bureau of Credit Histories (NBCH), the majority of credit borrowers live in Republic of Buryatia, Republic of Khakassia and Amur region.

It’s interesting that according to Rosstat, average salary in these regions is far from being the lowest countrywide and varies from RUR 24,2 to 17,8 th. At the same time, the minimum of the average salary is registered in Kalmykiya and amounts to RUR 11,3 th.

According to NBCH, the average Russian borrower spends almost 26% of his/her income on promissory notes service every month. However, lately more and more borrowers spend almost 60% of their salary monthly on loan servicing. In the Republic of Buryatia there are 18,92 % of such borrowers, in Khakassia - 17,88%, in Amur region - 17,74%.

| № | Region | Share of borrowers with debt burden over 60% |

|---|---|---|

| 1 | Republic of Buryatia | 18,92% |

| 2 | Republic of Khakassia | 17,88% |

| 3 | Amur region | 17,74% |

| 4 | Altai Territory | 13,50% |

| 5 | Arkhangelsk region | 13,30% |

| 6 | Sakhalin region | 13,17% |

| 7 | Zabaykalsky Krai | 13,05% |

| 8 | Novgorod region | 12,95% |

| 9 | Tyumen region | 12,34% |

| 10 | Kamchatka Krai | 12,14% |

Experts link the growth in number of borrowers with their wrong world view, perceiving credits as additional source of revenue. Thus, the availability of loans together with irrational treatment lead to situation when families, having taken a lot of credits, borrow more and more money in order to pay off the previous debts.

In addition to that, the borrower’s TOP-10 includes the regions where the regional average salary exceeds the average salary countrywide. For instance, in the Sakhalin region this indicator amounts to RUR 39,9 th., in Tyumen region – RUR 36,3 th., in Kamchatka Krai – RUR 34,5 th. However, in this case it’s worth paying attention to the price level in these regions. Thus, according to Dmitry Medvedev, the food and housing prices in Sakhalin region and Kamchatka Krai are significantly higher than average salary countrywide, therefore the cost of one ruble is lower there. Experts note the wealth divide in the Tyumen region.

At that the representatives of the banking sector state that recently the rate of borrowers with low incomes has significantly grown. They are almost hooked on the credits. However, the experts can’t find the reasons why in some regions credits are paid off better, than in others. Thus, the economic situation, earnings stability of the citizens, operational effectiveness of the local collection agencies (the agencies that specialize in past-due debt and bad debts collection) exert influence on the regional credit rate. Moreover, cultural characteristics and habits of the citizens shouldn’t be left unmentioned. For example, if the borrower sees that his/her neighbor doesn’t have trouble with no paying off his/her debt, his/her desire to pay disappears.

It bears reminding that, previously the Bank of Russia proposed to impose restrictions by the debt to income ratio (DTI). There were two options. The first option was to impose restrictions for banks on granting of credits to clients, if the borrower’s DTI reaches the threshold values. More merciful option intended to grant credits to borrowers with excessive DTI, laying tougher requirements for the credit. However, Vasiliy Pozdyshev, director of bank regulation department of the Central Bank of Russia, stated last autumn that the ratio wouldn’t be imposed.