New requirements for counterparties check in 2022

The Information and Analytical System Globas provides services, the request for which has existed for more than 25 years: checking companies, analytical functionality and tools for the right decision concerning counterparties choice.

Globas offers solutions that will help to meet legal requirements, manage risks, and gain a competitive advantage due to prompt information and tools for quick and deep analysis.

GLOBAS FUNCTIONALITY MEETS NEW CHECKING REQUIREMENTS:

- AML / CFT and Compliance Reports;

- integration using Globas.API;

- automation of the process of selection and check of counterparties;

- monitoring;

- check against sanctions lists;

- analysis of affiliation and influence of beneficiaries;

- checking persons to identify conflicts of interest.

The high probability of restrictions, unpredictable bankruptcies, non-fulfillment of obligations by partners, as well as resolutions of regulatory bodies and legislative changes have formed in 2021 new requirements for the procedure for ensuring economic security, which will be relevant throughout 2022.

5 CURRENT TRENDS IN BUSINESS RISKS AND DUE DILLIGENCE

1. Implementation of a compliance system in response to legal requirements.

| Facts: | |

| According to the General Prosecutor's Office, 30 thousand corruption crimes were recorded in 2021, 12% more than in 2020. Over 200 thousand organizations are included in the list of tax debtors for December 2021. In 15 thousand organizations, the CEOs are disqualified persons. Identifying and knowing the counterparty is an important legal requirement, which AML / CFT and Compliance Reports in Globas will help to fulfill. |

2. Demand for massive checks of counterparties caused by deferred demand after a strict lockdown.

| Case: | |

| The industrial enterprise has been capturing the list of suppliers in Excel for several years. Having discovered an increase in accounts receivable and the counterparties ignored payment reminders, the company's employees used the Analysis of the list in Globas and found 22% of liquidated and bankrupt companies in the list of their long-term partners. |

3. Monitoring of factors that indirectly indicate an unstable financial position.

| Facts: | |

| According to Globas, about 10% of companies were declared bankrupt or liquidated within 12 months if they have records on false CEO, shareholders or address, pledged authorized capital, tax debts and other negative non-financial factors. |

4. Search for new partners and customers due to the formation of new supply chains and reorientation to domestic suppliers.

| Case: | |

| Due to the pandemic and lockdowns, the volume of production and cargo transportation around the world has decreased. Russian enterprises experienced a shortage, in particular, of electronic components, feed additives for animals and other goods traditionally imported from abroad. The "Filters" section in Globas contains over 100 settings, which will provide an accurate search for reliable suppliers. |

5. Countering the growing cybercrimes and fraudulent activities of individuals and shell companies.

| Facts: | |

| According to the General Prosecutor's Office, in 2021, 4,2% more economic crimes (107,115) were recorded, and 6,2% more people who committed economic crimes were detected (43,023). Globas will help to gather and analyze information about a company or person, identify factors requiring attention, as well as verification of passport and tax number (INN), check for debts, bankruptcy, ban on business activities and much more. |

TOP 10 microfinance organizations

According to the Central Bank of the Russian Federation, during first 9 months of 2021, microfinance organizations issued microloans for a total of 440 billion RUB, which is 53% more than during first 9 months of 2020. This is a very high growth since the pandemic 2020, when the market of microcredit companies was virtually shrinking with a growing unprofitability. The restriction of microloan marginal rates planned in 2022 may lead to a reduction in the number of players in the market, which at the end of 2021 had just over 1,000 companies.

For this ranking the Information agency Credinform using the Globas System selected the largest microcredit companies (TOP 100 and TOP 10) in terms of annual revenue for the last reporting periods available in the state statistics bodies and the Federal Tax Service (2018 - 2020). They were ranked by net profit ratio (Table 1).

Net profit ratio (%) is calculated as the ratio of net profit (loss) to sales revenue and shows the level of profit from sales.

There is no standard value for this indicator. It is recommended to compare companies in the same industry, or to analyze changes in the coefficient over time for a specific company. Negative value of the indicator shows the presence of net loss, high value indicates effectiveness of the company's work.

It is necessary to pay attention to the entire set of indicators and financial ratios to get the most complete and fair presentation of enterprise's financial condition.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Net profit ratio, % | Globas Solvency Index | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| MICROCREDIT COMPANY NALICHNYE ZAJMY LLC INN 1903023650 Republic of Khakassia |

25,8 25,8 |

34,5 34,5 |

1,5 1,5 |

1,7 1,7 |

5,65 5,65 |

5,07 5,07 |

271 Medium |

| MICROCREDIT COMPANY EXPRESS FINANCE LLC INN 2801155708 Primorsk territory |

32,9 32,9 |

29,9 29,9 |

1,9 1,9 |

1,5 1,5 |

5,63 5,63 |

4,93 4,93 |

292 Medium |

| MICROCREDIT COMPANY AGAR LLC INN 5957017522 Perm territory |

41,7 41,7 |

36,2 36,2 |

0,9 0,9 |

1,4 1,4 |

2,15 2,15 |

5,07 5,07 |

246 Strong |

| MICROCREDIT COMPANY TOYAN LLC INN 7017444751 Tomsk region |

14,1 14,1 |

34,3 34,3 |

-2,5 -2,5 |

0,6 0,6 |

-17,90 -17,90 |

1,85 1,85 |

316 Adequate |

| MICROCREDIT COMPANY DAYTONA GROUP LLC INN 3123399990 Belgorod region |

21,8 21,8 |

20,7 20,7 |

1,1 1,1 |

0,3 0,3 |

4,94 4,94 |

1,36 1,36 |

363 Adequate |

| MICROCREDIT COMPANY CYBERIAN GOLD LLC INN 5405992480 Novosibirsk region |

25,2 25,2 |

20,2 20,2 |

0,8 0,8 |

0,3 0,3 |

3,18 3,18 |

1,26 1,26 |

282 Medium |

| POKOLENIE LLC INN 9710060106 Moscow |

0,0 0,0 |

40,1 40,1 |

0,1 0,1 |

-0,1 -0,1 |

1 233,33 1 233,33 |

-0,18 -0,18 |

382 Weak |

| MICROCREDIT COMPANY FASTMONEY.RU LLC INN 7805714988 Saint Petersburg |

258,1 258,1 |

116,2 116,2 |

-9,7 -9,7 |

-3,6 -3,6 |

-3,75 -3,75 |

-3,11 -3,11 |

365 Adequate |

| MICROCREDIT COMPANY SIMPLEFINANCE LLC INN 7703381419 Moscow |

829,2 829,2 |

647,7 647,7 |

3,0 3,0 |

-136,6 -136,6 |

0,36 0,36 |

-21,09 -21,09 |

324 Adequate |

| MICROCREDIT COMPANY DELOVOE RESHENIE LLC INN 9701118335 Moscow |

8,0 8,0 |

19,1 19,1 |

0,3 0,3 |

-8,3 -8,3 |

3,82 3,82 |

-43,45 -43,45 |

384 Weak |

| TOP 10 average value |  125,7 125,7 |

99,9 99,9 |

-0,3 -0,3 |

-14,3 -14,3 |

123,74 123,74 |

-4,94 -4,94 |

|

| TOP 100 average value |  15,7 15,7 |

12,4 12,4 |

0,1 0,1 |

-1,6 -1,6 |

-16,64 -16,64 |

-47,82 -47,82 |

|

| Industry average value |  10,0 10,0 |

11,3 11,3 |

3,7 3,7 |

-4,4 -4,4 |

37,40 37,40 |

-38,79 -38,79 |

|

indicator improvement for the previous period,

indicator improvement for the previous period,  indicator deterioration for the previous period

indicator deterioration for the previous period

In 2020, average values of the net profit ratio of the TOP 10 companies exceed values of the TOP 100 companies and average industry values. Only three companies of TOP 10 improved their performance in 2020, while there were five such companies in 2019.

4 out of 10 companies increased revenue and/or net profit in 2020. At the same time, the average revenue of TOP 10 and TOP 100 decreased by 21%, and the industry average increased by 13%. The average loss of TOP 10 increased almost 48 times, for TOP 1000 it increased 17 times. On average, the industry's loss grew more than twice.

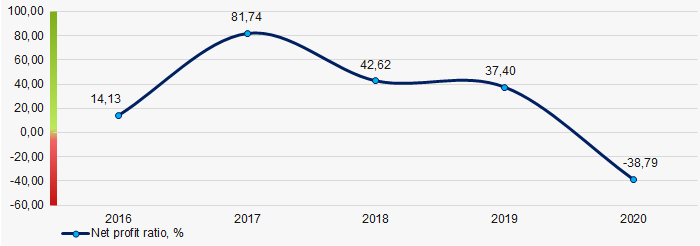

During the past 5 years, average industry values of the net profit ratio have deteriorated over three periods. The best value was achieved in 2017, and the worst result was shown in 2020. (Picture 1).

Picture 1. Change in average industry values of the net profit ratio in the market of loans provision in 2016-2020.

Picture 1. Change in average industry values of the net profit ratio in the market of loans provision in 2016-2020.