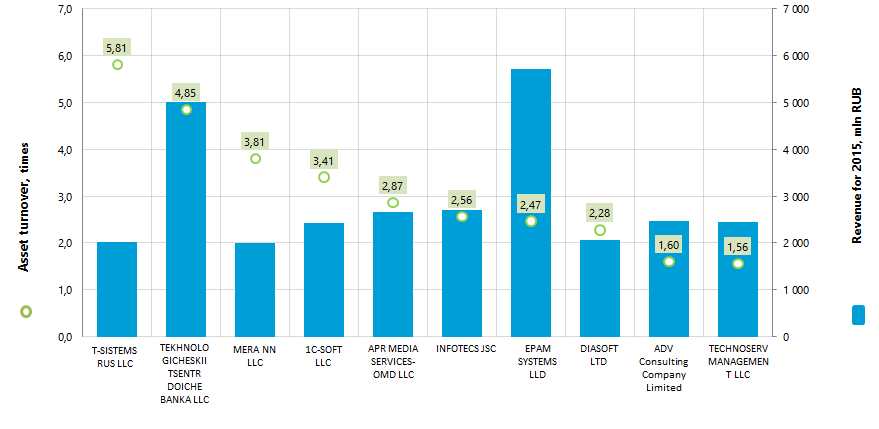

Asset turnover of the largest Russian enterprises – developers of computer software

Information agency Credinform prepared a ranking of the largest Russian enterprises – developers of computer software.

Russian enterprises – developers of computer software were selected according to the data from the Statistical Register for the latest available period - for 2015 (TOP-10) and then they were ranked by asset turnover (Table 1).

Asset turnover (times) is calculated as a relation of sales proceeds to the average value of company's total assets for a period and characterizes the efficiency of use by a company of all available resources, apart from sources of their attraction. The ratio shows how many times a year the full cycle of production and circulation completes, which brings the effect in the form of profit.

Asset turnover provides the most accurate assessment of the effectiveness of the operating activity of an enterprise. The duration of finding funds in the turnover of the enterprise is affected by a number of factors of internal and external nature.

The external factors include: business segment of a company, sector profile, size of an enterprise. The macroeconomic situation has a significant impact on the turnover of the company's assets. The breaking of existing ties with other organizations, inflation processes lead to the accumulation of stocks, which significantly slows the turnover of funds.

The factors of internal nature are: company’s pricing policy, structure of assets and method of evaluation of inventories.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all available combination of ratios, financial and other indicators.

| Name, INN, Region | Net profit for 2015, mnl RUB | Revenue for 2015, mnl RUB | Revenue for 2015 by 2014, % | Asset turnover, times | Solvency index Globas-i |

|---|---|---|---|---|---|

| T-SISTEMS RUS LLC INN 7708807718 Saint-Petersburg |

49,3 | 2 012,4 | 158 | 5,81 | 248 High |

| TEKHNOLOGICHESKII TSENTR DOICHE BANKA LLC INN 7714941430 Moscow |

225,0 | 5 013,3 | 736 | 4,85 | 233 High |

| MERA NN LLC INN 5257053317 Nizhny Novgorod region |

124,0 | 1 993,0 | 114 | 3,81 | 259 High |

| 1C-SOFT LLC INN 7730643014 Moscow |

391,6 | 2 427,1 | 780 | 3,41 | 211 High |

| APR MEDIA SERVICES-OMD LLC INN 7702768149 Moscow |

35,1 | 2 661,5 | 117 | 2,87 | 312 Satisfactory |

| INFOTECS JSC INN 7710013769 Moscow |

422,9 | 2 700,0 | 174 | 2,56 | 152 The highest |

| EPAM SYSTEMS LLD INN 7719232155 Moscow |

940,0 | 5 719,6 | 170 | 2,47 | 166 The highest |

| DIASOFT LTD INN 7715560268 Moscow |

56,6 | 2 055,6 | 89 | 2,28 | 226 High |

| ADV Consulting Company Limited INN 7706127570 Moscow |

549,9 | 2 465,7 | 108 | 1,60 | 191 The highest |

| TECHNOSERV MANAGEMENT LLC INN 7722536788 Moscow |

0,4 | 2 455,7 | 146 | 1,56 | 298 High |

The average value of the asset turnover ratio in the group of TOP-10 companies amounted to 3,12 in 2015. The same indicator in the group of TOP-100 companies made 2,80, by the industry average of 1,47.

Nine companies from the TOP-10 got the highest and high solvency index Globas-i, that indicates their ability to repay debt obligations in time and fully.

APR MEDIA SERVICES-OMD LLC got satisfactory solvency index Globas-i, due to the available information about its participation as a defendant in debt recovery proceedings.

The total revenue of the TOP-10 companies made 29,5 billion rubles in 2015, that is by 69% more than in 2014. The total net profit in this group of enterprises increased by 86%. At the same time MERA NN LLC, DIASOFT LTD and ADV Consulting Company Limited allowed a decrease in the value of net profit in 2015 compared with the previous period. DIASOFT LTD reduced also the size of revenue by 11%.

In the group of TOP-100 companies an increase in total revenue made 44% for the same period, in case of an increase in total net income by 45%.

All of TOP-10 companies, as well as enterprises of the industry as a whole, demonstrate positive values of asset turnover ratio.

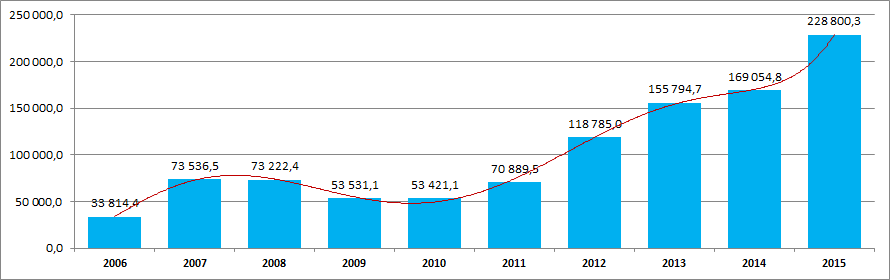

All of this points to a high enough efficiency of the work of the industry, that is confirmed also by the data of the Federal Service of State Statistics (Picture 2).

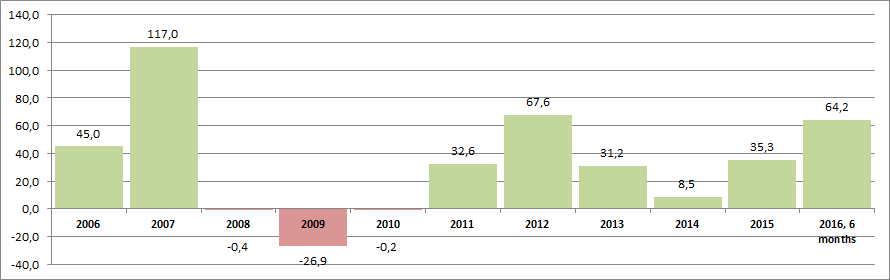

At the same time it is observed the dependence of the growth rates on the macroeconomic situation (Picture 3).

*) - data for 6 months 2016 are presented by the corresponding period of 2015

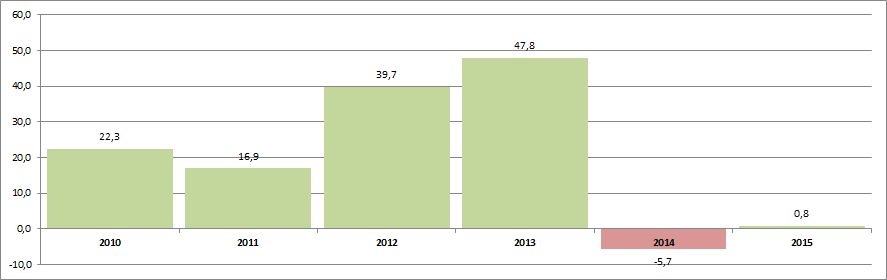

In addition, it may be noted also the prospectivity of this industry in terms of the availability of significant reserves for further growth. Thus, according to the same data from Rosstat, the common costs of Russian organizations on information and communication technologies, including capital and current technologies, costs for their development, acquisition, introduction and use rose by more than 2 times in 2015 compared to 2010 and amounted to 1 184 184 mln RUB. This trend to an increase of these costs is due to the scientific-technical progress and will remain probable for the next few years, even though the decline in growth rates in recent times (Picture 4).

Companies - developers of computer software tend to a large extend to the biggest industrial and financial centers of the country - Moscow and Saint-Petersburg. This is testified by the data of the Information and analytical system Globas-i, according to which 100 the largest developers of computer software in terms of revenue for 2015 are focused in 15 regions of Russia (TOP-7 regions):

| Region | Number of registered companies |

|---|---|

| Moscow | 65 |

| Saint-Petersburg | 13 |

| Republic of Tatarstan | 5 |

| Nizhny Novgorod region | 3 |

| Belgorod region | 2 |

| Moscow region | 2 |

| Novosibirsk region | 2 |

Thus, 78% of the largest companies in the industry are concentrated in Moscow and Saint-Petersburg.

Tax information exchange with other countries

On May 2016 The Federal Tax Service of the RF (FTS of the RF), participating in the Organization for Economic Co-operation and Development (OECD) forum on tax administration, signed multilateral agreement on the automatic standardized exchange of taxpayers information by tax authorities of different countries. According to the agreement, FTS of the RF will get information on Russian residents running a business abroad. The tax information exchange with tax authorities of other countries will start from 2018 based on data for 2017.

Realization of that agreement required entering of several statutory and regulatory provisions to the legislation of the RF. In particular, there will be new sections in the Tax Code: on presenting to the tax authorities of documentation on international groups of companies and оn international contracts implementation concerning taxation and mutual administrative support of taxation.

As a result, data collection vehicle for automatic exchange with other countries will be established by statutory and regulatory provisions. This information will be provided by Russian financial organizations and international groups of companies. Besides, providing information by the Tax Service of Russia as part of automatic exchange does not regarded as disclosure of tax secret.

According to the definition in the Tax Code, International group of companies (IGC) will be considered as a group of organizations or foreign structures without forming a legal entity, associated to each other through participation and control, and for that group consolidated financial statement is made. This group must consist of at least one organization that is a tax resident of the RF.

Participants of the group, that total revenue is more than 50 bln RUB, are obliged to present to the tax authorities a notification on participation in that group and country information. Besides, on demand of the tax authorities, global and national documentation should be provided during three months.

The notification should content name, basic state registration number and identification number of every participant of the group. IGC should present country data in the form of report and include the following information:

- total revenue for financial year broken down by transactions with subsidiaries and other parties;

- profit/loss before taxation for financial year;

- accumulated earnings to the end of financial year;

- accumulated profit tax and sum of paid profit tax;

- amount of the authorized capital and tangible assets;

- average number of employees.

The Tax Code will also content a section describing the vehicle for automatic exchange of financial information with foreign countries for tax purposes. As part of this procedure financial organizations will be obliged to present financial information on clients, beneficiaries and controlling bodies and entities to the tax authorities. For that purpose financial organizations should ask clients for related information.

In case of refusal of providing information, a bank have a right to terminate a contract unilaterally or, if this is a first contract, to reject its conclusion. Besides, the legislation prescribes administrative punishment in the form of penalties for the violation of providing information. Sum of penalties will vary from 50 th to 500 th RUB depending on violation.