VAT for providers of electronic services

In our publication from July 20, 2016 “Foreign sellers of the Internet content will pay VAT in Russia”we informed that since January 1, 2017 the Federal law as of July 3, 2016 №244-FL came into force. The law amended the procedure governing the taxation of foreign providers of electronic services. The article 174.2 “Special aspects of tax assessment and payment for foreign enterprises rendering of services in electronic format” was introduced into the Part Two of the Tax Code of the Russian Federation. The article defines rendering of electronic services as automatic services using information technologies via information and telecommunication networks, including Internet.

The Federal law as of November 27, 2017 №335-FL “On amendments to the Part One and Part Two of the Tax Code of the Russian Federation and certain legislative acts of the Russian Federation” established that since January 1, 2019, foreign providers of electronic services for legal entities and individual entrepreneurs in Russia are obliged to pay value added tax (VAT). In this regard, all foreign providers are required to register for tax purposes until February 15, 2019.

When violating these provisions, the company will be imposed with fine up to 10% of its profits (according to paragraph 2 of article 116 of the Tax Code). Moreover, VAT, penalty and fine from 20% to 40% of unpaid tax will be charged.

Large foreign companies have already registered with tax authorities. According to the Federal tax Service , over 200 foreign companies are recorded as VAT taxpayers. Comprehensive information on their economic activities is available by subscription to the Information and Analytical System Globas.

Reliance on borrowings in wood processing sector

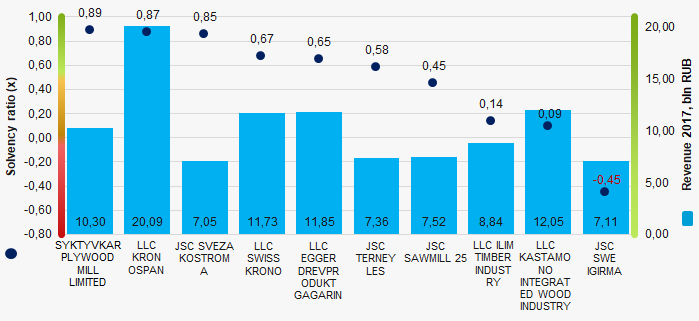

Information agency Credinform represents a ranking of the largest Russian wood processing factories. The enterprises with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (2015 – 2017). Then they were ranked by solvency ratio (Table 1). The analysis is based on the data of the Information and Analytical system Globas.

Solvency ratio (х) is calculated as the relation of the amount of equity capital to balance sum and indicates the reliance on external borrowins. The recommended value is >0,5.

The value below the minimum recommended limit indicates a heavy reliance on external sources of financing that may adversely impact liquidity and lead to an unstable financial situation of the company in case of worsening economic situation.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For wood processing factories, the practical value of the solvency ratio is from 0,01 to 0,94 in 2017.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, region, business scope | Revenue, bln RUB | Net profit (loss), bln RUB | Solvency ratio (x), >0,5 | Solvency index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| SYKTYVKAR PLYWOOD MILL LIMITED INN 1121009024 Republic of Komi Manufacture of plywood, wood veneered panels and similar laminated materials, wood-based panels of wood and other woody materials |

9,72 9,72 |

10,30 10,30 |

1,85 1,85 |

2,06 2,06 |

0,86 0,86 |

0,89 0,89 |

185 High |

| KRONOSPAN LLC INN 5011021227 Moscow region Manufacture of plywood, wood veneered panels and similar laminated materials, wood-based panels of wood and other woody materials |

19,98 19,98 |

20,09 20,09 |

2,95 2,95 |

1,59 1,59 |

0,80 0,80 |

0,87 0,87 |

205 Strong |

| JSC SVEZA KOSTROMA INN 4401006864 Kostroma region Manufacture of plywood, wood veneered panels and similar laminated materials, wood-based panels of wood and other woody materials |

7,48 7,48 |

7,05 7,05 |

1,31 1,31 |

1,06 1,06 |

0,88 0,88 |

0,85 0,85 |

213 Strong |

| LLC SWISS KRONO INN 4407006010 Kostroma region Manufacture of plywood, wood veneered panels and similar laminated materials, wood-based panels of wood and other woody materials |

12,76 12,76 |

11,73 11,73 |

2,31 2,31 |

1,18 1,18 |

0,62 0,62 |

0,67 0,67 |

192 High |

| EGGER DREVPRODUKT GAGARIN LLC INN 6723019741 Smolensk region Manufacture of plywood, wood veneered panels and similar laminated materials, wood-based panels of wood and other woody materials |

8,22 8,22 |

11,85 11,85 |

-1,05 -1,05 |

-3,01 -3,01 |

0,46 0,46 |

0,65 0,65 |

213 Strong |

| JSC TERNEYLES INN 2528000813 Primorye territory Production of veneer, plywood, wooden plates and panels |

8,16 8,16 |

7,36 7,36 |

1,81 1,81 |

0,91 0,91 |

0,46 0,46 |

0,58 0,58 |

180 High |

| JSC SAWMILL 25 INN 2928001265 Arkhangelsk region Production of lumber, except profiled, with a thickness of more than 6 mm; production of untreated wooden railroad and tram sleepers |

6,51 6,51 |

7,52 7,52 |

0,78 0,78 |

0,62 0,62 |

0,43 0,43 |

0,45 0,45 |

203 Strong |

| LLC ILIM TIMBER INDUSTRY INN 7838407799 Saint Petersburg Production of lumber, except profiled, with a thickness of more than 6 mm; production of untreated wooden railroad and tram sleepers |

6,61 6,61 |

8,84 8,84 |

0,38 0,38 |

0,22 0,22 |

0,12 0,12 |

0,14 0,14 |

244 Strong |

| KASTAMONU INTEGRATED WOOD INDUSTRY LLC INN 1646027030 Republic of Tatarstan Manufacture of wood products, suber, straw and materials for weaving |

9,37 9,37 |

12,05 12,05 |

6,10 6,10 |

-0,31 -0,31 |

0,11 0,11 |

0,09 0,09 |

302 Adequate |

| JSC SAWING AND WOODWORKING ENTERPRISE IGIRMA INN 3811113307 Irkutsk region Sawing and planing of wood In process of being wound up since 21.05.2018 |

6,36 6,36 |

7,11 7,11 |

1,47 1,47 |

-0,21 -0,21 |

-0,35 -0,35 |

-0,45 -0,45 |

600 Insufficient |

| Total for TOP-10 companies |  95,19 95,19 |

103,91 103,91 |

17,92 17,92 |

4,11 4,11 |

|||

| Average value for TOP-10 companies |  9,52 9,52 |

10,39 10,39 |

1,79 1,79 |

0,41 0,41 |

0,44 0,44 |

0,47 0,47 |

|

| Industry average value |  0,04 0,04 |

0,06 0,06 |

0,0044 0,0044 |

-0,0005 -0,0005 |

0,18 0,18 |

0,18 0,18 |

|

— growth of indicator to the previous period,

— growth of indicator to the previous period,  — decrease of indicator to the previous period.

— decrease of indicator to the previous period.

The average indicator of solvency ratio of TOP-10 companies is within the practical value, above the average and below the recommended one. In 2017, eight companies of TOP-10 increased their figures in comparison with the previous period.

Picture 1. Solvency ratio and revenue of the largest Russian wood processing factories (TOP-10)

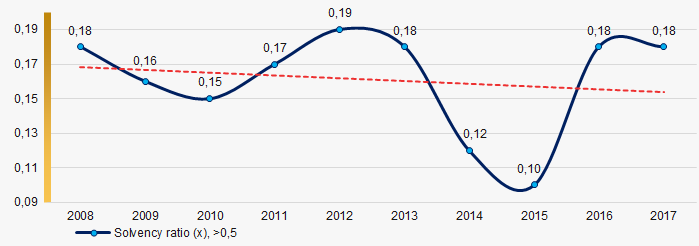

Picture 1. Solvency ratio and revenue of the largest Russian wood processing factories (TOP-10)Over the past 10 years, the industry average values of solvency ratio have a trend to decrease (Picture 2).

Picture 2. Change in the industry average values of solvency ratio of the largest Russian wood processing factories in 2008 – 2017

Picture 2. Change in the industry average values of solvency ratio of the largest Russian wood processing factories in 2008 – 2017