Credit protection of paper and cardboard manufacturers in Russia

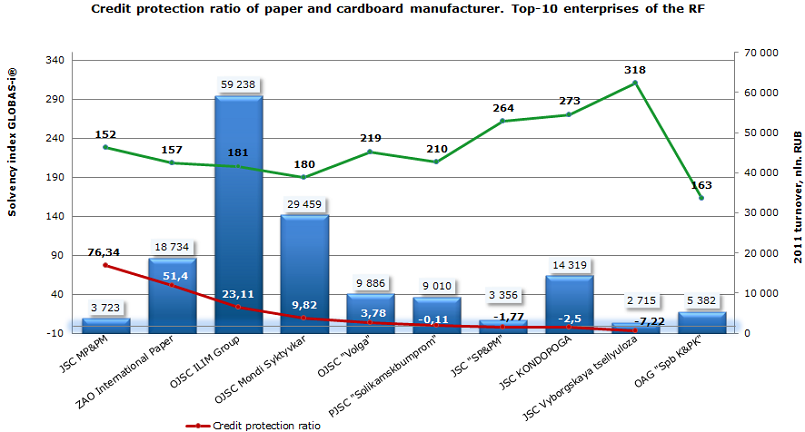

Information agency Credinform prepared the ranking for credit protection of paper and cardboard manufacturers in Russia. The ranking list includes industry’s 10 largest Russian companies with mentioned activity type and is based on revenue as stated in the Statistics register, with the reference period of 2011. The selected companies were ranked first in terms of turnover, and then at a rate of credit protection.

Credit protection index is rated as the ratio of earnings before tax and interest on loans to the amount of interest due. This financial indicator shows the possible reduce level of borrower’s operating profit, in which he is able to pay interests. The recommended ratio value is more than 1.

| № | Name, INN | Region | Turnover 2011, mln. RUB | Credit protection ratio, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | JSC Mariiskii Pulp and Paper Mill,INN 1216010765 | Mari El Republic | 3 723 | 76,34 | 152 (top) |

| 2 | ZAO International Paper,НН 4704012472 | Leningrad region | 18 734 | 51,4 | 157 (top) |

| 3 | Open Joint-Stock Company ILIM Group,ИНН 7840346335 | Saint-Petersburg | 59 238 | 23,11 | 181 (top) |

| 4 | Open Joint Stock Company Mondi Syktyvkar,ИНН 1121003135 | The Komi Republic | 29 459 | 9,82 | 180 (top) |

| 5 | Open Joint Stock Company "Volga",ИНН 5244009279 | The Nizhni Novgorod region | 9 886 | 3,78 | 219 (high) |

| 6 | Public Joint Stock Company "Solikamskbumprom",ИНН 5919470121 | The Perm Territory | 9 010 | -0,11 | 210 (high) |

| 7 | Joint Stock Company "Syassky Pulp and Paper Mill",ИНН 4718011856 | Leningrad region | 3 356 | -1,77 | 264 (high) |

| 8 | JOINT STOCK COMPANY KONDOPOGA,ИНН 1003000650 | The Republic of Karelia | 14 319 | -2,5 | 273 (high) |

| 9 | JSC Vyborgskaya tsellyuloza,ИНН 7825481883 | Leningrad region | 2 715 | -7,22 | 318 (medium) |

| 10 | Joint Stock Company "Saint-Petersburg Cardboard and polygraphic Plant",ИНН 4719003640 | Leningrad region | 5 382 | — | 163 (top) |

The first line of the ranking is JSC Mariiskii Pulp and Paper Mill with 76.34% loans protection, which is significantly higher than 1. This means that the company makes a sufficient flow of operating profit for the timely interest repayment. Positive result is confirmed by the top solvency index GLOBAS-i ®, which also characterizes the company as financially stable. Next in the ranking are ZAO International Paper and Open Joint-Stock Company ILIM Group with 51.4% and 23.11% ratio of loans protection respectively, which corresponds to the recommended values.

At the same time Open Joint-Stock Company ILIM Group has the highest sales figures in 2011. Both companies were also assigned the highest solvency index GLOBAS-i ®.

Four of top-10 companies in terms of revenue in 2011 have values of loans protection below the recommended figure. But despite the deviation from the recommended values, 3 companies (Public Joint Stock Company "Solikamskbumprom", Joint Stock Company "Syassky Pulp and Paper Mill" and JOINT STOCK COMPANY KONDOPOGA) were assigned a high solvency index GLOBAS-I ®. This shows the financial strength and uncritical deviation from the standard meaning. JSC Vyborgskaya tsellyuloza was given a satisfactory solvency index GLOBAS-i ®, due to the loss in a balance sheet figures, as well as variance of liquidity ratio and financial stability to the standard values. Credit protection ratio was not rated for Joint Stock Company "Saint-Petersburg Cardboard and polygraphic Plant ", as the company’s interest due was 0 in 2011.

In general, the critical value for the industry could be the level of credit protection ratio less than (-2.5). But it should be noted that integrated approach, including examining of liquidity and profitability ratios, should be used for an objective assessment of the company's solvency.

Saint-Petersburg housing market

According to the latest data for January-June 2013, the building complex of St. Petersburg introduced 947.5 thousand square meters of housing, which is 75% more than the same period last year with its 541.4 thousand square meters.

For this indicator, St. Petersburg takes a 7th place among all the subjects of the Russian Federation. More housing was built only in Moscow region - 2 266.1 thousand square meters, in Krasnodar Territory – 1 697 square meters, in the Republic of Tatarstan – 1 199.8 thousand square meters, in Moscow - 1 187.1 thousand square meters, in Tyumen region - 1 011.5 thousand square meters, in the Republic of Bashkortostan - 1 009.7 thousand square meters.

The increase in housing construction can be explained by the renewal of projects stalled during the recent economic crisis, the relative stability of the financial markets, and last but not least by the high demand for housing, which is fuelled by non-resident buyers, regarding St. Petersburg as an attractive place to live and work.

In January-June the average construction cost of total area was fixed at 47.3 thousand for 1 square meter, which is higher than in neighboring Leningrad region with its 41.8 thousand rubles and in more "rich" Moscow with 33.2 million rubles. According to this indicator St. Petersburg takes 10th place among all regions of the country. The average construction cost is higher only in remote northern regions - Chukotka, Yamal-Nenets Autonomous District, the Magadan region, etc.

High construction cost could be explained with the lack of free land resources within the city.

As for the acquisition average market price for 1 square meter, the situation is as follows: on primary housing market the price was 8 8017.7 rubles in July, having increased by 3.91% in January. The situation on secondary housing market is the following: 95 219.9 rubles with increase of 0.06%.

Secondary housing market prices have not reached the level of September 2008 yet, when they were to 109 thousand rubles per square meter. Primary market is very close to overcoming the historical peak in autumn 2008 with 91.6 thousand rubles per square meter.

Thus, there is a gradual adjustment of prices on the primary and secondary housing markets. In consumer qualities new housing surpasses objectively the old housing stock with panel large-scale houses, but in some cases it is inferior in transport accessibility.