Trends of buildings construction

Information Agency Credinform presents a review of activity trends of the largest buildings construction companies in Russia.

Construction companies with the largest annual revenue (TOP-10 and TOP-1000) have been selected for the analysis, according to the data from the Statistical Register for the latest available accounting periods (2015 — 2017). The analysis was based on the data from the Information and Analytical system Globas.

Net asset value indicates fair value of corporate assets and is calculated annually as assets on balance less company’s liabilities. Net asset value is negative (insufficiency of property) if liabilities are larger than the property value.

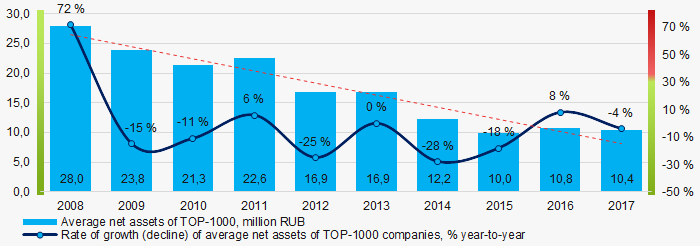

Average net assets of TOP-1000 companies tended to decrease during the last decade (Picture 1).

Picture 1. Change in average net assets of buildings construction companies in 2008 – 2017

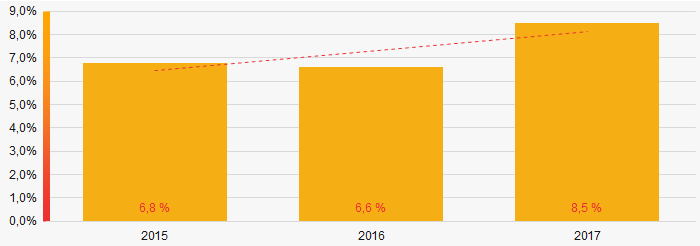

Picture 1. Change in average net assets of buildings construction companies in 2008 – 2017The share of TOP-1000 companies with insufficiency of property tends to increase within the last 3 years (Picture 2).

Picture 2. Share of TOP-1000 companies with negative value of net assets in 2015-2017

Picture 2. Share of TOP-1000 companies with negative value of net assets in 2015-2017Sales revenue

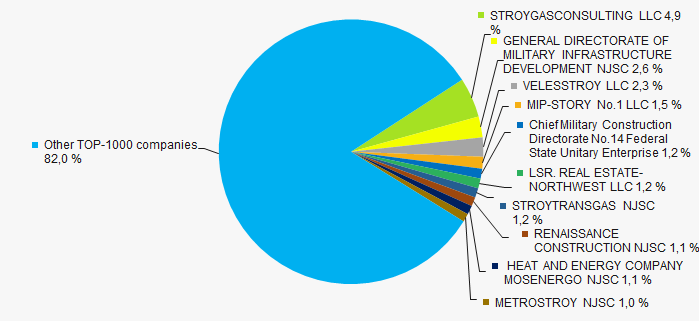

In 2017 sales revenue of 10 industry leaders amounted to 18% of total revenue of TOP-1000 companies (Picture 3). This is an indicator of a high level of competition within the industry.

Picture 3. TOP-10 companies by their share in 2017 total revenue of TOP-1000 companies

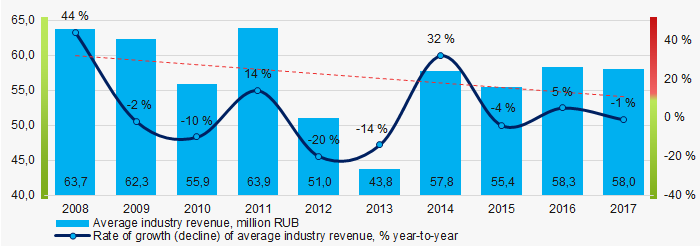

Picture 3. TOP-10 companies by their share in 2017 total revenue of TOP-1000 companiesIn general, average industry revenue tends to decrease during the decade (Picture 4).

Picture 4. Change of average industry revenue of TOP-1000 buildings construction companies in 2008 – 2017

Picture 4. Change of average industry revenue of TOP-1000 buildings construction companies in 2008 – 2017Profit and loss

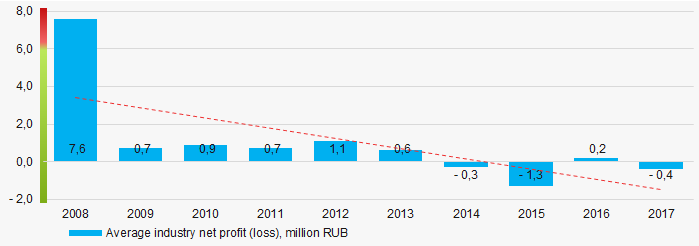

During the decade average industry net profit tended to decrease (Picture 5).

Picture 5. Change in average industry net profit of buildings construction companies in 2008 — 2017

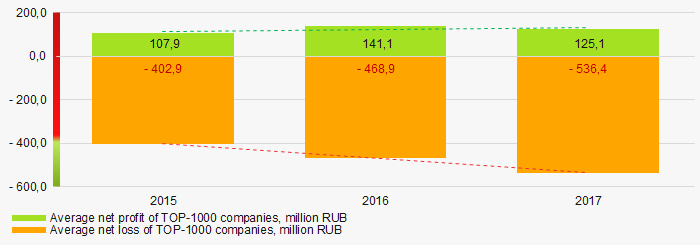

Picture 5. Change in average industry net profit of buildings construction companies in 2008 — 2017During the last 3 years average industry net profit of TOP-1000 companies increased, as well as average net loss (Picture 6).

Picture 6. Change in average net profit and loss of TOP-1000 companies in 2015 — 2017

Picture 6. Change in average net profit and loss of TOP-1000 companies in 2015 — 2017Key financial ratios

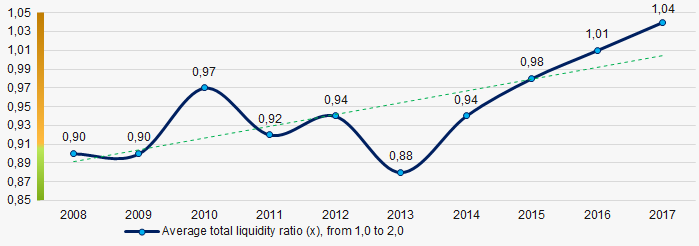

During the last decade average values of total liquidity ratio of TOP-1000 companies were below the recommended value — from 1,0 to 2,0, tending to increase (Picture 7).

Total liquidity ratio (a ratio of current assets to current liabilities) reveals the sufficiency of a company’s funds for meeting its short-term liabilities.

Picture 7. Change in average values of total liquidity ratio of TOP-1000 buildings construction companies in 2008 — 2017

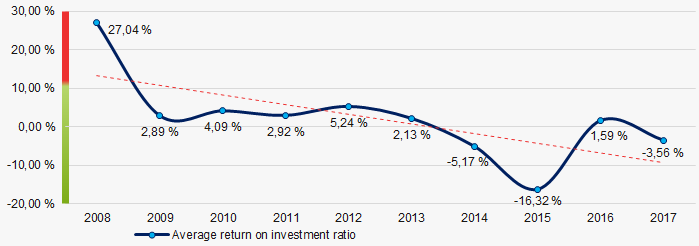

Picture 7. Change in average values of total liquidity ratio of TOP-1000 buildings construction companies in 2008 — 2017During the last decade, average industry values of return on investment ratio tended to decrease (Picture 8).

It is a ratio of net profit to total equity and noncurrent liabilities, and it demonstrates benefit from equity engaged in business activity and long-term raised funds of the company.

Picture 8. Change in average values of return on investment ratio of TOP-1000 buildings construction companies in 2008 — 2017

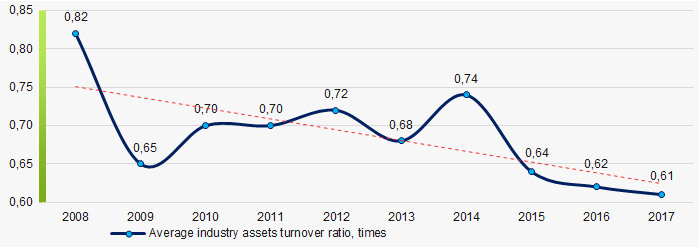

Picture 8. Change in average values of return on investment ratio of TOP-1000 buildings construction companies in 2008 — 2017Assets turnover ratio is a ratio of sales revenue to average total assets for the period, and it measures resource efficiency regardless of the sources. The ratio indicates the number of profit-bearing complete production and distribution cycles per annum.

During the last decade, this activity ratio tended to decrease (Picture 9).

Picture 9. Change in average values of assets turnover ratio of TOP-1000 buildings construction companies in 2008 — 2017

Picture 9. Change in average values of assets turnover ratio of TOP-1000 buildings construction companies in 2008 — 2017Small business

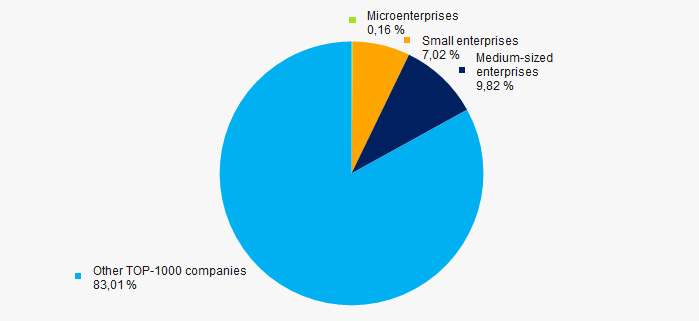

46% of TOP-1000 companies are included in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. In general, their share in total revenue of TOP-1000 in 2017 amounted to 17% that is lower than the average national value (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in TOP-1000 companies' revenue, %

Picture 10. Shares of small and medium-sized enterprises in TOP-1000 companies' revenue, %Key regions of activity

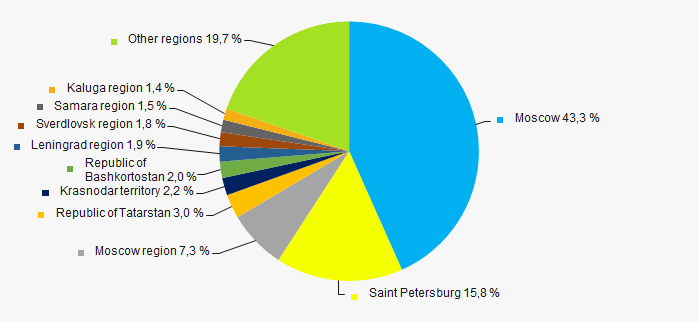

TOP-1000 companies are unevenly located throughout Russian territory and are registered in 76 regions. Over 66% of their revenue are concentrated in Moscow, St. Petersburg and the Moscow region (Picture 11).

Picture 11. Revenue of TOP-1000 companies by Russian regions

Picture 11. Revenue of TOP-1000 companies by Russian regionsFinancial position score

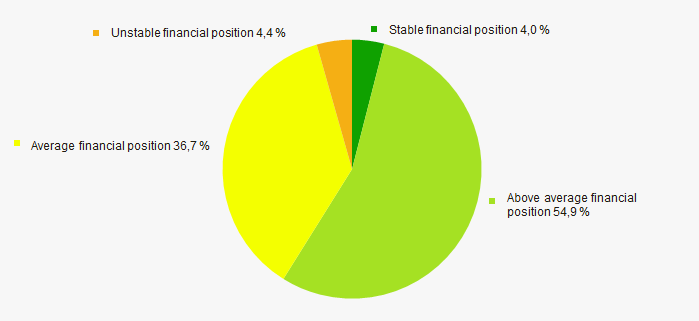

Assessment of financial state of TOP-1000 companies indicates that most of the companies have an above average financial position (Picture 12).

Picture 12. TOP-1000 companies by their financial position score

Picture 12. TOP-1000 companies by their financial position scoreSolvency index Globas

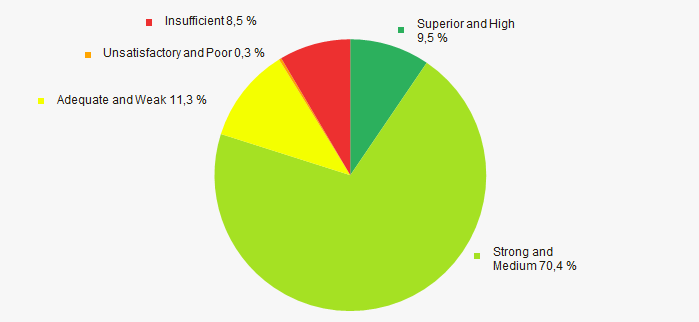

The majority of TOP-1000 companies have got a superior, high, strong or medium Solvency index Globas, that indicates their capability to meet liabilities timely and in full (Picture 13).

Picture 13. TOP-1000 companies by Solvency index Globas

Picture 13. TOP-1000 companies by Solvency index GlobasAccording to the Federal Statistics Service, the share of buildings construction companies in the national revenue from sale of goods and services in 2018 amounted to 1,67%.

Conclusion

A comprehensive assessment of the largest buildings construction companies in Russia, that considers key indexes, financial figures and ratios, is indicative of negative trends in the industry (Table 1).

| Trends and assessment factors | Relative share of the factor, % |

| Rate of growth (decline) of average industry net assets |  -10 -10 |

| Increase/ Decrease of share of companies with negative net assets |  -10 -10 |

| Rate of growth (decline) of average revenue |  -10 -10 |

| Level of competition/ monopolization |  10 10 |

| Rate of growth (decline) of average net profit (loss) |  -10 -10 |

| Increase/ Decrease of average net profit of TOP-1000 companies |  10 10 |

| Increase/ Decrease of average net loss of TOP-1000 companies |  -10 -10 |

| Increase/ Decrease of average total liquidity ratio |  5 5 |

| Increase/ Decrease of average return on investment ratio |  -10 -10 |

| Increase/ Decrease of average assets turnover ratio |  -10 -10 |

| Share of small and medium-sized business within the region by revenue over 22% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial standing (majority share) |  10 10 |

| Solvency index Glogas (majority share) |  10 10 |

| Average factors' value |  -2,7 -2,7 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

Own resources of construction companies

Information agency Credinform presents ranking of the largest companies engaged in construction of buildings. Enterprises with the largest volume of annual revenue (TOP-10), were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2015-2017). Then they were ranked by working capital to current assets ratio (Table 1).The analysis was made on the basis of the data of the Information and Analytical system Globas.

Working capital to current assets ratio (x) is calculated as diminution of equity and intangible assets to current assets. The indicator shows ability of a company to finance current activities with the help of own working capital. Recommended value is > 0,1.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Working capital to current assets ratio (x), > 0,1 | Solvency Index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| LLC LSR. Real Estate-SZ INN 7826090547 Saint-Petersburg |

33947,0 33947,0 |

37868,0 37868,0 |

6777,1 6777,1 |

8394,8 8394,8 |

0,12 0,12 |

0,14 0,14 |

199 High |

| JSC TEK MOSENERGO INN 7721604869 Moscow Bankruptcy claims |

24183,0 24183,0 |

34357,0 34357,0 |

783,1 783,1 |

920,9 920,9 |

-0,09 -0,09 |

0,07 0,07 |

400 Weak |

| JSC METROSTROY INN 7813046910 Saint-Petersburg Bankruptcy claims |

24449,4 24449,4 |

31919,7 31919,7 |

497,8 497,8 |

436,7 436,7 |

0,05 0,05 |

0,06 0,06 |

350 Adequate |

| LLC VELESSTROY INN 7709787790 Moscow |

88231,4 88231,4 |

73780,8 73780,8 |

2218,9 2218,9 |

1651,7 1651,7 |

0,05 0,05 |

0,05 0,05 |

209 Strong |

| JSC RENAISSANSE CONSTRUCTION INN 7814017341 Saint-Petersburg |

18124,2 18124,2 |

34862,3 34862,3 |

597,8 597,8 |

629,6 629,6 |

0,02 0,02 |

0,01 0,01 |

201 Strong |

| LLC MIP-STROI №1 INN 7701394860 Moscow |

28858,8 28858,8 |

46025,3 46025,3 |

284,5 284,5 |

424,7 424,7 |

-0,04 -0,04 |

-0,03 -0,03 |

296 Medium |

| JSC Armed forces infrastructure development directorate general INN 7703702341 Moscow Bankruptcy claims |

61923,8 61923,8 |

80570,3 80570,3 |

84,1 84,1 |

56,0 56,0 |

0,00 0,00 |

-0,05 -0,05 |

400 Weak |

| JSC STROYTRANSGAZ INN 5700000164 Moscow Bankruptcy claims |

25741,0 25741,0 |

36382,6 36382,6 |

643,1 643,1 |

717,6 717,6 |

-0,06 -0,06 |

-0,06 -0,06 |

189 High |

| LLC STROYGAZCONSULTING INN 7703266053 Saint-Petersburg Bankruptcy claims |

153019,2 153019,2 |

153789,1 153789,1 |

-6566,9 -6566,9 |

-7008,8 -7008,8 |

-0,05 -0,05 |

-0,13 -0,13 |

400 Weak |

| FGUP GVSU №14 INN 5047054473 Moscow Bankruptcy proceedings |

56977,7 56977,7 |

38089,7 38089,7 |

-905,7 -905,7 |

-4978,9 -4978,9 |

-0,05 -0,05 |

-0,22 -0,22 |

550 Insufficient |

| Total for TOP-10 |  515455,4 515455,4 |

567645,0 567645,0 |

4413,7 4413,7 |

1244,2 1244,2 |

|||

| Average for TOP-10 companies |  51545,5 51545,5 |

56764,5 56764,5 |

441,4 441,4 |

124,4 124,4 |

-0,01 -0,01 |

-0,02 -0,02 |

|

| Average industrial value |  58,36 58,36 |

58,0 58,0 |

0,2 0,2 |

-0,4 -0,4 |

-0,29 -0,29 |

-0,25 -0,25 |

|

— growth of indicator to the previous period,

— growth of indicator to the previous period,  — decrease of indicator to the previous period.

— decrease of indicator to the previous period.

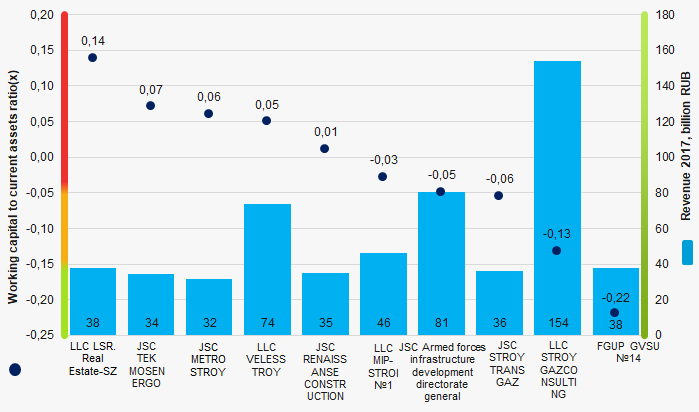

The average indicator of the working capital to current assets ratio of TOP-10 companies is characterized with negative value and above the average industrial value. Only one company of the group showed result above the recommended value in 2017.

Picture 1. Working capital to current assets ratio and revenue of the largest construction companies (TOP-10)

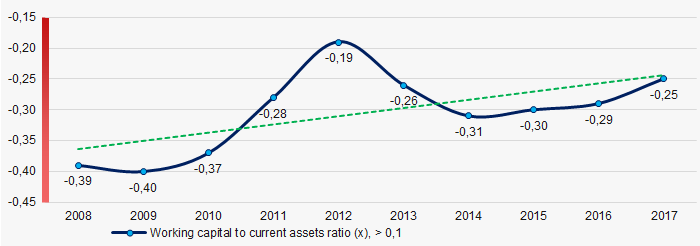

Picture 1. Working capital to current assets ratio and revenue of the largest construction companies (TOP-10) During 10 years average industrial indicators of the working capital to current assets ratio have negative values with increasing tendency. (Picture 2).

Picture 2. Change of average industrial indicators of the working capital to current assets ratio of the Russian construction companies in 2008 – 2017

Picture 2. Change of average industrial indicators of the working capital to current assets ratio of the Russian construction companies in 2008 – 2017