Changes in legislation

The new procedure for licensing of educational activity will be established from January 1st to December 31st, 2021 by the Decree of the Government of the Russian Federation as of 18.09.2020 No. 1490.

The licensed activity is the provision of educational services on implementation of educational programs.

The approved licensing authorities are:

- The Federal Service for Supervision in Education and Science (Rosobrnadzor) - in relation to:

- higher educational organizations,

- secondary vocational educational organizations in the following fields: defense, manufacture of products by the defense order, activities of law enforcement agencies and Russian guard forces, safety, nuclear energetics, transport and communication, science absorbing industry (the list is approved by the Government of the RF),

- organizations, situated outside the Russian Federation,

- organizations, established in accordance with the Russian international agreements,

- organizations, operating in the territory of diplomatic representatives and consular institutions of Russia,

- branches of foreign organizations.

- Executive government bodies of the constituent entities of the RF – in relation to:

- organizations, operating in the territory of the constituent entity of the Russian Federation, its branches in other constituent entities.

Educational organizations, operating in the territory of Skolkovo Innovation Сentre as well as innovation scientific and technological centers, may work without licenses, in accordance with the article 17 of the Federal law as of 28.09.2010 No. 244-FL and the article 21 of the Federal law as of 29.07.2017 No. 216-FL respectively.

The Provision, approved by the Decree of the Government, contains the licensed requirements for license applicants and licensees, the list of educational services, the documents and information necessary for the registration of a license.

A state fee is charged for the issuance or renewal of license.

The users of the Information and Analytical system Globas have access to all the available information (including archive data) about all educational organizations. Currently, there are almost 39 thousand active licenses for these types of activities.

Trends of builders of engineering constructions

Information agency Credinform presents a review of the activity trends of the largest builders of engineering constructions.

The largest enterprises (TOP-1000) in terms of annual revenue were selected for the analysis according to the data from the Statistical Register for the period of 2010 – 2019 years. The analysis was based on the data from the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company of the industry in term of net assets is JSC MOSTOTREST-SERVICE, INN 7701045732, Moscow. In 2019, net assets value of the company amounted to almost 24 billion RUB.

The lowest net assets value among TOP-1000 was recorded for Public company Sibmost, INN 5407127899, Novosibirsk region, the legal entity is declared insolvent (bankrupt) and bankruptcy proceedings are initiated, 22/05/2020.

In 2019, insufficiency of property of the company was indicated in negative value of -5 billion RUB.

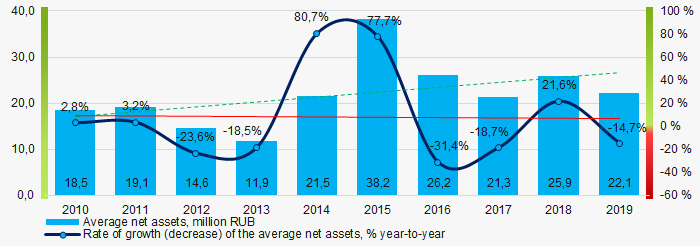

For the decade, the average net assets values of TOP-1000 had a trend to increase, with the decreasing growth rates (Picture 1).

Picture 1. Change in average net assets value in 2010 – 2019

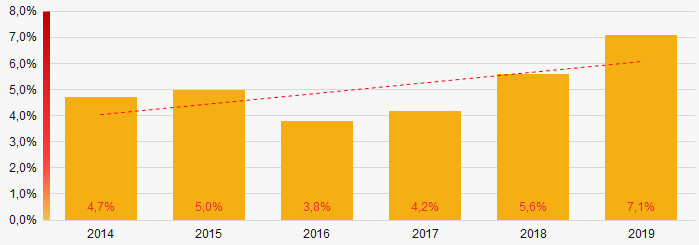

Picture 1. Change in average net assets value in 2010 – 2019The shares of TOP-1000 companies with insufficient property had a trend to increase in the past 6 years (Picture 2).

Picture 2. Shares of companies with negative net assets value in TOP-1000 in 2014 - 2019

Picture 2. Shares of companies with negative net assets value in TOP-1000 in 2014 - 2019Sales revenue

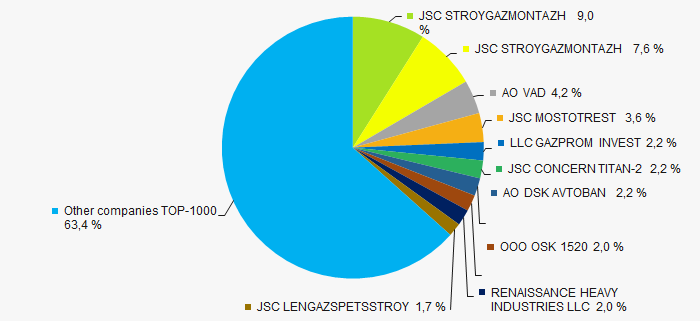

The revenue volume of the 10 leading industry companies amounted to 37% of the total revenue of TOP-1000 companies. (Picture 3). It gives evidence to the high level of monopolization in this industry.

Picture 3. Shares of TOP-10 companies in the total revenue of 2019 TOP-1000

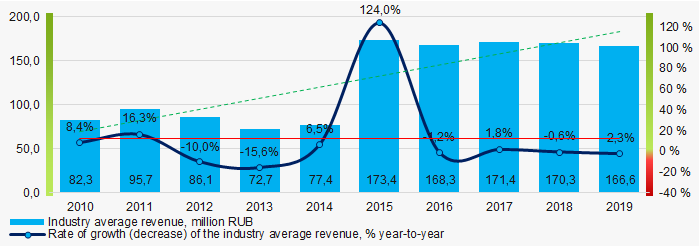

Picture 3. Shares of TOP-10 companies in the total revenue of 2019 TOP-1000 In general, there is a trend to increase in revenue with the negative dynamics of the growth rates (Picture 4.)

Picture 4. Changes in average industry revenue in 2010 - 2019

Picture 4. Changes in average industry revenue in 2010 - 2019Profit and loss

The largest industry company in term of net profit is AO VAD, INN 7802059185, Vologda region. The company’s profit amounted to almost 7 billion RUB in 2019.

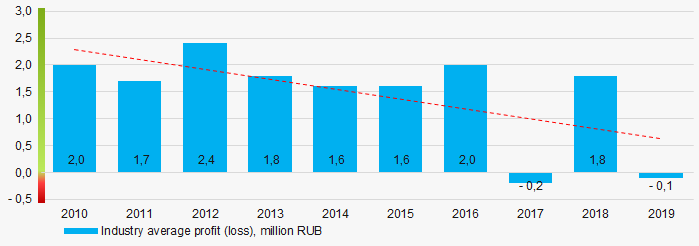

During the decade, the average profit figures of TOP-1000 companies had a trend to decrease (Picture 5).

Picture 5. Change in average profit (loss) in TOP-1000 in 2010- 2019

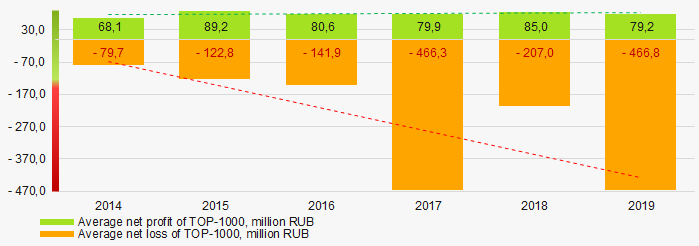

Picture 5. Change in average profit (loss) in TOP-1000 in 2010- 2019For a six-year period, the average net profit figures of TOP-1000 companies had a trend to increase with the increasing average net loss (Picture 6).

Picture 6. Change in average net profit and net loss of TOP-50 companies in 2014 - 2019

Picture 6. Change in average net profit and net loss of TOP-50 companies in 2014 - 2019Key financial ratios

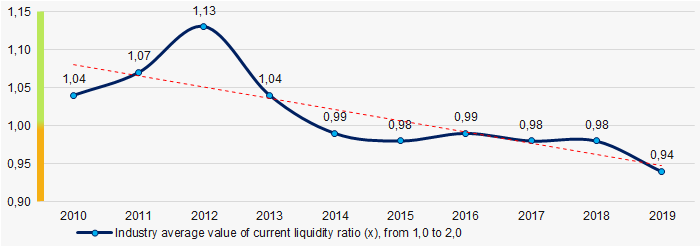

For the decade, the average values of the current liquidity ratio of TOP-1000 were between the recommended one – from 1,0 to 2,0, with a trend to decrease. (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in average industry values of current liquidity ratio in 2010 - 2019

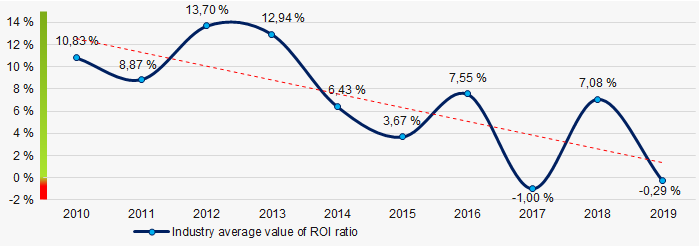

Picture 7. Change in average industry values of current liquidity ratio in 2010 - 2019For the decade, there was a general trend to decrease in the average ROI values (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average industry values of return on investments ratio in 2010 - 2019

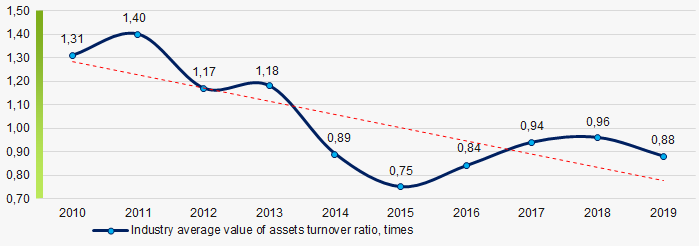

Picture 8. Change in average industry values of return on investments ratio in 2010 - 2019Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the decade, there was a trend to decrease (Picture 9).

Picture 9. Change in average industry values of assets turnover ratio in 2010 - 2019

Picture 9. Change in average industry values of assets turnover ratio in 2010 - 2019Small enterprises

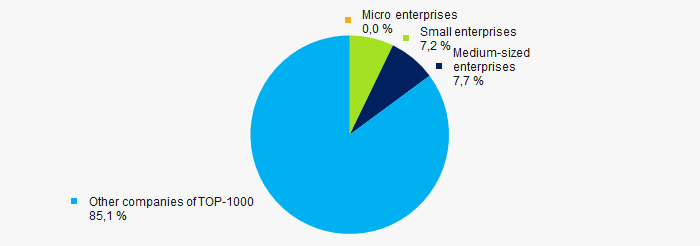

64% companies of TOP-1000 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. At the same time, their share in total revenue of TOP-1000 amounts to 15%, which is lower than the average country value in 2018 – 2019 (Picture 10).

Picture 10. Shares of small and medium business enterprises revenue in TOP-1000

Picture 10. Shares of small and medium business enterprises revenue in TOP-1000Main regions of activity

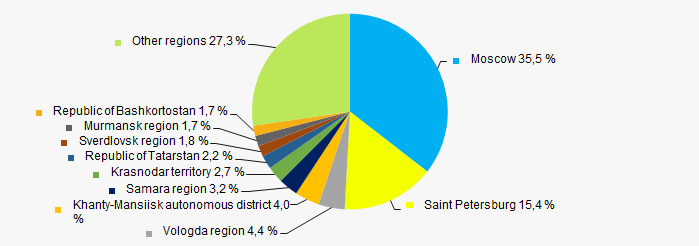

TOP-1000 companies are registered in 79 regions and spread in an uneven manner within the country. Almost 51% of the largest by the revenue companies consolidate in Moscow and St. Petersburg (Picture 11).

Picture 11. Revenue distribution of TOP-50 companies by regions in Russia

Picture 11. Revenue distribution of TOP-50 companies by regions in RussiaFinancial position score

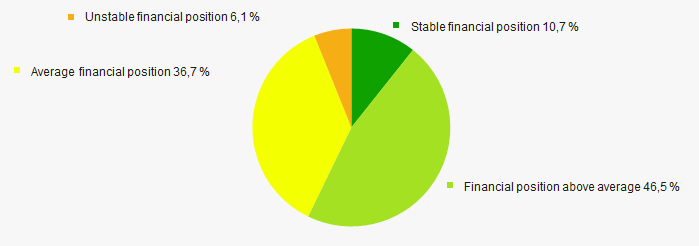

According to the assessment, the financial position of most TOP-1000 companies is above average (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

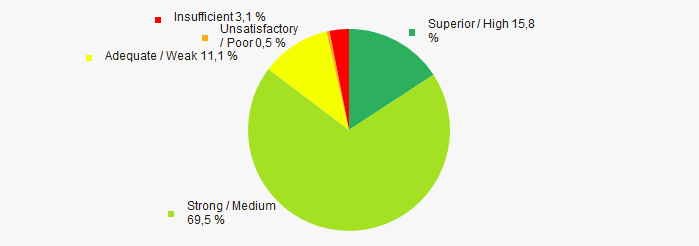

The major part of TOP-1000 companies got Superior / High and Strong / Medium index Globas. This fact shows their ability to meet their obligations fully and by the due date (Picture 12).

Picture 13. Distribution of TOP-1000 companies by Solvency index Globas

Picture 13. Distribution of TOP-1000 companies by Solvency index GlobasConclusion

The complex assessment of the activity of the largest builders of engineering constructions in Russia, taking into account the main indexes, financial indicators and ratios, demonstrates the prevalence of negative trends in 2010 - 2019 (Table 1).

| Trends and evaluation factors | Relative share of factor, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decline) in the average size of net assets |  -10 -10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  -10 -10 |

| Level of competition / monopolization |  -5 -5 |

| Dynamics of the average revenue |  10 10 |

| Rate of growth (decline) in the average size of revenue |  -10 -10 |

| Dynamics of the average profit (loss) |  -10 -10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Growth / decline in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of current liquidity ratio |  -5 -5 |

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in terms of revenue being more than 22% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  -3,1 -3,1 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).