Return on investment of enterprises manufacturing flour, grain and starch

Information agency Credinform prepared a ranking of flour milling companies and enterprises producing grain and starch.

The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by decrease in return on investment ratio.

Return on investment (%) is the ratio of company’s net profit (loss) to its net asset value. It shows how many monetary units were earned by each unit of net profit. It characterizes the effectiveness of use of resources by a company.

There are no recommended or specified values prescribed for the mentioned ratio, because it varies strongly depending on the branch, where each concrete organization conducts business, that is why the company should be assessed relying on industry-average indicator of the sector, as well as on indexes of other enterprises of the same industry. The higher is the ratio value, the more efficient are the investments. If the ratio is in negative zone, it points to that an enterprise has net loss in the period under review.

Agro-industrial complex represents an important unit of gross domestic product of Russia and joins in itself several branches of economy focused on manufacture and processing of agricultural raw materials and getting of products from it, reaching an ultimate consumer. Two main sectors of agro-industrial complex can be distinguished – crop growing and animal breeding and separate sector of food processing industry, as well as the sphere of production of agricultural and other related equipment and developments of chemical industry (fertilizers, pesticides). All mentioned spheres are closely related and bound together.

In 90th the economic slowdown didn’t keep away also from agrarians. The area of farming land was reduced, as well as production of basic crops, material and technical facilities got old, shelves of stores were full of imported, sometimes defective products.

Today the situation begins to change gradually for the better. Production, turnover, net profit of enterprises increase. What has, finally, an impact on substitution of import for domestic products. The branch becomes attractive for investments.

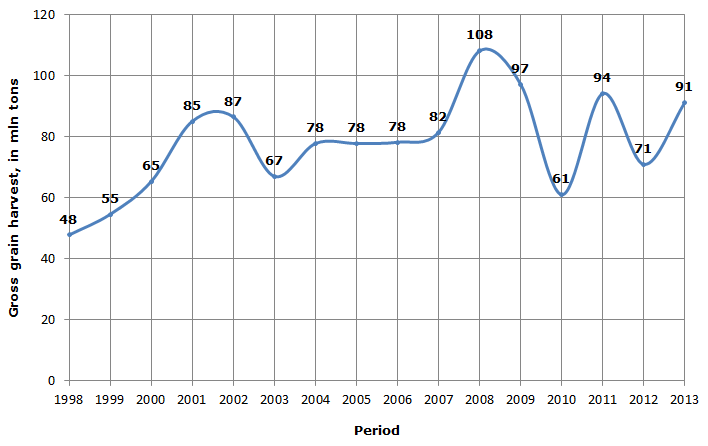

Picture 1. Gross grain harvest, in mln tons

For last years the gross grain harvest has a trend to gradual increase of storage volume. Certainly, the climatic factor can have a significant impact on the aging process of crops till up to the present, as it was in the period of heat wave of 2010 or moist summer of 2012, but, under otherwise equal conditions, if in 1998 agrarians succeeded to gather «only» 48 mln tons, then at year-end 2013 already 91 mln tons - the gain by 89,5%. Russia became again one of the largest exporters of crops on the world market, it supplied 23 mln tons in the previous year.

Flour-and-cereals industry, its investment attractiveness and competitive ability depend directly on quantity and quality of gathered grain.

| № | Name | Region | Turnover,in mln RUB, for 2012 | Turnover gain by the year 2011, % | Return on investments, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | Peterburgsky melnichny kombinat OJSC INN: 7810229592 |

Saint-Petersburg | 2 863,3 | 16,7 | 36,4 | 216 high |

| 2 | MAGNITOGORSKY KOMBINAT KHLEBOPRODUKTOV–SITNOCJSC INN: 7414001724 |

Chelabinsk region | 3 376,8 | 13,7 | 32,5 | 212 high |

| 3 | LENINGRADSKY KOMBINAT KHLEBOPRODUKTOV IM. S. M. KIROVA OJSC INN: 7830002303 |

Saint-Petersburg | 4 923,2 | -0,4 | 29,5 | 223 high |

| 4 | ResursLLC INN: 7440007056 |

Chelabinsk region | 2 781,8 | -13,0 | 27,9 | 220 high |

| 5 | KAZANZERNOPRODUKTOJSC INN: 1658001372 |

Republic of Tatarstan | 2 782,9 | -6,9 | 18,0 | 232 high |

| 6 | KOMBINAT KHLEBOPRODUKTOV STAROOSKOLSKY CJSC INN: 3128033189 |

Belgorod region | 4 038,5 | 14,6 | 10,9 | 246 high |

| 7 | MELKOMBINATOJSC INN: 6903001493 |

Tver region | 4 199,7 | 9,3 | 8,9 | 233 high |

| 8 | KARGILL LLC INN: 7113502396 |

Tula region | 18 559,7 | 9,6 | 8,5 | 245 high |

| 9 | ALEISKZERNOPRODUKT IMENI S.N.STAROVOITOVA CJSC INN: 2201000766 |

Altai territory | 5 131,7 | 4,9 | 5,9 | 211 high |

| 10 | MELNIKOJSC INN: 2209006093 |

Altai territory | 4 289,9 | 26,1 | 3,3 | 239 high |

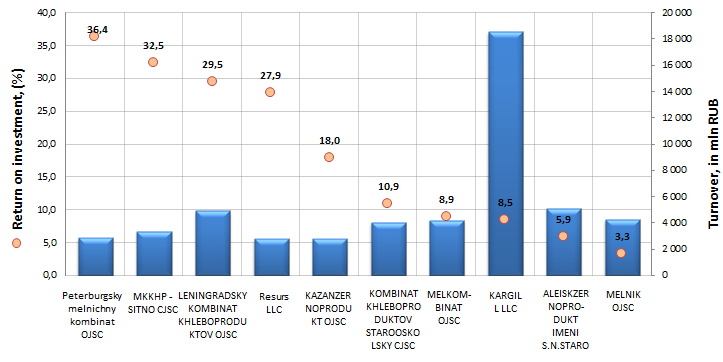

Picture 2. Return on investments, turnover of the largest enterprises manufacturing flour, grain and starch (TOP-10)

Turnover of the largest enterprises manufacturing flour, grain and starch (TOP-10) reached 52,9 bln RUB, went up by 7,8% per annum. The leaders accumulate up to 30% of sales revenue of all companies in the industry. The average return on investment of the TOP-10 list made 18,2%.

Following companies in the ranking showed the return on investment ratio above TOP-10 average: Peterburgsky melnichny kombinat OJSC (36,4%) and LENINGRADSKY KOMBINAT KHLEBOPRODUKTOV IM. S. M. KIROVA OJSC (29,5%) from Saint-Petersburg, as well as MAGNITOGORSKY KOMBINAT KHLEBOPRODUKTOV – SITNO CJSC (32,5%) and Resurs LLC (27,9%) from Chelyabinsk region. Now therefore, investors will receive more benefit from investments in these enterprises.

Peterburgsky melnichny kombinat OJSC and LENINGRADSKY KOMBINAT KHLEBOPRODUKTOV IM. S. M. KIROVA OJSC are the leaders of flour-and-cereals industry of the North-West of Russia. The production under TM «Aladushkin», «Yasno Solnyshko», «Muka Predportovaya», «Gornitsa» etc. takes up to 70% of the retail market of flour and more than 60% of the market of cereal crops of Saint-Petersburg and Leningrad region. Besides, the companies satisfy about 25% of demand of the market of productive consumption of flour in Saint-Petersburg and region.

MAGNITOGORSKY KOMBINAT KHLEBOPRODUKTOV – SITNO CJSC is the main supplier of bakery, creamy, flour and confectionary products in Magnitogorsk and outside it. The plant produces 180 names of bakery products and more than 200 names of pies, cakes, spice cakes, biscuits, muffins, tartlets, wafers, cracknels and dry bread crumbs.

Resurs LLC produces cereals, including boil-in-the-bags under TM «Uvelka», which have won popularity by consumers not only in the Urals, but also in the rest of Russia.

All enterprises from TOP-10 got a high solvency index GLOBAS-i®, what points to sound enough financial standing of the branch.

See also: Return on investment of oil and gas companies in Russia

Russia’s GDP: it seems to have its negative trend

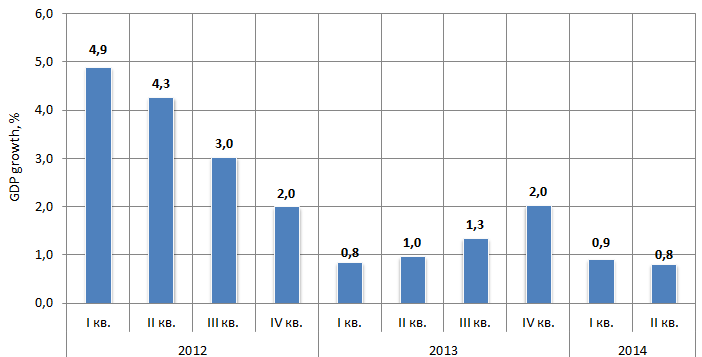

GDP growth in the 2nd quarter of 2014 amounted 0.8% that is worse than the expectation of the Ministry of Economic Development and Trade with its trend of 1.1%.

Positive beginning of the year when the Russian economy demonstrated its positive figures against the 1st quarter of the last year has changed with the worsening of major national measures. The high growth rate of the industrial production due to the manufacturing branches in the 1st half of the year did not subscribe the positive speedup trend.

Russian GDP growth by quarter against the relevant period of the last year, %

The negative reversal is occasioned with the related facts. The sufficiently measurable slowdown of the public consumption is being observed that is checked out with trend reduction of the retail turnover from 3.6% in the 1st quarter to 1.8 in the 2nd quarter. The heavy as ever geopolitical environment makes Marquee Investors flesh crawl and the sanctions against Russia restrict the abroad crediting to the range of the largest companies. The economic environment is getting worse.

The retaliation measures that Russia has taken for the import ban of the essential supplies from the countries of EC, USA, Canada, Australia and Norway can give a fillip to the national agricultural industry on a long-term horizon. However, the accelerating inflation that already exceeds all the guidelines of the Government for this year should be expected near the future. The key interest raise to 8% by the Central Bank will lead to the credit tightening as well as damping the low investment activity as it is.

All that is lacking is to hope for the early settlement of the conflict in Ukraine that is hurting not only the economy of Russia, but also other states, primarily the countries of EC.