World trade leaders

The world trade is currently undergoing a transformation: Russia, China, Turkey start to work out the plans to abandon the dollar in calculations among themselves; the U.S. trade sanctions are applied not only to Russia and a number of "unfriendly" states, but also to the closest allies; the duties war between USA and China risks to undermine the impressive dynamics of global cooperation.

According to 2017 results, international trade in goods and services amounted to USD 35.8 trn, 10.6% higher than in 2016.

China, USA and Germany are leaders by foreign trade turnover, controlling almost 30% of world trade. Meanwhile USA has the world's largest negative balance of trade (excess of imports over exports) – minus USD 862 bln (see Table 1). In this case, it becomes clear the U.S. attempts to correct the current disadvantaged position of the country. In this regard, the following point is remarkable: although Russia significantly lags behind the top three countries in terms of foreign trade turnover, it has the world's third-largest positive balance of trade: USD 116 bln, second only to China with USD 421 bln and Germany with USD 281 bln.

| № | Country | Foreign trade turnover, bln USD | Share in global trade,% | Export, bln USD | Share in world export, % | Import, bln USD | Share in world import, % | Balance of trade, bln USD |

| GLOBAL | 35754 | 100 | 17730 | 100 | 18024 | 100,0 | -294 | |

| 1 | China | 4105 | 11,5 | 2263 | 12,8 | 1842 | 10,2 | 421 |

| 2 | USA | 3956 | 11,1 | 1547 | 8,7 | 2409 | 13,4 | -862 |

| 3 | Germany | 2615 | 7,3 | 1448 | 8,2 | 1167 | 6,5 | 281 |

| 4 | Japan | 1370 | 3,8 | 698 | 3,9 | 672 | 3,7 | 26 |

| 5 | Netherlands | 1226 | 3,4 | 652 | 3,7 | 574 | 3,2 | 78 |

| 6 | France | 1160 | 3,2 | 535 | 3,0 | 625 | 3,5 | -90 |

| 7 | Hong Kong | 1140 | 3,2 | 550 | 3,1 | 590 | 3,3 | -40 |

| 8 | Great Britain | 1089 | 3,0 | 445 | 2,5 | 644 | 3,6 | -199 |

| 9 | Republic of Korea | 1052 | 2,9 | 574 | 3,2 | 478 | 2,7 | 96 |

| 10 | Italy | 959 | 2,7 | 506 | 2,9 | 453 | 2,5 | 53 |

| 11 | Canada | 863 | 2,4 | 421 | 2,4 | 442 | 2,5 | -21 |

| 12 | Mexico | 841 | 2,4 | 409 | 2,3 | 432 | 2,4 | -23 |

| 13 | Belgium | 833 | 2,3 | 430 | 2,4 | 403 | 2,2 | 27 |

| 14 | India | 745 | 2,1 | 298 | 1,7 | 447 | 2,5 | -149 |

| 15 | Singapore | 701 | 2,0 | 373 | 2,1 | 328 | 1,8 | 45 |

| 16 | Spain | 672 | 1,9 | 321 | 1,8 | 351 | 1,9 | -30 |

| 17 | UAE | 628 | 1,8 | 360 | 2,0 | 268 | 1,5 | 92 |

| 18 | Russia | 592 | 1,7 | 354 | 2,0 | 238 | 1,3 | 116 |

| 17 | Taiwan | 576 | 1,6 | 317 | 1,8 | 259 | 1,4 | 58 |

| 20 | Switzerland | 569 | 1,6 | 300 | 1,7 | 269 | 1,5 | 31 |

In 2017 the Russian foreign trade volume amounted to USD 592 bln or 1,7% of the global turnover. Thus, Russia takes the 18th place. USD 354 bln of the amount (2% of world export) were exported, USD 238 bln (1,3% of world import) were imported.

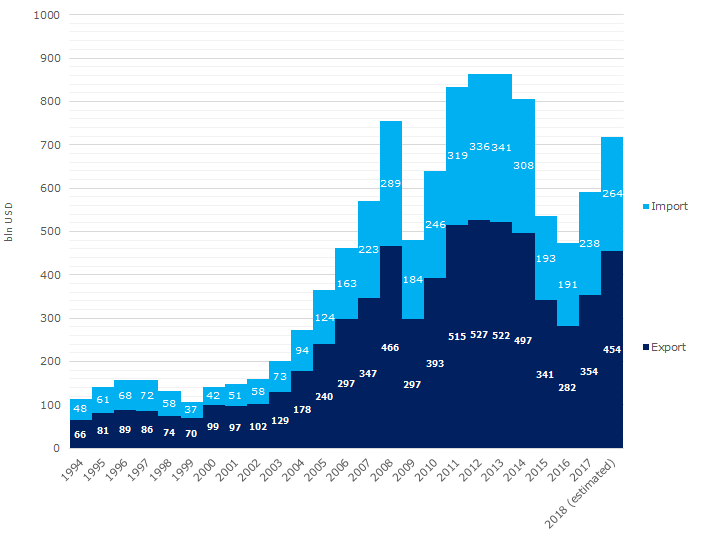

According to the latest data published by the Federal Customs Service, the positive growth dynamics of export and import is observed in January-July 2018 compared with the same period in 2017. In relative terms, this is 28.5% and 11%, respectively. By the end of 2018, upon the maintaining of momentum in the second half of the year (taking into account the devaluation of ruble, the dynamics may be slightly lower), the volume of foreign trade turnover will increase to USD 719 bln, including export – 454 bln, import – 264 bln, positive balance of trade - USD 190 bln (Picture 1).

Picture 1. Dynamics of Russian foreign trade, bln USD

Picture 1. Dynamics of Russian foreign trade, bln USD According to the data collected by the Central Bank of the Russian Federation, the top value of the Russian foreign trade was recorded in 2012 and 2013 – USD 863 bln. In contemporary landscape, this would put our country in the 11th place in the world. Under otherwise equal conditions, in case we extrapolate the current rate of trade development to 2019, we can expect USD 877 bln in the next year. This will exceed the previous historical record and bring Russia closer to the Top-10 leaders. In that way, the previously lost positions will be fully restored.

Check on engagement in terrorism

Entrepreneurs providing legal or accounting services are obliged by the Federal Financial Monitoring Service (Rosfinmonitoring) to check their clients on participation in shady financial transactions and terrorism.

Clarifications are given in the Information letter of the Rosfinmonitoring №54 from July 19, 2018.

According to the Federal law «On Combating Legalization (Laundering) of Proceeds from Crime and Financing of Terrorism» from August 7, 2001 №115-FL, in case of any suspicions on legalization of clients` income, it is necessary to identify them and inform the Rosfinmonitoring.

These requirements, in accordance with the Article 7.1 of the115-FL concern attorneys, notary officers and other legal persons, in case when they on behalf of their clients:

- make real estate transactions;

- operate monetary funds, securities or property, banking or security accounts;

- attract monetary funds of organizations for their foundation, operation or management;

- found organizations, carry out activities or manage them;

- make transactions of purchase and sale of organizations.

Clause 2 of the Article 7.1 of the115-FL explicitly refers to the obligation of persons providing legal and accounting services to inform the Rosfinmonitoring if they have any reason to suppose that their clients` transactions or financial operations are or may be carried out for legalization of income, received by criminal means or financing of terrorism.

Procedure for transmission of such data to the Rosfinmonitoring is defined by the Decision of the Government of the RF №82 from February 16, 2005.

Form of data representation, coding form, code list able for use, other peculiarities of data representation, information and telecommunication networks used for data transmission in electronic format are regulated by the Directive approved by the Order of the Rosfinmonitoring №10 from April 22, 2015.

According to the clause 2.8 of the Directive, representation of formalized electronic messages, containing transmitted data, is carried out only with the use of personal account on the official web-site of the Rosfinmonitoring.

Foregoing requirements are also applicable to registrars – to the full extent, and court-appointed managers – in cases when they provide other additional types of professional activities listed in the Federal Law №115.

Legal entities and individual entrepreneurs, providing legal and accounting services, are obliged to have internal check rules and a special executive, responsible for compliance with the rules. Competence requirements, training and teaching requirements for such executives are approved by the Decision of the Government №492 of the RF from May 29, 2014.

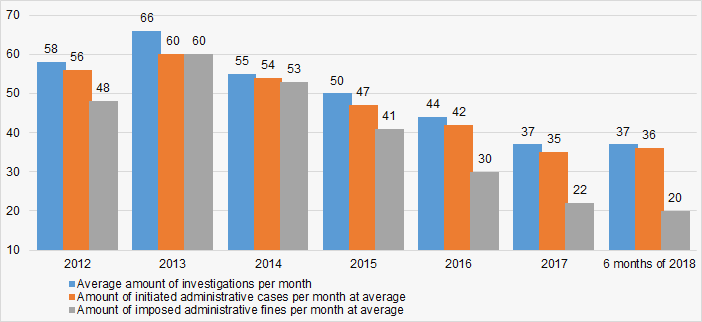

According to the data from the Federal State Statistics Service for the first half-year period of 2018, the Federal Financial Monitoring Service made 223 investigations regarding legal entities and individual entrepreneurs. In 2012 – 2015 almost every investigation ended with initiation of cases concerning administrative offences and (or) imposition of administrative fines. Over the last years, amount of revealed major violations is decreasing. (Picture 1).

Picture 1. . Investigations of the Rosfinmonitoring concerning legal entities and individual entrepreneurs in 2012 – 2018 (items)

Picture 1. . Investigations of the Rosfinmonitoring concerning legal entities and individual entrepreneurs in 2012 – 2018 (items)Link to «List of organizations and individuals known for their engagement in extremist activities or terrorism» can be found in the section «Useful links» of the Information and Analytical system Globas.