Activity trends of the largest Russian furniture manufacturing enterprises

Information agency Credinform represents an overview of activity trends of the largest Russian furniture manufacturing enterprises.

Furniture manufacturing enterprises with the largest volume of annual revenue (TOP-10 and TOP-1000) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2013 - 2017). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets are an indicator, reflecting the real value of company’s property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

| № | Name, INN, region, type of activity | Net assets value, mln RUB |

Solvency index Globas | ||||

| 2015 | 2016 | 2017 | |||||

| 1 | 2 | 3 | 4 | 5 | 6 | ||

| 1 | BYUROKRAT LLC INN 5048035314 Moscow region Furniture production for offices and trade enterprises |

0.8 | 1183.0 | 3042.6 | 205 Strong | ||

| 2 | BOROVICHI-MEBEL NJSC INN 5320017595 Novgorod region Furniture production for offices and trade enterprises |

2257.4 | 2530.2 | 2892.8 | 194 High | ||

| 3 | MEBELNAYA KOMPANIYA LEROM LLC INN 5834023068 Penza region Manufacture of other furniture |

2503.3 | 2755.6 | 2876.8 | 216 Strong | ||

| 4 | OPYTNYI ZAVOD MIKRON NJSC INN 6002005478 Pskov region Furniture production for offices and trade enterprises |

1670.1 | 2216.4 | 2839.5 | 177 High | ||

| 5 | INDUSTRIAL COMPANY ANGSTREM LLC INN 3662128110 Voronezh region Manufacture of other furniture |

1111.0 | 1449.8 | 1645.0 | 174 High | ||

| 996 | BRIGANTINA LLC INN 3908030661 Kaliningrad region Furniture production for offices and trade enterprises |

-78.1 | -74.3 | -74.1 | 320 Adequate | ||

| 997 | TEKHSERVIS LLC INN 5016013734 Moscow region Furniture manufacture |

-96.9 | -94.8 | -101.2 | 245 Strong | ||

| 998 | FOREMA-KUKHNI NJSC INN 7720123922 Moscow region Furniture production for offices and trade enterprises Process of being wound up, from 10.12.2015 |

-44.0 | -44.6 | -138.0 | 600 Unsufficient | ||

| 999 | APSHERONSKII LES NJSC INN 2325022191 Krasnodar territory Furniture manufacture Bankruptcy claim was filed against the company |

-111.2 | -183.6 | -258.8 | 400 Weak | ||

| 1000 | NOVO MEBEL NJSC INN 7114020170 Tula region Furniture manufacture |

-702.1 | -641.8 | -844.6 | 329 Adequate | ||

— increase in the indicator to the previous period, — decrease in the indicator to the previous period.

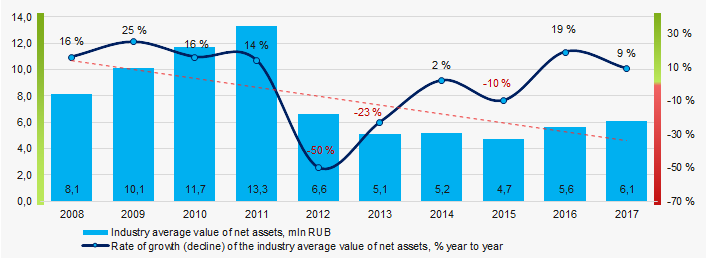

The average values of net assets of TOP-1000 enterprises tend to decrease over the ten-year period (Picture 1).

Picture 1. Change in the industry average indicators of the net asset value of furniture manufacturing enterprises in 2008 – 2017

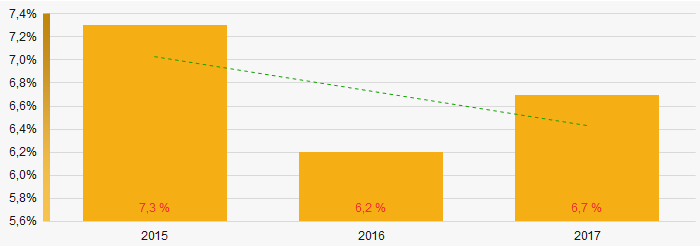

Picture 1. Change in the industry average indicators of the net asset value of furniture manufacturing enterprises in 2008 – 2017The share of enterprises with insufficiency of assets is declining in the last three years (Picture 2).

Picture 2. Share of enterprises with negative values of net assets in TOP-1000

Picture 2. Share of enterprises with negative values of net assets in TOP-1000Sales revenue

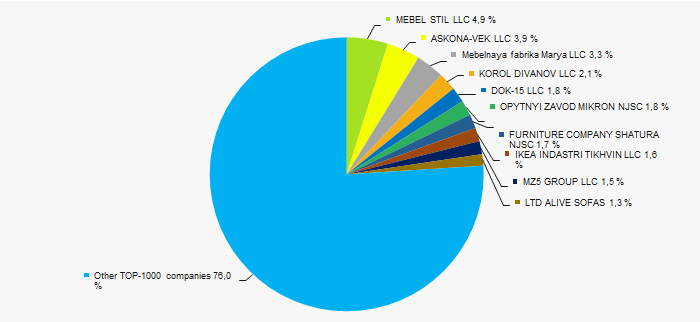

The revenue volume of 10 industry leaders made 24% of the total revenue of TOP-1000 companies in 2017. (Picture 3). It points to a high level of competition in the industry.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2017

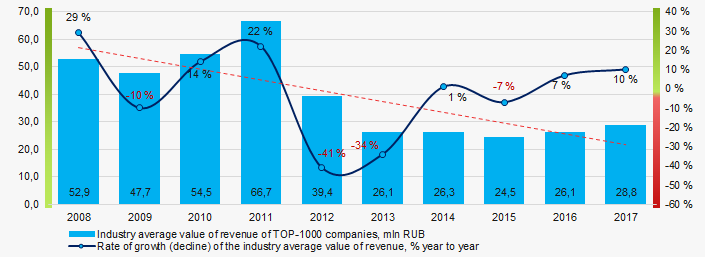

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2017In general, there is a trend towards a decrease in revenue volume over the ten-year period (Picture 4).

Picture 4. Change in the industry average revenue of furniture manufacturing enterprises in 2008 – 2017

Picture 4. Change in the industry average revenue of furniture manufacturing enterprises in 2008 – 2017Profit and losses

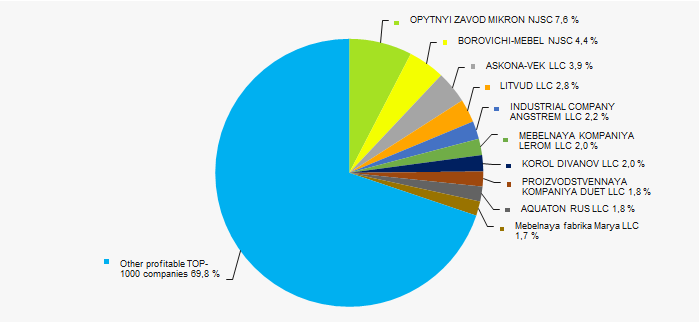

The profit volume of 10 industry leaders made 30% of the total profit of TOP-1000 companies in 2017 (Picture 5).

Picture 5. Shares of participation of TOP-10 companies in the total volume of profit of TOP-1000 enterprises for 2017

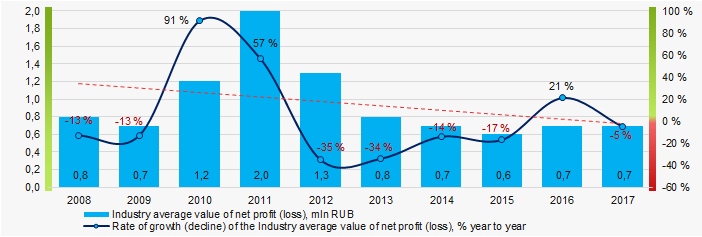

Picture 5. Shares of participation of TOP-10 companies in the total volume of profit of TOP-1000 enterprises for 2017Industry average values of net profit’s indicators period trend to decrease over the ten-year (Picture 6).

Picture 6. Change in the industry average values of net profit of furniture manufacturing enterprises in 2008 – 2017

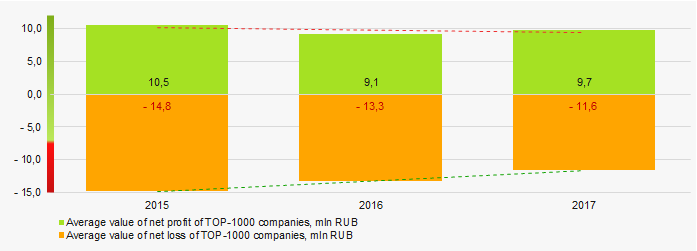

Picture 6. Change in the industry average values of net profit of furniture manufacturing enterprises in 2008 – 2017Industry average values of net profit’s indicators of TOP-1000 companies tend to decrease for the three-year period, while the average value of net loss also decreases (Picture 7).

Picture 7. Change in the average values of indicators of profit and loss of TOP-1000 companies in 2015 – 2017

Picture 7. Change in the average values of indicators of profit and loss of TOP-1000 companies in 2015 – 2017Key financial ratios

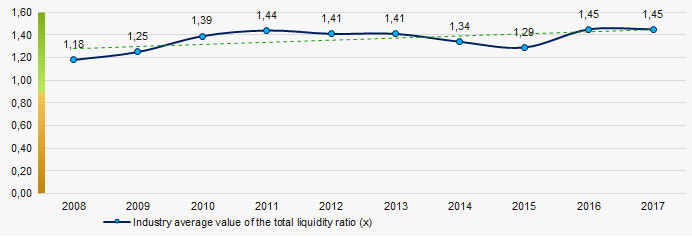

Picture 8. Change in the industry average values of the total liquidity ratio of furniture manufacturing enterprises in 2008 – 2017

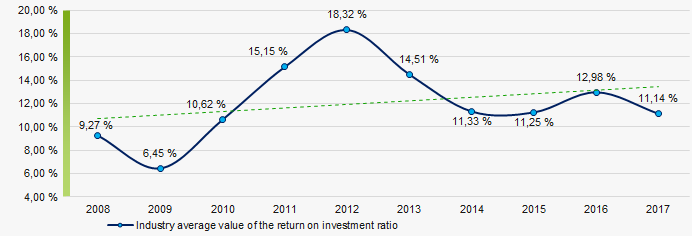

Picture 8. Change in the industry average values of the total liquidity ratio of furniture manufacturing enterprises in 2008 – 2017There has been a trend towards an increase in the industry average values of the return on investment ratio for ten years (Picture 9). The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity of own capital and the long-term borrowed funds of an organization.

Picture 9. Change in the industry average values of the return on investment ratio of furniture manufacturing enterprises in 2008 – 2017

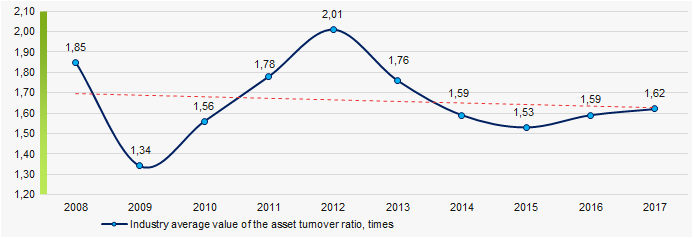

Picture 9. Change in the industry average values of the return on investment ratio of furniture manufacturing enterprises in 2008 – 2017Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit. This ratio of business activity showed a tendency to decrease over the ten-year period (Picture 10).

Picture 10. Change in the industry average values of the asset turnover ratio of furniture manufacturing enterprises in 2008 – 2017

Picture 10. Change in the industry average values of the asset turnover ratio of furniture manufacturing enterprises in 2008 – 2017Production structure

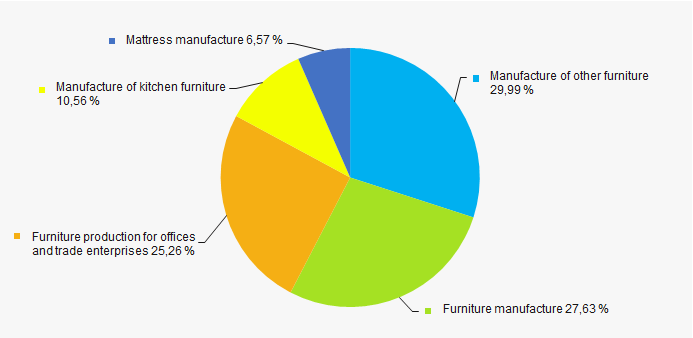

The largest share in the total revenue of TOP-1000 is owned by companies, specializing in manufacture of other furniture, i.e. sofas, sofa beds and sofa sets; garden chairs and seats; furniture for bedrooms, living rooms, gardens; casings for sewing machines, TVs etc. (Picture 11).

Picture 11. Distribution of types of output in the total revenue of TOP-1000 companies, %

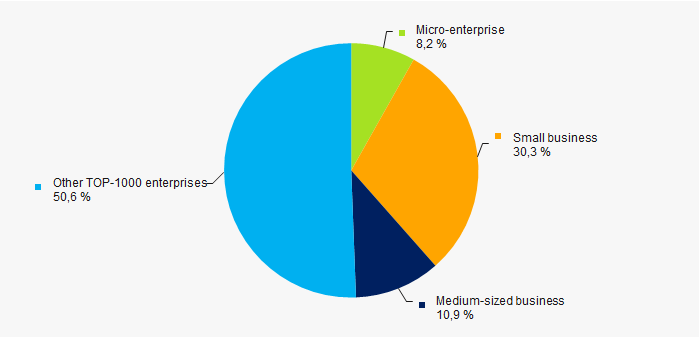

Picture 11. Distribution of types of output in the total revenue of TOP-1000 companies, %92% of TOP-1000 companies are registered in the Register of small and medium-sized businesses of the Federal Tax Service of the RF. At the same time, their share in the total revenue of TOP-1000 enterprises amounted to 49% in 2017 (Picture 12).

Picture 12. Shares of proceeds of small and medium-sized businesses in TOP-1000 companies, %

Picture 12. Shares of proceeds of small and medium-sized businesses in TOP-1000 companies, %Main regions of activity

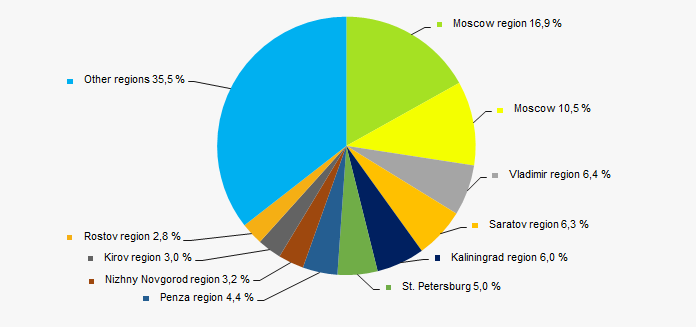

The TOP-1000 companies are distributed unequal on the Russian territory and registered in 70 regions. The largest enterprises in terms of revenue volume are concentrated in Moscow region and Moscow (Picture 13).

Picture 13. Distribution of the revenue of TOP-1000 companies by regions of Russia

Picture 13. Distribution of the revenue of TOP-1000 companies by regions of RussiaFinancial position score

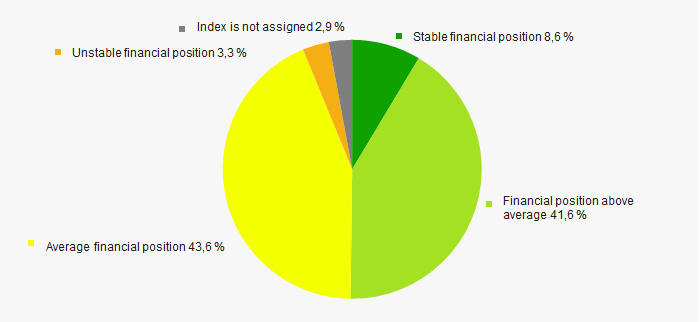

An assessment of the financial position of TOP-1000 companies shows that almost half of them are in a stable financial position and above the average (Picture 14).

Picture 14. Distribution of TOP-1000 companies by financial position score

Picture 14. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

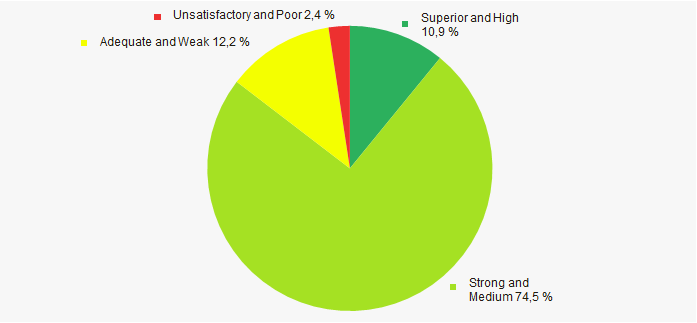

Most of TOP-1000 companies got Superior/High or Strong Solvency index Globas, that points to their ability to pay off their debts in time and fully (Picture 15).

Picture 15. Distribution of TOP-1000 companies by solvency index Globas

Picture 15. Distribution of TOP-1000 companies by solvency index GlobasConclusion

A comprehensive assessment of activity of the largest Russian furniture manufacturing enterprises, taking into account the main indices, financial indicators and ratios, points to favorable trends. However, negative and alarming factors are: decrease in industry average indicators of net assets, revenue, net profit and industry average values of the asset turnover ratio.

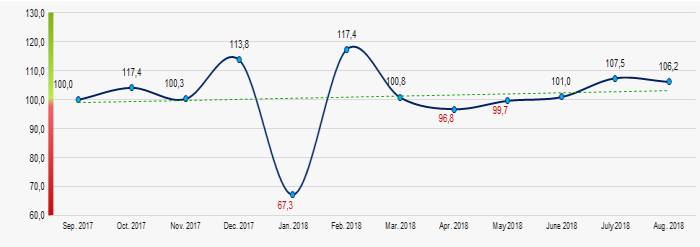

According to the Federal Service of State Statistics (Rosstat), the tendency to some increase in the values of industrial production indices of furniture manufacture is observed in 2017 – 2018, as a whole (Picture 16). For the period from September 2017 to August 2018, industrial production index of furniture manufacture grew by an average of 1,3%, however an average decline in the index by 0,4% is observed over 8 months of 2018.

Picture 16. Industrial production index of furniture manufacture in 2017 - 2018, month to month (%)

Picture 16. Industrial production index of furniture manufacture in 2017 - 2018, month to month (%)Signs of shell companies

The Letter of the Federal Tax Service of Russia (hereinafter “the FTS”) #ED-4-15/13247 from July 10, 2018 “On preventive control of tax legislation” contains updated criteria of identification of legal entities and individual entrepreneurs acting as shell.

While tax statements checking, it will be made a point of signs of reasonable suspicion of taxpayers in the absence of real activity or signing documents by unauthorized or unidentified persons.

According to the FTS Letter, these signs are:

- submission of corrective tax statements with false order number;

- avoidance of legal entities’ executives and individual entrepreneurs of presence in questioning more than twice;

- residing of executives or individual entrepreneurs not at the place of registration;

- absence of legal entities at the place of registration;

- representation of taxpayers’ interest by trustees registered or resided in another subject of Russia;

- organizations established or registered after 2017;

- submission of zero accounting for several reporting periods;

- income amount recorded in the tax statement is close to amount of expenses;

- share of VAT offset is over 98%;

- absence of lease agreements for occupied premises;

- average number of employees - 1 employee;

- lack of employees;

- lack of income of executives, including from companies they manage;

- change of places of tax registration;

- replacement of management with the introduction of relevant information shortly before reporting;

- absence of current accounts within 3 months from the date of establishment or registration;

- presence of closed current accounts;

- opening or closing more than 10 current accounts;

- transit of funds through current accounts;

- presence of bank accounts not at the place of registration;

- proved facts of cash withdrawals;

- not resolved discrepancies with previous reporting periods;

- presence of unreliable data on the address, executive, shareholder of company in the Unified State Register of Legal Entities (EGRUL);

- executives or shareholders are non-residents of Russia.

When there is a complex of the above signs, tax statements may be considered unreliable. In this case, the withdrawal of tax statements is possible upon observance of legal procedures prescribed by law.

It should be noted that the above list of grounds for the cancellation of tax statements is open for replenishment and other criteria.

Provisions of this letter cannot be applied to tax statements with ended period of the office audits.