Tax secrecy regime changes

The State Duma has passed the Federal Law of 01.05.2016 № 134-FL «On amendments to the article 102 of the Part One of the Tax Code of the RF», allowing the possibility for companies to withdraw from the tax secrecy regime.

The legal meaning of the tax secrecy regime lies in protection of the rights and legal interests of taxpayers concerning the information that the tax authorities hold. The information containing the tax secret, unlike all other types of secrets, can be obtained by the tax authorities only in the exercise of their powers. According to the Article 102 Part I of the Tax Code of the RF, the tax secret is any information about the taxpayer obtained by the tax, law enforcement, investigative, customs or the State non-budgetary funds authorities.

Before enactment of the amendments, as an exception to the general rule, the following information did not contain the tax secret:

- if the information became public with the approval of the taxpayer;

- identification number of the taxpayer;

- violations of the tax registration and sanctions;

- special tax regimes used by the taxpayers and participation in the consolidated taxpayer group;

- provided to the tax, customs or law enforcement authorities of other countries according to the international treaties or agreements;

- sent to the election commissions according to the election legislation;

- provided to the State information system about state and municipal payments;

- provided to the local self-governing authorities for implementation of control on completeness and reliability of information for local taxes calculation and on amount of tax in default.

According to the amendments, the tax secrecy regime can be withdrawn by agreement of the taxpayer at his choice, either regarding all the information provided to the tax authorities or some pieces of information. The tax secrecy regime does not concern the information date the year previous to the year of publication the information on the Internet. The list of information that does not concern the tax secret is completed with the data of the average number of employees; paid amount of taxes and dues excepted for the data of payments in case of goods entry to the customs area of the EEU or as tax agent; on amounts of incomes and costs according to the financial accounts.

The information that does not concern tax secret will be placed on the official web-site of the Federal Tax Service of the RF and will not be shown on demand except for the cases provided by the federal laws.

The law is published on the official web-portal of legal information on May 1, 2016 and comes into force on the expiry of one month from this date.

According to the experts` opinion, the taken amendments can be regarded as measures intended to improve the visibility of the companies` activity and running business in general, that in the future can have the beneficial impact on the investment attractiveness of the state economy.

Debt to assets ratio of the largest construction companies of Russia

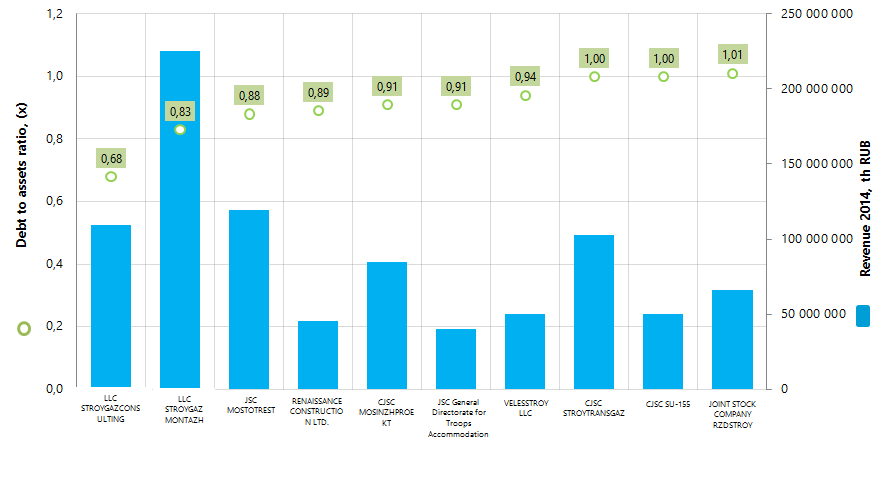

Information agency Credinform prepared a ranking of leading construction companies of Russia.

Companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2014). The enterprises were ranked by debt to assets ratio (Top-10).

Debt to assets ratio (x) is calculated as a ratio of long-term and short-term borrowings to the amount of the balance and indicates the proportion of the company's assets funded by loans.

Recommended value is from 0,2 to 0,5. Exceeding the upper normative value indicates the excessive debt load, which can stimulate the development but has a negative impact on corporate finance stability. The value below normative shows conservative strategy of financial management and excessive caution in attracting the new borrowings.

For the most comprehensive and objective view on the company’s financial situation, it is necessary to pay attention not only to the average indicators in the industry, but to the totality of financial indicators and ratios.

| N п/п | Name, INN, region | Net profit 2014, th RUB | Revenue 2014, th RUB | Revenue in 2014 to 2013, % | Debt to assets ratio, (х) | Solvency index Globas-i® |

|---|---|---|---|---|---|---|

| 1. | LIMITED LIABILITY COMPANY STROYGAZCONSULTING INN 7703266053 Moscow |

-5 060 351 | 109 180 295 | 54 | 0,68 | 550 Unsatisfactory |

| 2. | LIMITED LIABILITY COMPANY STROYGAZMONTAZH INN 7729588440 Moscow |

15 210 453 | 224 986 345 | 99 | 0,83 | 246 High |

| 3. | Joint stock Company MOSTOTREST INN 7701045732 Moscow |

4 416 369 | 119 168 335 | 144 | 0,88 | 206 High |

| 4. | RENAISSANCE CONSTRUCTION LTD. INN 7708185129 Moscow |

1 653 126 | 45 640 503 | 142 | 0,89 | 214 High |

| 5. | Closed Joint stock Company MOSINZHPROEKT INN 7701885820 Moscow |

1 911 964 | 84 444 273 | 102 | 0,91 | 196 The highest |

| 6. | JSC General Directorate for Troops Accommodation INN 7703702341 Moscow |

80 038 | 40 199 606 | 64 | 0,91 | 263 High |

| 7. | VELESSTROY LLC INN 7709787790 Moscow |

1 394 452 | 50 335 012 | 151 | 0,94 | 236 High |

| 8. | CLOSED JOINED STOCK COMPANY STROYTRANSGAZ INN 7714572888 Moscow |

3 876 677 | 102 678 119 | 178 | 1,00 | 229 High |

| 9. | CJSC SU-155 INN 7736003162 Moscow |

127 617 | 50 319 847 | 87 | 1,00 | 550 Unsatisfactory |

| 10. | JOINT STOCK COMPANY RZDSTROY INN 7708587205 Moscow |

-6 479 531 | 65 963 289 | 78 | 1,01 | 267 High |

All Top-10 companies are in a high degree of dependence on loans. Debt to assets ratio is higher than recommended value and varies from 0,68 and 1,01. Only three companies have indicators lower than for the industry average which is 0,89.

Eight companies of the Top -10 were got the highest solvency indexes Globas-i®. That indicates their ability to timely and fully cover their debt liabilities and the risk of non-fulfilment is minimal.

LIMITED LIABILITY COMPANY STROYGAZCONSULTING and CJSC SU-155 were got unsatisfactory indexes Globas-i®, because of their bankruptcy cases in arbitration proceedings.

Picture 1. Revenue, debt to assets ratio of the largest construction companies of Russia (Top-10)

According to the latest published annual financial statements for 2014, total annual revenue of the largest construction companies of Russia (Top-10) amounted to 892,9 bln RUB, which is 4% lower than in the previous year.

This industry is characterized with a high concentration of mainly large construction holdings in Moscow, the largest financial center of the country. The statistics of the Information and analytical system Globas-i® confirms the tendency of distributing of 100 companies with the highest volume of revenue for 2014 registered in the regions (Top-5 of regions):

Moscow - 44

Saint-Petersburg - 16

Moscow region - 6

Sverdlovsk region - 5

Leningrad region - 3

Khanty-Mansi autonomus okrug - Yugra - 3

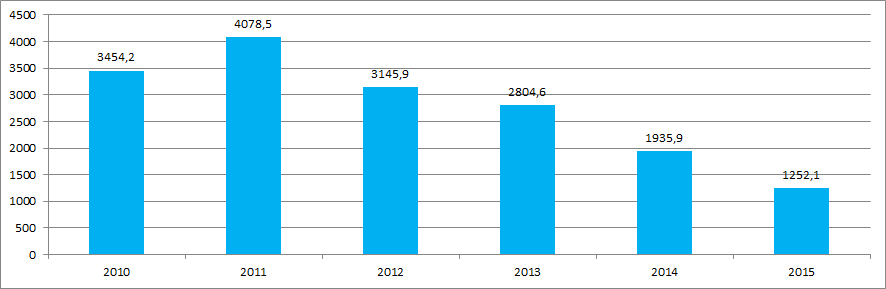

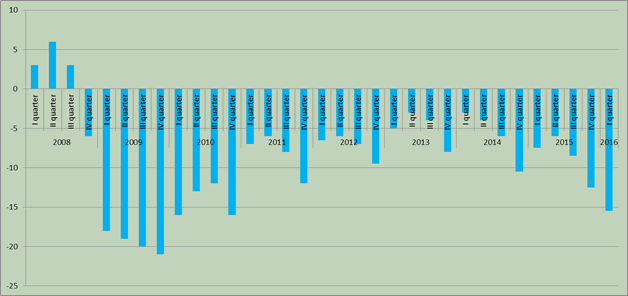

In general, the Russian construction industry has difficulties in recent years, construction volume is reduced. The attractiveness of this business to investors falls. This can be illustrated by the data of the Federal State Statistics Service on production of cement, the main component of construction, and on the index of business confidence in construction according to the results of research of the construction companies’ economic activity (Pictures 2, 3).