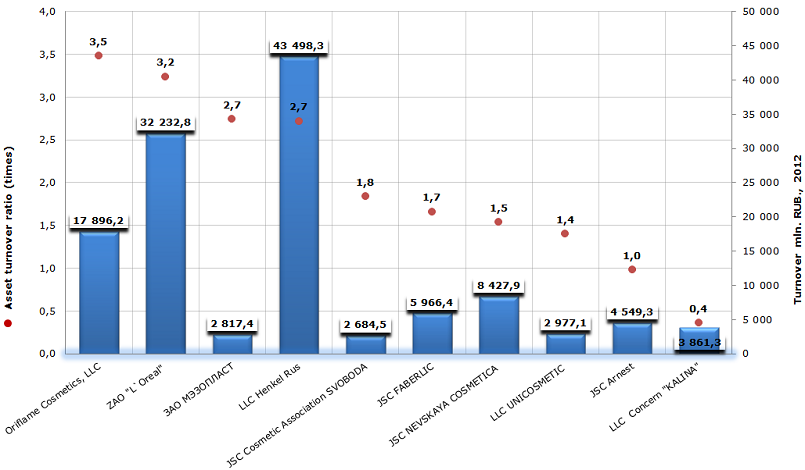

Asset turnover of perfumery and cosmetic production manufacturers

Information agency Credinform prepared а ranking of asset turnover of enterprises engaged in manufacture of perfumery and cosmetic production. The ranking list includes largest companies and is based on total revenue as stated in the Statistics register, with the reference period of 2012. The companies were ranked by decrease of asset turnover ratio.

Asset turnover ratio (times) - is a relation of sales proceeds to the average value of company's total assets for a period. The ratio characterizes the efficiency of use by the company of all available resources, apart from ways of their involvement. This ratio shows how many times a year the complete cycle of production and circulation is made, bringing a corresponding effect in the form of profit.

There is no normative value of the ratio, however, it’s much better when the company has high asset turnover. The low ratio value indicates an inefficiency use of company’s assets. At the same time, it is necessary to take into account the specificity of each industry, because it would be incorrect to compare the companies engaged in manufacture of different products. That’s why the ratio is important for the analysis of the enterprises from the same industry, segment. Anyway the financial condition, solvency and liquidity of the company directly depend on the speed of invested funds turn.

| № | Name | Region | Turnover 2012, mln. RUB. | Asset turnover ratio (times) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Oriflame Cosmetics, LLC INN: 7704270172 | Moscow | 17 896,2 | 3,48 | 245(high) |

| 2 | ZAO "L`Oreal" INN: 7726059896 | Moscow | 32 232,8 | 3,24 | 201(high) |

| 2 | ZAO MEZOPLAST INN: 7721025967 | Moscow | 2 817,4 | 2,74 | 259(high) |

| 4 | LLC Henkel Rus INN: 7702691545 | Moscow | 43 498,3 | 2,72 | 192(the highest) |

| 5 | JSC Cosmetic Association SVOBODA INN: 7714078157 | Moscow | 2 684,5 | 1,84 | 296(high) |

| 6 | JSC FABERLIC INN: 5001026970 | Moscow | 5 966,4 | 1,66 | 201(high) |

| 7 | JSC NEVSKAYA COSMETICA INN: 7811038047 | Saint-Petersburg | 8 427,9 | 1,54 | 149(the highest) |

| 8 | LLC UNICOSMETIC INN: 7826704356 | Saint-Petersburg | 2 977,1 | 1,40 | 157(the highest) |

| 9 | JSC Arnest INN: 2631006752 | Stavropol Region | 4 549,3 | 0,98 | 224(high) |

| 10 | LLC Concern "KALINA" INN: 6685018127 | Sverdlovsk region | 3 861,3 | 0,36 | 247(high) |

Picture 1. Asset turnover ratio of perfumery and cosmetic production manufacturers

According to the results of 2012, total turnover of TOP-10 largest perfumery and cosmetic production manufacturers amounted to 124 911,2 mln.RUB.

International brands opened their own production in the country or bought ready-made business. This fact testifies of the domestic economy segment attractiveness for the foreign investors.

Six companies from TOP-10 ranking list are located in Moscow, two – in Saint-Petersburg, that is not surprising: in two largest Russian agglomerations a large amount of population with rather high consumer demand, including perfumes and cosmetics industry, is concentrated. Besides, the developed transport and logistics network will allow delivering the produced goods to other regions of the country.

Average estimated value of assets turnover ratio of market leaders is 2 times. It means that the company makes two complete cycles of production and circulation during a year.

The largest industry’s enterprise LLC Henkel Rus with the asset turnover ratio of 2,7 times, takes the fourth place of the raking list.

The fastest period of TOP-10 asset turnover list has Oriflame Cosmetics, LLC – 3,5 times a year, the lowest - LLC Concern "KALINA"– 0,4 times. During a year Concern "KALINA" can’t fully repay investments in business. That gives a reason to think about the efficiency of production and marketing, company’s financial management.

Assets of other companies from the ranking list turn one and more times a year.

It should be mentioned that all companies of TOP-10 list have high and the highest independent solvency index GLOBAS-i® of the agency Credinform. The companies guarantee repayment of the debts. The risk of debt default is minimum or below average. This testifies of the favorable situation in the industry; enterprises are competitive and have a steady consumer demand in their segments. From the investment point of view, the cooperation with the companies from the TOP-10 list seems to be quite reasonable.

Russian government legitimated the disposal fee, but reduced the waste tax

Amendments to the federal law “On Production and Consumption Waste” will come into force from 1 January, 2014. According to this law, domestic manufacturers together with outside will have to pay the disposal fee.

New amendments are to settle claims of the European Union and other countries importing vehicles of violating by the Russian Federation of the World Trade Organization rules. Besides, they are to become the legal basis for fulfillment by the RF of its obligations as a member of the WTO for creation of equal competitive terms for domestic and outside vehicle manufacturers.

As a reminder, initially disposal fee was introduced in 2012 and worked only for foreign vehicles. At that moment authorities promised to spend assets arrived to the budget from car manufacturers on creation of environmentally-friendly technologies for vehicles recycling.

Introduction of the disposal fee a year ago didn’t result in substantial increase of prices, due to severe rivalry on the market and descending demand for products. The strongest was the reaction of the truck market that time. According to experts, after introduction of the equalizing amendments, when both importers and manufacturers have to pay, gradual increase of prices is expected.

As a matter of fact, the disposal fee is a payment for disposal of the goods. Basic rate of the fee for cars accounts for 20 thousand rubles, for commercial, dual-purpose and truck vehicles – 150 thousand rubles. Further on the basic rate multiplies by the special ratio that considers the year of vehicle’s manufacture, its mass and other functional characteristics, that influence on expenditures on disposal of this vehicle.

At the same time the disposal fee won’t cover vintage cars, equipment imported by the members of the state programs for rendering help to compatriots, living abroad, vehicles of refugees, representatives of international organizations and diplomatic consular institutions.

Meanwhile, in a panel session of Foreign Investment Advisory Council the vice Prime Minister Arkady Dvorkovich stated that domestic companies that will have to pay the disposal fee would get a kind of tax deduction. It is expected to fix deduction from tax basis when calculating income tax. Also the vice Prime Minister brought into focus the fact that requirements to some manufacturers or other will be introduced gradually. Considering readiness of economy sectors, the government will have to define for what kind of goods the obligations will come into effect in 2015, and for what kind later.

Representatives of entrepreneurial community are concerned about their disposal contributions. Thus, according to the Treasury for budget implementation, for 2012 budget replenishment owing to the disposal fee accounts for 51, 6 billion of rubles. Now discussions about the status of the contribution fund are in progress (will it be budgetary or off-budgetary) and how it will be managed in order to provide purposive character of payments.