Unified concept of a state-private partnership is enshrined in law

The law, which gives the unified concept of a state-private partnership, will come into force on January 1, 2016.

In July 2015 the President of the Russian Federation signed the Federal Law from July 13, 2015 of No. 224-FZ "About state-private partnership, municipal-private partnership in the Russian Federation and modification of separate legal acts of the Russian Federation".

Various infrastructure projects in the form of state-private partnership (SPP) are implemented in Russia within more than 10 years and regulated by 9 Federal Laws and number of acts of federal and regional executive authorities. The regional laws about participation of the Russian subject in the state-private partnerships are adopted in 71 Russian regions, however for implementation in specific projects they were used only in 18 regions; regional legislation, which is estimated as effective, acts only in Saint-Petersburg, Tomsk region and Yamalo-Nenets Autonomous district.

According to the «Unified information system of state-private partnership in Russia», the official resource about state-private partnerships, created with the assistance of the Ministry of economic development, countrywide almost 1000 projects are under practical implementation stage in the following sectors: transport infrastructure and construction, water supply and drainage, heating, electricity, urban beautification, health, culture and education, social services, tourism and sport, waste disposal.

The practice showed undeniable advantages of the state-private partnership such as redistribution of risks, increasing of private initiative role, long-term and stable nature of relationships between public and private partners, confidence in completion of the project according to the original plan, potential profitability and increasing of chances of investors’ participation in large projects.

The new Federal Law generalizes the previous legal framework and practices and also regulates the legal relations in preparation, execution and termination of SPP agreements and projects, including the level of municipal authorities.

The Law clearly describes the range of public and private partners and the objects of SPP agreements; the guarantees of legitimate interests and rights of private partner are fixed; the procedures, starting from projects and agreements development, to their completion or termination are regulated; the criteria and rules of competitive procedures, requirements to tender documents are set; direct agreement of the parties about contract terms and the order of interaction of the partner with funding entity is provided; the object deposit of the SPP agreement (rights under the agreement) is allowed as the way of ensuring the fulfillment of obligations to the funding entity; the potential appearance of the private partner's property right on the object of SPP agreement under the condition of its encumbrance is provided.

The Law also made correlative changes in a number of Codes and Federal laws. For example, in the Federal Law "About insolvency (bankruptcy)", it regulates the sale features of the object of SPP agreement in case of initiation of bankruptcy proceeding in respect of the private partner.

The transitional period for SPP legislative acts of regional and municipal levels is set until July 1, 2016 to make changes in accordance with the Federal law. Thus the agreements, which are already made, can be executed till their completion under previously adopted legislation.

According to the experts of Information Agency Credinform, the implementation of provisions of the law about state-private partnership, as one of the key events of the market, will influence on the harmonization of SPP legislative acts of all levels, give the possibility to the Government to make more informed decisions about projects and increase the effective return in the form of additional investment, increase tax revenues and new working places.

Cash outflow in Russia: problem, benefit or necessity

Analysis of cash flows shows that practically there are normal and illegal cash outflow. Cash flows fall in the category of normal cash flow and are necessary, because they help export-import operations and financial activity of transnational corporations (TNC). Moreover, cash outflow is a benefit while incomes of the Russian TNC`s external assets and export operations are the source of cash inflow in Russia.

Illegal cash outflow (look «Reference information», table 1) is understood to be: use of illegal business schemes for capital outflow; cases of overcoming customs barriers; instruments of thin capitalization; facts of non-repayment of export income or non-payment of import contract and others.

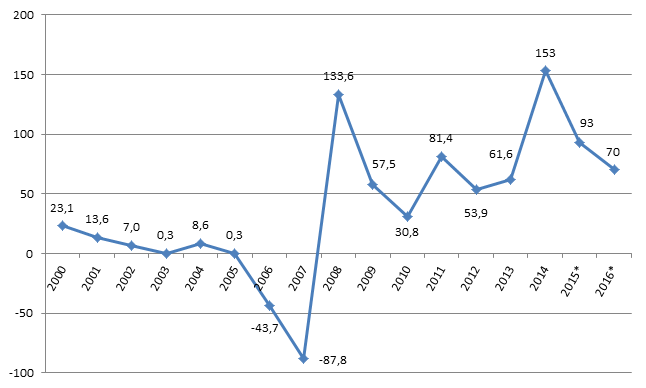

According to the Central Bank of the RF (CB RF), cash outflow in Russia in 2014 was 153 billion USD (picture 1). During 15 years (2000-2014) cash outflow was predominant in Russia. Up to the year 2005 inclusive it was minor/ insignificant, especially on the back of the period of 2008-2014 and outbursts of financial crisis in 2008 and 2014. Cash inflow was in 2006-2007, when Russia seemed to be relatively stable amid the global financial crisis and probably became a place of financial capital maintenance.

Picture 1. Cash outflow (inflow«-»/outflow«+») by private sector in 2000-2014 and 2015-2016 (* - estimate), billion USD

Reasons behind such significant volume of cash outflow are following: Necessity of payment of external debt in 2014 in an amount of 180 billion USD that made this reason the key element of cash outflow;

- Decrease in possibilities for debt refinancing, lack of access to the foreign markets financing because of economic sanctions imposed on Russia;

- Rouble devaluation, especially on December 2014, increased demand for hard currency, USD in particular, that became an impulse for cash outflow;

- Disinvestment in Russian markets on the back of unstable economic climate;

- Out of total sum of cash outflow in 2014 (the fourth quarter) about 20 billion USD accounted for REPO bargains with banks, however the money should be paid back.

The Ministry of Economic Development and Trade forecasts cash outflow in an amount of 93 billion USD at the end of 2015, and 70 billion USD - at the end of 2016. Predicted values are diminished, because external debt payments are planned to be measurably reduced, e.g. at the end of 2015 – 120 billion USD. Moreover, fall in oil prices in the world market may help. In this case a smaller source level will be required for such purpose. Also business may use tax amnesty that remains in force up to December 31, 2015.

Significant cash outflow is a big problem for the state, especially in respect to illegal cash outflow, because funds at the state`s disposal are decreased. Such situation leads to the investment reduction; slowdown in economic development; reduction of cash deposit in human capital assets by means of development of educational system, medicine, culture; prevention from social programs accomplishment and, finally, worsening of food supply security and country`s defense potential.

Reference information.

According to Russian analysts, who used balance of payment the CB RF data, for the period 2008-2013 cash outflow in Russia was 416.9 billion USD more than cash inflow. Almost 60% of this sum (about 249 billion USD) were accounted for illegal outflow (table 1).

It worth mentioning that illegal cash outflow significantly decreased because of the measures taken by the government, compared to 2001.

| 2001 | 2007 | 2009 | 2012 | 2013 | |

|---|---|---|---|---|---|

| Illegal cash outflow – total, billion USD | 15 416 | 44 230 | 30 953 | 49 187 | 37 998 |

| Illegal cash outflow, % of net cash outflow | 76,2 | 16,2 | 56,9 | 28,1 | 21,9 |