The deputies want to check non-state pension funds (NSPFs) for solvency.

On the 22nd October of the present year the speaker of the State Duma of Russian Federation committee of labor and social politics Andrei Isaev, speaking at the session of three political platforms of “Edinaya Rossia” public association (“United Russia”), proposed to check non-state pension fund for solvency.

According to his opinion all funds, including NSPFs created by State Corporations, should be checked on equal terms. In other words in practice Andrei Isaev insists on relicensing of organizations. According of deputy’s data in 2012 licenses of three NSPFs were annulled, in 2013 – six, and 28 funds were had a notices. Isaev also notes that after last license annulations lots of funds had problems with repayments on indemnified person's accounts. More than 700 statements on the subject of charge of NSPFs in willful enlisting of money were requested in regional branches of Pension fund as well. According to service of the Bank of Russia on the 5th November of 2013 123 NSPFs on the territory of the Russian Federation have current license for an indefinite term.

It bears reminding that previously finance minister Anton Siluanov corroborated information about coming reorganization of NSPFs, controlling moneys of voluntary pension accumulation of citizens.

The Credinform information agency offers wide range of services for solvency check of companies. For this purpose Solvency Index and GLOBAS-i ® rating were created by agency analytics. Also the independent value method of banks solvency is prepared for issue.

Asset turnover of perfumery and cosmetic production manufacturers

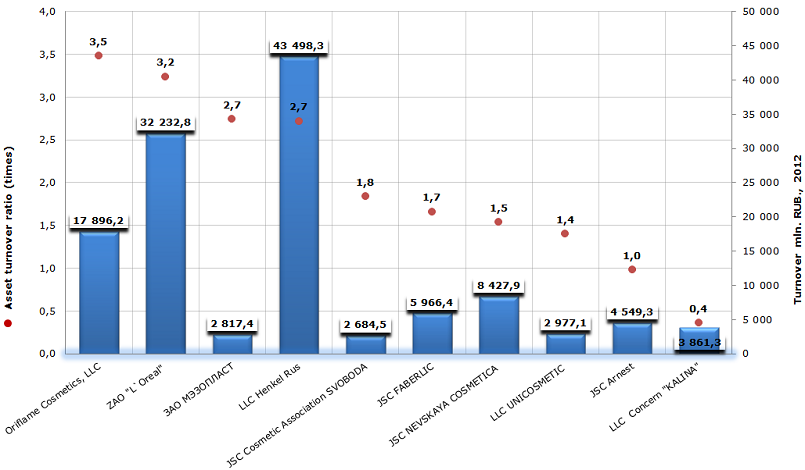

Information agency Credinform prepared а ranking of asset turnover of enterprises engaged in manufacture of perfumery and cosmetic production. The ranking list includes largest companies and is based on total revenue as stated in the Statistics register, with the reference period of 2012. The companies were ranked by decrease of asset turnover ratio.

Asset turnover ratio (times) - is a relation of sales proceeds to the average value of company's total assets for a period. The ratio characterizes the efficiency of use by the company of all available resources, apart from ways of their involvement. This ratio shows how many times a year the complete cycle of production and circulation is made, bringing a corresponding effect in the form of profit.

There is no normative value of the ratio, however, it’s much better when the company has high asset turnover. The low ratio value indicates an inefficiency use of company’s assets. At the same time, it is necessary to take into account the specificity of each industry, because it would be incorrect to compare the companies engaged in manufacture of different products. That’s why the ratio is important for the analysis of the enterprises from the same industry, segment. Anyway the financial condition, solvency and liquidity of the company directly depend on the speed of invested funds turn.

| № | Name | Region | Turnover 2012, mln. RUB. | Asset turnover ratio (times) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Oriflame Cosmetics, LLC INN: 7704270172 | Moscow | 17 896,2 | 3,48 | 245(high) |

| 2 | ZAO "L`Oreal" INN: 7726059896 | Moscow | 32 232,8 | 3,24 | 201(high) |

| 2 | ZAO MEZOPLAST INN: 7721025967 | Moscow | 2 817,4 | 2,74 | 259(high) |

| 4 | LLC Henkel Rus INN: 7702691545 | Moscow | 43 498,3 | 2,72 | 192(the highest) |

| 5 | JSC Cosmetic Association SVOBODA INN: 7714078157 | Moscow | 2 684,5 | 1,84 | 296(high) |

| 6 | JSC FABERLIC INN: 5001026970 | Moscow | 5 966,4 | 1,66 | 201(high) |

| 7 | JSC NEVSKAYA COSMETICA INN: 7811038047 | Saint-Petersburg | 8 427,9 | 1,54 | 149(the highest) |

| 8 | LLC UNICOSMETIC INN: 7826704356 | Saint-Petersburg | 2 977,1 | 1,40 | 157(the highest) |

| 9 | JSC Arnest INN: 2631006752 | Stavropol Region | 4 549,3 | 0,98 | 224(high) |

| 10 | LLC Concern "KALINA" INN: 6685018127 | Sverdlovsk region | 3 861,3 | 0,36 | 247(high) |

Picture 1. Asset turnover ratio of perfumery and cosmetic production manufacturers

According to the results of 2012, total turnover of TOP-10 largest perfumery and cosmetic production manufacturers amounted to 124 911,2 mln.RUB.

International brands opened their own production in the country or bought ready-made business. This fact testifies of the domestic economy segment attractiveness for the foreign investors.

Six companies from TOP-10 ranking list are located in Moscow, two – in Saint-Petersburg, that is not surprising: in two largest Russian agglomerations a large amount of population with rather high consumer demand, including perfumes and cosmetics industry, is concentrated. Besides, the developed transport and logistics network will allow delivering the produced goods to other regions of the country.

Average estimated value of assets turnover ratio of market leaders is 2 times. It means that the company makes two complete cycles of production and circulation during a year.

The largest industry’s enterprise LLC Henkel Rus with the asset turnover ratio of 2,7 times, takes the fourth place of the raking list.

The fastest period of TOP-10 asset turnover list has Oriflame Cosmetics, LLC – 3,5 times a year, the lowest - LLC Concern "KALINA"– 0,4 times. During a year Concern "KALINA" can’t fully repay investments in business. That gives a reason to think about the efficiency of production and marketing, company’s financial management.

Assets of other companies from the ranking list turn one and more times a year.

It should be mentioned that all companies of TOP-10 list have high and the highest independent solvency index GLOBAS-i® of the agency Credinform. The companies guarantee repayment of the debts. The risk of debt default is minimum or below average. This testifies of the favorable situation in the industry; enterprises are competitive and have a steady consumer demand in their segments. From the investment point of view, the cooperation with the companies from the TOP-10 list seems to be quite reasonable.