Return on sales of the largest Russian of food retailers

Information agency Credinform offers the ranking of the largest food retail chains of Russia.

The largest enterprises of the retail sales of food products were selected on the highest volume of annual revenue for the ranking for the latest period available in the State statistics authorities (for the year 2014). The TOP-10 of the largest companies was ranked by decrease in the return on sales ratio. (Table 1).

Return on sales (%) is the share of operating profit in company's sales volume. The return on sales ratio reflects the efficiency of industrial and commercial activity of an enterprise and shows, how much money remains with the company as a result of the sale of products after covering its costs, interest payments on loans and discharge of taxes.

Return on sales is an indicator of company’s price policy and its ability to control outlays. The differences in the competitive strategies and product ranges cause a significant variety of return on sales values in companies. Therefore, it should be taken into account that the return on sales of two companies can differ a lot at the equal values of revenue, operating expenses and pre-tax profit under the influence of volumes of interest payments on the net profit margin.

| Name, Trademark, INN, Region | Net profit for 2014, mln RUB | Net profit for 2014, to 2013, % | Revenue for, 2014, mln RUB | Revenue for 2014, to 2013, % | Return on sales, % | Solvency index Globas-i® |

|---|---|---|---|---|---|---|

| AUCHAN LLC (© АШАН) INN 7703270067 Moscow region |

11 934 | 109 | 313 629 | 117 | 4,93 | 219 high |

| AGROTORG LLC (© Пятёрочка, Перекресток, Карусель) INN 7825706086 Saint-Petersburg |

1 089 | 64 | 116 042 | 122 | 3,80 | 250 high |

| TANDER NAO (© Сеть "Магнит") INN 2310031475 Krasnodar territory |

38 151 | 130 | 830 320 | 132 | 2,21 | 212 high |

| TORGOVY DOM PEREKRESTOK NAO (© Перекресток) INN 7728029110 Moscow |

8 760 | 115 | 583 105 | 124 | 1,29 | 222 high |

| ELEMENT-TREID LLC (© ТС "Монетка") INN 6674121179 Sverdlovsk region |

1 180 | 100 | 57 854 | 119 | 0,99 | 218 high |

| DIKSI YUG NAO (© Дикси) INN 5036045205 Moscow region |

1 675 | 649 | 198 420 | 163 | 0,92 | 225 high |

| LENTA LLC (© ЛЕНТА) INN 7814148471 Saint-Petersburg |

6 157 | 92 | 220 338 | 136 | 0,91 | 238 high |

| ATAK LLC (© ATAK) INN 7743543232 Moscow |

1 388 | 107 | 58 023 | 129 | 0,83 | 220 high |

| TD INTERTORG LLC (© "Народная 7Я семьЯ", "идеЯ", "SPAR") INN 7842005813 Leningrad region |

101 | 61 | 55 897 | 133 | 0,09 | 216 high |

| О’КЕY LLC (© О’КЕY Group) INN 7826087713 Saint-Petersburg |

5 993 | 172 | 158 905 | 109 | -0,71 | 219 high |

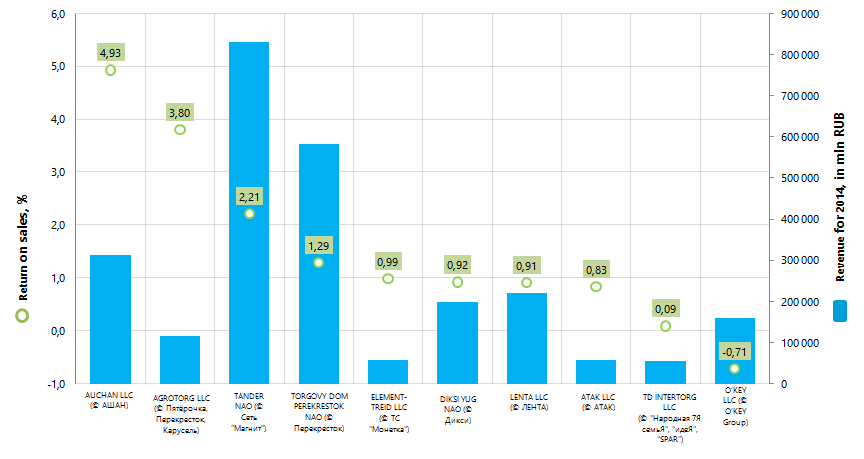

NAO TANDER, the leader of the industry in term of the annual revenue, shows the return on sales of 2,21% and takes the third place of the ranking.

The average return on sales of the largest enterprises of the retail sales of food products (TOP-10) amounted to 1,52% at year-end 2014, by the industry average value of 2,36%. AUCHAN LLC and AGROTORG LLC, taking the first two places of the ranking, have the return on sales value of 4,93% and 3,80% respectively.

О’КЕY LLC demonstrates a negative value of the return on sales. It testifies that the production cost is higher than the profit from its sale, the price isn’t high enough to cover all costs, and own assets of the company are used inefficiently.

All companies of the TOP-10 finished the year 2014 with a positive trend in revenue and with profit. However, three companies have a decrease in the net profit compared to the previous period.

All companies of the TOP-10 got a high solvency index Globas-i, that points to their ability to pay off their debts in time and fully, while risk of default is minimal.

Picture 1. Revenue and return on sales of the largest food retailers (TOP-10)

The annual revenue of the companies from the TOP-10 list amounted to 2,59 trillion rubles at the year-end 2014, that is higher by 28% than the consolidated figure in 2013. The indicators of net profit of these enterprises show also a positive dynamics. Thus, the total net profit of the TOP-10 companies, which amounted to 76,4 billion rubles in 2014, increased by 60% compared with the previous year.

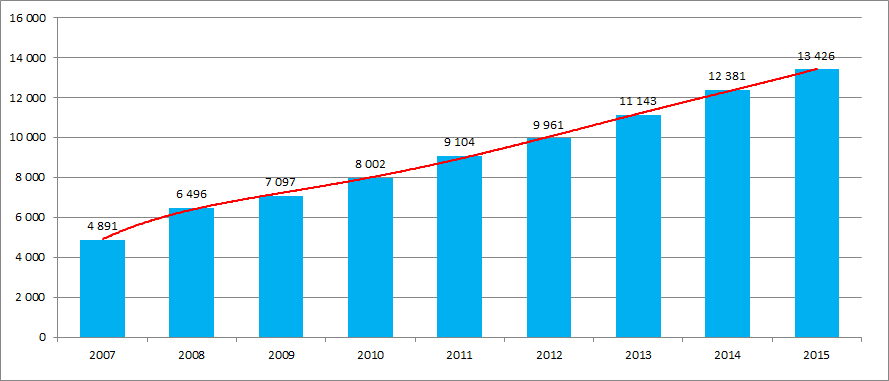

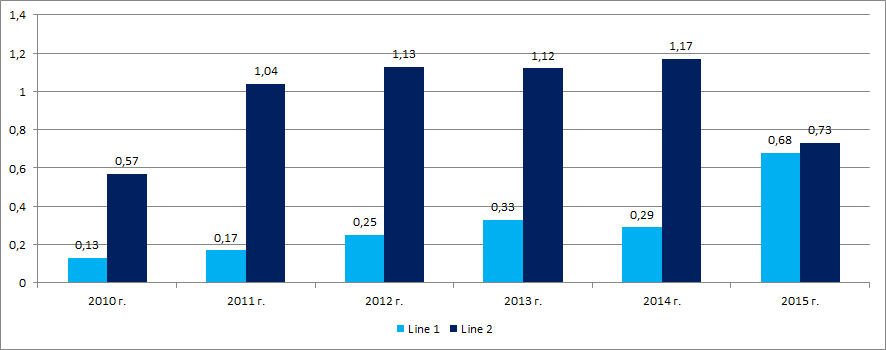

Retail trade has been one of the drivers of the economic growth for a long time. In the current complicated economic conditions, in spite of the increased inflation and the decline in effective demand, the industry as a whole continues to show a positive dynamics with a gradual decline in growth rates. This is confirmed by the data of Rosstat on the turnover of retail trade of food, including beverages and tobacco products nationwide (Picture 2, 3).

A steady growth of retail trade turnover of food products is observed on the diagram, which wasn’t significantly impacted by crisis developments in the economy in 2008 – 2009 and 2014 – 2015.

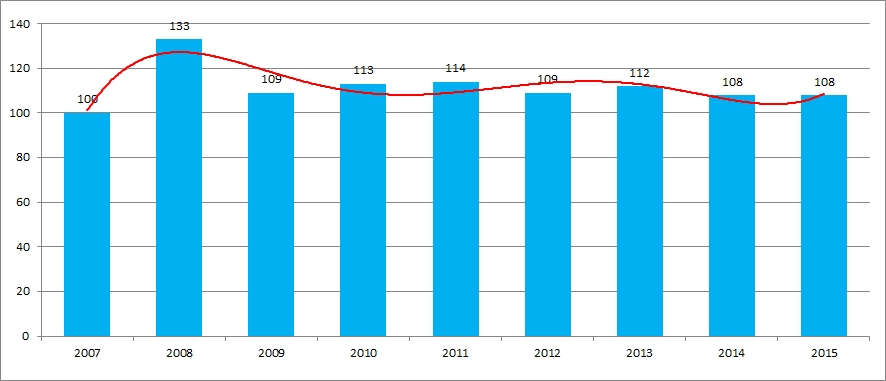

Picture 3. Growth rates of the retail trade turnover of food, including beverages and tobacco products (from year to year since 2007, %%)

Growth rates of the retail trade turnover of food demonstrate varying indicators from year to year, with a gradual decline starting on 2013. The quarterly analysis shows a similar tendency. In the 1st quarter of 2016 the growth rate was of 4% compared with the same period in 2015.

The retail chain stores are characterized by a high concentration of companies in Moscow and in large industrial centers of the country with the most solvent people. This is confirmed by the data of the Information and analytical system Globas-i on the distribution of 100 the largest companies on revenue in the industry registered across the regions (TOP-12 Regions):

| Region | Number of companies | |

|---|---|---|

| 1. | Moscow | 22 |

| 2. | Saint-Petersburg | 9 |

| 3. | Moscow region | 8 |

| 4. | Krasnoyarsk territory | 4 |

| 5. | Nizhny Novgorod region | 4 |

| 6. | The Republic of Bashkortostan | 4 |

| 7. | Altai Territory | 3 |

| 8. | Volgograd region | 3 |

| 9. | Leningrad region | 3 |

| 10. | The Republic of Tatarstan | 3 |

| 11. | Sverdlovsk region | 3 |

| 12. | Chelyabinsk region | 3 |

Current liquidity ratio of the largest Russian auto dealers

Information Agency Credinform has prepared the ranking of Russian auto dealers. TOP-10 largest enterprises in terms of revenue were selected according to the data from the Statistical Register for the latest available period (for the year 2014). Then, the companies were ranged by Current liquidity ratio (Table 1).

Current liquidity ratio (х) (coverage ratio) is a ratio of total working capital to short-term liabilities. The ratio shows the sufficiency of company’s assets to meet short-term obligations.

The recommended value is from 1,0 to 2,0. The ratio value less than 1 indicates about the excess of short-term liabilities over current working capital.

For the most full and fair opinion about the company’s financial position, not only compliance with standard values should be taken into account, but also the whole set of financial indicators and ratios.

| Name, INN, Region | 2014 net profit, th RUB | 2014 revenue, th RUB | 2014/2013 revenue, % | Current liquidity ratio, (х) | Solvency index Globas-i |

|---|---|---|---|---|---|

| LLC MAZDA MOTOR RUS INN 7743580770, Moscow |

2 775 897 | 43 119 554 | 120 | 3,39 | 151 The highest |

| NAO AVILON Automotive Group INN 7705133757, Moscow |

1 305 918 | 52 596 319 | 114 | 2,06 | 163 The highest |

| LLC TOYOTA MOTOR INN 7710390358, Moscow region |

4 019 401 | 248 627 531 | 108 | 1,74 | 207 High |

| MMC RUS LLC INN 7715397999, Moscow |

1 510 594 | 77 580 644 | 108 | 1,67 | 208 High |

| Hyundai Motor CIS LLC INN 7703623202, Moscow |

1 227 890 | 124 843 324 | 112 | 1,61 | 238 High |

| LLC ROLF INN 5047059383, Moscow region |

2 732 356 | 89 443 332 | 132 | 1,48 | 190 The highest |

| NAO MERCEDES-BENZ RUS INN 7707016368, Moscow |

5 720 774 | 147 624 280 | 123 | 1,34 | 205 High |

| GESELLSCHAFT MIT BESCHRANKTER HAFTUNG "BMW RUSSLAND TRADING ООО" INN7712107050, Moscow |

-1 002 893 | 87 607 721 | 108 | 1,03 | 263 High |

| KIA MOTORS RUS LLC INN 7728674093, Moscow |

-8 202 055 | 126 362 972 | 104 | 1,02 | 282 High |

| NAO VOLVO VOSTOK INN 5032048798, Kaluga region |

-144 541 | 33 477 074 | 90 | 1,02 | 279 High |

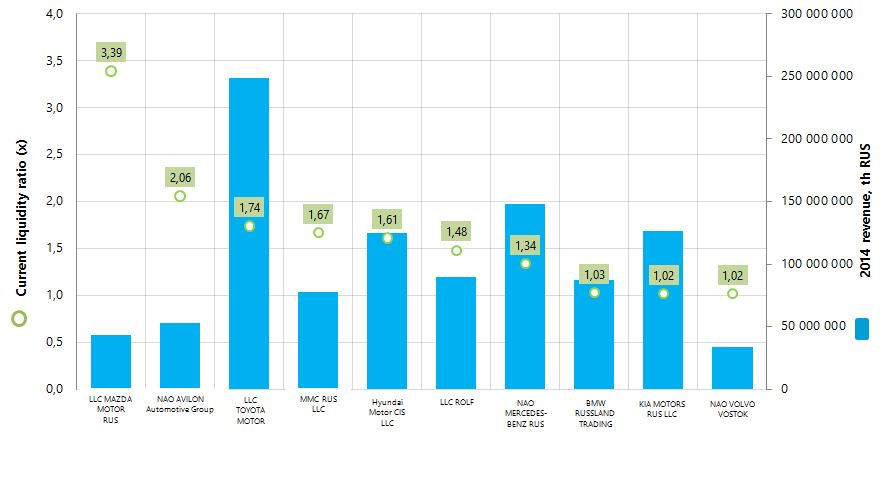

The current liquidity ratio of TOP-10 companies varies from 3,39 to 1,02, that satisfies the lower bound of recommended values. In 2014, with industry average value of 1.28, the average ratio of 10 largest auto dealers amounted to 1,64.

All participants of TOP-10 have the highest and high solvency index Globas-i, that shows their stable financial condition.

First two places of the ranking take LLC MAZDA MOTOR RUS and NAO AVILON Automotive Group with Current liquidity ratios, exceeding the upper bound of recommended values, as current assets of the enterprises significantly exceed short-term liabilities. According to 2013 results the leaders of the ranking were LLC JAGUAR LAND ROVER and HONDA MOTOR RUS LLC with ratio values 3,28 and 2,87 accordingly. According to 2014 results these two companies were not included in TOP-10.

Picture 1. 2014 revenue and current liquidity ratio of the largest Russian auto dealers (TOP-10)

According to 2014 results, the annual revenue of TOP-10 enterprises amounted to 1 031 bln RUB, that is 12% higher than total revenue in 2013. However, net profit indicators of these companies demonstrate negative dynamics. Thus, 2014 total net profit of TOP-10 enterprises amounted to 9,9 bln RUB, it decreased by 53% in comparison with previous period. Only 4 out 10 participants (LLC MAZDA MOTOR RUS, MMC RUS LLC, LLC ROLF, NAO MERCEDES-BENZ RUS) increased net profit in 2014. Other companies showed decline or even net loss.

Taking into account the increased inflation and reduced consumer demand, the industry as a whole demonstrates negative dynamics. For example, below is the data from the Federal State Statistics Service about the stock of cars in trade enterprises in comparison with the data about wholesale sales of passenger cars, including light cars, minibuses, special passenger cars etc. (Picture 2).

The analysis shows the threefold increase in car stocks among trade industry in 2015 with almost 40% decline in sales in monetary terms.

Auto dealers are characterized by high concentration of enterprises in Moscow – the largest financial center of the country. This fact is confirmed by the data from the Information and analytical system Globas-i on distribution across the country of 100 largest registered companies of the industry in terms of 2014 revenue (TOP-7 of Regions):

Moscow - 51

Moscow region - 18

Saint-Petersburg - 7

Krasnodar region - 3

Nizhny Novgorod region - 3

Novosibirsk region - 3

Sverdlovsk region - 3