Get out of debts

According to the Bank of Russia, loan debt of the Russian corporate sector by September has reached historical peak of 31,8 trn RUB or 35% of the GDP. Compared to the same period of 2017, debts have increased by 10,5%.

To get funding is one of the key challenges hindering the development of business in Russia. The problem of business funding remains relevant throughout the company’s life.

According to the survey by Rosstat, 35% of executives brought insufficient funds to notice, 27% pointed at high interest rate, and 50% of respondents mentioned low demand on products.

The situation is that companies take credits while insufficient demand negatively affects the revenue. As a result, there is a need in additional financial resources, which are increasingly difficult to be serviced.

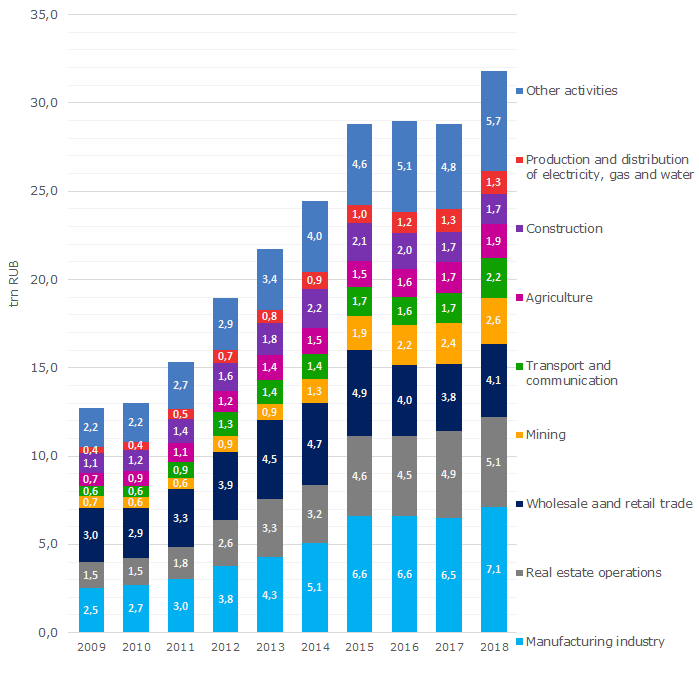

Following the reduction of the key rate to 7,25% by the Bank of Russia this year, loan debt growth has quicken noticeably. Companies began active borrowing of money after the period of 2015-2017 when the average debt was at the level of 28,8 trn RUB (see Picture 1). Processing enterprises have the highest size of indebtedness – 7,1 trn RUB.

For the past 4 years credit indebtedness in manufacturing industry increased by 40% at the industrial-production growth by about 6.8% for the same period.

In general, companies of all sectors of domestic economy accumulate debts at a fast pace. However due to historically low mortgage rates and deferred housing demand, the construction sector has noticeable increase in the number of real estate buyers, and credit indebtedness is gradually going down.

Picture 1. Dynamics of credit indebtedness by sectors, according to the Bank of Russia on September 1 of each year

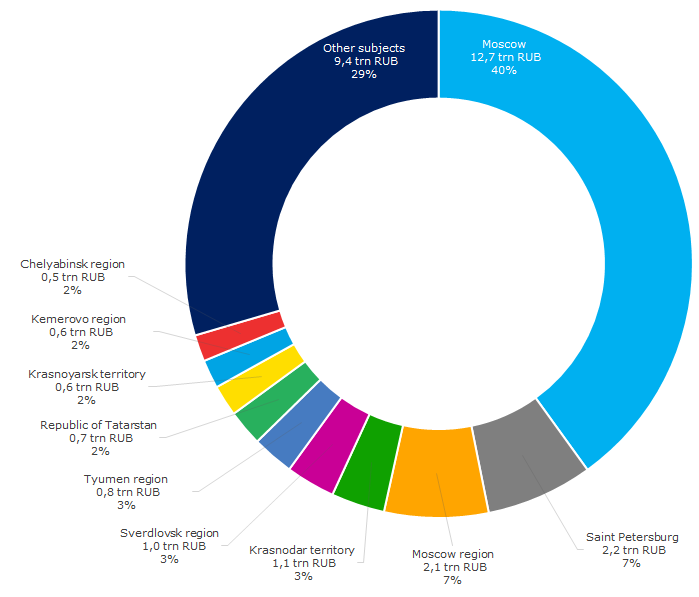

Picture 1. Dynamics of credit indebtedness by sectors, according to the Bank of Russia on September 1 of each yearThe highest credit indebtedness is accumulated by companies in Moscow – 12,4 trn RUB or over 40% of total debt. It bears mentioning that only 21% of all active legal entities in Russia are registered in Moscow, that speaks for disproportion in allocation of business. The bulk of business leaders are located in the capital. Significantly less investment, credit and debt in raw numbers fall for the share of regions. Saint Petersburg with loan debts of 2,1 trn RUB is ranked the second.

According to the Information and Analytical system Globas, total debt to banks and counterparties of Moscow companies for 2017 reached 44,2 trn RUB, and 5,8 trn RUB – of companies in Saint Petersburg.

Picture 2. Credit indebtedness by regions as of 01.09.2018

Picture 2. Credit indebtedness by regions as of 01.09.2018The highest average amount of credit indebtedness per 1 company is in Yamal-Nenets autonomous district – 35 mln RUB, Tyumen region – 19 mln RUB, and Chukotka autonomous district – 15 mln RUB (see Table 1).

As of 01.09.2018, the average credit indebtedness of legal entities throughout Russia amounted to 8 mln RUB, 15 mln RUB in Moscow, and 7 mln RUB in Saint Petersburg.

Table 1. Average credit indebtedness per 1 company, as of 01.09.2018

| Rank | Subject | Average amount of credit indebtedness per 1 company, mln RUB |

| 1 | Yamal-Nenets autonomous district | 35 |

| 2 | Tyumen region | 19 |

| 3 | Chukotka autonomous district | 15 |

| 4 | Moscow | 15 |

| 5 | Kemerovo region | 13 |

| 6 | Leningrad region | 10 |

| 7 | Kursk region | 10 |

| 8 | Moscow region | 9 |

| 9 | Bryansk region | 9 |

| 10 | Tula region | 9 |

The highest increase in loan debts was recorded for companies of the Republic of Crimea, Tambov and Voronezh regions: by 44%, 41% and 37% respectively. The Republic of Khakassia leads by the rate of debt drawdown – by 45% (see Table 2).

From 01.09.2017 to 01.09.2018 credit indebtedness of companies in Moscow and Saint Petersburg increased by 13% and 9% respectively.

Table 2. The highest increase and decrease in corporate credit indebtedness by regions, according to the Bank of Russia

| Rank | Subject | Increase rate of credit indebtedness, % as of 01.09.2018 to 01.09.2017 | Subject | Decrease rate of credit indebtedness, % as of 01.09.2018 to 01.09.2017 |

| 1 | Republic of Crimea | 44 | Republic of Khakassia | -45 |

| 2 | Tambov region | 41 | Zabaikalye Territory | -38 |

| 3 | Voronezh region | 37 | Republic of Sakha (Yakutia) | -19 |

| 4 | Chukotka autonomous district | 35 | Smolensk region | -18 |

| 5 | Republic of Udmurtia | 33 | Kabardino-Balkarian Republic | -16 |

| 6 | Tyumen region | 32 | Arkhangelsk region | -14 |

| 7 | Tula region | 31 | Kostroma region | -11 |

| 8 | Magadan region | 30 | Ivanovo region | -11 |

| 9 | Novgorod region | 29 | Novosibirsk region | -11 |

| 10 | Lipetsk region | 27 | Samara region | -9 |

For the relatively short period not only business community based on market relations was formed in Russia, but also money-and-credit mechanism. Loans help companies to attract additional funds for increase in profits and sales, development of fixed assets and output. However, under adverse circumstances, loans could be crushing burden and one of the reasons of bankruptcy.

Loan growth should be followed by accelerated dynamics in economy, which is unfortunately not observed nowadays. Credits are used for accrued expenses and old debts covering, as well as for sustaining capital.

On September 14, 2018, the Bank of Russia raised the key rate up to 7,5% for the first time since 2014. According to Credinform experts, this will lead to some drawdown of corporate debt growth rate, but not eliminate the debt overburden risk. Balance between own and attracted funds, and reasonable estimate of sectoral macroeconomic indicators by the company’s management are indispensable conditions for sound business and economy in general.

Customs Regulation Act

Federal Law No. 289-FL from August 3, 2018, which is generally intended to improve administration and reduce customs formalities, regulates:

– order of import (export) of goods to the Russian Federation and their transportation through the country under customs supervision;

– order of temporary storage and customs declaration of goods, their usage according to the customs procedures;

– procedure of customs control, levying and payment of customs charges and special duties;

– rights and duties of bodies interacting during customs procedures;

– legal status and organizational framework of customs authorities’ activity in the Russian Federation;

– aspects of embargo on certain types of goods within the Russian territory.

The Law permits:

– to use ‘register guarantee’ of customs agents during customs declaring procedure;

– delivery of preliminary decisions on application of customs valuation methods of imported goods;

– exemption of fair companies from guarantees for compulsory payment of customs duties;

– provision of preliminary information in English.

Along with that, the term for preliminary decision on the country of origin and classification of goods has become shorter, the list of cases for exemption from guarantees for compulsory payment of customs duties has become larger, the customs procedure of free warehouse has been introduced, and the procedure of identification of goods in their derivatives has been simplified.

Furthermore, the act introduces provisions for customs clearance charges for personal goods (including ones sent by international mail) via program of technical payment systems used by customs payment operators, or by cash paid to customs authorities’ desk (cash office of the federal postal service), or to authorized officials (given the agreement of full personal liability for damage according to the legislation).

Customs duties, taxes on personal goods, which are delivered by carriers (transportation companies or delivery services) to private persons, are paid by money transfer.

The Law provides for the customs payment operators’ duty to make provisions for advance payments, customs duties, taxes and other payments using national payment instruments within the terms fixed by the Central Bank of the Russian Federation.

In addition, the Law specifies the procedure of uncontested recovery of custom authorities’ orders by banks. Particularly, uncontested recovery of custom authorities’ orders are to be executed according to the priority set by the civil legislation of the Russian Federation:

– if levying money from ruble accounts - not later than 1 transaction day following the order receipt day;

– if levying money from foreign currency or precious metals accounts - not later than 2 transaction days following the order receipt day;

– if levying by electronic money balance in rubles - not later than 1 transaction day , and in foreign currency – 2 transaction days, following the order receipt day.

This Federal Law was put in force on September 4, 2018, excluding certain provisions that will take effect later.

For example, provisions of law concerning electronic interaction of customs authorities and payers will come into effect on January 1, 2019, electronic consulting provisions – on January 1, 2020, provisions on

In general, the new Federal Law consists of 398 articles. We recommend our readers that are involved in foreign trade to take a closer look at the Law, as this significant act will define basic concepts of customs regulations for years to come.