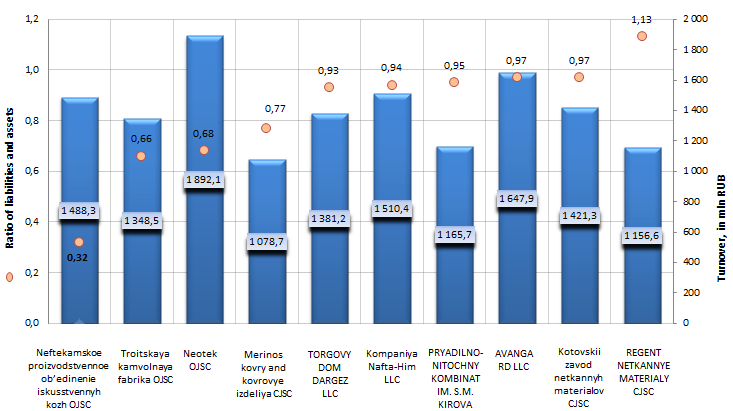

The ratio of liabilities and assets of Russian textile enterprises

Information agency Credinform prepared a ranking of Russian textile enterprises.

The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by increase in value of the ratio of liabilities and assets.

The ratio of liabilities and assets (х) is the relation of long-term and short-term borrowings to total assets. It shows what share of assets of an enterprise is funded through borrowings.

Recommended value: from 0,2 to 0,5. If the ratio is equal to zero, then it testifies that an organization has no liabilities. If the ratio is above 1, it means that a company has on its books the value of liabilities higher, than its assets, what in terms of financial management should be considered as company's development policy being risky enough.

However, it should be understood, that recommended values can differ essentially as well for enterprises of different branches, as for organizations of the same industry.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to industry-average indicators in the branch, but also to all presented combination of financial indicators and company’s ratios.

| № | Name | Region | Turnover,in mln RUB, for 2012 | Solvency index GLOBAS-i® | Ratio of liabilities and assets, (х) |

|---|---|---|---|---|---|

| 1 | Neftekamskoe proizvodstvennoe ob’edinenie iskusstvennyh kozh OJSC INN: 0264005146 |

Republic of Bashkortostan | 1 488 | 0,32 | 211(high) |

| 2 | JSC "Troitskaya Kamvolnaya Fabrika" INN: 5046005770 |

Moscow | 1 348 | 0,66 | 209(high) |

| 3 | Neotek OJSC INN: 7736600070 |

Moscow | 1 892 | 0,68 | 292(high) |

| 4 | "Merinos Carpet and Carpet Wares" CJSC INN: 6165125323 |

Rostov region | 1 079 | 0,77 | 247(high) |

| 5 | TORGOVY DOM DARGEZ LLC INN: 7706406478 |

Moscow | 1 381 | 0,93 | 217(high) |

| 6 | Kompaniya Nafta-Him LLC INN: 7716206076 |

Moscow region | 1 510 | 0,94 | 194(the highest) |

| 7 | PRYADILNO-NITOCHNY KOMBINAT IM. S.M. KIROVA OJSC INN: 7825666563 |

Saint-Petersburg | 1 166 | 0,95 | 206(high) |

| 8 | AVANGARDLLC INN: 7826741774 |

Saint-Petersburg | 1 648 | 0,97 | 220(high) |

| 9 | Kotovskii zavod netkannyh materialov CJSC INN: 6820028830 |

Tambov region | 1 421 | 0,97 | 229(high) |

| 10 | JSC "REGENT NON MATERIALS" INN: 7722508646 |

Moscow | 1 157 | 1,13 | 340(satisfactory) |

Picture 1. Ratio of liabilities and assets and turnover of the largest Russian textile enterprises (TOP-10)

Cumulative turnover of the first 10 largest textile enterprises of Russia made, according to last published financial statement, 14 090,6 mln RUB or 24,3% from sales revenue of TOP-100 companies in the same branch. This points to that this sector of the economy is fragmented, that there are no clear-cut monopolists.

Following organizations among TOP-10 on sales revenue showed the most optimal ratio values, supporting acceptable relation of liabilities to balance sheet assets: Neftekamskoe proizvodstvennoe ob’edinenie iskusstvennyh kozh OJSC (0,32), JSC "Troitskaya Kamvolnaya Fabrika" (0,66), Neotek OJSC (0,68), "Merinos Carpet and Carpet Wares" CJSC (0,77).

Neftekamskoe proizvodstvennoe ob’edinenie iskusstvennyh kozh OJSC (Iskozh) is the leader and the largest manufacturer and supplier of manmade materials for automotive, footwear and fancy goods industries, as well as for furniture and clothing trade in Russia and CIS countries.

JSC "Troitskaya Kamvolnaya Fabrika" is the leader of Russian textile industry on output of yarn for hand and machine knitting and different kinds of combed sliver (tops). Besides of that the factory produces covers with wool and artificial fillers.

Neotek OJSC is engaged in manufacturing and realization of cotton fabrics, furniture and textile products for household use through its own network of trade representations.

"Merinos Carpet and Carpet Wares" CJSC is one of the largest factories in Russia on production of carpets and rugs.

The rest companies from TOP-10 exceeded recommended values of the ratio, the value of liabilities on the books - over half from the value of assets.

However, according to the independent estimation of solvency, developed by the Information agency Credinform, all TOP-10 enterprises (except JSC "REGENT NON MATERIALS") got a high and the highest solvency index GLOBAS-i®, what guarantees that they can pay off their loan liabilities in time and fully. Risk of default in the nearest time is highly improbable; organizations are attractive objects for investment, especially considering high potential of the Russian market.

Satisfactory index by JSC "REGENT NON MATERIALS" may be largely due to the fact that liabilities exceed the value of assets on the books of the company.

The Central Bank of the Russian Federation will give a loan to Vnesheconombank

Alexander Ivanov, Vice-President of Vnesheconombank (VEB), reported that VEB negotiates with the Central Bank for getting the refunding operation. Mr. Ivanov also noted that the possibility of credit financing against the investment projects, which are provided by the government guaranties and on security of the non-market assets, is discussed above all. The requirement of VEB additional financing can be explained by the expenses on Sochi Olympic Games, as during its preparation the state corporation gave credits to a number of projects.

Today the negotiations are in the initial stage, though some experts estimate VEB’s chances as low. They explain it as this state corporation is not going to get the bank charter and according to the current regulations it cannot employ funds of the Bank of Russia. However, upon the applications of Mr. Ivanov, Vnesheconombank is waiting for the Central Bank’s modifications to the mechanism of banks refinancing against the investment projects. Such «mechanism» is already ready and it may be started until the end of June. The supposed changes should ease the access to credits for banks and stimulate economic growth.

At the same time the extent of planned credits is still unknown. According to the experts’ estimations the financial requirement of state corporations is 2.5 – 5 bln USD for the nearest 3 years. However, taking into account the adverse trends of the capital outflow from Russia and the high requirements of economy in investments, the requirements of the bank can be higher.

It should be noted that VEB - is the state corporation, established in 2007 for major and high-priced projects. At the same time the special status of the organization is emphasized by the absence of license of the Central Bank. According to 2013 results, the net profit of this organization reduced more than twofold in comparison to 2012 results and amounted to 8.5 bln RUB. In such case the total project financing by the end of the last year amounted to 918 bln RUB, but which part of this sum was given against the state guarantee is not announced.

In autumn 2013 the requirement of VEB’s recapitalization was lively discussed. Thus, according to the experts’ estimations, it is necessary to raise 400 bln RUB in the period of 2014-2016, as Vnesheconombank gave this much under the non-market terms. In that case if the government authorities continue to raise VEB for the infrastructure projects financial package, by 2020 the sum will be 700 bln RUB.

Meanwhile, the experts also note that there are big companies in Vnesheconombank’s portfolio, which are good for the Central Bank to cooperate. Capital investment projects are certainly riskier, but if the regulator trains the corresponded manner, it accepts this risk and is ready to work in such conditions.