New limit values for income from business activities

Practice of the world economy shows that efficiency of small and medium-sized businesses (SMB) is one of the most important indicators of the state’s competitiveness. The share of small and medium-sized businesses in the gross domestic product of our country is about 20%, while abroad this figure reaches 50% for the developed countries. According to the statistics, slightly more than 3% of small enterprises in Russia are operating more than three years, while the remaining close earlier.

Information agency Credinform has often addressed to the topic of small and medium-sized businesses in Russia. For example, one of the latest publications informs that during the past forum “Small business – the national idea”, the Presidium of business association “Support of Russia” and the VII Conference of the Chamber of Commerce and Industry of the Russian Federation in the beginning of 2016, it was discussed the suggestion of increasing the limit values of income from 60 to 120 mln RUB for using the simplified tax system.

After these events, the RF President’s Administration has released the lists of orders. As a result, the RF Government has adopted a resolution №265 from April 4, 2016 “On limit values of the income for each category of small and medium-sized businesses received from the entrepreneurial activity”

The resolution affirmed the limit values of income received from the business activity for the past calendar year. The income is summed by all existing types of activity and by all tax regimes for the subjects of SMB: 120 mln RUB for micro-sized, 800 mln RUB for small-sized and 2 bln RUB for medium-sized enterprises. The resolution will come into force since August 1, 2016.

As already known, the criteria of being the SMB subjects are confirmed by the Federal Law №209-FL from 24.07.2007 (as amended from 29.12.2015) “On the development of small and medium entrepreneurship in the Russian Federation”, which determines the average stuff for SMB enterprises. The limit values of revenue from sales of goods, works and services are defined by the resolutions of the RF Government for each of the categories. The previous resolution №702 was released in July 13, 2015.

The implementation of new norms can be resulted in easier access of small and medium-sized enterprises to grants, relatively cheap loans and state orders, including orders from state corporations. In addition, the effect of a three-year ban on scheduled inspections of legal entities and individual entrepreneurs - small businesses will spread on many more companies.

Information about the enterprises of small and medium-sized business will be contained in the State Register of small and medium-sized companies, which must appear on the website of the Federal Tax Service after August 1, 2016.

The publication of Credinform contains the statistics of a number of small and medium-sized enterprises in Russia formed by the Information and analytical system Globas-i. That publication will help to size the scale of new norm operations.

Equity turnover ratio of the world's largest coal mining companies

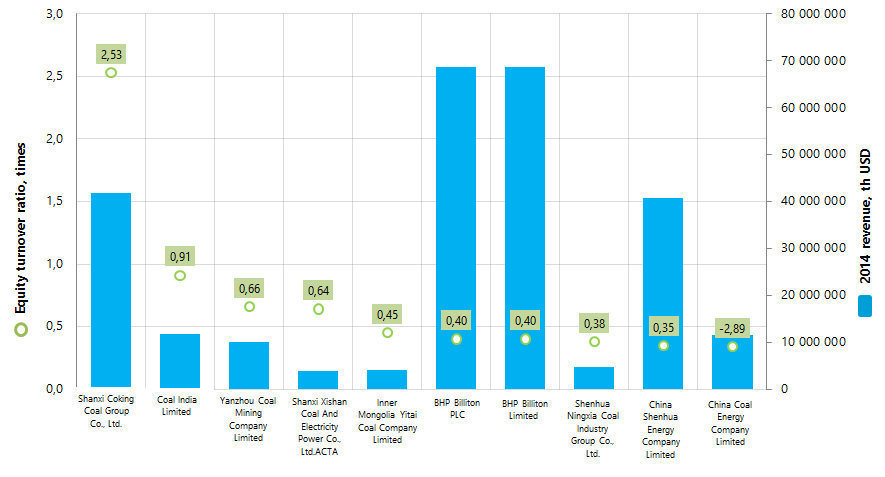

Information Agency Credinform has prepared the ranking of the largest global coal mining companies by equity turnover ratio. The world's largest enterprises in terms of 2014 revenue were selected within the industry. Then, the companies were ranked by equity turnover ratio (Top-10).

Equity turnover ratio (times) is calculated as a ratio of revenue to yearly average sum of equity and demonstrates the company’s usage rate of total assets.

Equity turnover ratio reflects the turnover rate of own capital. The higher is the ratio value, the better the enterprise uses its own funds. Low ratio value indicates about inaction of the part of own funds.

| № | Name | Country | 2014 revenue, th USD | Equity turnover ratio, times |

|---|---|---|---|---|

| 1 | Shanxi Coking Coal Group Co., Ltd. | China | 41 820 287 | 2,53 |

| 2 | Coal India Limited | India | 11 838 160 | 0,91 |

| 3 | Yanzhou Coal Mining Company Limited | China | 9 971 937 | 0,66 |

| 4 | Shanxi Xishan Coal And Electricity Power Co., Ltd. | China | 3 934 521 | 0,64 |

| 5 | Inner Mongolia Yitai Coal Company Limited | China | 4 084 748 | 0,45 |

| 6 | BHP Billiton PLC | Great Britain | 68 765 000 | 0,40 |

| 7 | BHP Billiton Limited | Australia | 68 724 000 | 0,40 |

| 8 | Shenhua Ningxia Coal Industry Group Co., Ltd. | China | 4 746 725 | 0,38 |

| 9 | China Shenhua Energy Company Limited | China | 40 689 820 | 0,35 |

| 10 | China Coal Energy Company Limited | China | 11 581 654 | 0,34 |

Equity turnover ratio of the world's coal mining leaders varies from 2,53 times (Shanxi Coking Coal Group Co., Ltd.), to 0,34 times (China Coal Energy Company Limited). Equity turnover ratio of the largest enterprise by annual revenue BHP Billiton PLC is 0,4 times per period.

Picture 1. Equity turnover ratio and revenue of the world's largest coal mining companies (TOP -10)

JOINT STOCK COMPANY SUEK-KUZBASS (INN 4212024138) is the largest Russian coal mining company, which is not included in the TOP-10 and takes the 29th place of the world's rating by 2014 annual revenue (1 224 208 th USD); the company’s equity turnover ratio is 29,9 times per period. At the same time, the ratio of the ranking’s leader Shanxi Coking Coal Group Co., Ltd. is 2,53 times.

Coal is still one of the most important sources of thermal power and valuable raw material for chemical industry. The share of coal and oil shale in total volume of world's fossil fuel reserves is about 90%, peat - 5%, oil and natural gases - 5%.

According to Statistical review of the world’s energy made by BP company in 2013: 7 896,4 mln tons of coal were produced in the world. The distribution of coal mining countries is reflected in Table 2.

| Country | 2013 coal mining, mln tons | The share in world production, % |

|---|---|---|

| People's Republic Of China | 3 680,0 | 46,60 |

| USA | 892,6 | 11,30 |

| India | 605,1 | 7,66 |

| Australia | 478,0 | 6,05 |

| Indonesia | 421,0 | 5,33 |

| Russia | 347,1 | 4,40 |

| South Africa | 256,7 | 3,25 |

| Germany | 190,3 | 2,41 |

| Poland | 142,9 | 1,81 |

| Kazakhstan | 114,7 | 1,45 |

The world's leader in coal mining is China, that is reflected in the current ranking: 7 out of 10 participants from the Top-10 list are Chinese companies.

For reference

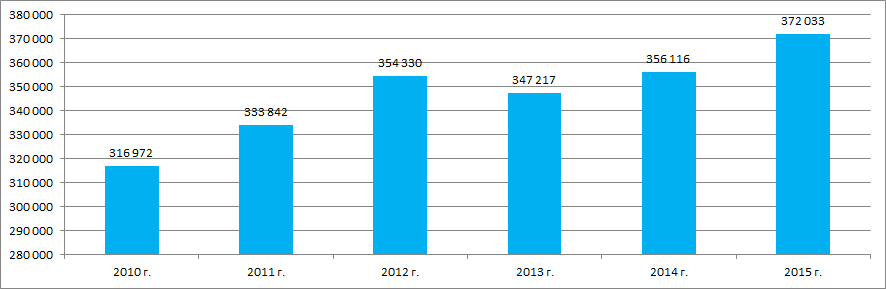

Picture 2. Coal mining in Russia in 2010 – 2015 (according to the Federal State Statistics Service), th tons