Absolute liquidity of state enterprises

Information agency Credinform represents the ranking of the largest unitary enterprises in Russia. The unitary enterprises (TOP-10) with the largest annual revenue were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available accounting periods (2017 - 2019). Then the enterprises were ranked by the absolute liquidity ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Absolute liquidity ratio (х) is calculated as a ratio of the amount of cash, being at the disposal of a company, to short-term liabilities.

The ratio determines the share of short-term liabilities, which an enterprise can satisfy in the near future, before satisfying receivables or sale of other assets.

The recommended value is from 0,1 to 0,15. The higher is the indicator, the better is the solvency of an enterprise. However, a too high ratio value might speak of an irrational capital structure and stranded assets in the form of cash and funds on bank accounts, which depreciate and lose their initial liquidity as time passes or as a result of inflation.

In order to get the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of financial indicators and company’s ratios.

| Name, INN, region | Revenue, billion RUB | Net profit (loss), billion RUB | Absolute liquidity ratio (x), from 0,1 to 0,15 | Solvency index Globas | |||

| 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| MAIN MILITARY CONSTRUCTION DEPARTMENT FOR SPECIAL OBJECTS INN 7734003657 Amur region,in process of reorganization in the form of transformation since 02.09.2016 |

31,82 31,82 |

44,77 44,77 |

-4,54 -4,54 |

-2,07 -2,07 |

0,09 0,09 |

0,06 0,06 |

322 Adequate |

| State Unitary Enterprise Fuel and Energy Complex of St. Petersburg INN 7830001028 Saint Petersburg |

30,90 30,90 |

32,12 32,12 |

0,29 0,29 |

0,30 0,30 |

0,04 0,04 |

0,06 0,06 |

213 Strong |

| State Unitary Enterprise Vodokanal Saint Petersburg INN 7830000426 Saint Petersburg |

35,80 35,80 |

36,88 36,88 |

0,64 0,64 |

1,74 1,74 |

0,04 0,04 |

0,08 0,08 |

206 Strong |

| State Unitary Enterprise Moscow metro INN 7702038150 Moscow |

118,20 118,20 |

126,49 126,49 |

-1,64 -1,64 |

-8,38 -8,38 |

0,15 0,15 |

0,12 0,12 |

251 Medium |

| ROSMORPORT INN 7702352454 Moscow |

26,92 26,92 |

28,87 28,87 |

1,03 1,03 |

0,84 0,84 |

0,46 0,46 |

0,20 0,20 |

193 High |

| State Unitary Enterprise Saint Petersburg Metro INN 7830000970 Saint Petersburg |

37,75 37,75 |

42,28 42,28 |

1,77 1,77 |

0,69 0,69 |

0,26 0,26 |

0,24 0,24 |

251 Strong |

| State Unitary Enterprise Mosgortrans INN 7705002602 Moscow |

43,22 43,22 |

41,12 41,12 |

-9,45 -9,45 |

-1,28 -1,28 |

0,37 0,37 |

0,32 0,32 |

298 Medium |

| FEDERAL STATE ENTERPRISE SECURITY OF RAILWAY TRANSPORT OF THE RUSSIAN FEDERATION INN 7701330105 Moscow |

29,78 29,78 |

31,61 31,61 |

0,31 0,31 |

0,31 0,31 |

0,51 0,51 |

0,54 0,54 |

233 Strong |

| Federal State-owned Enterprise Russian Television and Radio Broadcasting Network INN 7717127211 Moscow, In process of reorganization by spin-off since 04.07.2016 |

27,09 27,09 |

33,37 33,37 |

0,72 0,72 |

0,79 0,79 |

0,71 0,71 |

1,23 1,23 |

182 High |

| State Federal Unitary Enterprise State ATM Corporation INN 7734135124 Moscow |

110,63 110,63 |

117,49 117,49 |

32,82 32,82 |

14,69 14,69 |

8,85 8,85 |

8,28 8,28 |

182 Superior |

| Average value by TOP-10 companies |  49,21 49,21 |

53,50 53,50 |

2,20 2,20 |

0,76 0,76 |

1,15 1,15 |

1,11 1,11 |

|

| Average value by TOP-1000 companies |  1,53 1,53 |

1,62 1,62 |

0,01 0,01 |

-0,02 -0,02 |

0,44 0,44 |

0,51 0,51 |

|

improvement compared to prior period,

improvement compared to prior period,  decline compared to prior period

decline compared to prior period

Average value of absolute liquidity ratio of TOP-10 companies is higher than the average industry one. Only one company has the standard value in 2019.

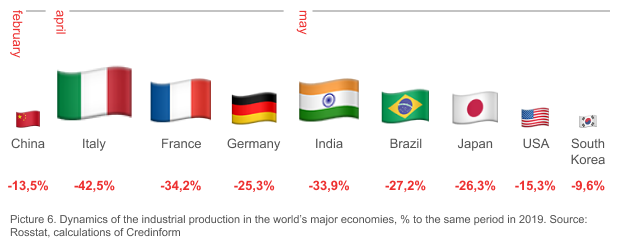

Picture 1. Absolute liquidity ratio and revenue of the largest unitary enterprises (TOP-10)

Picture 1. Absolute liquidity ratio and revenue of the largest unitary enterprises (TOP-10)Within 6 years the average industry values of absolute liquidity ratio TOP-1000 were on the whole beyond the limits of the standard value and tend to improve (Picture 2)

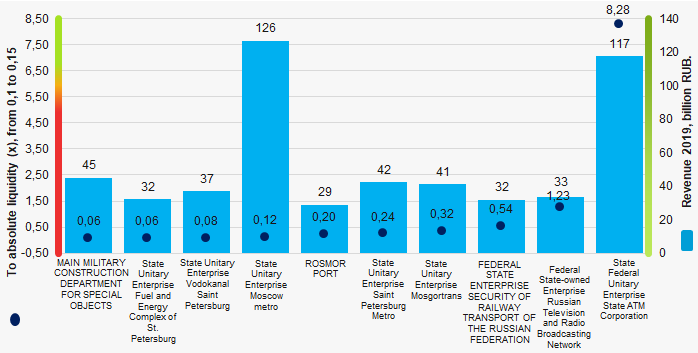

Picture 2. Change of industry average values of absolute liquidity ratio TOP-1000 unitary enterprises in Russia in 2014 – 2019

Picture 2. Change of industry average values of absolute liquidity ratio TOP-1000 unitary enterprises in Russia in 2014 – 2019Dynamics of the industrial production in Russia for 7 months of 2020

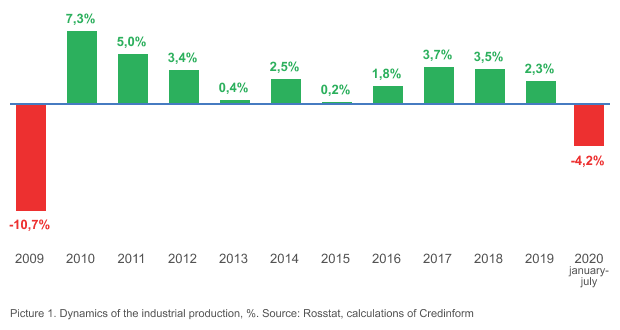

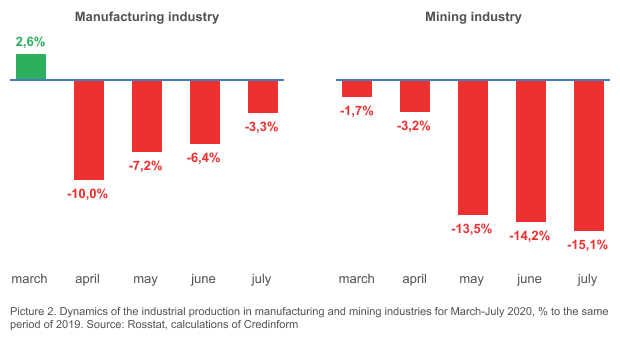

In January-July 2020, industrial production in Russia reduced by 4,2% comparing to the same period of the previous year. The maximum reduction to 9,6% was recorded in May. Since June there is an emerging trend to improve the situation.

The negative annual dynamics in the manufacturing industry was recorded also in 2009, the reduction was 10,7%.

Manufacturing recovers, and mining industry continues to slow down

In March 2020, manufacturing had an increase by 2,6% comparing to March 2019. After the restrictions imposed in April, there was recorded a slow down by 10% in comparison with April 2019. In July 2020, the reduction became slower and was 3,3% comparing to July 2019.

In March 2020, mining was slightly decreased by 1,7%. However, in April-June the decline increased and reached 15,1% in July. For a long time, oil and gas industry will be affected by negative demand for energy resources, as well as obligations of Russia as part of OPEC+ new deal.

In March 2020, mining was slightly decreased by 1,7%. However, in April-June the decline increased and reached 15,1% in July. For a long time, oil and gas industry will be affected by negative demand for energy resources, as well as obligations of Russia as part of OPEC+ new deal.Not oil alone

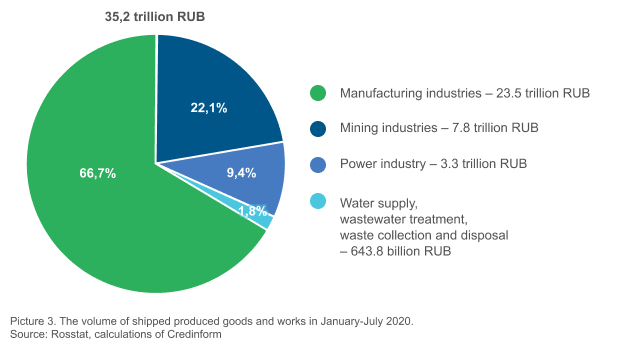

In the structure of the industry, the share of sectors producing products with high added value is increasing. In January-July 2020, manufacturing industries produced 66,7% of the total volume of goods, works and services in monetary terms; 22,1% - mining industries, 9,4% – electrical energy industry, 1,8% – water supply, wastewater disposal, waste collection and disposal. This dynamics of increasing the share of manufacturing industries has been traced for several years.

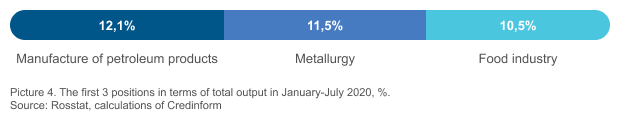

The structure of manufacturing industry

Manufacturing: affected sectors and growth leaders

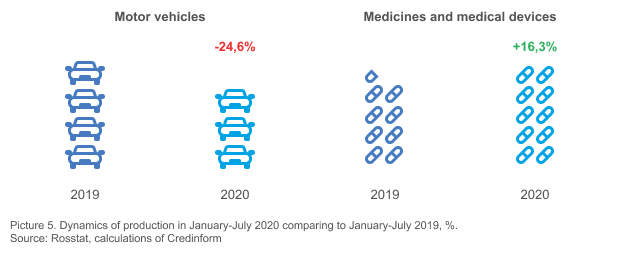

Automotive production is the worst affected sector of the manufacturing industry: in January-July 2020, the automotive industry decreased by 24,6% compared to the same period in 2019.

Enterprises producing medicines and medical devices benefited significantly: for 7 months of 2020, they increased supplies by 16,3%.

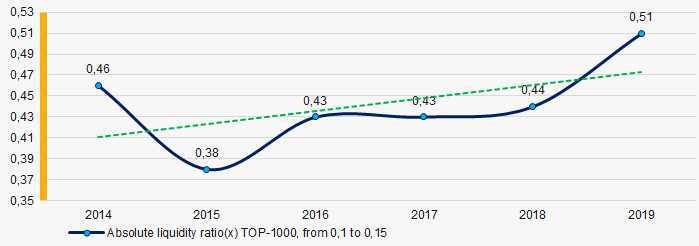

Crisis in industrial production of world’s major economies

The current situation has affected the world's industrial centers in different ways. The maximum decline in production, comparing to the same period in 2019, was recorded in April 2020: 42,5% in Italy, 34,2% in France, and 25,3% in Germany. In May 2020, there was the peak of the industrial crisis in India with a slow down by 33,9%, Brazil – 27,2%, Japan – 26,3%, the USA – 15,3%, and South Korea – 9,6 %.

China experienced the consequences of the pandemic earlier than other countries: the maximum decline by 13,5% was recorded in February 2020.