TOP-10 companies with 2020 financial accounts

Over 400 thousand companies have submitted 2020 financial accounts to the Federal Tax Service of Russia. The analysis of 2018 – 2020 revenue and net profit of the largest of them makes it possible to assess their efficiency in 2020. Companies with the largest volume of annual revenue (TOP-10 and TOP-1000) were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2018 - 2020) (Table 1). The selection and analysis is based on the data of the Information and Analytical system Globas.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, region, activity type | Revenue, billion RUB | Net profit (loss), billion RUB | Solvency index Globas | ||||

| 2018 | 2019 | 2020 | 2018 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| JSC ROSNEFT OIL COMPANY INN 7706107510 Moscow Oil extraction |

6 968,2 |  6 827,5 6 827,5 |

4 835,1 4 835,1 |

460,8 |  396,5 396,5 |

155,8 155,8 |

209 Strong |

| JSC GAZPROM NEFT INN 5504036333 Saint Petersburg Wholesale of solid, liquid and gaseous fuels |

2 070,0 |  1 809,8 1 809,8 |

1 512,8 1 512,8 |

90,2 |  216,9 216,9 |

162,6 162,6 |

220 Strong |

| JSC MINING AND METALLURGICAL COMPANY NORILSK NICKEL INN 8401005730 Krasnoyarsk territory Production of other non-ferrous metals |

609,1 |  878,1 878,1 |

923,9 923,9 |

165,0 |  514,7 514,7 |

300,1 300,1 |

185 High |

| LLC GAZPROMNEFT-REGIONAL SALES INN 4703105075 Saint Petersburg Wholesale of motor fuel, including aviation gasoline |

661,9 |  617,9 617,9 |

601,0 601,0 |

9,4 |  11,8 11,8 |

15,2 15,2 |

202 Strong |

| JSC SEVERSTAL INN 3528000597 Vologda region Production of cast iron, steel and ferroalloys |

432,8 |  457,6 457,6 |

450,9 450,9 |

124,3 |  105,7 105,7 |

114,9 114,9 |

222 Strong |

| JSC NOVOLIPETSK STEEL MILL INN 4823006703 Lipetsk region Production of cold-rolled steel sheets |

493,8 |  421,8 421,8 |

437,1 437,1 |

117,9 |  83,4 83,4 |

61,1 61,1 |

237 Strong |

| JSC MAGNITOGORSK IRON & STEEL WORKS INN 7414003633 Chelyabinsk region Production of cast iron, steel and ferroalloys |

458,2 |  434,9 434,9 |

400,2 400,2 |

73,7 |  55,6 55,6 |

51,5 51,5 |

172 Superior |

| JSC MOSENERGOSBYT INN 7736520080 Moscow Electricity trade |

351,0 |  370,4 370,4 |

372,8 372,8 |

2,3 |  4,0 4,0 |

4,1 4,1 |

196 High |

| LLC RN-YUGANSKNEFTEGAZ INN 8604035473 Khanty-Mansi autonomous district - Yugra Provision of services in the field of oil and natural gas production |

293,2 |  297,8 297,8 |

311,5 311,5 |

1,9 |  5,3 5,3 |

7,8 7,8 |

233 Strong |

| JSC AERFOLOT – RUSSIAN AIRLINES INN 7712040126 Moscow Transportation by scheduled air passenger transport |

504,7 |  551,8 551,8 |

229,8 229,8 |

2,8 |  5,3 5,3 |

-96,5 -96,5 |

284 Medium |

| Average value for TOP-10 | 1 284,3 |  1 266,8 1 266,8 |

1 007,5 1 007,5 |

104,8 |  139,9 139,9 |

77,7 77,7 |

|

| Average value for TOP-1000 | 18,8 |  18,8 18,8 |

15,4 15,4 |

1,8 |  2,1 2,1 |

1,0 1,0 |

|

growth of indicator to the previous period,

growth of indicator to the previous period,  decrease of indicator to the previous period

decrease of indicator to the previous period

The average values of revenue and net profit of TOP-10 companies are much above the average one of TOP-1000. In 2019, four companies have increased their values compared to the previous period.

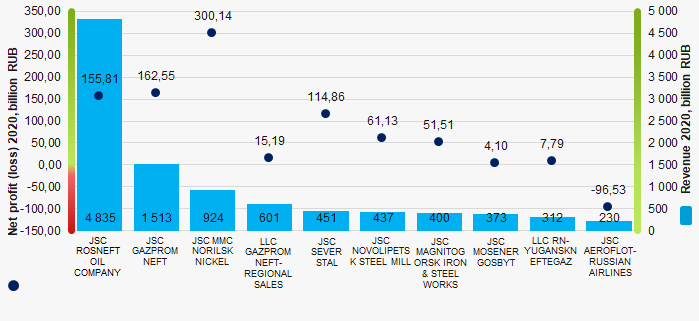

Picture 1. Net profit (loss) and revenue of the Russian companies submitted the 2020 financial accounts (TOP-10)

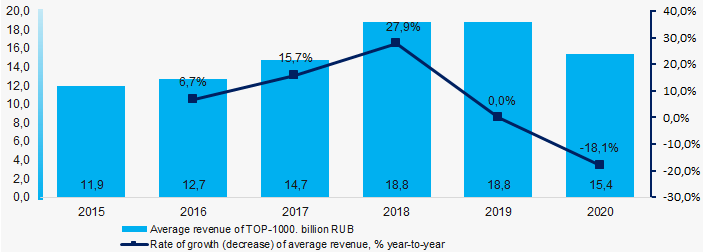

Picture 1. Net profit (loss) and revenue of the Russian companies submitted the 2020 financial accounts (TOP-10)In 2015 – 2018, the revenue of TOP-1000 companies had a trend to increase. In 2019, the zero increase rate was observed, and in 2020, it was the negative one. The 2020 revenue fell 18% (Picture 2).

Picture 2. Change in the average 2015 - 2020 revenue of TOP-1000 largest Russian companies submitted the 2020 financial accounts

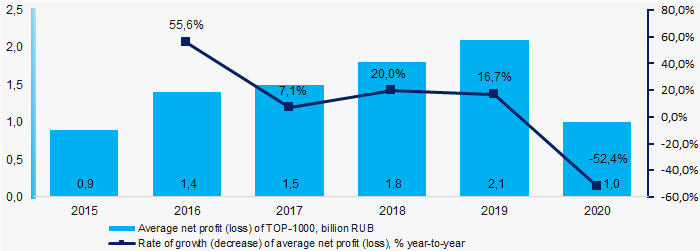

Picture 2. Change in the average 2015 - 2020 revenue of TOP-1000 largest Russian companies submitted the 2020 financial accountsA slight net profit gain among TOP-1000 companies, and diverse growth rate were recorded up to 2019. In 2020, there was almost double fell of the profit compared to the previous period (Picture 3).

Picture 3. Change in the 2015 - 2020 net profit of TOP-1000 largest Russian companies submitted the 2020 financial accounts

Picture 3. Change in the 2015 - 2020 net profit of TOP-1000 largest Russian companies submitted the 2020 financial accountsTOP-1000 of the largest taxpayers

Information agency Credinform represents a ranking of the largest Russian taxpayers.

The largest income tax payers with the highest annual revenue (TOP-1000) were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2014 - 2019). The selection and analysis of companies were based on the data of the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company in term of net assets is JSC ATOMIC ENERGY POWER CORPORATION, INN 7706664260, Moscow, other information technology and computer service activities. In 2019, net assets value of the company almost amounted to 1 352 billion RUB.

The lowest net assets value among TOP-1000 belonged to LLC RN-VOSTOKNEFTEPRODUKT, INN 2723049957, Khabarovsk territory, wholesale of motor-fuel, including aviation fuel. In 2019, insufficiency of property of the legal entity was indicated in negative value of -7,5 billion RUB.

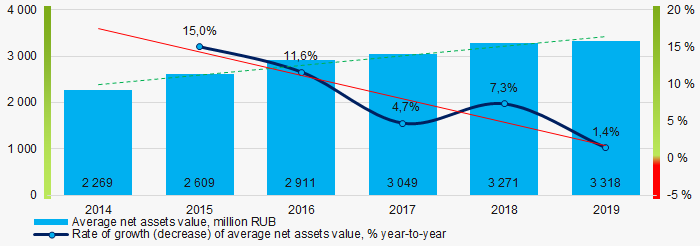

Covering the six-year period, the average net assets values of TOP-100 have a trend to increase with a decreasing growth rate (Picture 1).

Picture 1. Change in industry average net assets value in 2014 – 2019

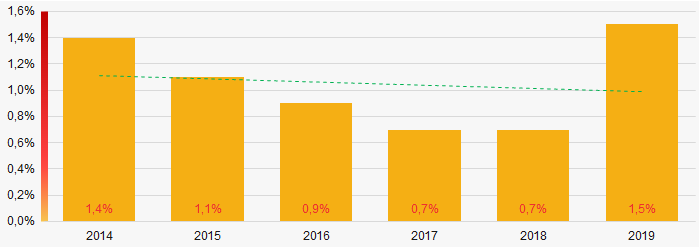

Picture 1. Change in industry average net assets value in 2014 – 2019Over the past six years, the share of companies with insufficient property had a positive trend to decrease (Picture 2).

Picture 2. Shares of TOP-1000 companies with negative net assets value in 2014-2019

Picture 2. Shares of TOP-1000 companies with negative net assets value in 2014-2019Sales revenue

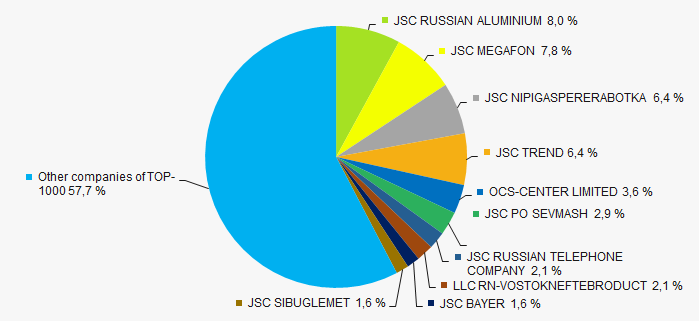

In 2019, the revenue volume of ten largest companies was 42% of total TOP-1000 revenue (Picture 3). This is indicative of a quite high level of aggregation of capital in the examined group of companies.

Picture 3. The share of TOP-10 companies in total 2019 revenue of TOP-1000

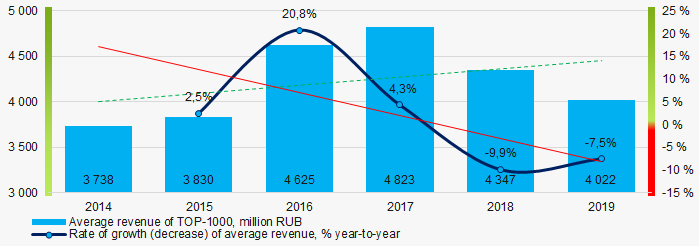

Picture 3. The share of TOP-10 companies in total 2019 revenue of TOP-1000In general, there is a trend to increase in revenue with the decreasing growth rate (Picture 4).

Picture 4. Change in industry average net profit in 2014 – 2019

Picture 4. Change in industry average net profit in 2014 – 2019Profit and loss

The largest organization in term of net profit is JSC NIPIGASPERERABOTKA, INN 2310004087, Tyumen region, development of industrial processes and production project. The company’s profit for 2019 exceeded 11 billion RUB.

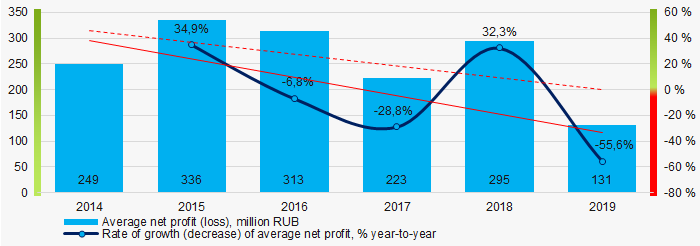

Covering the six-year period, there is a trend to decrease in average net profit with the decreasing growth rate (Picture 5).

Picture 5. Change in industry average net profit (loss) values in 2014 – 2019

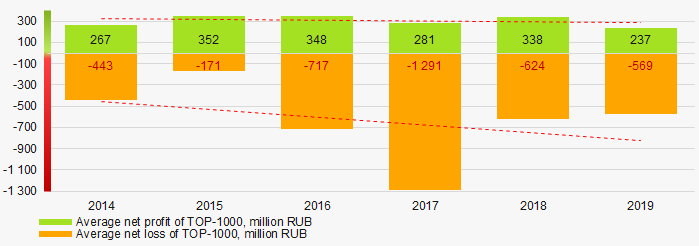

Picture 5. Change in industry average net profit (loss) values in 2014 – 2019For the six-year period, the average net profit values of TOP-1000 have the decreasing trend with the increasing net loss (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2014 – 2019

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2014 – 2019Key financial ratios

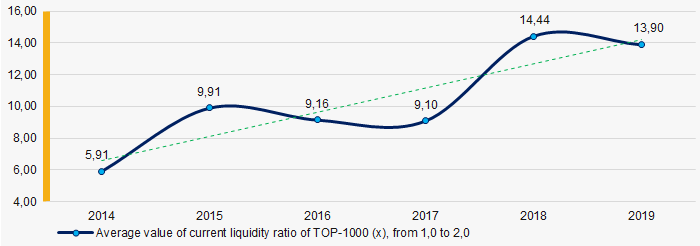

Covering the six-year period, the average values of the current liquidity ratio were much above the recommended one - from 1,0 to 2,0 with a trend to increase (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in industry average values of current liquidity ratio in 2014 – 2019

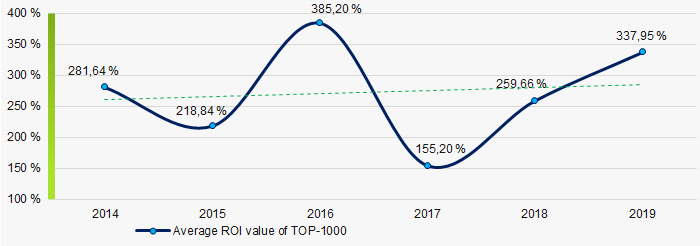

Picture 7. Change in industry average values of current liquidity ratio in 2014 – 2019Covering the six-year period, the average values of ROI ratio were at the high level with a trend to increase (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in industry average values of ROI ratio in 2014 – 2019

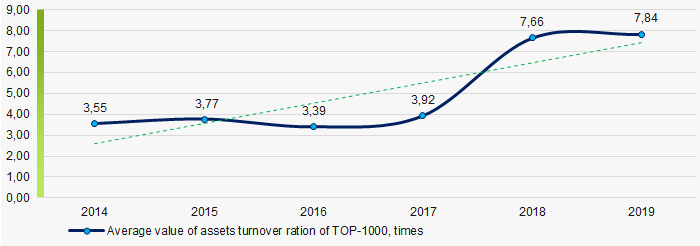

Picture 8. Change in industry average values of ROI ratio in 2014 – 2019Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Covering the six-year period, business activity ratio demonstrated the increasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2014 – 2019

Picture 9. Change in average values of assets turnover ratio in 2014 – 2019Small business

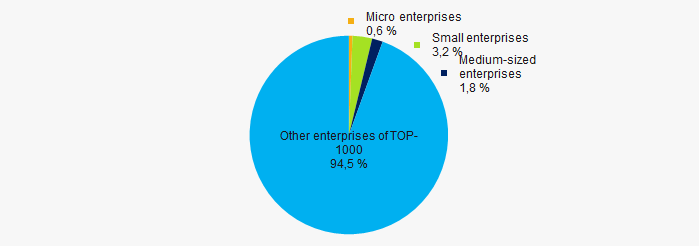

66% of companies included in TOP-1000 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. Their share in total revenue of TOP-1000 is 5,5% that is much lower than the average country values (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in TOP-1000

Picture 10. Shares of small and medium-sized enterprises in TOP-1000Main regions of activity

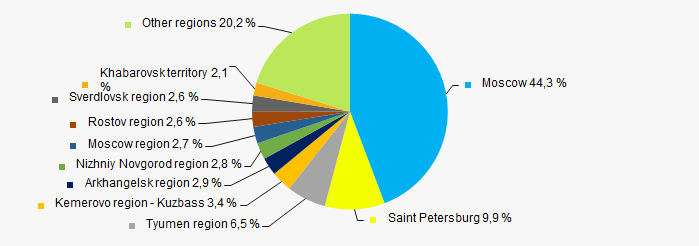

Companies of TOP-1000 are registered in 65 regions of Russia, and unequally located across the country. Over 54% of companies largest by revenue are located in Moscow and Saint Petersburg (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by regions of Russia

Picture 11. Distribution of TOP-1000 revenue by regions of RussiaFinancial position score

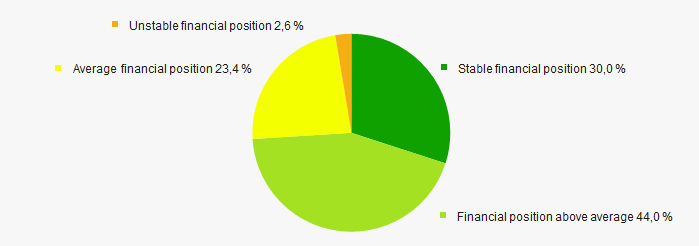

Assessment of the financial position of TOP-1000 companies shows that the majority of them have financial position above average (Picture 11).

Picture 12. Distribution of TOP-100 companies by financial position score

Picture 12. Distribution of TOP-100 companies by financial position scoreSolvency index Globas

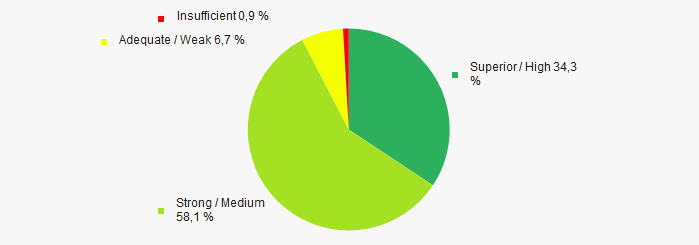

Most of TOP-1000 companies got Superior / High and Strong / Medium indexes Globas. This fact shows their limited ability to meet their obligations fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasConclusion

Complex assessment of activity of the largest taxpayers, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of negative trends in 2014 - 2019 (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decrease) in the average size of net assets |  -10 -10 |

| Increase (decrease) in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition / monopolization |  -10 -10 |

| Dynamics of the average revenue |  10 10 |

| Rate of growth (decrease) in the average size of revenue |  -10 -10 |

| Dynamics of the average profit (loss) |  -10 -10 |

| Rate of growth (decrease) in the average profit (loss) |  -10 -10 |

| Growth / decline in average values of companies’ net profit |  -10 -10 |

| Growth / decline in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  5 5 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  10 10 |

| Share of small and medium-sized businesses in terms of revenue being more than 22% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of factors |  -0,9 -0,9 |

positive trend (factor),

positive trend (factor),  negative trend (factor)

negative trend (factor)