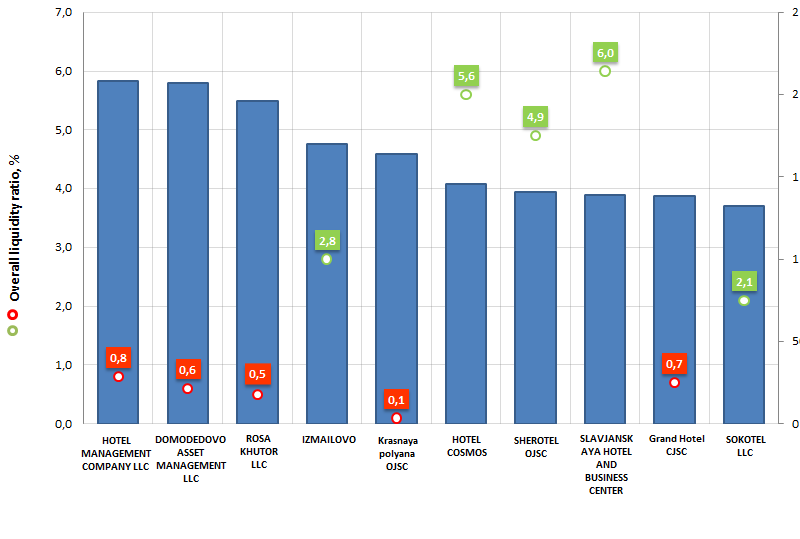

Overall liquidity ratio of Russian hotel complexes

Information Agency Credinform has prepared the ranking of the largest Russian hotel chains.

Top-10 enterprises in terms of revenue were selected according to the data from the Statistical Register for the latest available period (for the year 2014). The enterprises were ranked by decrease in annual revenue; besides, revenue trend data relative to previous period, overall liquidity ratio and solvency index GLOBAS-i® is also represented (see table 1).

Overall liquidity ratio - characterizes the ability of the company to secure short-term obligations by the most easily realizable part of assets – working capital. The recommended value is from 1,0 to 2,0.

Ratio value equal 1 assumes equality of the current assets and liabilities. Excessively high values may testify about unsatisfactory assets management, loss of liquidity taking into account the time factor. The value below 1 testifies about financial risk, connected with inability to fulfill current liabilities regularly.

For the most full and fair opinion about the company’s financial situation, not only the average values of the indicators should be taken into account, but also the whole set of financial indicators and ratios.

| № | Name | Region | Revenue, mln RUB, 2014 | Revenue growth,% | Overall liquidity ratio, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | LLC HOTEL MANAGEMENT COMPANY INN 7710578737 |

Moscow | 2 081,2 | -13,4 | 0,8 below normal |

300 satisfactory |

| 2 | DOMODEDOVO ASSET MANAGEMENT (Airhotel) INN 5009096987 |

Moscow Region | 2 070,2 | 7,3 | 0,6 below normal |

322 satisfactory |

| 3 | SKI RESORT DEVELOPMENT COMPANY ROSA KHUTOR , LLC INN 7702347870 |

Moscow | 1 959,7 | 76,3 | 0,5 below normal |

280 high |

| 4 | TOURIST HOTEL COMPLEX "IZMAILOVO" INN 7719017101 |

Moscow | 1 698,5 | -3,1 | 2,8 above normal |

161 the highest |

| 5 | OJSC Krasnaya polyana INN 2320102816 |

Krasnodar Region | 1 641,6 | 920,9 | 0,1 below normal |

306 satisfactory |

| 6 | HOTEL COSMOS INN 7717016198 |

Moscow | 1 456,6 | -5,8 | 5,6 above normal |

184 the highest |

| 7 | OJSC SHEROTEL INN 7712014856 |

Moscow Region | 1 405,4 | 5,4 | 4,9 above normal |

249 high |

| 8 | SLAVJANSKAYA HOTEL AND BUSINESS CENTER (Radisson Slavyanskaya Hotel) INN 7730001183 |

Moscow | 1 387,3 | -3,8 | 6,0 above normal |

197 the highest |

| 9 | CJSC Grand Hotel (Marriott Grand Hotel) INN 7707172215 |

Moscow | 1 381,7 | -12,5 | 0,7 below normal |

259 high |

| 10 | LLC SOKOTEL (Sokos Hotel) INN 7841338200 |

Saint-Petersburg | 1 324,2 | -2,3 | 2,1 above normal |

273 high |

Overall liquidity ratio of the largest Russian hotel chains does not fit the recommended standard values (both for lower and upper boarder). In the first case it is the excess of current liabilities over assets; that may lead the company to financial crisis because of inability to fulfill liabilities. In the second case it is the irrational structure of capital, as if not to put it in requisition, the risk of loss of a certain percentage of liquidity is growing up.

Picture 1. Revenue and overall liquidity ratio of the largest Russian hotel chains (Top-10)

According to the latest financial statements (2014), the revenue of the largest Russian hotel chains (Top-10), amounted to 16,4 bln RUB, that is 12,3% higher than total sum in 2013.

The development of hotel business in Russian is significantly changing. The growth of USD and EUR rate influences on the amount of hotel visitors. The owners are forced to reduce the price of the rooms in order to attract the tourists.

The foreign policy of Russia and the impact of foreign mass media are negatively influence on travel activity level in Saint-Petersburg, Moscow and other Russian cities. The image of «aggressive country» decreased the popularity level of excursions across the country. On average, the price of a hotel room decreased by 8%. The hotels are forced to change its rent conditions in connection with decrease in business activity among Russian regions.

The growth rate influenced people’s choice. Now people choose cheaper hotels with service level not worse, than in expensive hotels; however, as a rule, such hotels are located farther from the center. Infrastructure level is also lower than lux rooms in the city center. According to the experts, today the 70% fill rate is the great indicator for hotel business owners.

Russia will continue to develop

The outgoing year was quite complicated: the consumer demand and real income of the population have decreased; capital outflow came amid high bank credit rates and closing up of many investment programs; reduction of the GDP and industrial production was recorded for the first time since 2009; inflation was significantly accelerated. However, sanctions and devaluation of the ruble resulted in net profit double-valued growth of many domestic companies. Expensive import and low ruble smoothed path for the Russian manufacturers to the domestic market; now there is an opportunity to push export more efficiently.

Moreover, a number of major investment projects are at the final stage. The next year we expect them to be completed or to be in a startup phase of first priority (see table 1).

Table 1. Major investment projects of Russia expecting to be completed (in full/alternately) in 2016, investment volume exceeds 100 bln RUB.

| № | Project | Region, city/town | Investor | Investment declared, bln RUB |

|---|---|---|---|---|

| 1 | Construction of “Western High-Speed Diameter” high-speed motorway. The central section | Saint-Petersburg | Northern Capital Highway, LLC | 213 |

| 2 | Unit for petrol production on Kirishi oil refinery | The Leningrad region, Kirishi | OJSC Surgutneftegas | 170 |

| 3 | Gas chemical complex in Budennovsk | The Stavropol Territory, Budennovsk | LUKOIL oil company | 140 |

| 4 | Boguchansky aluminum plant | The Krasnoyarsk Territory, Tayezhniy settlement | OJSC RUSAL | 122 |

| 5 | Reconstruction of Komsomolsk oil refinery | The Khabarovsk Territory, Komsomolsk-na-Amure | OJSC ROSNEFT | 119 |

Western High-Speed Diameter. The central section is a toll high-speed motorway aimed at transport connection of the Big port Saint-Petersburg with the federal ways to Moscow, regions of Russia, the Baltics and Northland countries through the ring road. The motorway will also reduce traffic load in the historical part of the city.

Kirishi oil refinery will raise the oil refining ratio. A unit for the production of Euro-5 high-octane gasoline and the capacity of 2 bln t/year is constructing.

Gas chemical complex in Budennovsk (as a part of OOO “Stavrolen”) will process up to 5 bln cubic meters/year of gas from the North Caspian fields. The complex will be the largest center in Russia for manufacture of polymers (along with OOO “Tobolsk-Polimer”). Considering that there was almost no modern polymer production in Russia until recently, the mentioned event will be momentous for the whole Russian industry.

Boguchansky aluminum plant is one of the most modern and the largest metallurgical enterprise in Russia. In terms of full capacity, the plant takes the 3rd place following the Krasnoyarsk and Bratsk aluminum plants. Boguchansky plant is able to manufacture about 600 th tons of aluminum per year.

Komsomolsk oil refinery will be modernized. This will help to raise the oil refining ratio. The high value added products are always of high demand, for example for the PRC, our neighbor from the East.

In addition to the infrastructure projects mentioned above, many other programs are implemented despite of all difficulties. The outside observer will be quite surprised after exploring them: the stereotype about the country trading with raw materials without recycling and “manufacturing nothing” for the self-use is just a frustrated affirmation.

Absent circumstances of insuperable force, the GDP and industrial production growth are expected to raise in the medium-term. The reduction of the Central Bank key rate will revive the credit market.

Information agency Credinform congratulates you with the forthcoming New Year! May the 2016 year give you new business prospects, investments for the development and new clients!