Business entity should know its counterparty

On July 18, 2017, the President of the RF has signed the Federal Law «On amendments to Part One of the Russian Tax Code» (№163-FZ). This statutory instrument is also called the «law on tax abuses». According to the developers, the main objectives of this law are the identifying of common and understandable signs that testify to the facts of abuse, the uniform application of the developed law-enforcement approaches and thereby the creation of fair business environment and exclusion of unfair competition.

According to the law, the signs, which testify to the facts of abuse:

- distortion of information about facts of business life (a combination of such facts), about objects of taxation that are to be recorded in tax accounting and/or bookkeeping or in tax reporting of a taxpayer;

- non-payment (partial payment) and/or set-off (refund) of a tax amount considered as the main objectives of the transaction (operation);

- fulfillment of the obligation for a transaction (operation) by the person, who is not the party to the contract concluded with a taxpayer and/or a person, to whom the obligation to execute the transaction (operation) under the contract or the law has not been transferred.

In addition, the law determines that the following facts should not be considered as illegal as the ground for recognizing the fact that the taxpayer decreases the tax base and/or the amount of tax payable:

- signing of primary accounting documents by an unidentified or unauthorized person;

- violation by a counterparty of a taxpayer of the legislation on taxes and fees;

- possibility of a taxpayer to receive the same result of economic activity when making other transactions (operations) that are not prohibited by the law.

All mentioned above is equally applicable to payers of fees, insurance payments and tax agents. It is crucially that the law imposes the duty on tax authorities to prove facts of abuse by a taxpayer.

The developers believe that the law requires to proceed only from the reality of transactions (operations) carried out by a taxpayer. It makes possible to avoid the use of vague notions such as «business purpose», «impossibility of real performance of transactions», «lack of necessary conditions», «non-exercise of due diligence».

Experts of the Information agency Credinform believe that the notion of «due diligence and caution» will not disappear from the practice of the business. This concept is much broader than it is considered and used by tax authorities, assessing a taxpayer for the existence of facts of unjustified tax benefit.

«Due diligence and caution» from the point of view of doing business means, first of all, a comprehensive check of a counterparty by business entity and proceeds from an assessment of possible risks from cooperation with him, his experience, understanding of the ability to perform the contract by the contractor. As the ultimate goal of such inspection is considered the necessity to avoid signing a contract with a fly-by-night company or with a firm that has problems with solvency, or an organization that undergoes bankruptcy proceedings or uses fraudulent schemes etc.

In its letter from March 23, 2017 (№ED-5-9/547@) the tax service pays attention to this in the course of inspection by requesting documents from the taxpayer that record the results of the search, monitoring and selection of a counterparty; results of market monitoring of the relevant goods (works, services); study and evaluation of potential counterparties, their business reputation, solvency, availability of necessary resources, experience; including documented rationale for choosing a particular counterparty and other aspects.

The Information and Analytical system Globas will make it possible to report to the tax service on all the positions mentioned in the letter. The system has an intellectual search for information on business entities both in Russia and abroad, the corresponding analytical capabilities for the diagnostics of the business of a counterparty, assessment of the state of industries, of the competitive environment, solution of business problems, making managerial decisions to prevent (reduce) entrepreneurial risks and factors of their influence.

The largest debtors in the first half of 2017

Following the results of the first half of 2017, there are 418 debtor companies in Russia against which the monitoring procedure in cases of insolvency (bankruptcy) was introduced.

The monitoring procedure is an initial stage of bankruptcy aimed at ensuring the safety of the debtor's property, conducting of its financial condition analysis and compiling a register of creditors' demands. At this stage, the potential of restoration of solvency and the expediency of continuing the activities of the organization are studied, realistic terms for such recovery are settled. Alongside the current management, the temporary administrator (temporary administration) appointed by the court starts to work in the firm.

Introduction of a monitoring procedure does not necessarily lead to irreversible negative consequences. The decision can be appealed in higher instances, or the parties can reach an amicable agreement, or the court can completely stop the proceedings and break the bankruptcy procedure. Nevertheless, the fact of such situation gives reason the company’s current and potential counterparties to think over the question: how did the company allow the situation when creditors are forced to return their funds with a measure of last resort?

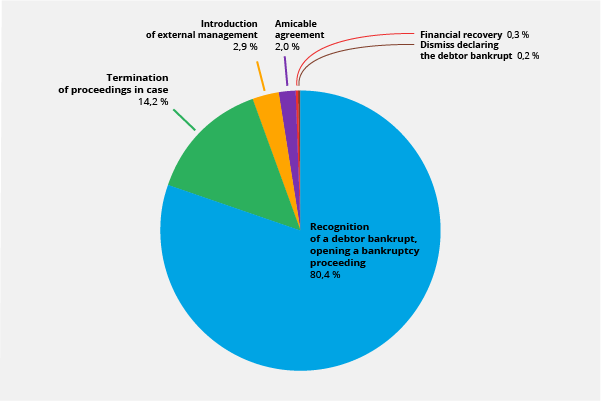

If the company failed to reach an agreement with the partners from the get-go and avoid a monitoring procedure, it is important for all the parties to understand what scenarios are possible. Following the summary statistics of arbitration courts for 2016, the scenario in the further examination of cases after the monitoring procedure introduction can be as follows: 80,4% of court decisions are aimed at recognizing the debtor as bankrupt and opening a bankruptcy proceeding; in 14,2% of cases the court closes the proceedings, including due to an amicable agreement between the parties - 2% of decisions; in 2,9% of cases, external management is introduced and only in 0,3% of cases financial recovery or refusal to recognize the company bankrupt is ordered– 0,2% of decisions (see Picture 1).

Picture 1. Results of monitoring procedure in cases of insolvency (bankruptcy), % of total number of decisions made by arbitration courts in 2016

Picture 1. Results of monitoring procedure in cases of insolvency (bankruptcy), % of total number of decisions made by arbitration courts in 2016For the majority of companies against which the monitoring procedure was introduced, the situation goes not the best way and the bankruptcy proceeding being a final stage of bankruptcy of a debtor company in the Russian legislation is initiated. The main goal is an adequate consideration of creditors’ demands, determining priority and sources of payments. The bankruptcy proceedings is introduced for a period of 6 months with the possibility of extending at the request of one of the party, but not more than on six months.

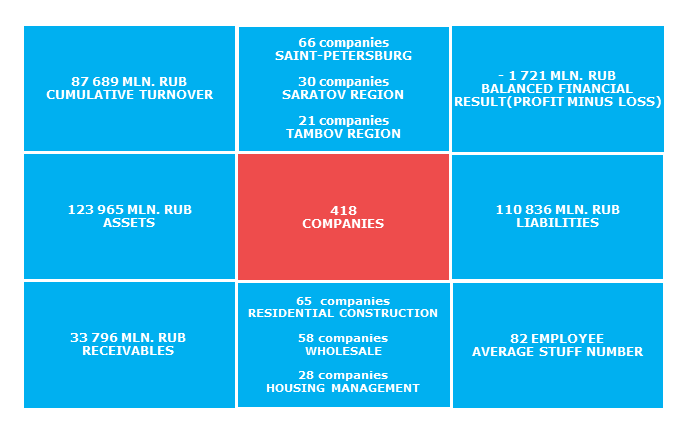

The following is a summary analysis of all companies against which a monitoring procedure in the first half of 2017 was introduced: the majority of total 418 legal entities are registered in Saint-Petersburg, Saratov and Tambov regions; 65 companies are engaged in residential construction, 58 – in wholesale; 28 – in housing management. Industry classification of business captured by difficult economic factors is quite understandable: the current crisis is characterized by a significant reduction in real incomes of the population, and as a result - fall in demand for housing, and general decrease in consumption. As for managing companies, the sector of housing and communal services traditionally refers to loss-making and low-profitable segment of the economy. Other highlights of the debtors' activities are presented on Scheme 1.

Scheme 1. Highlights of companies against which the monitoring procedure was introduced in the 1st half of 2017.

Scheme 1. Highlights of companies against which the monitoring procedure was introduced in the 1st half of 2017.The largest company in terms of assets, against which the monitoring procedure was introduced in the 1st half of 2017, is Essen Production AG engaged in production of ketchup, mayonnaise, sweet cereals and snacks under “Makheev” and “Obzhorka” brands. Currently the case № А55-23870/2016, is in cassation instance, and it seems like the company will not be declared bankrupt, because courts of higher instances abolished the decision on the monitoring procedure made by the court of first instance. Since the process has not yet been completed, and the next hearing is scheduled for August 10, 2017, there is still no need to talk about the full rehabilitation of the debtor.

| № | Debtor | Assets, mln RUB | Scope of business | Bankruptcy case No | Instance |

| 1 | Essen Production AG Samara region |

9 509 | Production of food products under “Makheev” and “Obzhorka” brands | А55-23870/2016 | Cassation |

| 2 | JSC PROGNOZ Perm territory |

5 635 | Development of predictive-analytical IT-systems | А50-22272/2016 | Appeal |

| 3 | LLC MERIDIAN Saint-Petersburg |

4 812 | Financial intermediation | А56-73628/2016 | First |

| 4 | JSC NOVAYA SKANDINAVIA (frm ZAO Gruppa Praim ) Saint-Petersburg |

3 562 | Construction | А56-96685/2015 | Appeal |

| 5 | LLC «Savelovo machine-building plant» Tver region |

3 256 | Mechanical engineering | А66-10803/2016 | First |

| 6 | ZAO MEGALIT Saint-Petersburg |

3 246 | Construction | А56-68290/2016 | Cassation |

| 7 | LLC OBUKHOVOENERGO Saint-Petersburg |

3 001 | Power industry, generation | А56-63788/2016 | First |

| 8 | JSC TREST MORDOVPROMSTROY Republic of Mordovia |

2 817 | Construction | А39-2735/2016 | Appeal |

| 9 | LLC VOLZHSKY PLANT OF CONSTRUCTION MATERIALS Republic of Tatarstan |

2 592 | Production of building materials | А65-24952/2016 | Appeal |

| 10 | ZAO ORANGE-DEVELOPMENT Saint-Petersburg |

2 501 | Construction | А56-72827/2015 | First |

Bankruptcy gives a positive effect: it is a method of eliminating inefficiently operating organizations from the market. However, it is often accompanied with special circumstances and does not always have legal features: redistribution of property, monopolization of certain goods and services markets, connections to the criminal world. In view of the mentioned factors, it is especially important for the enterprise, industry and economy in general to obtain an objective picture of financial and economic state and stability level of the enterprise.

When checking counterparties, it is necessary to pay attention to cases of insolvency (bankruptcy), in which the company acts as a defendant. It is a rare occasion when outcome is favorable for the defendant. If the decision on the monitoring procedure is made, organizations are declared bankrupt in 80% of cases.

Existence of bankruptcy cases in which the counterparty acts as a creditor (plaintiff) is also has to be considering from a negative point of view. It is necessary to take into account the overall duration of the proceedings, which sometimes goes on for several years (consequently, costs are increased). In addition, it will be quite difficult to obtain the initially claimed amount: as a rule, the debtor does not have readily obtainable assets for sale. Not to bring the case to court is the best solution for parties.

Information and Analytical system Globas provides an overall assessment of the financial and economic activities of companies, as well as ability of immediate check of arbitration practices of counterparties.