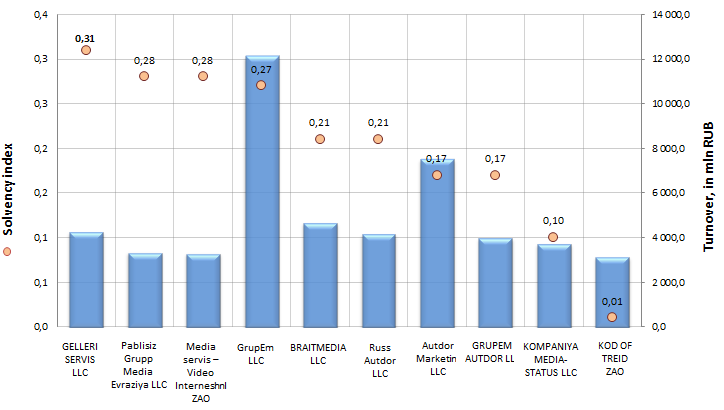

Solvency ratio of enterprises involved in advertising business

Information agency Credinform prepared a ranking of companies engaged in advertising business.

The enterprises with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2012). These firms were ranked by decrease in the value of solvency ratio. It shows company’s dependence on external borrowings.

Recommended value: > 0,5.

The indicator is interesting first of all for investors, engaged in long-term investing, i.e. the ratio characterizes firm's ability to satisfy its long-term obligations.

It’s to be understood that recommended values can differ essentially as well for enterprises of different branches, as for organizations of the same industry.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to industry-average indicators in the branch, but also to all presented combination of financial data.

| № | Name | Region | Turnover, in mln RUB, for 2012 | Solvency index, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | GELLERI SERVIS LLC INN: 7714564333 |

Moscow | 4 270,1 | 0,31 | 246 high |

| 2 | Pablisiz Grupp Media Evraziya LLC INN: 7743068844 |

Moscow | 3 356,8 | 0,28 | 187 the highest |

| 3 | Media servis – Video Interneshnl ZAO INN: 7723141052 |

Moscow | 3 308,6 | 0,28 | 190 the highest |

| 4 | GrupEm LLC INN: 7731529770 |

Moscow | 12 144,5 | 0,27 | 250 high |

| 5 | BRAITMEDIA LLC INN: 7707600213 |

Moscow | 4 692,0 | 0,21 | 254 high |

| 6 | Russ Autdor LLC INN: 7731196087 |

Moscow region | 4 178,8 | 0,21 | 228 high |

| 7 | Autdor Marketing LLC INN: 7709272021 |

Moscow | 7 533,1 | 0,17 | 296 high |

| 8 | GRUPEMAUTDORLLC INN: 7731568779 |

Moscow | 3 988,9 | 0,17 | 230 high |

| 9 | KOMPANIYA MEDIA-STATUS LLC INN: 7718840440 |

Moscow | 3 734,9 | 0,10 | 230 high |

| 10 | KOD OF TREID ZAO INN:7710601954 |

Moscow | 3 137,6 | 0,01 | 313 satisfactory |

Picture 1. Solvency ratio, turnover of the largest enterprises engaged in advertising business (TOP -10)

The turnover of the largest enterprises involved in advertising business (TOP-10) made 50,345 bln RUB. The leaders accumulate up to 20% of sales revenue of all companies of the branch. The average solvency ratio of TOP-10 list is 0,2, what is less than recommended values. This points to that the mentioned service sector is dependent enough on attracted funds, what is explained to a large extent by specific character of its work – advertising and PR orders, contract cost are not always constant values.

On the other hand, according to the independent estimation of the Information agency Credinform, the organizations of the TOP-10 list got a high and the highest solvency index (except KOD OF TREID ZAO), what can signal to a potential investor, that the enterprises can pay off their debts in time and fully, while risk of default is minimal or low.

See also: Solvency ratio of dental clinics

The enterprises would be given a jump start to buy new equipment

In spite of slackening in the rate of economic growth, the Government of the Russian Federation proposed to make revaluation of the equipment belonging to companies in accordance with its market price as of January 1, 2015 in the next year.

The account is laid with the fact that the outdated equipment will be imposed by increased property tax. As a result, the companies would be incented to replace it with more advanced counterpart. This will lead to general modernization of the country.

On the one hand, the idea isn’t baseless, as many plants in our country are fit with the machinery produced many decades ago, i.e. in the Soviet period, that directly influence the quality and competitive ability of the released product, service and finished costs (under general expenses on maintenance works of outdated equipment).

In this regard, the Ministry of Finance proposes to reevaluate the equipment in the accounting report of the large and medium industrial, transport and telecommunication enterprises in accordance with their market price as of January 1, 2015.

Residual value of equipment in ownership, in rent (with the right of redemption) and on lease will be subject to adjustment. The changes will be included on determination of the tax base while calculating of the property tax.

This measure won’t affect small enterprises. Besides, new requirements won’t impose the equipment in the process of disposal.

However, owing to sanctions on the part of the Western countries which prohibit among other things the supply of the double-purpose equipment, continuing stagnation of the Russian economics, it would be difficult for Russian companies to carry out the governmental plan. If the program is adopted in legislation, it will with high probability lead to short-term perspective of production cost increase and decrease of enterprise profitability. As a result, there will be inevitable price increase, the dynamics of which doesn’t fall into bounds outlined for it by financial authorities.