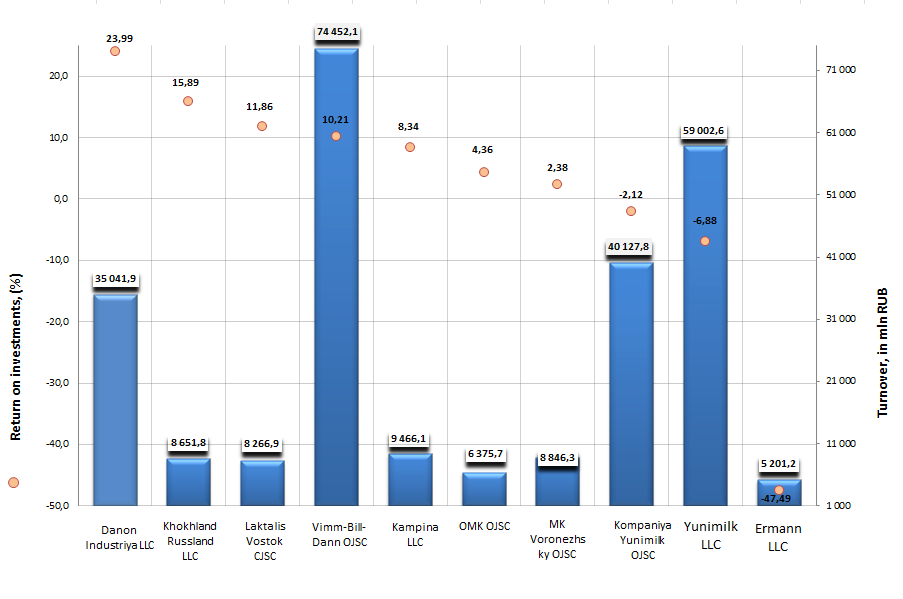

Return on investment of dairy products manufacturers

Information agency Credinform offers to get acquainted with the ranking of Russian manufacturers of dairy products. The companies with the highest volume of revenue involved in this activity were selected by the experts according to the data from the Statistical Register for the latest available period (for the year 2013). Then, the first 10 enterprises selected by turnover were ranked by decrease in return on investment.

Return on investment is the indicator of the benefit from own capital of an organization, involved in business activities, and borrowed funds at a long date. It is calculated as the ratio of net profit to the sum of own capital and long-term liabilities.

As is known, there are no specified values prescribed for profitability ratios, because they vary strongly depending on the branch, where an enterprise operates. Therefore, each concrete company should be investigated in comparison with industry indicators. The importance of the return on investment ratio is not only that it shows benefit from invested assets, but also that, based on this ratio, it is possible to estimate the advisability of borrowing funds at certain interest: company should take credits, the interest on which is lower, than profitability of investment capital.

| № | Name | Region | Turnover in mln RUB, for 2013 | Return on investment, (%) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Danon Industriya LLC INN 5048005969 |

Moscow region | 35 042 | 23,99 | 218 (high) |

| 2 | Khokhland Russland LLC INN 5040048921 |

Moscow region | 8 652 | 15,89 | 170 (the highest) |

| 3 | Laktalis Vostok CJSC INN 7716128854 |

Moscow region | 8 267 | 11,86 | 229 (high) |

| 4 | Vimm-Bill-Dann OJSC INN 7713085659 |

Moscow | 74 452 | 10,21 | 238 (high) |

| 5 | Kampina LLC INN 5045021970 |

Moscow region | 9 466 | 8,34 | 232 (high) |

| 6 | Ostankinsky molochny kombinat OJSC INN 7715087436 |

Moscow | 6 376 | 4,36 | 217 (high) |

| 7 | Molochny kombinat Voronezhsky OJSC INN 3662009586 |

Voronezh region | 8 846 | 2,38 | 221 (high) |

| 8 | Kompaniya Yunimilk OJSC INN 7714626332 |

Moscow | 40 128 | -2,12 | 309 (satisfactory) |

| 9 | Yunimilk LLC INN 7714285185 |

Moscow | 59 003 | -6,88 | 293 (high) |

| 10 | Ermann LLC INN 5040044451 |

Moscow region | 5 201 | -47,49 | 285 (high) |

The first three companies in the ranking list are as follows: Danon Industriya LLC with the return on investment 23,99%, Khokhland Russland LLC (15,89%) and Laktalis Vostok CJSC (11,86%). All three enterprises showed the value of return on investment ratio being at high enough level, what points to high benefit from borrowed funds and wise management of companies. This fact is confirmed by that the enterprises get a high and the highest solvency index GLOBAS-i®.

Рicture 1. Return on investment of dairy products manufacturers, TOP-10

Vimm-Bill-Dann OJSC, the leader on turnover at year-end 2013, takes the 4th place in the ranking, with the return on investment value 10,21%, what is also an excellent result. The company was founded in 1992 as a juice bottling line, аnd already after 10 years it became the first Russian food company carried out IPO. In 2010 the enterprise felt under the control of American PepsiCo, which paid 3,8 bln USD for 66% of its shares – the record price for non-resource sector in Russia.

At a time three enterprises, being a part of the group of companies Danone-Unimilk (the main competitor of Vimm-Bill-Dann OJSC), were got shortlisted in the ranking of the largest domestic manufacturers of dairy products: Danon Industriya LLC, which took the lead in the ranking list, Kompaniya Yunimilk OJSC (-2,12%) and Yunimilk LLC (-6,88%). Negative values of the return on investments testify to an irrational use of funds and, as a consequence, to existence of losses in the structure of balance sheet ratios. With that, considering the combination of financial and non-financial indicators, the company Yunimilk LLC got a high solvency index GLOBAS-i®, what characterizes it as financially stable.

The turnover of the TOP-10 largest domestic manufacturers of dairy products made above 250 bln RUB, following the results of the year 2013, what is by 7,6% more than in 2012. However, according to expert opinion, due to food embargo more impressive results should be expected from domestic producers in the current year.

As a reminder, on the 7th of August of the current year Russia announced a delivery block for meat products, vegetables and fruit, seafood and cooled fish, milk and dairy products from countries of EU, Australia, Canada, Norway and the USA. Please note that, according to estimates of European Commission, the export of dairy products into Russia reached 2,3 bln EUR in 2013, 1 bln from which was accounted for by cheese deliveries. Thus, such restriction on import should promote the development of domestic dairy production and help domestic manufacturers cement their place in the internal market.

Russia is forced to settle down to a course of diversification

At his Address to the Federal Assembly from 4th December 2014 Vladimir Putin, the President of the Russian Federation, brought into focus the move away from import-hanging development model as one of the high-priority tasks. Domestic resource companies will help with it. The President has noted that «they have to focus on domestic manufacturer and create a demand on its products at executing of major oil, energy-related and transport projects».

The Address was announced at the period of the strongest devaluation of rouble against other currencies; scales of this devaluation are comparable only with the 1998 recession year. The current devaluation of rouble has already exceeded the figures of 2008. The exchange value of US Dollar has risen almost on 70% and EUR – on 50%. Dramatic situation against the backdrop of the falling oil is far from its end. Widespread volatility on the market is going on.

Such a rate could lead to uncontrolled price increase, resulting in winding of devaluation-inflation spiral with all that it implies for economy and its agents.

Deteriorating lending terms, unsatisfactory business environment and import notedly risen in price – all this will eventually affect the population and its real earnings.

Nolens volens Russia will have to start developing its manufacturing sector, involve scientific resources for developing new economy sectors. Otherwise, explicitly uncovered structural problems will not enable us to take rightful place in the world.