Legislative amendments, which came into force on January 1, 2017

Starting from January 1, 2017 changes in legislation including laws, regulating the relations in economy, came into force.

Information Agency Credinform has prepared the short overview of the most important federal legislative acts coming into force this year.

Federal Law of July 13, 2015 No. 218-FZ «On state registration of the real estate» regulates relations, which are forming due to: state registration of the real property titles and real estate transactions, which must be registered in accordance with legislation of the Russian Federation; state cadastral registration of real estate, which should be recorded according to this Federal Law; maintenance of the Uniform State Register of Real Estate and providing information from the register.

Federal Law of June 23, 2016 No. 216-FZ «On the amendments to Articles 346[2] and 346[3] of Part II of the Russian Federation Tax Code» according to the Law, agricultural manufacturers (companies and individual entrepreneurs), who want to apply the taxation system for agricultural manufacturers (unified agricultural tax) starting from January 1, 2017 should notify the tax authority at the location of the company or at the place of residence of individual entrepreneur about the transition to payment of the unified agricultural tax no later than February 15, 2017.

Federal Law of July 3, 2016 No. 237-FZ «On state cadastral assessment» regulates relations, which are forming during the state cadastral assessment on a territory of the Russian Federation.

Federal Law of July 3, 2016 No. 238-FZ «On independent assessment of qualification» regulates relations, which are forming during independent assessment of the employees’ qualification and persons, aspiring to operate under a certain type of work activities.

Federal Law of July 3, 2016 No. 231-FZ «On the amendments to certain legislative acts of the Russian Federation due to adoption of the Federal Law «On the protection of rights and legitimate interests of individuals while repayment of overdue debt and on the amendments to the Federal Law «On microfinance and microfinance organizations».

Federal Law of July 3, 2016 No. 248-FZ «On the amendments to Part II of the Russian Federation Tax Code» defined, that the types of business activities in industrial, social and scientific fields with 0 per cent tax rate, are determined by subjects of the Russian Federation on the basis of the Russian Classification of Economic Activities.

Federal Law of July 3, 2016 No. 243-FZ «On the amendments to Parts I and II of the Russian Federation Tax Code due to the transfer of authority over administration of pension, social and medical insurance payments to the tax authorities».

Federal Law of July 3, 2016 No. 282-FZ «On the amendments to the Code of Merchant Marines of the Russian Federation and Articles 17 and 19 of the Federal Law «On the sea ports in the Russian Federation and on the amendments to individual legislative acts of the Russian Federation» defined the terms for provision of the vessel, registered in National Shipping Register, Russian International Register of Vessels or Small Ships Register, for usage and ownership to a foreign charterer under a bareboat charter.

Federal Law of July 3, 2016 No. 287-FZ «On amendments to the Federal Law «On noncommercial organizations» in terms of establishing the status of a nonprofit organization - executor of public utility services».

Federal Law of July 3, 2016 No. 275-FZ «On amendments to the Federal Law «On concessionary agreements» defined the features of regulating relations, which are forming during preparation, conclusion, execution, modification and termination of concessionary agreements in terms of heat supply facilities, centralized hot water systems, cold water supply and (or) disposal systems, separate objects of such systems.

Federal Law of July 3, 2016 No. 321-FZ «On amendments to individual legislative acts of the Russian Federation in terms of purchase of goods, works, services for state and municipal needs and the needs of individual types of legal entities» defined the features of procurement organized by state unitary enterprises and municipal unitary enterprises.

Federal Law of July 3, 2016 No. 343-FZ «On amendments to the Federal Law «On joint stock companies» and the Federal Law «On limited liability companies» regulating major transactions and related-party transactions».

Federal Law of July 3, 2016 No. 348-FZ «On amendments to the Labour Code of the Russian Federation in terms of the specifics of regulating the labour of individuals employed by businesses classed as micro-organizations».

Federal Law of July 3, 2016 No. 361-FZ «On amendments to individual legislative acts of the Russian Federation and invalidation of individual legislative acts (provisions of legislative acts) of the Russian Federation» made the amendments in legislation due to implementation of the Uniform State Register of Real Estate; defined the arrangements for using the information from the Uniform State Register of Real Estate for credit and insurance organizations, notarial actions; defined key elements for governmental registration of hypothecation.

Federal Law of July 3, 2016 No. 304-FZ «On the amendments to the Federal Law «On the participation in shared construction of apartment houses and other objects of immovable property and on the amendments to certain legislative acts of the Russian Federation» and certain legislative acts of the Russian Federation» defined the requirements to the builder for the attraction of citizens’ funds on construction of the apartment building on the basis of the participatory share construction agreement.

Federal Law of July 3, 2016 No.315-FZ «On the amendments to Part I of the Civil Code of the Russian Federation and individual legislative acts of the Russian Federation» defined the list of immovable items, which include the residential and non-residential premises as well as structural elements of buildings and structures for transport vehicles (car-places) in case the borders of such areas, elements of buildings and structures are described in the state cadastral registration procedure, established by legislation.

Federal Law of November 30, 2016 No. 403-FZ «On the amendments to Article 219 of Part II of the Russian Federation Tax Code» on obtaining of the tax deduction by the employee.

Federal Law of November 30, 2016 No. 405-FZ «On the amendments to Article 266 of Part II of the Russian Federation Tax Code» on doubtful debts reserves for banks, consumer credit cooperatives and micro financial entities.

Federal Law of November 30, 2016 No. 399-FZ «On the amendments to Articles 83 and 84 of Part I and Article 226 of Part II of the Russian Federation Tax Code» introduced the concept of tax agent for the entities on a territory of Russia.

Federal Law of December 19, 2016 No. 449-FZ «On the amendments to Article 311 of the Federal Law «On noncommercial organizations» on state support of noncommercial organizations - executors of public utility services.

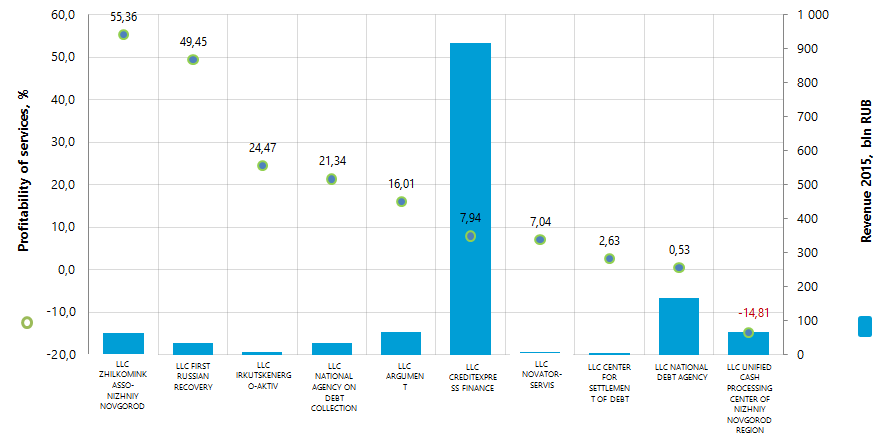

Profitability of services of the Russian debt collection agencies

Information agency Credinform prepared a ranking of profitability of services of the Russian debt collection agencies.

The Russian debt collection agencies (Top-10) with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available periods (2015 and 2014). The enterprises were ranked by decrease in profitability of services (see table 1).

Profitability of services or goods is sales profit to expenses from ordinary activities. Profitability in general indicates production efficiency. The analyses of profitability of services allows to conclude about expediency of one or another kind of services. There is no standard value for profitability indicators, because they change in accordance with the industry the company operates in.

For the most complete and objective view of the financial condition of the enterprise it is necessary to pay attention to the complex of presented ratios, financial and other indicators of the company.

| Name | Net profit 2015, bln RUB | Reveue 2015, bln RUB | Reveue 2015 to 2014, +/- % | Profitability of services, % | Solvency index Globas-i |

|---|---|---|---|---|---|

| LLC ZHILKOMINKASSO-NIZHNIY NOVGOROD INN 5257119624 Nizhniy Novgorod region |

15,32 | 64,75 | 78,4 | 55,36 | 191 The highest |

| LLC FIRST RUSSIAN RECOVERY INN 5402573988 Novosibirsk region |

-5,47 | 33,86 | -12,3 | 49,45 | 403 Satisfactory |

| LLC IRKUTSKENERGO-AKTIV INN 3811095792 Irkutsk region |

2,59 | 9,11 | 201,6 | 24,47 | 189 The highest |

| LLC NATIONAL AGENCY ON DEBT COLLECTION INN 7728718713 Moscow |

12,47 | 33,49 | 2,6 | 21,34 | 262 High |

| LLC ARGUMENT INN 0276114446 Republic of Bashkortostan |

3,48 | 66,16 | 316,6 | 16,01 | 175 The highest |

| LLC CREDITEXPRESS FINANCE INN 7707790885 Moscow |

4,30 | 916,88 | 11,3 | 7,94 | 244 High |

| LLC NOVATOR-SERVIS INN 6829029316 Tambov region |

0,23 | 7,84 | 44,1 | 7,04 | 213 High |

| LLC CENTER FOR SETTLEMENT OF DEBT INN 0264067752 Republic of Bashkortostan |

-0,19 | 6,48 | 59,6 | 2,63 | 331 Satisfactory |

| LLC NATIONAL DEBT AGENCY INN 3255516816 Bryansk region |

0,69 | 168,08 | -8,9 | 0,53 | 308 Satisfactory |

| LLC UNIFIED CASH PROCESSING CENTER OF NIZHNIY NOVGOROD REGION INN 5249089687 Nizhniy Novgorod region |

-9,12 | 65,95 | -9,9 | -14,81 | 298 High |

Average value of profitability of services for the Top-10 companies amounted to 17,0% in 2015. Average value in Top-25 amounted to 32,2% at industry average value of 6,7%.

Seven companies in the Top got high solvency index Globas-i indicating their ability to timely and fully fulfill their debt liabilities.

Three companies got satisfactory index. LLC FIRST RUSSIAN RECOVERY has active writs of execution and loss in key figures; there are also cases of delays in payments. LLC CENTER FOR SETTLEMENT OF DEBT has loss in key figures. LLC NATIONAL DEBT AGENCY has insufficient amount of working assets for funding debt.

Total revenue of the TOP-10 in 2015 amounted to 1,4 bln RUB that is by 13% higher than in 2014. At the same time total net profit of the same group decreased in 7,6 times.

Five companies in the Top (marked with red in Table 1) have decrease in net profit or loss in comparison with the previous period, or decrease in revenue.

Total revenue of TOP-25 companies for the same period increased by almost 14% at increase in total net profit by 66%.

In general, the Russian market of debt collection services is not fully-formed yet. The Federal law regulating debt collection is coming into force since January 1, 2017.

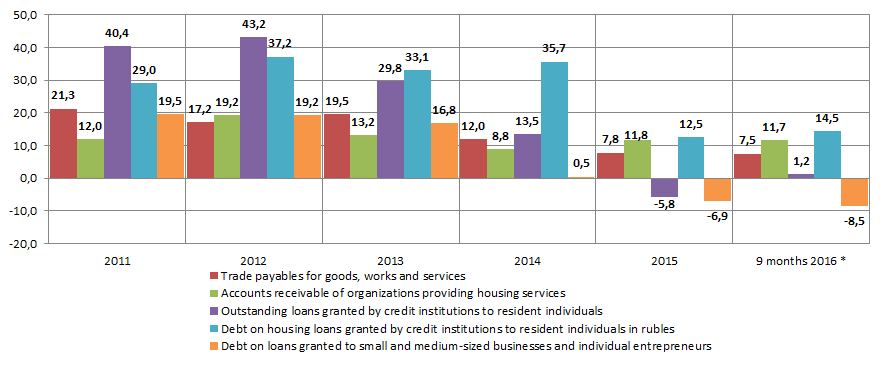

In case of orderly formation of these services’ market within the frameworks of the law, debt collection agencies will have quite good development prospects considering the potential volume of debt collection services. This is shown by estimated data on debts growth rates (Picture 2) based on information of the Federal state statistics service and the Central Bank of Russia on nominal debts values (Table 2).

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 9 months of 2016 | |

|---|---|---|---|---|---|---|---|

| Trade payables for goods, works and services | 8 791 247 | 10 667 130 | 12 510 870 | 14 947 143 | 16 744 745 | 18 044 549 | 18 126 867 |

| Accounts receivable of organizations providing housing services | 579 380 | 649 154 | 773 561 | 875 444 | 952 440 | 1 064 746 | 1 081 464 |

| Outstanding loans granted by credit institutions to resident individuals | 3 715 266 | 5 218 029 | 7 474 220 | 9 698 950 | 11 005 289 | 10 366 829 | 10 538 916 |

| Debt on housing loans granted by credit institutions to resident individuals in rubles | 1 050 901 | 1 356 057 | 1 860 892 | 2 476 273 | 3 360 775 | 3 782 381 | 4 329 775 |

| Debt on loans granted to small and medium-sized businesses and individual entrepreneurs as of 1 October | 3 455 844 | 4 130 651 | 4 925 291 | 5 755 001 | 5 784 212 | 5 385 111 | 4 926 069 |

For the whole six years from 2010 to 2015, the significant growth of debts in nominal values is observed from 1,6 to 3,6 times in dependence of the industry. At the same time growth rates of debts has significantly decreased in the last two years (Picture 2, decrease in nominal value is marked with green in Table 2).

*) – Data for 9 months of 2016 is presented to the relevant period of 2015.

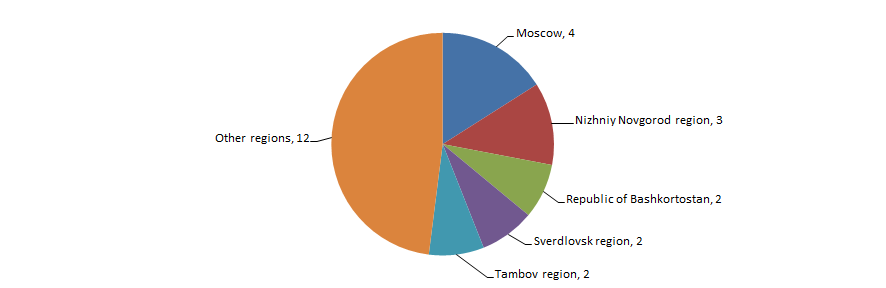

There is no strongly marked concentration of debt collection agencies in the regions of Russia. According to the Information and analytical system Globas-i 25 of companies in the sector with the highest volume of revenue for 2015 are located in 17 regions of Russia (Picture 3).