The Federal Contract System: a new game by old rule?

Well known federal statute №94 “The law on order placing, execution of work, state and municipal needs”, which got a lot of blames for its crudity and inefficiency when companies offered the less price instead of better quality win contests, will give place to Federal Contact System from 1 January 2014.

Under the current legislation, an inequality principle of a customer and supplier of goods and services is laid down. Thus in a case of overstepping or improper execution of a contract for the customer, the penalty is 1/300 of a refinancing entry for each overstepping. For the supplier the penalty is 1/300 of a refinancing entry without upper threshold limitation. Practically it means the customer could demand overstepping overpassing a contract value. It is nonsense in itself, which did not embarrass a legislator in time. It is easy to assume that many of the potential contractors of state or municipal customer, which make responsible use of their finances, think twice whether they should get involved in such a "gamble". In the result “owns” suppliers win tenders, and alike sanctions has declarative character for them. In case of default new tenders are organized, new agreements and other procedures are negotiated for liberation from economic responsibility.

The Ministry of Finance worked out regulations which will work in Federal Contract System. Following these regulations, the customer will be able to amerce the supplier in certain circumstances to the value of 100% from a price of a contract for sale of defective products. In due course the maximum amount of liability could be 20% of a contract. Inequality of the customer and supplier keeps again, but the upper threshold of the penalty amount, which is limited by the contract price, is denoted.

Information about State contracts and their deadlines can be obtained from daily update Globas-i® system of The CredInform information agency.

Return on assets of Russian watch manufacturers

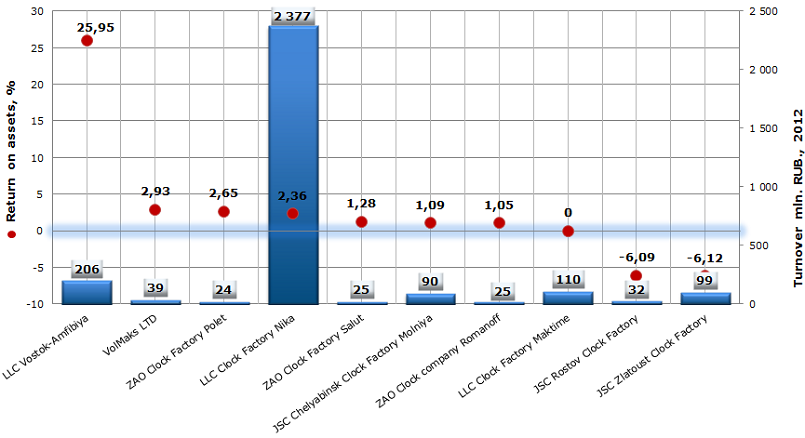

Information agency Credinform prepared а ranking of return on assets of Russian watch manufacturers. The ranking list includes industry’s largest companies and is based on turnover as stated in the Statistics register, with the reference period of 2012. The first 10 companies, selected by turnover, later were ranked by decrease of return on assets value.

Return on assets – is a financial indicator, which is calculated as the relation of net profit and interest payable to company’s total assets value. The indicator shows how many monetary units of net profit earned each unit of total assets. There is no normative or recommended value of the profitability ratio, because its value is strongly varied depending on industry.

Despite the widespread use of smart phones, tablets and other gadgets, ordinary watches don’t lose their popularity. Manufacture of watches – is a difficult multistage process, demanding serious capital investments, especially, if it’s a custom-made watches or watches with use of precious stones and metals. Traditionally Japanese watches are considered to be the most qualitative. However, Swiss wrist watches are still classics, being attribute of businessman and demonstrating the high status of its owner. Domestic enterprises try to compete with foreign manufacturers, annually expanding the model range, covering various segments of the market. The leaders of Russian market are represented in the table below.

| № | Name INN | Region | Turnover 2012, mln. RUB. | Return on assets, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | LLC Vostok-Amfibiya INN 1652005589 | The Republic of Tatarstan (Tatarstan) | 206 | 25,95 | 161 (the highest) |

| 2 | VolMaks LTD INN 7709368044 | Moscow | 39 | 2,93 | 254 (high) |

| 3 | ZAO Clock Factory Polet ИНН 7709210360 | Moscow | 24 | 2,65 | 216 (high) |

| 4 | LLC Clock Factory Nika INN 7727510127 | Moscow | 2 377 | 2,36 | 234 (high) |

| 5 | ZAO Clock Factory Salut INN 5404203823 | Novosibirsk region | 25 | 1,28 | 269 (high) |

| 6 | JSC Chelyabinsk Clock Factory Molniya INN 7453006148 | Chelyabinsk Region | 90 | 1,09 | 270 (high) |

| 7 | ZAO Clock company Romanoff INN 7709596121 | Moscow | 25 | 1,05 | 237 (high) |

| 8 | LLC Clock Factory Maktime INN 7723117740 | Moscow | 110 | 0 | 239 (high) |

| 9 | JSC Rostov Clock Factory INN 6152001095 | Rostov Region | 32 | -6,09 | 293 (high) |

| 10 | JSC Zlatoust Clock Factory INN 7404003024 | Chelyabinsk Region | 99 | -6,12 | 290 (high) |

The first place of ranking list takes the second on turnover industry’s company LLC Vostok-Amfibiya with return on assets ratio of 25,95%. In other words each ruble, invested in company’s assets, brings it additional 25,95 kopeks. Moreover, this is the only company in ranking list with the highest solvency index GLOBAS-i®. That characterizes the company as financially stable.

The second and third places of the ranking list take VolMaks LTD and ZAO Clock Factory Polet with return on assets ratio of 2,93% and 2,65% respectively. In spite of the fact that the companies significantly lag behind the leader of research, they have high solvency index GLOBAS-i®. That testifies of company’s ability to repay its financial liabilities in time and fully.

Return on assets of Russian watch manufacturers, TOP-10

The leader of the industry on turnover LLC Clock Factory Nika, due to the high prime cost of products, takes the fourth place of ranking list.

LLC Clock Factory Maktime ended 2012 with return on assets ratio of 0, two other companies of ranking list JSC Rostov Clock Factoryand JSC Zlatoust Clock Factory have negative values of return on assets ratio. That testifies of low quality of capital management and company’s inability to generate the income excluding the structure of its capital.

As return on assets is usually lower for capital-intensive industries than for service companies, which are not demanding large financial investments, the results of ranking are quite predictable. However, be aware, that for full and objective assessment of the enterprise, it is necessary to consider the summation of financial indicators.