Trends in social services

Information agency Credinform has prepared a review of trends of the largest Russian providers of social services.

The largest companies providing social services to the old and disabled people, child care services, social care, etc. (TOP-1000) in terms of annual revenue were selected for the analysis according to the data from the Statistical Register for the latest available periods (2010-2019). The analysis was based on the data of the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest organization in term of net assets is REPUBLICAN FOUNDATION FOR SUPPORTING SOCIAL AND ECONOMIC PROGRAMS SOZIDANIE, INN 1326178496, the Republic of Mordovia. In 2019, net assets value of the foundation amounted to 1996 million RUB.

The lowest net assets value among TOP-1000 belonged to ZNAYKA KINDERGARTEN LLC, INN 5047152061, Moscow. In 2019, insufficiency of property of the organization was indicated in negative value of -348 million RUB.

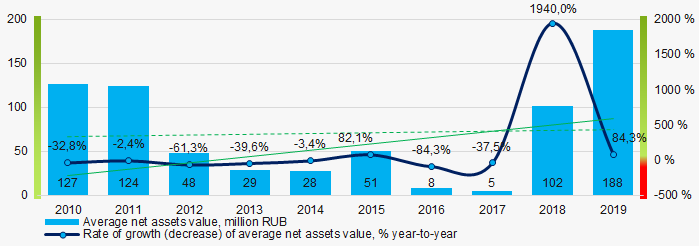

Covering the ten-year period, the average net assets values have a trend to increase with a positive dynamics of the growth rate (Picture 1).

Picture 1. Change in industry average net assets value in 2010 – 2019

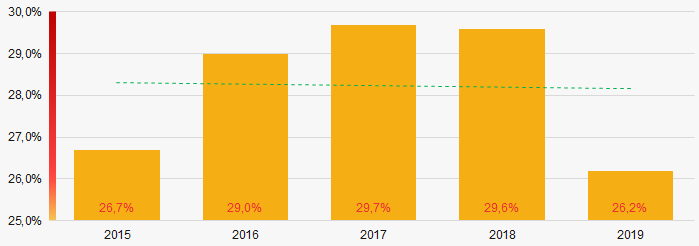

Picture 1. Change in industry average net assets value in 2010 – 2019In general, for the past five years, organizations with insufficient property had significant shares in the TOP-1000 with a trend to some decrease (Picture 2).

Picture 2. Shares of TOP-1000 companies with negative net assets value in 2015-2019

Picture 2. Shares of TOP-1000 companies with negative net assets value in 2015-2019Sales revenue

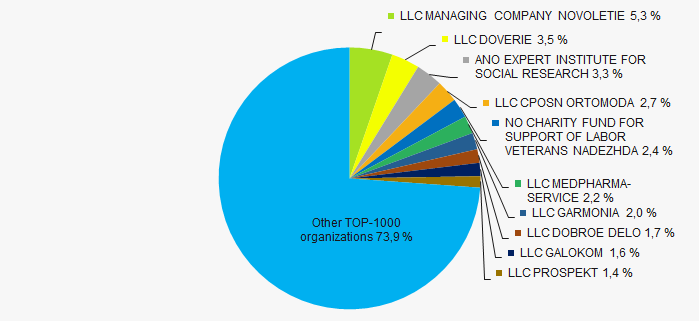

In 2019, the revenue volume of 10 largest organizations of the industry was 26% of total TOP-1000 revenue (Picture 3). This is indicative of relatively high level of competition in the sector.

Picture 3. The share of TOP-10 organizations in total 2019 revenue of TOP-1000

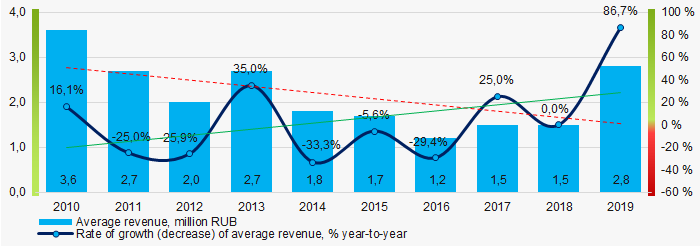

Picture 3. The share of TOP-10 organizations in total 2019 revenue of TOP-1000In general, there is a trend to decrease in revenue with positive dynamics of the growth rate (Picture 4).

Picture 4. Change in industry average net profit in 2010 – 2019

Picture 4. Change in industry average net profit in 2010 – 2019Profit and loss

The largest organization in term of net profit is LLC MANAGING COMPANY NOVOLETIE, INN 5904182219, Perm territory. Its profit for 2019 reached 521 million RUB.

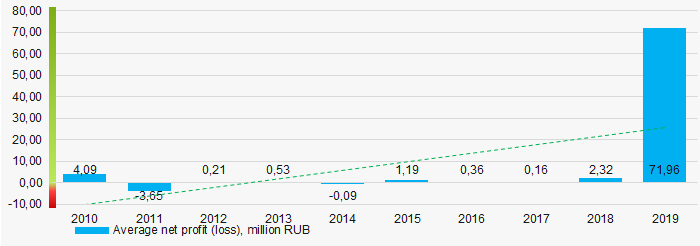

Covering the ten-year period, there is a trend to increase in average net profit (Picture 5).

Picture 5. Change in industry average net profit (loss) values in 2010 – 2019

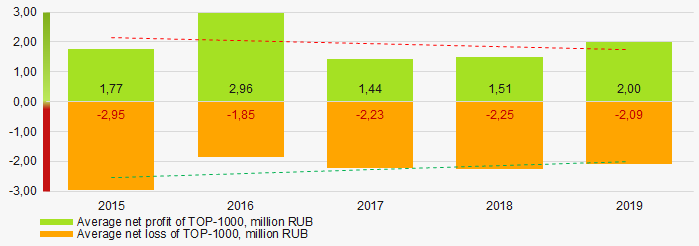

Picture 5. Change in industry average net profit (loss) values in 2010 – 2019For the five-year period, the average net profit values of TOP-1000 have the decreasing trend with the decreasing net loss (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2015 – 2019

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2015 – 2019Key financial ratios

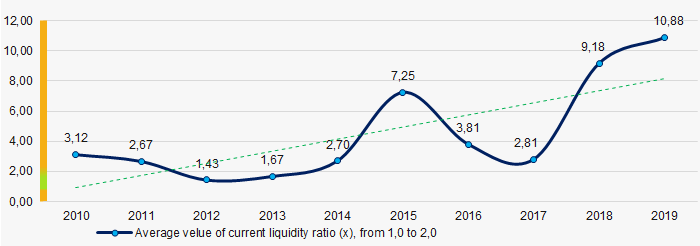

Covering the ten-year period, the average values of the current liquidity ratio were mainly out of the recommended one - from 1,0 to 2,0 with a trend to increase (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in industry average values of current liquidity ratio in 2010 – 2019

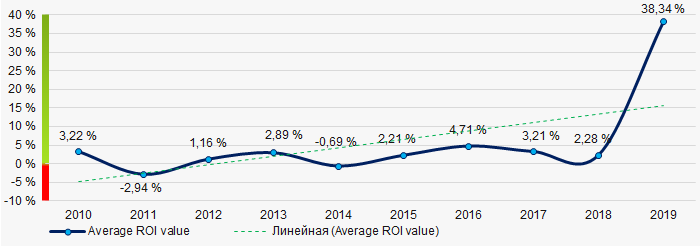

Picture 7. Change in industry average values of current liquidity ratio in 2010 – 2019 Covering the ten-year period, the average values of ROI ratio have a trend to increase (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in industry average values of ROI ratio in 2010 – 2019

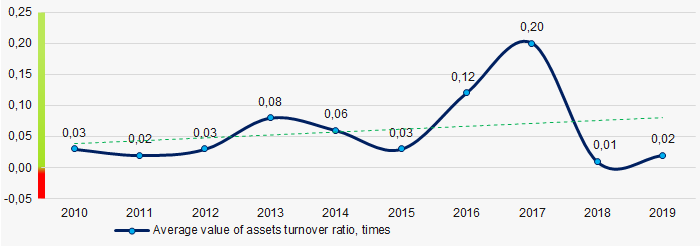

Picture 8. Change in industry average values of ROI ratio in 2010 – 2019Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Covering the ten-year period, business activity ratio demonstrated the increasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2010 – 2019

Picture 9. Change in average values of assets turnover ratio in 2010 – 2019Small business

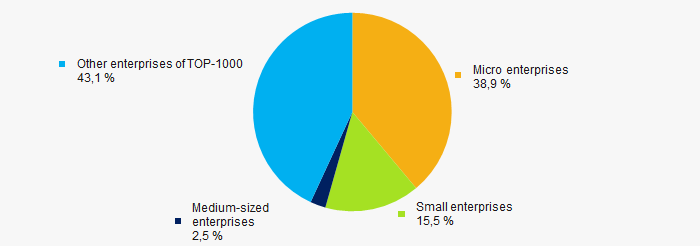

67% of TOP-1000 organizations are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. Their share in total revenue of TOP-1000 is 57% that is over three times above the national average in 2018-2019 (Picture 10).

Picture 10. Shares of revenue of small and medium-sized enterprises in TOP-1000

Picture 10. Shares of revenue of small and medium-sized enterprises in TOP-1000Main regions of activity

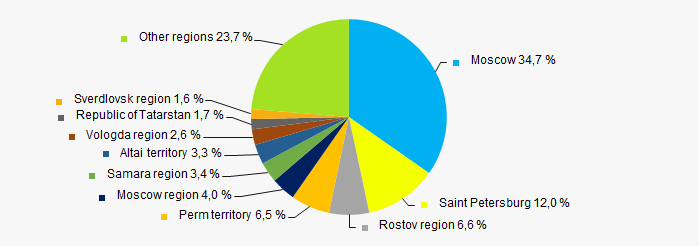

Organizations of TOP-1000 are registered in 74 regions of Russia, and unequally located across the country. Over 46% of organizations largest by revenue are located in Moscow and Saint Petersburg (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by regions of Russia

Picture 11. Distribution of TOP-1000 revenue by regions of RussiaFinancial position score

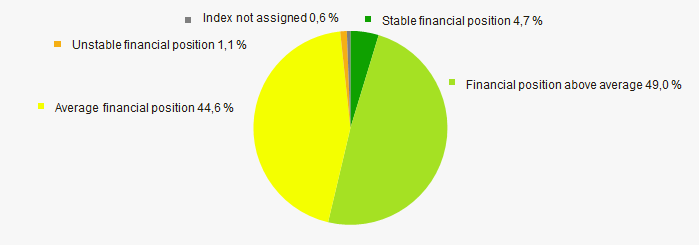

Assessment of the financial position of TOP-1000 organizations shows that the majority of them have financial position above average (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

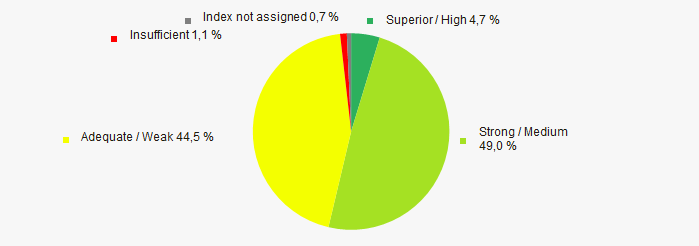

Most of TOP-1000 organizations got Superior / High and Strong / Medium index Globas. This fact shows their ability to meet their obligations fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasConclusion

Complex assessment of activity of the largest Russian providers of social services, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of positive trends (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  5 5 |

| Level of competition / monopolization |  10 10 |

| Dynamics of the average revenue |  -10 -10 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of companies’ net profit |  -10 -10 |

| Growth / decline in average values of companies’ net loss |  10 10 |

| Increase / decrease in average values of total liquidity ratio |  5 5 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  10 10 |

| Share of small and medium-sized businesses in terms of revenue being more than 20% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  5,6 5,6 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

Debts and assets of social services

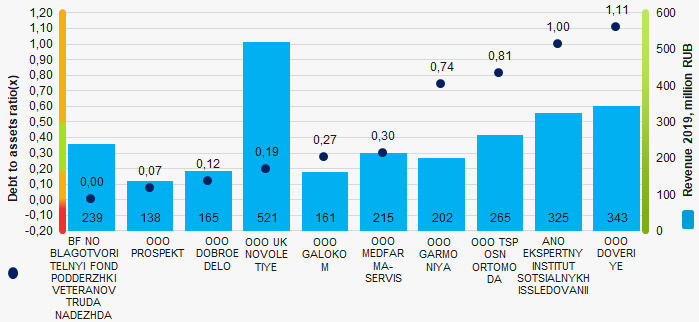

Information agency Credinform has prepared a ranking of the largest social service companies in Russia. The companies rendering social services to senior citizens and disabled people, providing child and social care etc. (TOP-10) with the largest annual revenue were selected for the ranking, according to the data from the Statistical Register and Federal Tax Service for the latest available accounting periods (2017 - 2019). Then the enterprises were ranked by the debt-to-assets ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Debt-to-assets ratio indicates the share of the company’s assets being financed by loans. Standard value of the ratio is from 0.2 to 0.5.

Sales revenue and net profit demonstrate a company’s size and its business efficiency, and debt to solvency ratio indicates the risk of insolvency.

A value that exceeds the maximum standard value indicates an excessive loan overburden that may facilitate development, but as well may have a negative impact on stability of corporate funds. A value lower than the minimum standard value may speak of a conservative financial management strategy and of an excessive caution in raising new debt funds.

In order to get the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of financial indicators and company’s ratios.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Debt-to-assets ratio (x), from 0,2 to 0,5 | Solvency index Globas | |||

| 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| BF NO BLAGOTVORITELNYI FOND PODDERZHKI VETERANOV TRUDA NADEZHDA INN 7714321154 Moscow |

196,48 196,48 |

238,65 238,65 |

14,21 14,21 |

11,76 11,76 |

0,12 0,12 |

0,00 0,00 |

257 Medium |

| OOO PROSPEKT INN 6229063499 Ryazan region |

145,46 145,46 |

138,18 138,18 |

9,35 9,35 |

10,55 10,55 |

0,06 0,06 |

0,07 0,07 |

196 High |

| OOO DOBROE DELO INN 7733241842 Moscow |

44,52 44,52 |

164,72 164,72 |

15,12 15,12 |

28,10 28,10 |

0,17 0,17 |

0,12 0,12 |

231 Strong |

| OOO UPRAVLYAYUSHCHAYA KOMPANIYA NOVOLETIYE INN 5904182219 Perm krai |

548,33 548,33 |

521,06 521,06 |

139,50 139,50 |

123,85 123,85 |

0,23 0,23 |

0,19 0,19 |

173 Superior |

| OOO GALOKOM INN 7733806570 Moscow |

143,05 143,05 |

160,89 160,89 |

27,02 27,02 |

112,54 112,54 |

0,11 0,11 |

0,27 0,27 |

248 Strong |

| OOO MEDFARMA-SERVIS INN 3525255572 Vologda region |

225,36 225,36 |

214,55 214,55 |

15,23 15,23 |

23,89 23,89 |

0,22 0,22 |

0,30 0,30 |

185 High |

| OOO GARMONIYA INN 7840317422 Saint Petersburg |

134,04 134,04 |

201,54 201,54 |

5,84 5,84 |

38,00 38,00 |

0,96 0,96 |

0,74 0,74 |

191 High |

| OOO CENTR PROEKTIROVANIYA OBUVI SPETSIALNOGO NAZNACHENIYA ORTOMODA INN 7718195662 Moscow |

0,00 0,00 |

265,13 265,13 |

0,00 0,00 |

11,60 11,60 |

|

0,81 0,81 |

254 Medium |

| ANO EKSPERTNY INSTITUT SOTSIALNYKH ISSLEDOVANII INN 7703424479 Moscow |

18,29 18,29 |

324,71 324,71 |

16,32 16,32 |

33,69 33,69 |

0,17 0,17 |

1,00 1,00 |

262 Medium |

| OOO DOVERIYE INN 6168004976 Rostov region |

340,72 340,72 |

342,81 342,81 |

-232,08 -232,08 |

52,77 52,77 |

1,12 1,12 |

1,11 1,11 |

234 Strong |

| Average value for TOP-10 |  179,62 179,62 |

257,22 257,22 |

1,05 1,05 |

44,68 44,68 |

0,35 0,35 |

0,46 0,46 |

|

| Industry average value |  1,52 1,52 |

2,78 2,78 |

2,32 2,32 |

71,96 71,96 |

0,03 0,03 |

0,99 0,99 |

|

improvement compared to prior period,

improvement compared to prior period,  decline compared to prior period

decline compared to prior period

Average value of debt-to-assets ratio of TOP-10 companies is lower than the average industry one. Two companies have the standard value in 2019.

Picture 1. Debt-to-assets ratio and revenue of the largest social service companies in Russia (TOP-10)

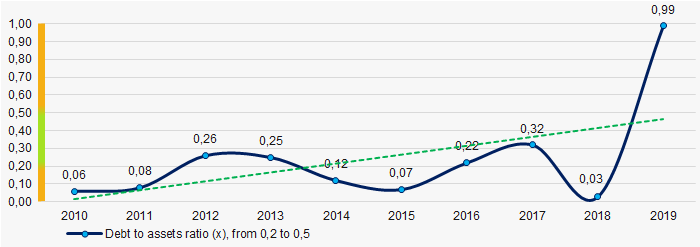

Picture 1. Debt-to-assets ratio and revenue of the largest social service companies in Russia (TOP-10)During the decade, average industry values of debt-to-assets ratio were on the whole beyond the limits of the standard value and had a tendency to improve (Picture 2)

Picture 2. Change of industry average values of debt-to-assets ratio of social service companies in Russia in 2010 – 2019

Picture 2. Change of industry average values of debt-to-assets ratio of social service companies in Russia in 2010 – 2019