Legislation amendments

The Article 28.1 of the Criminal Procedural Code of the Russian Federation set a mandatory condition for the termination of criminal prosecution against persons suspected or accused of committing a tax crime or related to the non-payment of insurance fees to the State non-budgetary funds. Earlier it was full recovery of damage caused to the budgetary system of the Russian Federation before the appointment of a court session.

The Federal Law dated 15.10.2020 No. 336-FZ introduced a change excluding the phrase: "before the appointment of a court session". The amendment gives the opportunity to relief from criminal responsibility of persons who have fully paid damages at a later stage of the trial, i.e. already during the court session.

According to the Internet source "Legislative and regulatory acts of the Russian Federation", in 2020 the Article 28.1 of the Criminal Procedural Code of the Russian Federation was applied in judicial practice more than 140 times.

According to the Judicial Department at the Supreme Court of the Russian Federation, the total amount of damage from crimes determined by acts of all legal authorities for the six months of 2020 amounted to more than 26 billion RUB.

Trends of food retailers

Information agency Credinform has prepared a review of trends of the largest Russian food retailers.

The largest companies of “Perekrestok, “Pyaterochka”, “Karusel”, “Lenta” and “Magnit” chains (TOP-50) in terms of annual revenue were selected for the analysis according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2014-2019). The analysis was based on the data of the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company in term of net assets is LLC CORPORATE CENTER X5, INN 7728632689, Moscow. In 2019, net assets value of the company almost amounted to 463 billion RUB.

The lowest net assets value among TOP-50 belonged to LLC EXPRESS RETAIL, INN 7707648286, Moscow. In 2019, insufficiency of property of the organization was indicated in negative value of -2,4 billion RUB.

Covering the six-year period, the average net assets values have a trend to increase with a decreasing growth rate (Picture 1).

Picture 1. Change in industry average net assets value in 2014 – 2019

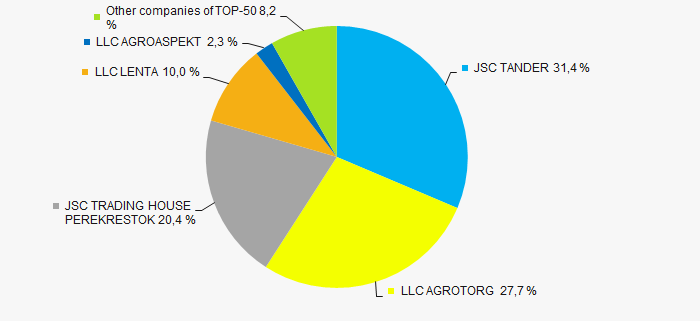

Picture 1. Change in industry average net assets value in 2014 – 2019Over the past six years, the share of companies with insufficient property had a negative trend to increase (Picture 2).

Picture 2. Shares of TOP-50 companies with negative net assets value in 2014-2019

Picture 2. Shares of TOP-50 companies with negative net assets value in 2014-2019Sales revenue

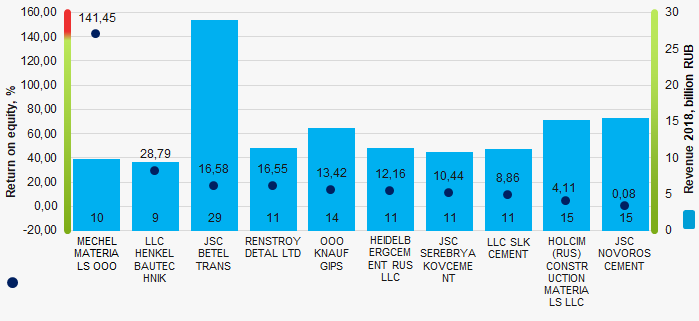

In 2019, the revenue volume of 3 largest companies of the industry was 80% of total TOP-50 revenue (Picture 3). This is indicative of relatively high level of aggregation of capital in the food retail market.

Picture 3. The share of TOP-10 companies in total 2019 revenue of TOP-50

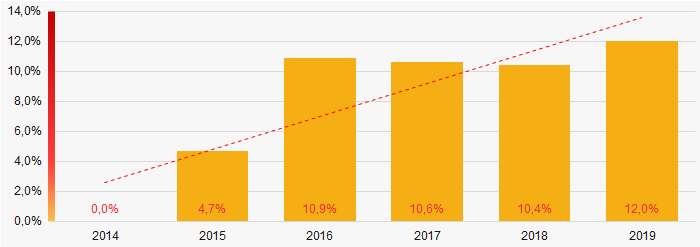

Picture 3. The share of TOP-10 companies in total 2019 revenue of TOP-50 In general, there is a trend to increase in revenue with decreasing growth rate (Picture 4).

Picture 4. Change in industry average net profit in 2014 – 2019

Picture 4. Change in industry average net profit in 2014 – 2019Profit and loss

The largest organization in term of net profit is JSC MAGNIT, INN 2309085638, Krasnodar territory. The company’s profit for 2019 almost reached 41 billion RUB.

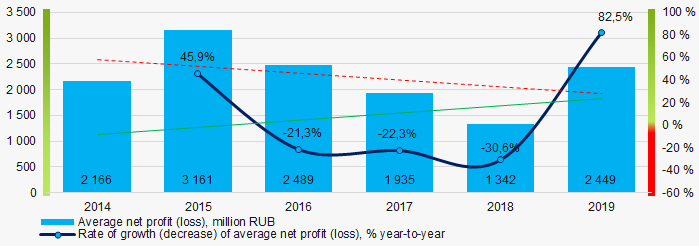

Covering the six-year period, there is a trend to decrease in average net profit with the increasing growth rate (Picture 5).

Picture 5. Change in industry average net profit (loss) values in 2014 – 2019

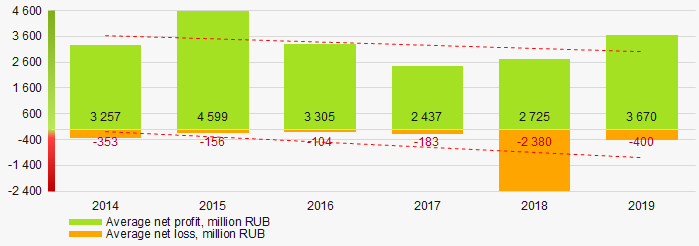

Picture 5. Change in industry average net profit (loss) values in 2014 – 2019For the six-year period, the average net profit values of TOP-50 have the decreasing trend with the increasing net loss (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP-50 in 2014 – 2019

Picture 6. Change in average net profit and net loss of ТОP-50 in 2014 – 2019Key financial ratios

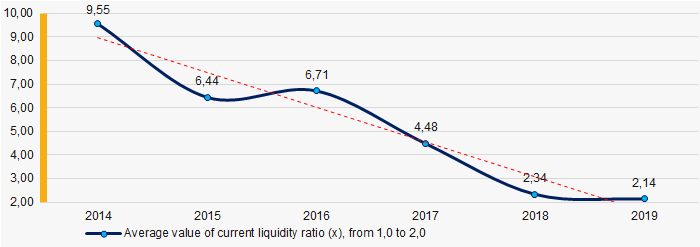

Covering the six-year period, the average values of the current liquidity ratio were above the recommended one - from 1,0 to 2,0 with a trend to decrease (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in industry average values of current liquidity ratio in 2014 – 2019

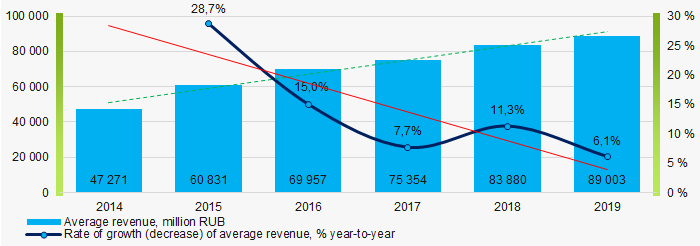

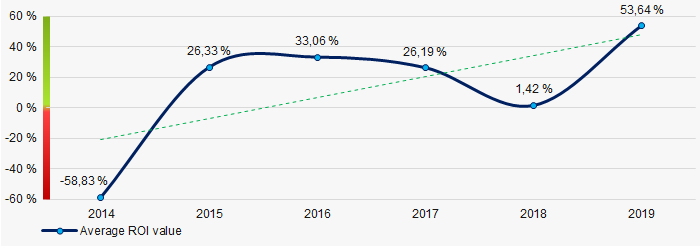

Picture 7. Change in industry average values of current liquidity ratio in 2014 – 2019 Covering the six-year period, the average values of ROI ratio have a trend to increase (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in industry average values of ROI ratio in 2014 – 2019

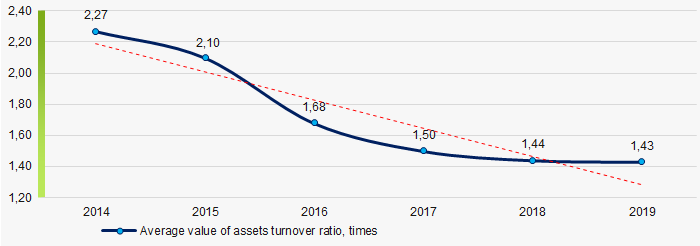

Picture 8. Change in industry average values of ROI ratio in 2014 – 2019Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Covering the six-year period, business activity ratio demonstrated the decreasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2014 – 2019

Picture 9. Change in average values of assets turnover ratio in 2014 – 2019Small business

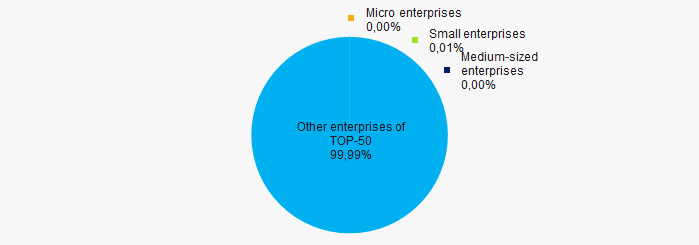

Only one company of the TOP-50 is registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. Its share in total revenue of TOP-50 is 0,01% that is significantly lower than the national average in 2018-2019 (Picture 10).

Picture 10. Shares of revenue of small and medium-sized enterprises in TOP-50

Picture 10. Shares of revenue of small and medium-sized enterprises in TOP-50Main regions of activity

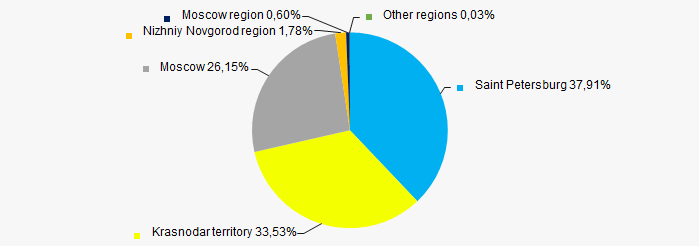

Companies of TOP-50 are registered in 8 regions of Russia, and unequally located across the country. Almost 98% of companies largest by revenue are located in Moscow, Saint Petersburg and Krasnodar territory (Picture 11).

Picture 11. Distribution of TOP-50 revenue by regions of Russia

Picture 11. Distribution of TOP-50 revenue by regions of RussiaFinancial position score

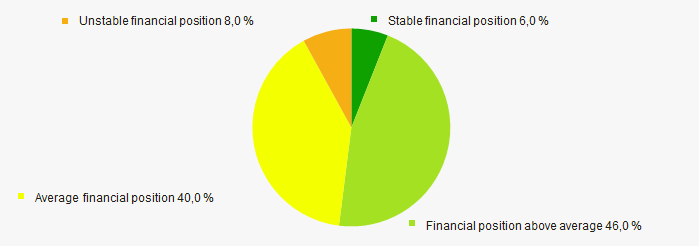

Assessment of the financial position of TOP-50 companies shows that the majority of them have financial position above average (Picture 12).

Picture 12. Distribution of TOP-50 companies by financial position score

Picture 12. Distribution of TOP-50 companies by financial position scoreSolvency index Globas

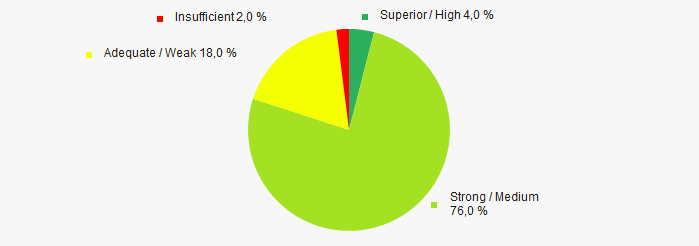

Most of TOP-50 companies got Superior / High and Strong / Medium index Globas. This fact shows their ability to meet their obligations fully (Picture 13).

Picture 13. Distribution of TOP-50 companies by solvency index Globas

Picture 13. Distribution of TOP-50 companies by solvency index GlobasConclusion

Complex assessment of activity of the largest Russian food retailers, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of negative trends in the industry in 2014 - 2019 (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decrease) in the average size of net assets |  -10 -10 |

| Increase (decrease) in the share of enterprises with negative values of net assets |  -10 -10 |

| Level of competition / monopolization |  -10 -10 |

| Dynamics of the average revenue |  10 10 |

| Rate of growth (decrease) in the average size of revenue |  -10 -10 |

| Dynamics of the average profit (loss) |  -10 -10 |

| Rate of growth (decrease) in the average profit (loss) |  10 10 |

| Growth / decline in average values of companies’ net profit |  -10 -10 |

| Growth / decline in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  -5 -5 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in terms of revenue being more than 22% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  -2,6 -2,6 |

positive trend (factor),

positive trend (factor),  negative trend (factor)

negative trend (factor)