Net profit ratio of the largest Russian enterprises of grain wholesale

Information agency Credinform has prepared a ranking of the largest Russian enterprises of grain wholesale. The enterprises with the highest volume of revenue (TOP-10 and TOP-100) were selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2015 and 2014) (TOP-10 and TOP-100). Then they were ranked by decrease in net profit ratio in 2015 (Table 1).

Net profit ratio (%) is calculated as a relation of net profit (loss) to sales revenue and shows sales profit rate. There is no prescribed value for this ratio. It is recommended to compare companies within one industry or change of the ratio with time for the particular enterprise. Negative value of the indicator shows net loss. High value of the indicator demonstrates efficient work of an enterprise.

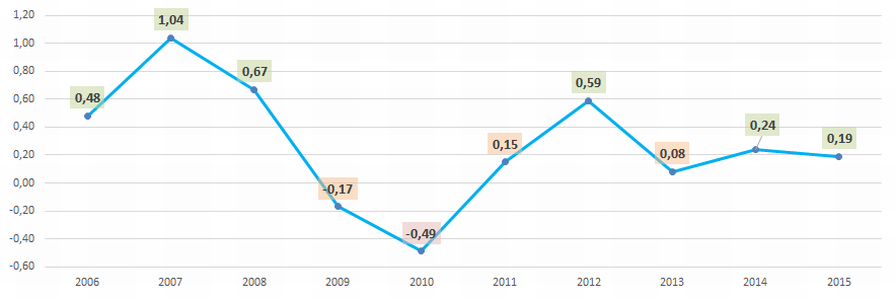

Taking into account the actual situation both for the economy in general and in industries, experts of the Information agency Credinform, developed and realized in the Information and Analytical system Globas® calculation of actual values of financial ratios that can be normal for the particular industry. For grain wholesale companies actual value of the net profit ratio in 2015 was 0,19%.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all available combination of financial indicators and ratios.

| Name, INN, region, foundation date | Net profit of 2015, mln RUB | Revenue of 2015, mln RUB | Revenue of 2015 to 2014, % | Net profit ratio, % | Solvency index Globas® |

| LLC ASTON TRADE HOUSE INN 6167045472 Rostov region 26.08.1998 | 623,8 | 15 881,7 | 11,3 | 3,93 | 198 The highest |

| LLC INTERNATIONAL GRAIN COMPANY INN 7708525142 Moscow 20.05.2004 | 1 813,8 | 47 696,0 | 26,7 | 3,80 | 195 The highest |

| LLC KRASNODARZERNOPRODUKT-EXPO INN 2310105350 Krasnodar territory 26.07.2005 | 131,0 | 19 564,0 | -11,5 | 0,67 | 235 High |

| LLC ZERNO-TREID INN 6154134277 Rostov region 14.07.2014 | 59,4 | 9 615,6 | 415,8 | 0,62 | 251 High |

| LLC GLENKOR AGRO KUBAN INN 2310093506 Krasnodar territory 28.05.2004 | 82,0 | 14 634,4 | 46,9 | 0,56 | 194 The highest |

| LLC AGROMARKET INN 2607017369 Stavropol territory 03.03.2004 | 31,1 | 8 587,7 | 32,4 | 0,36 | 206 High |

| LLC LIMITED LIABILITY MZK-ROSTOV INN 6164230188 Rostov region 12.01.2005 | 28,6 | 8 308,6 | 20,7 | 0,34 | 204 High |

| LLC YUZHNYI TSENTR INN 6167068896 Rostov region 08.08.2003 | 11,7 | 9 166,1 | 32,5 | 0,13 | 216 High |

| LLC ZERNOSOYUZ INN 5260226680 Rostov region 23.05.2008 | 1,4 | 10 317,5 | 16,0 | 0,01 | 236 High |

| LLC GRAVIT INN 7710964877 Moscow 03.07.2014 | -19,2 | 10 932,0 | 275,3 | -0,18 | 327 Satisfactory |

| Total for TOP-10 companies | 2 763,6 | 154 703,6 | |||

| Total for TOP-100 companies | 4 444,1 | 312 725,6 | |||

| Average for TOP-10 companies | 276,4 | 15 470,4 | 1,02 | ||

| Average for TOP-100 companies | 44,4 | 3 127,3 | 1,06 | ||

| Average for the industry | 0,3 | 177,2 | 0,19 |

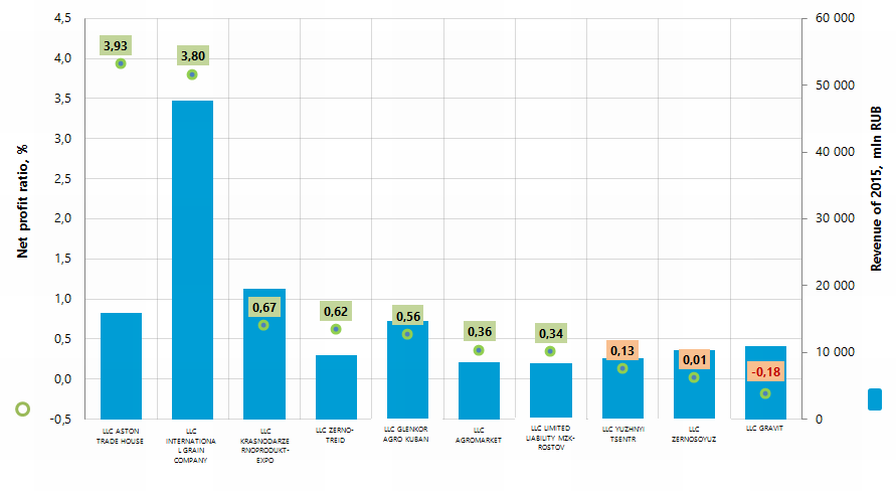

The average of sales profit ratio in 2015 in the TOP-10 and TOP-100 groups is higher than the practical value (marked with green and yellow filling, correspondingly, in the Table 1 and Picture 1).

Picture 1. Net profit ratio and revenue of the largest Russian enterprises of grain wholesale (TOP-10)

Picture 1. Net profit ratio and revenue of the largest Russian enterprises of grain wholesale (TOP-10)Revenue volume of the 10 largest companies in 2015 was 49% of the total revenue in the industry. This demonstrates relatively high level of monopolization in the industry. Besides, revenue volume of the largest companies in the industry belonging to the International grain company group (LLC INTERNATIONAL GRAIN COMPANY, LLC GLENKOR AGRO KUBAN , LIABILITY MZK-ROSTOV) was 23% of the total revenue of the 100 largest companies (Picture 2).

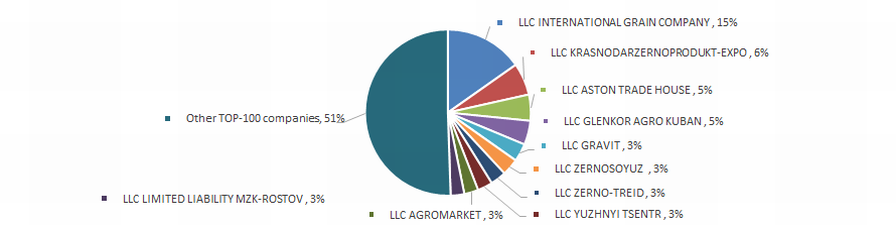

Picture 2. Shares of the TOP-10 companies in the total revenue of 2015 of the TOP-100 group, %

Picture 2. Shares of the TOP-10 companies in the total revenue of 2015 of the TOP-100 group, %Nine out of TOP-10 companies have got the highest or high solvency index Globas®, that shows their ability to pay the debts in time and fully.

LLC GRAVIT has got satisfactory solvency index Globas® because of the information about the participation as a defendant in arbitration court proceedings in terms of debt collection and loss in the balance sheets. Projected growth of the index is stable.

Three companies out of TOP-10 in 2015 decreased their indicators of revenue or net profit compared to the previous period (marked with red filling in the Table 1).

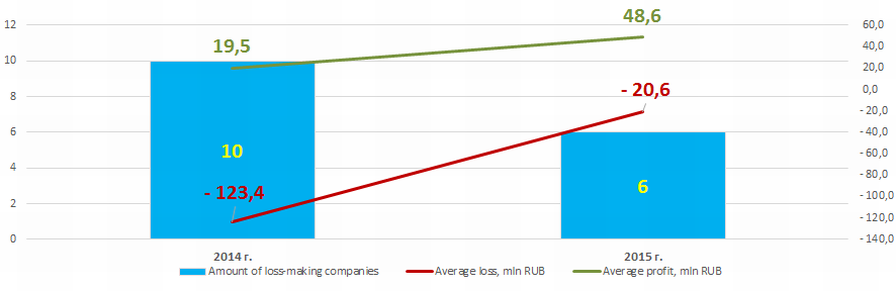

In the TOP-100 group in 2014 10 loss-making companies were observed, in 2015 their amount decreased to 6. Besides, average loss 83% decreased. For other TOP-100 companies average profit almost 2,5 times increased (Picture 3).

Picture 3. Amount of loss-making companies and their average loss, average profit in the TOP-100 companies in 2014 – 2015.

Picture 3. Amount of loss-making companies and their average loss, average profit in the TOP-100 companies in 2014 – 2015.Dynamics of the industrial ratios of net profit (Picture 4) shows macroeconomic situation in the country in general.

Picture 4. Average industrial values of the net profit ratio of the largest Russian enterprises of grain wholesale in 2006 – 2015

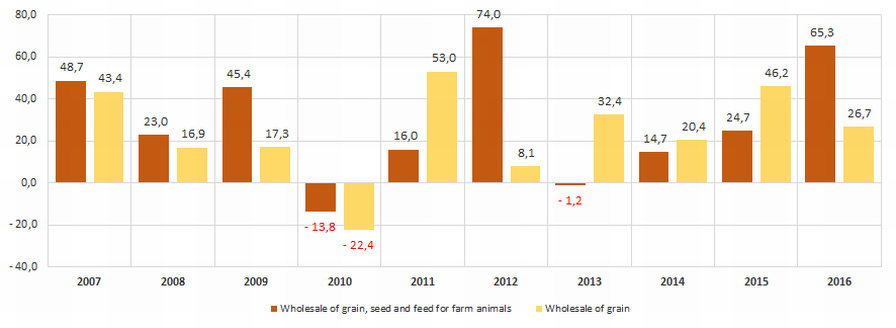

Picture 4. Average industrial values of the net profit ratio of the largest Russian enterprises of grain wholesale in 2006 – 2015 Indicators of the industry in monetary terms in general also show macroeconomic tendencies with correction to peculiar dependence of grain market on weather conditions that is confirmed by the data of the Federal State Statistics Service (Picture 5 and Table 2).

Picture 5. Rates of increase (decrease) in revenue from grain wholesale in monetary terms, year to year, %

Picture 5. Rates of increase (decrease) in revenue from grain wholesale in monetary terms, year to year, %For the last 10 years the highest revenue volume on grain wholesale was observed in 2016. (Table 2).

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

| Wholesale of grain, seed and feed for farm animals | 80,9 | 99,5 | 144,7 | 124,8 | 144,8 | 252,0 | 248,9 | 285,5 | 356,0 | 588,3 |

| Wholesale of grain | 68,4 | 79,9 | 93,7 | 72,7 | 111,2 | 120,2 | 159,1 | 191,6 | 280,1 | 354,9 |

*) in the Table 2 decrease in wholesale volume is marked with red filling and increase in wholesale volume with green one

Besides, according to the Ministry of Agriculture of the RF, grain gross collection has an increasing tendency (Table 3).

| Type of agricultural crop | 2012 | 2013 | 2014 | 2015 |

| Grain and leguminous crops – total | 70 908 | 92 385 | 105 315 | 104 786 |

| Grain and leguminous crops – total, increase (decrease) year to year, % | 30,3 | 14,0 | -0,5 | |

| including: | ||||

| winter and spring wheat | 37 720 | 52 091 | 59 711 | 61 786 |

| winter and spring rye | 2 132 | 3 360 | 3 281 | 2 087 |

| grain maize | 8 213 | 11 635 | 11 332 | 13 173 |

| millet | 334 | 419 | 493 | 572 |

| buckwheat | 797 | 834 | 662 | 861 |

| rice | 1 052 | 935 | 1 049 | 1 110 |

| leguminous | 2 174 | 2 038 | 2 196 | 2 357 |

*) in the Table 3 decrease in agriculture crops collection volume is marked with red filling and increase is marked with green one

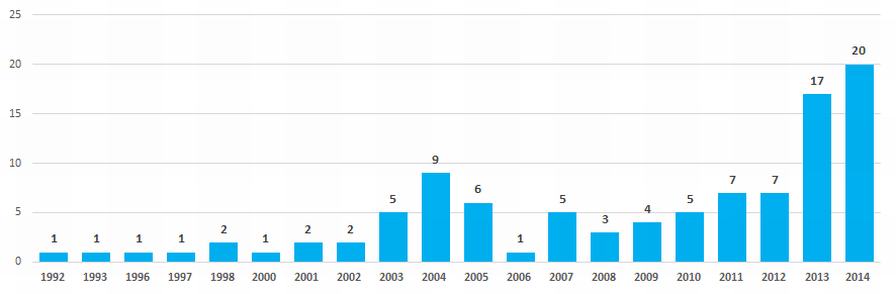

Probably, for this reason growing interest of business for wholesale grain market is observed recently. This can be illustrated by the data from the Information and Analytical system Globas® , according to that 37% companies of the 100 largest in terms of revenue volume for 2015 were founded in 2013 – 2014 (Picture 6).

Picture 6. Distribution of the 100 largest Russian wholesale grain companies in terms of years of foundation.

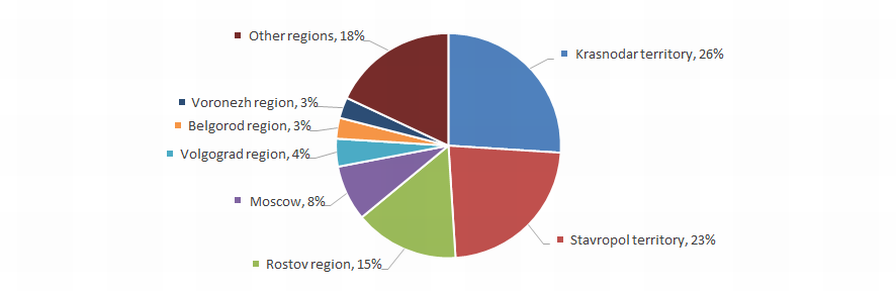

Picture 6. Distribution of the 100 largest Russian wholesale grain companies in terms of years of foundation.Wholesale grain enterprises are distributed through the territory of the country irregularly, with maximum concentration on regions having favourable environment for grain cultivation. This is confirmed by the data from the Information and analytical system Globas®, according to that 100 largest companies with the highest revenue volume for 2015 are registered only in 20 regions of Russia (Picture 7).

Picture 7. Distribution of the 100 largest grain wholesale enterprises through regions of Russia

Picture 7. Distribution of the 100 largest grain wholesale enterprises through regions of RussiaRussia in the frame of interrelations with the new economic leaders - China and India

The 21st St. Petersburg International Economic Forum (SPIEF), traditionally gathering leading politicians, representatives of the largest businesses and business circles, took place in Saint Petersburg from June 1–3, 2017. Special attention in the program of 2017 was given to India and China.

The subject of the Forum and interest to these countries are expectable, because under complicated relations with the western partners Russia widens integration contacts not only among EAEC members but also with new centers of East and South Asia where two the world-largest economies are forming. Experts in Russia and abroad pay undeservedly little attention to this matter: the GDP volumes are traditionally compared by the nominal rate of the national currency to the US dollar. Developing countries are remarkably behind the Golden billion in this comparison. This includes Russia, being on a small-scale position especially after the rouble devaluation.

However the accuracy of such analyses could be called into question due to the differences in purchasing power of currencies and price level on similar products in different countries. Applying the calculation by purchasing-power parity (PPP), the GDP of China exceeds the USA’s one and consolidated GDP of the EU countries. The point is that India today is the third among the largest economies, living Japan and Germany behind, and significantly outrunning China by the GDP growth (see table 1).

| Rank | Country | GDP (PPP),$ trn | GDP growth at the end of 2016, % | |

| 1 |  |

China | 23,2 | 6,7 |

| - |  |

EU | 20,9 | 1,9 |

| 2 |  |

USA | 19,4 | 1,6 |

| 3 |  |

India | 9,5 | 7,0 |

| 4 |  |

Japan | 5,4 | 1,0 |

| 5 |  |

Germany | 4,1 | 1,9 |

| 6 |  |

Russia | 3,9 | -0,2 |

| 7 |  |

Indonesia | 3,3 | 5,0 |

| 8 |  |

Brazil | 3,2 | -3,4 |

| 9 |  |

Great Britain | 2,9 | 2,0 |

| 10 |  |

France | 2,8 | 1,3 |

1According to the IMF (International Monetary Fund: Forecasted estimates for 2017)

Asia is gradually becoming the center of global development, and it is more than ever important for Russia to stand in with this region both in policy and mutual commodity turnover.

Dynamics of external turnover of Russia with China and India

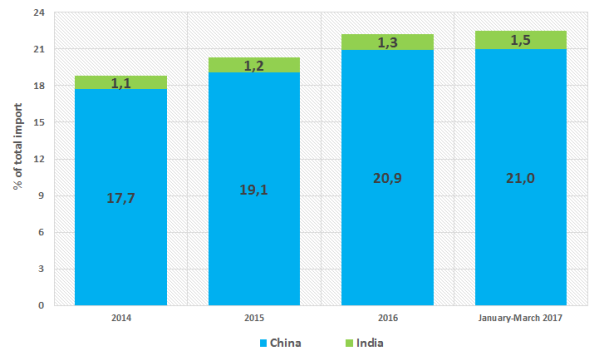

By the volume of commodity turnover India takes a back seat among countries involved in commercial relations with Russia. However there is a positive dynamics: its share in the total import volume amounted to 1,1% in 2014, but it was 1,3% in 2016 (19th rank). Supplies of the Russian goods to the Indian market are also not exceeded 2% (16th rank) of the total volume of the Russian export in monetary terms.

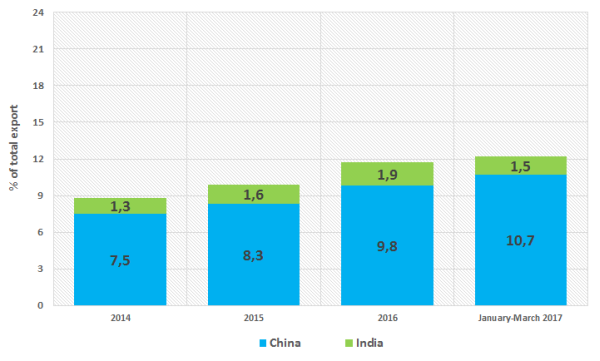

Speaking about the other Russian’s neighbor in the east, there is a different situation. China is the 1st by import and the 2nd by export (after the Netherlands), and its share is on the rise: following the results of January-March 2017, the share of import amounted to 21% of total volume in monetary terms, and of export - to 10,7% (see pictures 1.1 and 1.2).

Picture 1.1. Share of China and India in the RF’s import, % of its total volume in monetary terms

Picture 1.1. Share of China and India in the RF’s import, % of its total volume in monetary terms Picture 1.2. Share of China and India in the RF’s export, % of its total volume in monetary terms

Picture 1.2. Share of China and India in the RF’s export, % of its total volume in monetary termsStructure of external turnover of Russia with China and India

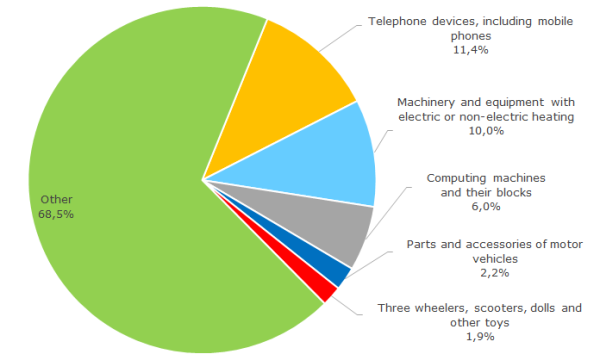

China supplies a broad list of products to the Russian market: various equipment and machinery, clothing, toys, fabrics. Following the results of 2016, the highest volume of purchases fell for mobile and fixed-line phones – 11,4% of total import in monetary terms; machinery and equipment with electric and non-electric heating – 10%; computing machinery – computers, facilities for record and storage of information – 6%; parts and accessories for cars – 2,2%; kids bikes, scooters, toys – 1,9%.

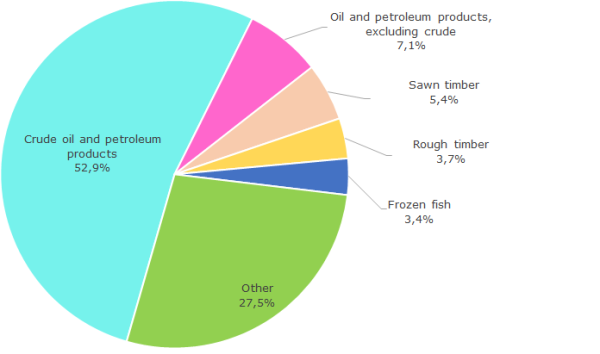

Speaking about export from the RF to China, unfortunately, low value-added goods are leading – oil and oil products, sawn and rough timber (see pictures 2.1 and 2.2).

Picture 2.1. Structure of import from China to Russia, % of its total volume in monetary terms in 2016

Picture 2.1. Structure of import from China to Russia, % of its total volume in monetary terms in 2016 Picture 2.2. Structure of export from Russia to China, % of its total volume in monetary terms in 2016

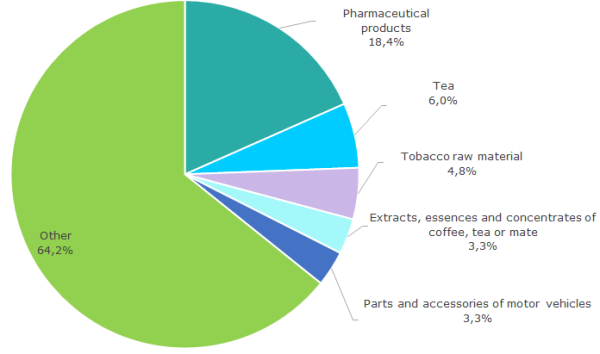

Picture 2.2. Structure of export from Russia to China, % of its total volume in monetary terms in 2016Distinctive feature of the Indian import is supply of pharmaceutical products to the Russian market – 18,4% of total volume, as well as tea, tobacco, coffee, extracts and essences from plants growing in humid temperate climate – 14,1% of annual import.

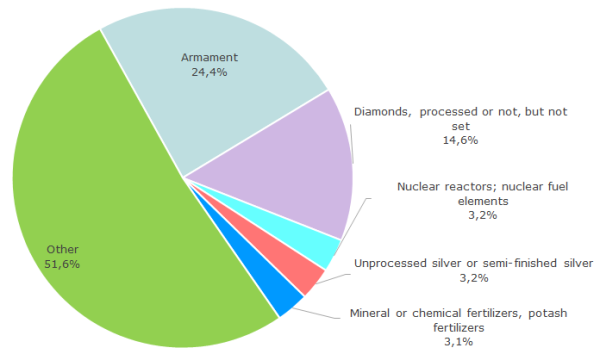

In its trade with India, Russia specializes in hi-tech goods: first of all, in the armament, being the principal exports – 24,4% of total proceeds in cash or 1,3 bln US dollars in 2016 (see pictures 3.1 and 3.2). India also procures nuclear fuel elements from Russia and continues the second construction phase of Kudankulam Nuclear Power Plant – common project of two states in nuclear power. Taking into account the population exceeding billion, India’s electrical demand is huge.

Picture 3.1. Structure of import from India to Russia, % of its total volume in monetary terms in 2016

Picture 3.1. Structure of import from India to Russia, % of its total volume in monetary terms in 2016 Picture 3.2. Structure of export from Russia to India, % of its total volume in monetary terms in 2016

Picture 3.2. Structure of export from Russia to India, % of its total volume in monetary terms in 2016The largest business in Russia with Chinese or Indian controlling participation

According to the Information and Analytical system Globas, currently there are about 790 active companies in Russia with dominant Chinese participation (controlling stake in the capital belongs to natural persons or legal entities from China). The table 2 contains companies largest in term of annual turnover (Top-5). These are enterprises of various sectors: telecommunications, gas filling stations, real estate, auto sales. While the EU authorities artificially limit the contacts of their entrepreneurs with Russia, Chinese investors actively aspire the Russian market.

| Rank | Company | Business scope | Revenue, 2015, bln RUB |

| 1 | ZTE-Communication Technologies, Ltd. ИНН: 7717147218 |

Telecommunications and mobile communications | 9,7 |

| 2 | LTD PHAETON - FUEL NETWORK NUMBER 1 ИНН: 7813474313 |

Trade with fuel, chain of gas filling stations | 6,8 |

| 3 | Geely Motors LLC ИНН: 7716641537 |

Sale of cars | 5,4 |

| 4 | JOINT-STOCK COMPANY RUSTEHNOLOGII LLC ИНН: 7114502310 |

Production of galvanized steel | 4,4 |

| 5 | ZAO BALTIC PEARL ИНН: 7801377058 |

Developer | 4,2 |

Currently there are 60 companies in Russia under Indian control, that is not to the potential of cooperation. The companies are mainly engaged in production of pharmaceuticals. The largest among them is Glenmark Impex LLC with annual turnover about 3 bln RUB.

| Rank | Company | Business scope | Revenue, 2015, bln RUB |

| 1 | Glenmark Impex LLC ИНН: 7709345865 |

Pharmaceutical industry | 3,0 |

| 2 | AGT LLC ИНН: 6165173567 |

Agriculture | 1,7 |

| 3 | ZAO DINA INTERNATIONAL ИНН: 7724586008 |

Sale and maintenance of medical equipment | 1,2 |

| 4 | Sun Pharmaceutical Industries Ltd. ИНН: 7728638440 |

Pharmaceutical industry | 0,9 |

| 5 | Hreya Life Sciences Ltd. ИНН: 7715641990 |

Pharmaceutical industry | 0,7 |

India demonstrates impressive development rates. Once backward, the country now has and develops new industries – pharmaceutical, electronic, IT, etc. Domestic business structures should size up the market, which will be the first in the world by a number of consumers in the near future. According to the population counter, 1 316 mln. people currently live in India, and 1 383 mln. – in PR China. Moreover, India is traditionally wary of China and could become a kind of counterbalance, taking into account significant negative trade balance of the country with PRC: the volume of the Russian export to China is one third less than import from this country.

Currently Russia and PRC have close cooperation in both economy and politics. The country is becoming important for the Russian energy corporations (construction of “The Power of Siberia” gas pipeline is at the final stage). At the same time, considering the scale of potential demand, products of manufacturing industry and agriculture still have a very weak position in export structure.

Russia has turned to the East. This is proved by good level of political relations with new world leaders and participation in development of economic connections being profitable for all parties. The SPIEF’17 has also demonstrated this fact with a number of major agreements signed within its frameworks: agreement on the amount of 239,4 bln RUB (4,2 bln US dollars) between the SC "Rosatom" and the Indian Atomic Energy Corporation on the construction of the 5th and 6th power units at the Kudankulam NPP; agreement on the amount of 28,5 bln RUB between EuroChem MHC and the Chinese corporation ChemChina on a joint industrial production in Russia; and other promising agreements.